Is the London Session More Volatile Than New York? Exploring Forex Market Dynamics

Is London Session More Volatile Than New York? Forex market trading sessions play a crucial role in determining the overall volatility of currency …

Read Article

The dividend option trading strategy is a popular technique used by investors to generate income from their stock holdings. This strategy involves buying call options on a stock that pays dividends, typically with the intention of collecting the dividend while also potentially profiting from an increase in the stock’s price.

When using the dividend option trading strategy, investors purchase call options on a stock before the ex-dividend date. The ex-dividend date is the date on which a stock starts trading without the right to the next dividend payment. By buying the call options before this date, investors can potentially benefit from a rise in the stock’s price leading up to and after the ex-dividend date.

One key advantage of using the dividend option trading strategy is the ability to generate income from the dividends paid by the underlying stock. By purchasing call options, investors can collect the dividend payment without having to own the actual shares of stock. This can be particularly beneficial for investors who may not want to commit a large amount of capital to a specific stock, but still want to take advantage of the dividend payments.

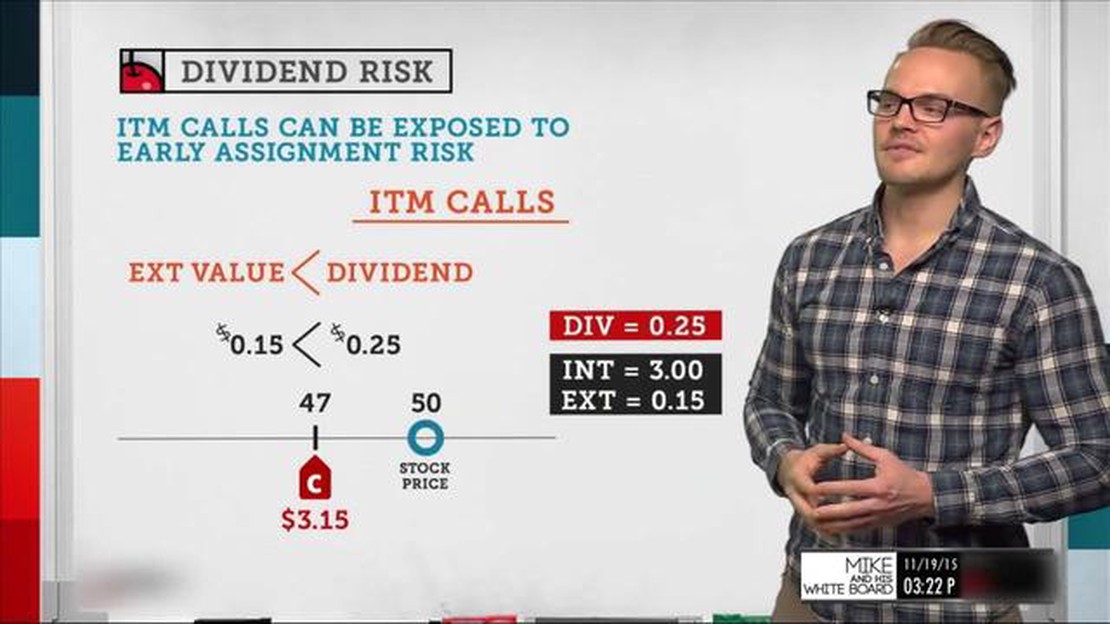

It is important to note that there are risks associated with the dividend option trading strategy. The price of the call options can fluctuate based on various factors, such as changes in the stock price, market conditions, and interest rates. Additionally, if the stock price does not increase or if it falls after the ex-dividend date, investors may not realize a profit from the strategy. Therefore, it is crucial for investors to carefully consider their risk tolerance and investment objectives before implementing the dividend option trading strategy.

The dividend option trading strategy is a method that allows investors to leverage the potential benefits of dividends by using options. Dividends are a distribution of a company’s profits to its shareholders, typically paid in cash or additional shares of stock. These payments are often made on a regular basis, such as quarterly or annually.

The dividend option trading strategy involves buying or selling options contracts to either enhance or protect an investor’s position in a dividend-paying stock. There are two main strategies that can be used: the covered call and the protective put.

Covered Call:

In a covered call strategy, an investor who owns shares of a dividend-paying stock sells call options against those shares. By selling the call options, the investor receives a premium upfront. If the price of the stock remains below the strike price of the call options until the options expire, the investor keeps the premium and continues to own the shares and receive dividends. If the price of the stock rises above the strike price, the shares may be sold, but the investor still keeps the premium received.

