What is the Forex Symbol for Crude Oil? | Forex Trading Guide

Forex Symbol for Crude Oil Forex trading is a popular way to invest in various financial markets, including commodities like crude oil. However, when …

Read Article

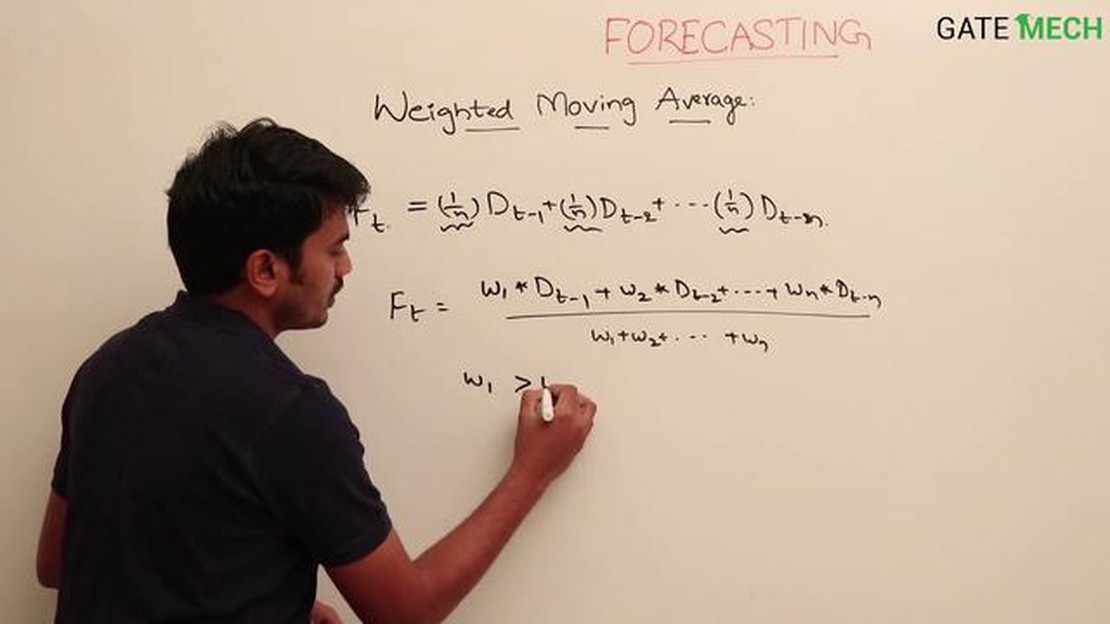

The weighted moving average is a widely used method for analyzing data in various fields, including finance, economics, and statistics. It is considered to be a more accurate method of analysis compared to the simple moving average, as it assigns different weights to data points based on their importance or relevance.

Unlike the simple moving average, which assigns equal weight to all data points, the weighted moving average takes into account the significance of each data point. This allows for a more accurate representation of trends and patterns in the data, as it gives more weight to the most recent or influential data points.

The weighted moving average is particularly useful in situations where certain data points have a greater impact on the overall trend or pattern. By assigning higher weights to these data points, the weighted moving average captures the underlying dynamics of the data more effectively, providing a clearer picture of the trend.

In addition, the weighted moving average can help smooth out noise or random fluctuations in the data, making it easier to identify the underlying trend. By giving more weight to recent data points, the weighted moving average is able to filter out short-term fluctuations and focus on the long-term trend.

Overall, the weighted moving average is a valuable tool for accurate analysis, as it takes into consideration the importance and relevance of each data point. By assigning different weights, the weighted moving average provides a more precise representation of trends and patterns in the data, helping analysts make informed decisions and predictions.

The Weighted Moving Average (WMA) is a powerful and versatile method used in data analysis. It offers a more accurate representation of data trends compared to other moving average methods.

Unlike the simple moving average, which gives equal weightage to all data points, the WMA assigns different weights to different data points. This makes it more responsive to recent changes in the data and provides a clearer picture of the current trend.

The WMA calculates the weighted average by multiplying each data point by its corresponding weight and then taking the sum of these products. The weights are usually assigned in a linear or exponential manner, giving more importance to recent data points.

One of the main advantages of the WMA is its ability to reduce lag. Lag refers to the delay in reflecting changes in the data, and it can be a significant drawback in analyzing time-sensitive data. By assigning higher weights to recent data points, the WMA can capture and reflect changes more quickly, reducing the lag and providing more up-to-date insights.

Additionally, the WMA offers greater flexibility in analysis. By adjusting the weights assigned to each data point, analysts can emphasize certain periods or trends of interest, allowing for more precise analysis and prediction. This customizability makes the WMA a valuable tool in various industries and domains.

However, it is worth noting that the WMA may not be suitable for all types of data. In situations where all data points have equal importance, such as when analyzing long-term trends or historical data, other moving average methods may be more appropriate.

In conclusion, the Weighted Moving Average is an effective analysis method that offers a more accurate representation of data trends. Through its ability to reduce lag and customization options, it provides valuable insights for analysts in various fields.

