Understanding the Perpetual Moving Average Cost in Inventory Management

Understanding Perpetual Moving Average Cost In the world of inventory management, understanding the perpetual moving average cost (PMAC) is essential …

Read Article

Forex trading is a complex and dynamic market where currencies are bought and sold. To participate in this global market, it is essential to understand how to place an order effectively. Placing an order refers to the process of entering a trade and executing it at a specific price. This step-by-step guide will walk you through the process of placing an order in forex trading.

Step 1: Choose your currency pair

Before placing an order, you need to decide which currency pair you want to trade. Forex trading involves buying one currency and simultaneously selling another. The most commonly traded currency pairs include EUR/USD, GBP/USD, and USD/JPY. Consider factors such as liquidity, volatility, and market conditions when selecting a currency pair.

Step 2: Decide on the order type

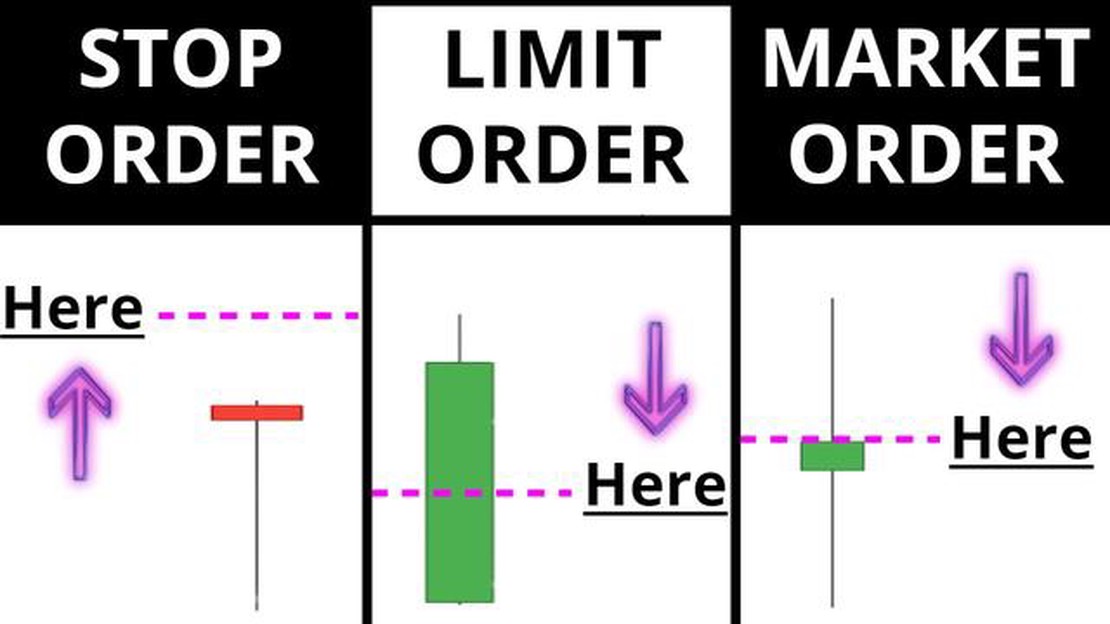

Next, you need to determine the type of order you want to place. The two main types are market orders and limit orders. A market order is executed immediately at the best available price, while a limit order allows you to set a specific price at which you want the trade to be executed.

Step 3: Set your entry and exit points

Once you have decided on the type of order, it’s important to set your entry and exit points. Your entry point is the price at which you want to enter the trade, while your exit point is the price at which you want to close your position. These points should be based on technical analysis, market trends, and your trading strategy.

Step 4: Determine your position size

Another crucial aspect of placing an order is determining your position size. This refers to the number of lots or units you want to trade. It’s crucial to manage your risk by calculating the appropriate position size based on your account balance, risk tolerance, and the size of your stop-loss order.

Read Also: Discover the Owner of MBA Forex and Unveil the Insights Behind the Success

Step 5: Monitor and manage your trade

After placing an order, it’s essential to monitor and manage your trade. Keep an eye on market conditions, news events, and price movements that may affect your trade. Consider implementing stop-loss and take-profit orders to protect your profits and limit potential losses.

In conclusion, placing an order in forex trading requires careful consideration and strategic decision-making. By following this step-by-step guide and implementing effective risk management techniques, you can increase your chances of success in the forex market.

Forex trading involves buying and selling currencies in the foreign exchange market. To execute a trade, you need to place an order with your broker. Here is a step-by-step guide on how to do it:

Placing an order in forex trading requires careful consideration of various factors such as currency pair selection, order type, order size, entry price, stop-loss and take-profit levels. By following the step-by-step guide outlined above, you can effectively place an order and participate in the exciting world of forex trading.

Forex trading, also known as foreign exchange trading, is the buying and selling of various currencies in the global marketplace. It is the largest and most liquid financial market in the world, with trillions of dollars being traded daily.

Read Also: Understanding the Benefits and Risks of a 2x Leveraged ETF Strategy

In forex trading, currencies are traded in pairs, such as EUR/USD or GBP/JPY. The first currency in the pair is called the base currency, while the second currency is called the quote currency. The value of a currency pair is determined by the relative value of the base currency compared to the quote currency.

Forex trading allows individuals and institutions to speculate on the fluctuations in currency prices and profit from these movements. Traders can go long (buy) a currency pair if they believe the base currency will strengthen against the quote currency, or go short (sell) if they believe the base currency will weaken against the quote currency.

One of the key advantages of forex trading is its high liquidity, which means that traders can enter and exit positions quickly and at a desired price. Additionally, forex trading is accessible 24 hours a day, five days a week, allowing traders to participate in the market at any time.

To engage in forex trading, traders need to open an account with a forex broker. They can then use various trading platforms to place orders and execute trades. These platforms provide real-time price quotes, charts, and analysis tools to help traders make informed decisions.

There are different types of orders that traders can place in forex trading, such as market orders, limit orders, and stop orders. A market order is an order to buy or sell a currency pair at the current market price. A limit order is an order to buy or sell a currency pair at a specific price or better. A stop order is an order to buy or sell a currency pair when it reaches a specific price, which is usually used to limit potential losses.

Overall, understanding the basics of forex trading is essential for anyone interested in participating in this dynamic and potentially profitable market. It is important to learn about the various trading strategies, risk management techniques, and market analysis tools to increase the chances of success in forex trading.

Placing an order in forex trading refers to the process of submitting an instruction to a broker to execute a trade in the foreign exchange market. It involves specifying the currency pair, the trade size, the type of order, and other relevant parameters.

Understanding Perpetual Moving Average Cost In the world of inventory management, understanding the perpetual moving average cost (PMAC) is essential …

Read ArticleUnderstanding the EMA Indicator: A Comprehensive Guide Technical analysis is an essential tool for traders and investors to make informed decisions in …

Read ArticleBest Charts for Commodity Trading Commodity trading is a complex and dynamic market where accurate information and analysis are crucial for making …

Read ArticleZambia Dollar to Euro Exchange Rate: Current Conversion Rates and Updates The exchange rate of Zambia dollar to the euro is an important indicator for …

Read ArticleIs Metatrader 5 Good for Forex Trading? When it comes to forex trading, having the right tools can make all the difference. One popular choice among …

Read ArticleIs ESPP a taxable benefit in Canada? Employee Stock Purchase Plans (ESPPs) are popular compensation programs offered by many companies in Canada. …

Read Article