Accounting for Cancelled Share Options: Explained and Analyzed

Accounting for Cancelled Share Options: A Comprehensive Guide Share options are a common form of compensation offered to employees as an incentive for …

Read Article

If you’re interested in the world of finance and investing, you’ve probably heard of Forex trading. The Forex market, also known as the foreign exchange market, is the largest and most liquid financial market in the world. It’s where currencies are bought and sold, allowing individuals and businesses to exchange one currency for another. Forex trading can be a lucrative and exciting venture, but it also comes with its own set of challenges. In order to succeed in the Forex market, you need to have a deep understanding of how it works and the strategies that can help you navigate its complexities.

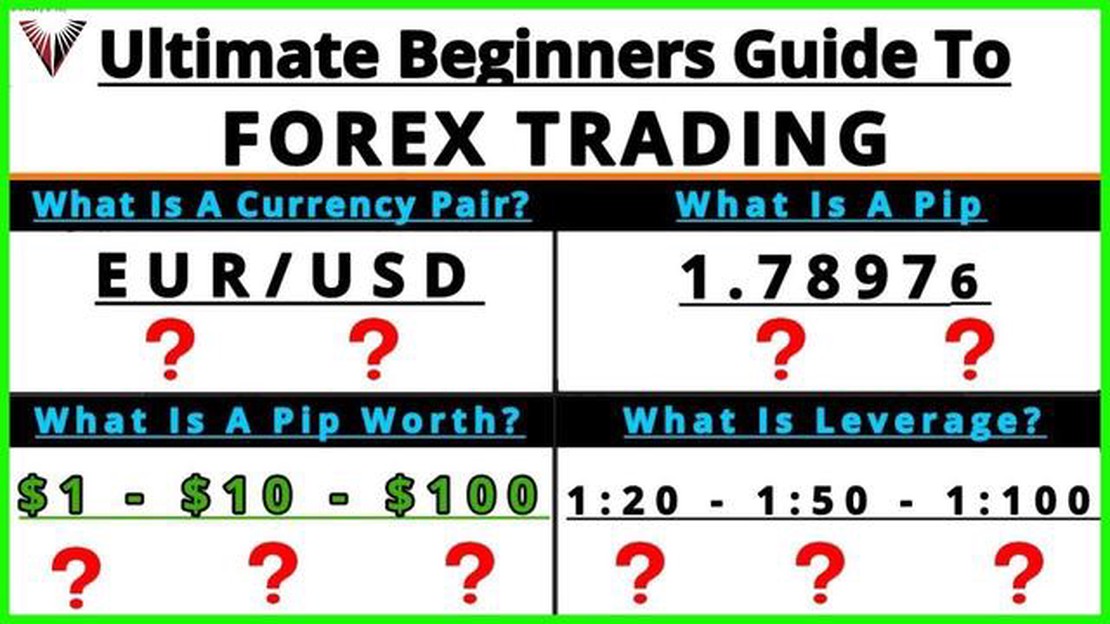

Learning Forex trading requires a combination of knowledge, practice, and discipline. There are many resources available to help you in your journey, from online courses and webinars to books and forums. It’s important to educate yourself on the fundamentals of Forex trading, including concepts such as currency pairs, pips, leverage, and margin. Understanding these concepts will give you a solid foundation to build upon as you further your learning.

Once you have a grasp of the basics, it’s time to put theory into practice. Opening a demo trading account is a great way to start practicing your trading skills without risking real money. A demo account allows you to trade with virtual funds, giving you the opportunity to test different strategies and techniques. This hands-on experience is invaluable in helping you develop your own trading style and gain confidence in your abilities.

In addition to practicing, it’s important to stay informed about market news and trends. The Forex market is influenced by a wide range of factors, including economic indicators, geopolitical events, and central bank policies. Keeping up-to-date with these developments can help you make more informed trading decisions. There are many sources of market analysis and news available, ranging from financial news websites to social media platforms. It’s important to use reputable sources and critically evaluate the information you come across.

Mastering Forex trading takes time and dedication. It’s not a get-rich-quick scheme, but rather a skill that can be honed over time. It’s important to approach Forex trading with a realistic mindset, understanding that there will be both wins and losses along the way. By continuously learning, practicing, and staying disciplined, you can increase your chances of success in the Forex market.

Forex trading, also known as foreign exchange trading, is the process of buying and selling currencies in order to make a profit. With an average daily trading volume of over $5 trillion, the forex market is the largest and most liquid financial market in the world. Mastering forex trading can be a challenging task, but with the right knowledge and skills, anyone can succeed.

Before diving into forex trading, it’s essential to understand the basics. Learn about currency pairs, how the forex market works, and the factors that can influence currency exchange rates. Familiarize yourself with key terms and concepts such as pips, lots, and leverage.

Take the time to educate yourself about forex trading. Read books, watch educational videos, and attend webinars or seminars. There are plenty of online resources available that can help you learn about technical analysis, fundamental analysis, and various trading strategies.

Selecting a reputable forex broker is crucial for your success. Look for a broker that is regulated by a recognized financial authority and offers a user-friendly trading platform. Consider factors such as spreads, commissions, customer support, and the availability of educational resources.

To succeed in forex trading, it’s essential to have a well-defined trading plan. Determine your trading goals, risk tolerance, and preferred trading style. Set clear entry and exit rules, and establish a risk management strategy to protect your capital.

