How to Buy Digital Currency in SBI: A Step-by-Step Guide

How to Purchase Digital Currency in SBI If you’re interested in buying digital currency and are a customer of the State Bank of India (SBI), you’re in …

Read Article

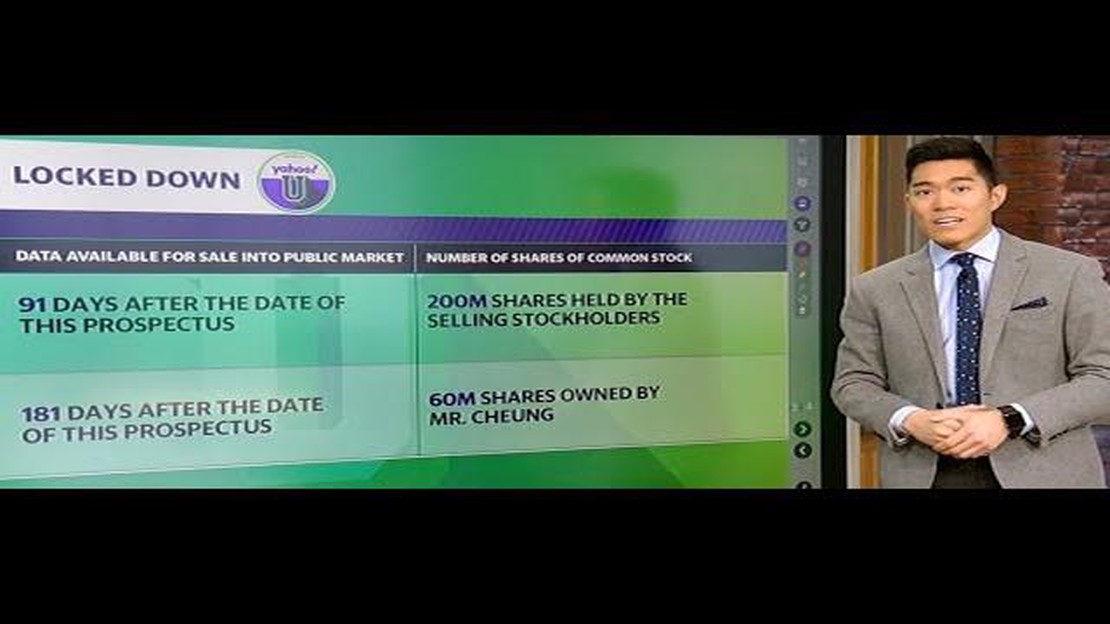

When a company goes public, there are certain restrictions put in place to protect both the company and its early investors. One of these restrictions is the lock-up period, which typically lasts around 90 to 180 days after the initial public offering (IPO). During this time, insiders, such as company executives and institutional investors, are prohibited from selling their shares.

Once the lock-up period expires, a significant amount of shares can potentially flood the market. This influx of supply can impact the stock price and create volatility in the market. Investors are eager to see how the market will react and what the insiders’ next moves will be. Will they sell their shares, hold onto them, or even buy more?

It is important to note that the end of the lock-up period does not necessarily mean that insiders will sell their shares. Many factors come into play, including the company’s performance, market conditions, and the individual investors’ long-term goals. Insiders may believe in the company’s future prospects and choose to hold onto their shares, potentially sending a positive signal to the market.

However, there are cases where insiders do decide to sell their shares after the lock-up period ends. This can be due to various reasons, such as needing to diversify their investment portfolios, capitalizing on the stock’s high valuation, or simply taking profits. As these transactions occur, it is crucial for investors to carefully monitor the market and the insiders’ actions to make informed decisions.

In conclusion, the end of the lock-up period is a significant milestone for a company and its investors. It opens up the possibility for insiders to sell their shares, which can impact the stock price and market dynamics. Investors should pay close attention to the post-lock-up period and evaluate the insiders’ next moves to navigate this potentially volatile period in the market.

After a company’s initial public offering (IPO), there is typically a period of time known as the lock-up period. During this time, certain investors and insiders are prohibited from selling their shares. Once the lock-up period expires, these individuals are free to sell their shares on the open market.

The post lock-up period refers to the time immediately following the expiration of the lock-up period. This period is crucial for both insiders and investors, as it can have a significant impact on the company’s stock price and overall market performance.

