Why is Citi stock so cheap? Uncovering the reasons behind Citi's undervalued stocks

Why is Citi stock priced so low? Citi, one of the world’s largest multinational investment banks, has been facing challenges in the stock market …

Read Article

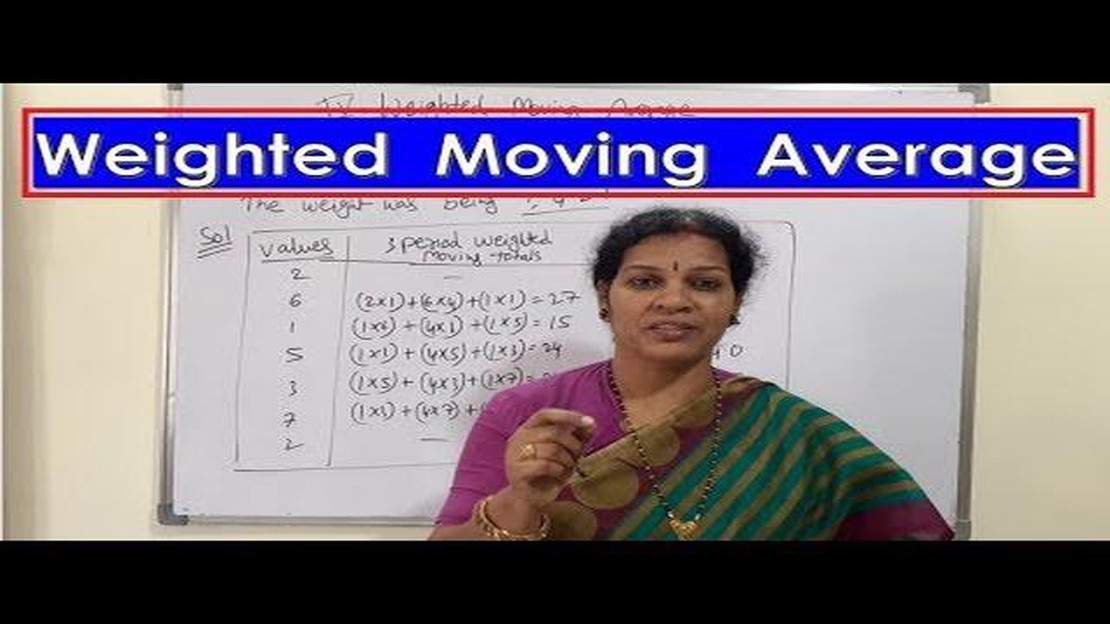

A weighted moving average is a commonly used technique in time series analysis to smooth out random fluctuations and extract underlying trends or patterns. It is a type of forecasting method that assigns different weights to different time periods within a given window. These weights are used to calculate a weighted average, which is then used to predict future values.

The weighted moving average takes into account the fact that recent observations may be more relevant for predicting future values than older observations. The weights assigned to each observation reflect the relative importance of that observation in the prediction process. Typically, the most recent observations are assigned higher weights, while older observations are assigned lower weights.

Weighted moving average models are particularly useful when there are seasonality or trend components present in the time series data. They can help identify patterns and make more accurate predictions by assigning higher weights to observations that are more representative of the underlying pattern or trend.

It is important to note that while a weighted moving average can be a useful tool in time series analysis, it is not a standalone model. It is often used in conjunction with other methods, such as exponential smoothing or autoregressive integrated moving average (ARIMA) models, to improve forecasting accuracy.

In conclusion, a weighted moving average is a valuable technique for analyzing time series data and extracting underlying trends or patterns. While it is not a complete model on its own, it can be a powerful tool when used in conjunction with other methods. By assigning different weights to different time periods, the weighted moving average allows for more accurate predictions by taking into account the relevance of each observation.

A Weighted Moving Average (WMA) is a time series forecasting model that assigns different weights to different historical data points. It is commonly used in financial analysis and demand forecasting to forecast future values based on past data.

The idea behind the WMA is that recent data points have more significance in predicting future values than older data points. By assigning higher weights to more recent data points, the WMA gives more importance to the most recent trends and changes in the time series.

The WMA is calculated by multiplying each data point by its corresponding weight, summing up the weighted values, and dividing the result by the sum of the weights. The weights can be chosen based on domain knowledge or through statistical techniques such as exponential smoothing.

To illustrate how the WMA works, let’s consider an example where we want to forecast the monthly sales of a product. We have the sales data for the past 12 months, with the most recent month being the last one.

| Month | Sales | Weight |

|---|---|---|

| Month 1 | 100 | 0.1 |

| Month 2 | 120 | 0.2 |

| Month 3 | 150 | 0.3 |

| … | … | … |

| Month 12 | 200 | 1.0 |

In this example, we assign higher weights to the more recent months, with the weight of the last month being 1.0. The weights can be chosen based on the business requirements and the importance of different data points.