Most brokers offer demo accounts that allow you to practice trading without risking real money. Use this opportunity to test your trading strategies, develop your skills, and gain confidence. Treat your demo account as if it were a real one to get a realistic trading experience.

To master forex trading, you need to stay informed about the latest market developments. Regularly monitor economic news and announcements, as they can have a significant impact on currency exchange rates. Utilize technical analysis tools and charts to identify potential trading opportunities.

The forex market is constantly evolving, so continuous learning is crucial for long-term success. Stay updated with the latest market trends and trading strategies. Analyze your trades, learn from your mistakes, and adapt your approach accordingly.

Psychology plays a significant role in forex trading. Greed, fear, and impatience can lead to irrational trading decisions. Develop discipline and emotional control to avoid impulsive trading and stick to your trading plan.

Risk management is vital in forex trading. Always use appropriate position sizing and set stop-loss orders to limit potential losses. Diversify your trades and avoid putting all your capital into a single trade. Never risk more than you can afford to lose.

Consider finding a mentor who has experience in forex trading. A mentor can provide guidance, share their knowledge and expertise, and help you navigate the challenges of the forex market. Learning from someone who has already achieved success can accelerate your learning curve.

Read Also: Understanding SMA Average: Definition, Calculation, and Benefits

In conclusion, mastering forex trading requires dedication, education, practice, and continuous learning. By following these steps and staying committed, you can increase your chances of success in the forex market.

Forex trading, also known as foreign exchange trading, is one of the most popular forms of investment in the financial market. It involves the buying and selling of currencies with the aim of making a profit from changes in their exchange rates.

Read Also: Learn how to practice swing trading effectively | Expert tips for beginners

To get started with forex trading, you need to understand a few key concepts and steps. Firstly, you need to have a basic understanding of how the forex market works. Unlike the stock market, forex trading operates 24 hours a day, five days a week, across different time zones.

One of the most important aspects of forex trading is understanding currency pairs. Currencies are traded in pairs, such as the EUR/USD or GBP/JPY. The first currency in the pair is known as the base currency, while the second currency is the quote currency. The exchange rate between the two currencies represents how much of the quote currency is required to buy one unit of the base currency.

Another crucial concept in forex trading is leverage. Leverage allows traders to control larger positions with a smaller amount of capital. It is important to understand that while leverage can amplify profits, it can also magnify losses, so it should be used with caution.

Before diving into forex trading, it is essential to choose a reliable forex broker. A forex broker acts as an intermediary between you and the forex market. Look for a broker that is regulated and has a good reputation. Additionally, consider factors such as trading platforms, customer support, and competitive spreads.

Once you have chosen a forex broker, you will need to open a trading account. Most brokers offer different types of accounts, such as a demo account for practice purposes or a live account to trade with real money. It is recommended to start with a demo account to familiarize yourself with the trading platform and strategies.

Developing a trading plan is crucial for success in forex trading. A trading plan outlines your goals, risk tolerance, and strategies. It helps you stay disciplined and make informed trading decisions. Consider factors such as analyzing charts, fundamental and technical analysis, and risk management strategies.

In conclusion, getting started with forex trading requires understanding how the forex market works, the concept of currency pairs, leverage, choosing a reliable forex broker, opening a trading account, and developing a trading plan. By mastering these basics, you will be on your way to becoming a successful forex trader.

Forex trading is the act of buying and selling currencies on the foreign exchange market. It involves speculating on the price movements of currency pairs in order to make a profit.

There are several ways to learn Forex trading. You can start by reading books, attending seminars, or taking online courses. It’s also important to practice trading on a demo account before using real money.

Yes, Forex trading carries a certain level of risk. The market is highly volatile and can be affected by numerous factors such as economic news, political events, and market sentiment. It’s important to manage your risk and only trade with money you can afford to lose.

Forex trading offers several advantages such as high liquidity, the ability to trade 24 hours a day, low transaction costs, and high leverage. It’s also a decentralized market, meaning there is no central exchange, which provides more trading opportunities.

To succeed in Forex trading, you need a combination of technical and fundamental analysis skills. You should be able to interpret charts, analyze economic indicators, and understand market trends. It’s also important to have strong risk management and emotional control.

Forex trading, also known as foreign exchange trading, is the buying and selling of currencies in the Forex market. It involves speculating on the price movements of various currency pairs in order to make a profit.

There are several ways you can learn Forex trading. You can start by educating yourself about the basics of Forex trading, such as how the market works, different trading strategies, and risk management. You can also take online courses or attend seminars and webinars to gain more knowledge and skills. Additionally, practicing with a demo account and analyzing market trends can help you gain practical experience and improve your trading abilities.

Accounting for Cancelled Share Options: A Comprehensive Guide Share options are a common form of compensation offered to employees as an incentive for …

Read ArticleShould you invest in Teladoc? A comprehensive analysis Investing in the stock market can be an exciting and profitable venture, but it is important to …

Read ArticleDiscover the Power of Grace and Learn How to Use It In our fast-paced and often chaotic world, finding moments of peace and tranquility can be a …

Read ArticleBest Places to Start Forex Trading Where Can I Start Forex Trading? The Best Places to Begin Trading Foreign Exchange Table Of Contents Where Can I …

Read ArticleIs Sirius XM stock a good buy? Sirius XM Holdings Inc. (NASDAQ: SIRI) is a leading satellite radio company that offers a wide range of entertainment …

Read ArticleSmart Trading: How to Improve Your Skills and Succeed in the Market Trading in the financial markets can be a challenging endeavor. It requires a …

Read Article