During the post lock-up period, it is common to see an increase in the supply of shares available for trading. This increase in supply can put downward pressure on the stock price, as the market adjusts to the potentially larger number of sellers. Investors should be prepared for potential volatility during this time, as the increased supply of shares can lead to price fluctuations.

Insiders who have been restricted from selling their shares during the lock-up period may choose to sell their shares at the first opportunity after the lock-up period expires. This can result in a sudden increase in selling pressure and further impact the stock price. However, it is important to note that not all insiders will choose to sell their shares immediately. Some insiders may choose to hold onto their shares for longer, believing that the stock price will increase.

Investors and market participants closely watch the post lock-up period to gauge how insiders and large shareholders are behaving. If there is a rush to sell shares, it may indicate that these individuals have lost confidence in the company’s prospects. On the other hand, if insiders continue to hold their shares, it may be a positive signal that they believe in the company’s future.

Overall, the post lock-up period is an important period of time for both insiders and investors. It can have a significant impact on the company’s stock price and market performance. Investors should carefully monitor this period to gain insights into how insiders and other large shareholders are positioning themselves.

Read Also: Understanding the Principle of Moving Average: A Comprehensive Guide

The post lock-up period refers to the period after the expiration of the lock-up agreement, which is a contractual provision that restricts certain shareholders from selling their shares for a designated period of time following an initial public offering (IPO). Once the lock-up period expires, these individuals or entities are free to sell their shares on the open market.

During the post lock-up period, investors closely monitor the activities of the shareholders who were previously restricted from selling their shares. The release of these shares into the market can potentially have a significant impact on the company’s stock price. If a large number of locked-up shares are sold, it could lead to a decline in the stock’s value.

Read Also: What Does FX Mean in Finance? - Explained

Institutional investors, such as venture capitalists or private equity firms, often have a lock-up period in their investment agreements. This allows the company to stabilize its stock price and provides an opportunity for the investors to exit their positions once the lock-up period is over. However, it is important to note that smaller investors or retail investors may not have a lock-up period and can freely trade their shares from the time of the IPO.

Following the expiration of the lock-up period, the market generally experiences an increase in the supply of shares available for trading. This increased supply can lead to greater competition among sellers and potential downward pressure on the stock price.

Investors should be aware of the potential impact of the post lock-up period on a company’s stock. It is crucial to monitor any announcements or news releases related to the expiration of the lock-up period, as this information can provide insights into the future direction of the stock price.

In conclusion, the post lock-up period is a critical time for investors as it can significantly influence the stock price of a company. Understanding the implications of this period and staying informed about any developments can help investors make more informed decisions.

A lock-up period is a time frame, usually specified in an agreement, during which insiders, such as company founders and early investors, are not allowed to sell their stock.

Companies have lock-up periods to maintain stability in the stock market after an initial public offering (IPO). This prevents a sudden influx of shares into the market, which could cause the stock price to plummet.

After the lock-up period ends, insiders are free to sell their shares on the open market. This can increase the supply of shares and potentially lead to a decrease in the stock price.

The end of the lock-up period can create a sense of uncertainty among investors, as they anticipate a potential increase in the supply of shares. This can lead to increased volatility in the stock price during this period.

While insiders are generally free to sell their shares after the lock-up period, they may still be subject to certain legal and regulatory restrictions. For example, they may need to comply with insider trading laws and file the appropriate paperwork with securities regulators.

How to Purchase Digital Currency in SBI If you’re interested in buying digital currency and are a customer of the State Bank of India (SBI), you’re in …

Read ArticleWeight of Plexiglass: Everything You Should Know Plexiglass, also known as acrylic glass or acrylic panel, is a lightweight and versatile material …

Read ArticleIs Crypto Halal to Trade? Islamic finance is a system of financial activities that complies with Islamic law, also known as Shariah law. One of the …

Read ArticleIs there a stock market in Brazil? Brazil is not only famous for its beautiful beaches, vibrant culture, and passionate football fans, but also for …

Read ArticleHave the Miami Heat made any trades? The Miami Heat, a professional basketball team based in Miami, Florida, have been making waves in the NBA with …

Read ArticleFind the Best Binary Options Broker for You If you’re in the market for binary options trading, finding the right broker is crucial to your success. …

Read Article