Once the weights are determined, we calculate the weighted moving average by multiplying each sales value by its corresponding weight, summing up the weighted values, and dividing the result by the sum of the weights. In this case, the WMA can be calculated as:

(100 * 0.1 + 120 * 0.2 + 150 * 0.3 + … + 200 * 1.0) / (0.1 + 0.2 + 0.3 + … + 1.0)

Read Also: Understanding the Basics of Employee Stock Options: An Introduction

The resulting value gives us the forecasted sales for the next month, based on the historical sales data and the chosen weights. The WMA can be updated on a rolling basis to generate forecasts for multiple future time periods.

One advantage of the WMA is that it gives more weight to recent data points, allowing it to capture short-term trends and react quickly to changes in the time series. However, the WMA assumes that the weights are the same for all data points, which may not always be the case in real-world scenarios. Additionally, it is sensitive to outliers and extreme values.

In conclusion, the Weighted Moving Average is a simple yet powerful time series forecasting model that assigns different weights to historical data points. It is commonly used in financial analysis and demand forecasting to forecast future values based on past data, with more recent data points having higher weights. By capturing short-term trends and reacting quickly to changes, the WMA can provide valuable insights and predictions for various industries and applications.

The Weighted Moving Average (WMA) is a time series forecasting model that gives different weights to different data points in the series. Unlike the Simple Moving Average (SMA) which gives equal weights to all data points, the WMA assigns higher weights to more recent data points and lower weights to older data points.

Read Also: Understanding Mean Reversion in Trading: Key Concepts and Strategies

The WMA calculates the forecast by multiplying each data point by a predetermined weight and summing up the results. The weights are typically assigned in a way that reflects the importance or relevance of each data point. For example, if the most recent data points are considered more relevant for forecasting, they will be assigned higher weights.

The formula for calculating the WMA is:

WMA = (w1 * X1) + (w2 * X2) + … + (wn * Xn)

Where:

The weights can be chosen based on domain knowledge or through optimization techniques. Commonly used weight allocation methods include linear, exponential, or triangular weights.

The WMA is useful for identifying trends and removing noise from time series data. It can be used for short-term forecasting, especially when recent data points have a higher impact on the forecasted values. However, it may not be suitable for long-term forecasting or when there are significant changes in the underlying data generating process.

A weighted moving average is a time series model that assigns different weights to the data points in a moving window before calculating the average. This gives more importance to certain data points compared to others, allowing the model to capture different patterns in the data.

A weighted moving average differs from a simple moving average in that it assigns different weights to the data points in the moving window. In a simple moving average, all data points have an equal weight, while in a weighted moving average, the weights can be adjusted to give more importance to certain data points.

The advantages of using a weighted moving average include the ability to assign more importance to certain data points, which can help capture different patterns or trends in the data. It also allows for more flexibility in adjusting the weights to better fit the data and can provide more accurate forecasts.

Some common weighting schemes used in weighted moving averages include exponential smoothing, where the weights decrease exponentially as the data points move further away from the present, and linearly decreasing weights, where the weights decrease linearly as the data points move further away from the present. Other weighting schemes include triangular weights, where the weights form a triangular shape, and custom-defined weights based on the specific characteristics of the data.

Yes, there are some limitations or drawbacks of using a weighted moving average. One limitation is that the weights need to be appropriately chosen to reflect the importance of the data points, and if the weights are not chosen correctly, it can lead to inaccurate forecasts. Another limitation is that a weighted moving average may not be suitable for all types of time series data, and other models such as exponential smoothing or ARIMA may be more appropriate.

Weighted moving average is a time series forecasting model that assigns different weights to different periods of historical data. The weights are assigned based on their importance or relevance in predicting the future values of the time series.

Why is Citi stock priced so low? Citi, one of the world’s largest multinational investment banks, has been facing challenges in the stock market …

Read ArticleHow to Connect eSignal to Interactive Brokers? Are you a trader who uses the eSignal platform and wants to connect it to Interactive Brokers? Look no …

Read ArticleTrading Nikkei 225 Futures: A Comprehensive Guide If you are interested in trading futures and want to expand your portfolio, the Nikkei 225 futures …

Read ArticleCan I get USD in ICICI Bank? If you are planning to travel to the United States and need to exchange your Indian Rupees for USD, you may be wondering …

Read ArticleUsing the SMA Indicator: A Comprehensive Guide The Simple Moving Average (SMA) is a widely used technical indicator in the field of trading and …

Read ArticleAlligator Indicator with Fractals: A Comprehensive Guide The Alligator Indicator is a popular technical analysis tool used by traders to identify …

Read Article