How to Calculate Growth Rate: A Comprehensive Guide

Calculating Growth Rate: A Step-by-Step Guide Calculating growth rate is an essential skill for individuals and businesses alike, as it provides …

Read Article

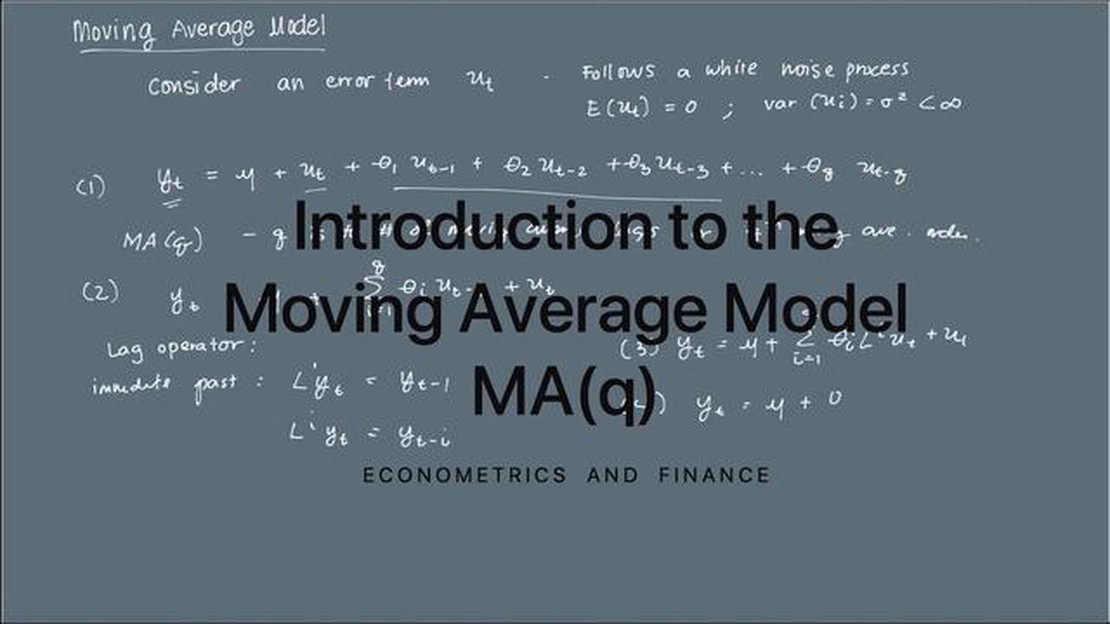

The moving average (MA) model is a commonly used statistical tool for analyzing time series data. It is a popular choice in econometrics, finance, and other fields where the temporal aspect of the data plays a crucial role. The MA model calculates the value of a variable based on the average of past values and the error term. Understanding the parameters of the MA model is essential for accurately interpreting and analyzing the data.

There are two main parameters in the MA model: the order of the model, denoted as q, and the coefficients or weights of the model. The order of the model determines the number of past observations used to calculate the current value. For example, an MA(1) model uses only one past observation, while an MA(2) model uses two.

The coefficients or weights of the MA model indicate the importance or contribution of each past observation in calculating the current value. These weights are assigned to the error terms associated with the past observations. The weights can be positive or negative, indicating the direction and magnitude of the impact each past observation has on the current value. The sum of the weights is often constrained to ensure the model is stationary and well-behaved.

Analyzing the parameters of the MA model is crucial for model selection, estimation, and interpretation. The order of the model needs to be carefully chosen based on the characteristics of the data and the objective of the analysis. The coefficients of the model can provide insights into the patterns and dynamics present in the time series data. Understanding these parameters allows for accurate forecasting, hypothesis testing, and decision-making based on the MA model.

In summary, the parameters of the moving average model, including the order of the model and the coefficients or weights, are essential components for analyzing time series data. These parameters determine the number of past observations used and the impact of each observation on the current value. Proper understanding and interpretation of these parameters are vital for accurately analyzing and predicting the behavior of the underlying data.

The moving average (MA) model is a commonly used time series analysis method that helps identify and predict patterns or trends in data. It is important to understand the different parameters that define the MA model in order to effectively utilize it.

