Where to Find Real-Time Exchange Rates on the Stock Exchange

Where to see exchange rates on the stock exchange? When it comes to investing in stocks and currencies, having access to up-to-date exchange rates is …

Read Article

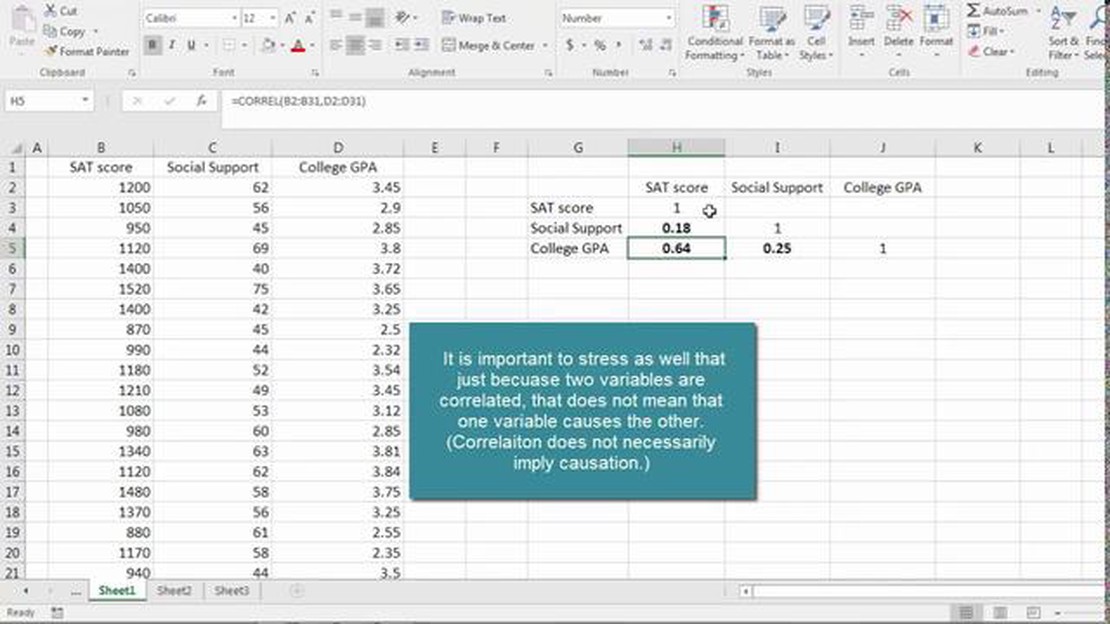

Correlation is a statistical measure that quantifies the relationship between two variables. It helps us understand how changes in one variable are related to changes in another variable. Calculating a correlation matrix is a useful technique in data analysis as it helps identify patterns and relationships between multiple variables.

To calculate a correlation matrix, follow these steps:

Remember, interpreting the correlation matrix requires understanding the context of your data and the variables being analyzed. A high positive correlation indicates a strong positive relationship between variables, while a high negative correlation indicates a strong negative relationship. A correlation coefficient close to zero suggests a weak or no relationship.

Calculating a correlation matrix step-by-step allows you to explore the relationships between variables and gain insights into your data. It is an essential tool for data analysts, statisticians, and researchers, providing valuable information for decision-making and further analysis.

A correlation matrix is a table that displays the correlation coefficients between a set of variables. It is commonly used in statistics and data analysis to examine the strength and direction of the linear relationship between variables. The correlation coefficient measures the extent to which two variables are related to each other.

The correlation matrix is a square matrix, where each row and column represents a different variable. The diagonal elements of the matrix are always equal to 1, as they represent the correlation between a variable and itself. The off-diagonal elements represent the correlation between two different variables. The correlation coefficient can range from -1 to 1, with -1 indicating a perfect negative correlation, 1 indicating a perfect positive correlation, and 0 indicating no correlation.

Read Also: Understanding Forex Switching: A Guide for Traders

A correlation matrix can be used to identify patterns and relationships in a dataset. It can help researchers understand how variables are related to each other and identify potential variables to include or exclude in statistical models. The correlation matrix can also be visualized using heatmaps or scatterplots, which provide a graphical representation of the correlation coefficients.

In summary, a correlation matrix is a useful tool for analyzing the relationship between variables. It provides a comprehensive overview of the correlations between a set of variables and can help researchers make informed decisions during data analysis.

A correlation matrix is a table that shows the correlation coefficients between multiple variables. It is used to understand the relationship between different variables and to identify patterns and trends in data. Here is a step-by-step guide on how to calculate a correlation matrix:

Calculating a correlation matrix can help in various fields such as finance, economics, psychology, and epidemiology. It provides insights into the strength and direction of relationships between variables, which can be used to make informed decisions and predictions.

Read Also: Why did the Canucks trade Luongo? Unveiling the reasons behind the trade

A correlation matrix is a table that displays the correlation coefficients between multiple variables in a dataset. It shows how the variables are related to each other.

A correlation coefficient is a numerical value that represents the strength and direction of the relationship between two variables. It is calculated by dividing the covariance of the two variables by the product of their standard deviations.

The correlation matrix is useful because it provides a quick and easy way to visualize the relationships between multiple variables. It can help identify patterns and dependencies in the data.

The correlation coefficient ranges from -1 to 1. A value of 1 indicates a perfect positive correlation, -1 indicates a perfect negative correlation, and 0 indicates no correlation. The closer the value is to 1 or -1, the stronger the correlation.

One limitation is that correlation does not imply causation. Just because two variables are strongly correlated does not mean that one variable causes the other. Another limitation is that the correlation matrix only measures linear relationships and may not capture other types of relationships.

Where to see exchange rates on the stock exchange? When it comes to investing in stocks and currencies, having access to up-to-date exchange rates is …

Read ArticleDoes it make sense to invest in bonds during periods of high interest rates? Investing in bonds can be a smart move to diversify your portfolio and …

Read ArticleUnderstanding the EMA Indicator: A Comprehensive Guide Technical analysis is an essential tool for traders and investors to make informed decisions in …

Read ArticleExchange rate of 1 euro in nrp Are you planning a trip to a country that uses the nrp as its currency? Or maybe you have some online shopping to do …

Read ArticleSummary of the International Trade System International trade plays a crucial role in the global economy, fostering economic growth, promoting …

Read ArticleConvert $500 USD to EGP Are you planning a trip to Egypt and wondering how much $500 USD is in Egyptian pounds (EGP)? Look no further! In this …

Read Article