Read Also: Choosing the Perfect Moving Average for Day Charts: Expert Advice

Protective Put:

In a protective put strategy, an investor who owns shares of a dividend-paying stock buys put options on those shares. Put options give the owner the right to sell the shares at a predetermined price, known as the strike price, within a specified time frame. By purchasing put options, the investor protects themselves from potential downside risk in the stock’s price. If the price of the stock decreases, the investor can exercise the put options and sell the shares at the strike price to limit their losses. They can continue to receive dividends while holding the stock.

The dividend option trading strategy can be effective for investors looking to generate income from dividend payments while still participating in the potential stock price appreciation. It allows investors to take advantage of dividends while also managing the risks associated with owning stocks. However, options trading involves additional risks and complexities, and it is important for investors to fully understand the strategy and potential outcomes before implementing it.

Dividend option trading strategy offers several benefits to investors. Here are some of the key advantages:

| Generate income | The dividend option strategy allows investors to generate income through regular dividend payments. By purchasing stocks that pay regular dividends and selling options against those stocks, investors can receive premiums which can enhance their income. |

| Diversification | Investors can use the dividend option strategy to diversify their portfolio. By investing in different stocks that pay dividends, investors can spread their risk and potentially enhance their overall returns. This strategy can help protect investors from volatility in individual stocks. |

| Reduced risk | The dividend option trading strategy can help investors reduce risk through the income generated from dividends and premiums. The regular income stream can act as a cushion against market fluctuations and provide stability to an investor’s portfolio. |

| Cash flow | This strategy can provide investors with a consistent cash flow. By selling options against stocks, investors can receive premiums upfront, which can be an additional source of cash flow. |

| Tax advantages | Dividend income is often taxed at a lower rate than other forms of investment income. By utilizing the dividend option trading strategy, investors may benefit from the preferential tax treatment of dividends. |

In conclusion, the dividend option trading strategy offers investors the opportunity to generate income, diversify their portfolio, reduce risk, and provide a consistent cash flow. Additionally, the tax advantages associated with dividends make this strategy even more appealing for investors seeking to maximize their returns.

Read Also: Is Barclays a publicly traded company? Learn about Barclays stock

Dividend option trading strategy is an investment approach that involves buying and selling options contracts based on upcoming dividends of certain stocks. It aims to profit from the movement in the stock price and the dividend announcement.

Dividend option trading strategy works by identifying stocks that are expected to pay dividends in the near future. Traders then buy or sell options contracts based on their predictions of the stock’s movement before and after the dividend announcement.

The potential advantages of using dividend option trading strategy include the ability to generate income from the dividend payments, the potential for capital appreciation from the stock’s price movement, and the flexibility to implement a variety of options trading strategies.

Yes, there are risks associated with dividend option trading strategy. These include the risk of the stock price not moving as expected, the risk of the dividend payments being lower than anticipated, and the risk of options contracts expiring worthless.

Yes, there are alternative strategies to dividend option trading. Some examples include momentum trading, value investing, and growth investing. Each strategy has its own advantages and disadvantages, so it’s important to choose the one that aligns with your investment goals and risk tolerance.

The dividend option trading strategy is a method of buying options on stocks that pay dividends. It involves purchasing call options on stocks before they go ex-dividend, then exercising the options to receive the dividend payment.

The dividend option trading strategy works by taking advantage of the difference in price between the stock with dividends and the option on that stock. Traders buy call options on stocks that are about to go ex-dividend, and then exercise the options to receive the dividend payment. This allows them to profit from the difference in price between the stock and the option, as well as the dividend payment.

Is London Session More Volatile Than New York? Forex market trading sessions play a crucial role in determining the overall volatility of currency …

Read ArticleIs MetaTrader Legal in India? If you are an individual or a company involved in online trading in India, you may have heard about MetaTrader. …

Read ArticleWhat are the Four Seasons of Forex Market? When it comes to trading on the forex market, understanding the different seasons can make a significant …

Read ArticleIs it Possible to Make Profit in Forex Trading? Forex trading, also known as foreign exchange trading, offers the potential for lucrative financial …

Read ArticleUnderstanding the Process of Investment Investment is an important and complex financial concept that plays a crucial role in our economy. In simple …

Read ArticleStrategies to Grow Your Wealth Managing your money wisely is essential for financial stability and future growth. Whether you are just starting on …

Read Article