The two main parameters of the MA model are the order of the model (q) and the coefficients. The order of the model indicates how many lagged error terms are included in the calculations. For example, an MA(1) model uses one lagged error term, while an MA(2) model uses two lagged error terms. The order of the model can range from 0 to infinity.

The coefficients represent the weights assigned to the lagged error terms. These coefficients are estimated using various methods, such as the maximum likelihood estimation or the method of moments. The coefficients determine the contribution of each lagged error term to the current value of the dependent variable.

In addition to the order and coefficients, it is also important to consider the stationarity of the time series data when working with MA models. Stationarity is a key assumption for the MA model to be valid. If the data is non-stationary, it may require transformation or differencing to achieve stationarity before applying the MA model.

Read Also: What is the Top Stock in Canada? Discover Canada's Best Performing Stock

Understanding and selecting appropriate values for the parameters of the MA model is crucial in order to accurately analyze and predict time series data. A proper understanding of the model parameters allows for better interpretation of the results and more reliable predictions.

Moving average models are a widely used statistical tool for analyzing time series data. They are particularly useful for understanding the trend and seasonality components of a time series, as well as identifying any outliers or irregularities.

The parameters of a moving average model, often denoted as MA(q), refer to the number of lags or time periods that are included in the model. These parameters play a crucial role in determining the accuracy and effectiveness of the model.

The first parameter, q, represents the number of lagged error terms that are used in the model. This parameter determines the order or complexity of the moving average model. A higher value of q indicates a more complex model that considers a larger number of past error terms. It is important to choose an appropriate value of q based on the characteristics of the time series data.

Another parameter that is often considered is the constant term in the moving average model. This term is denoted as μ and represents the mean or average value of the time series. Including a constant term in the model can help account for any overall trend or level shift in the data. However, it is not always necessary to include a constant term, as it depends on the specific characteristics of the time series.

When exploring the parameters of moving average models, it is important to consider the concept of stationarity. A time series is said to be stationary if its statistical properties, such as mean and variance, do not change over time. In order to apply a moving average model effectively, the time series should be stationary. If the time series is non-stationary, some pre-processing techniques, such as differencing, can be applied to achieve stationarity.

Read Also: Top Account Managers in Forex: Who are the Best Ones?

Choosing the appropriate parameters for a moving average model requires careful analysis and consideration of the characteristics of the time series data. It is important to strike a balance between model complexity and accuracy, as an overly complex model may lead to overfitting and poor performance on new data. Additionally, the parameters of a moving average model may need to be adjusted or updated over time as new data becomes available.

A moving average model is a time series forecasting model that uses past observations to predict future values. It calculates the average of a specified number of past observations and uses this average as the predicted value for the next time period.

A moving average model works by taking the average of a specified number of past observations to make predictions for future values. The number of past observations to include in the average is determined by the “order” of the moving average model.

The parameters of a moving average model include the order of the model (the number of past observations to include in the average), the coefficients of the past observations in the average, and the error term.

The order of a moving average model is determined by evaluating the autocorrelation function (ACF) plot of the time series data. The ACF plot shows the correlation between each observation and its lagged values. The order of the model is determined by the number of significant lags in the ACF plot.

Some limitations of the moving average model include the assumption of constant variance in the time series data, the inability to capture long-term trends or seasonality, and the inability to incorporate exogenous variables. It is also sensitive to outliers and can produce inaccurate predictions if the underlying data does not meet the assumptions of the model.

The Moving Average (MA) model is a time series model that is used to explain and predict future values based on past observations. It is a commonly used model in statistics and econometrics.

Calculating Growth Rate: A Step-by-Step Guide Calculating growth rate is an essential skill for individuals and businesses alike, as it provides …

Read ArticleEssential Factors to Consider When Trading Trading can be an exciting and potentially profitable venture, but it’s important to approach it with …

Read ArticleTrading Crude Options: A Comprehensive Guide Welcome to our comprehensive guide on trading crude options. Whether you’re a beginner looking to get …

Read ArticleIs Metatrader 5 Good for Forex Trading? When it comes to forex trading, having the right tools can make all the difference. One popular choice among …

Read ArticleDownload Forex Factory Calendar: Step-by-Step Guide If you are a forex trader, having access to accurate and up-to-date market information is …

Read ArticleIs kayak owned by Google? There has been speculation and rumors circulating about whether Kayak, the popular travel search engine, is owned by Google. …

Read Article