The weighted moving average (WMA) is a popular method for analyzing time series data. It is considered by many to be a more accurate method compared to the simple moving average (SMA) because it assigns different weights to each data point.

Unlike the SMA, which gives equal weight to all data points, the WMA calculates the average by assigning higher weights to more recent data points and lower weights to older data points. This means that the WMA gives more importance to recent trends and changes in the data, making it a more responsive method for analysis.

To calculate the WMA, you first need to determine the weights to assign to each data point. The weights are typically based on a predefined formula or pattern. For example, you could use a linear weight scheme or an exponential weight scheme.

Read Also: Understanding Box 14 on W-2: Explanation and Codes

Once you have the weights, you multiply each data point by its corresponding weight, sum up the results, and divide by the sum of the weights. This gives you the weighted average for the time period you are analyzing.

The WMA is commonly used in financial analysis, particularly in forecasting stock prices and analyzing trends. It is believed to be more accurate than the SMA because it gives more weight to recent data, which is often considered more relevant for predicting future trends.

Read Also: How to buy Chinese renminbi (RMB) in India: A complete guide

However, it is important to note that the WMA is not a foolproof method and should be used in conjunction with other analysis techniques. It is just one tool in the analyst’s toolkit and should be interpreted in the context of other factors and indicators.

In conclusion, the weighted moving average is a more accurate method for analysis compared to the simple moving average. It assigns different weights to each data point, giving more importance to recent trends and changes. However, it should be used alongside other analysis techniques to get a comprehensive understanding of the data.

Weighted Moving Average (WMA) is a powerful method for analyzing time series data that offers several advantages over other moving average methods.

2. Less lag: Unlike Simple Moving Average (SMA), which gives equal weight to all data points, WMA assigns higher weights to more recent data. This reduces the lag between the moving average line and the actual data, making WMA a better indicator for short-term analysis.

3. Improved forecasting: WMA’s focus on recent data makes it particularly effective for forecasting future values. By assigning higher weights to more recent data, WMA captures the most up-to-date trends and patterns, allowing analysts to make more accurate predictions about future market conditions.

4. Adaptable to changing volatility: WMA can be adjusted to account for changes in the volatility of the data. By assigning higher weights to more recent data during periods of high volatility and lower weights during periods of low volatility, WMA can provide a more accurate representation of the underlying market conditions.

5. Smoothed data: WMA can help to smooth out random fluctuations in the data, making it easier to identify underlying trends and patterns. By assigning different weights to each data point, WMA reduces the impact of outliers and noise, providing a clearer picture of the underlying market dynamics.

2. Less lag: Unlike Simple Moving Average (SMA), which gives equal weight to all data points, WMA assigns higher weights to more recent data. This reduces the lag between the moving average line and the actual data, making WMA a better indicator for short-term analysis.

3. Improved forecasting: WMA’s focus on recent data makes it particularly effective for forecasting future values. By assigning higher weights to more recent data, WMA captures the most up-to-date trends and patterns, allowing analysts to make more accurate predictions about future market conditions.

4. Adaptable to changing volatility: WMA can be adjusted to account for changes in the volatility of the data. By assigning higher weights to more recent data during periods of high volatility and lower weights during periods of low volatility, WMA can provide a more accurate representation of the underlying market conditions.

5. Smoothed data: WMA can help to smooth out random fluctuations in the data, making it easier to identify underlying trends and patterns. By assigning different weights to each data point, WMA reduces the impact of outliers and noise, providing a clearer picture of the underlying market dynamics.

In conclusion, Weighted Moving Average offers several advantages over other moving average methods. It reflects changing trends, has less lag, improves forecasting accuracy, is adaptable to changing volatility, and provides smoothed data. These advantages make WMA a valuable tool for analysts seeking a more accurate method for time series analysis.

Weighted moving average should be used when more recent data points are considered to be more important or carry more weight compared to older data points. This allows for a more accurate analysis of the trend in the data.

Weighted moving average is calculated by multiplying each data point by a weight, summing up the weighted values, and dividing the sum by the sum of the weights. The weights assigned to each data point are typically highest for the most recent data point and decrease as you move further back in time.

Weighted moving average can help reduce the impact of outliers in the data due to the emphasis on more recent data points. However, it may not completely eliminate outliers as it still considers all data points in the calculation. Additional data cleaning or outlier detection techniques may be necessary for a more robust analysis.

One disadvantage of using weighted moving average is that it can be more computationally intensive compared to simple moving average, especially when dealing with large data sets or longer time periods. Additionally, determining the appropriate weights for each data point can be subjective and may require some trial and error to achieve optimal results.

Forex Symbol for Crude Oil Forex trading is a popular way to invest in various financial markets, including commodities like crude oil. However, when …

Read ArticleShould You Consider Option Trading? Option trading is a popular and potentially lucrative investment strategy that allows traders to speculate on the …

Read ArticleCan you deposit foreign currency into HSBC UK? If you’re a customer of HSBC UK and you’ve recently returned from a trip abroad with leftover foreign …

Read ArticleUnderstanding Long and Short Positions in Currency Trading When it comes to currency trading, there are two important concepts that every trader …

Read ArticleIs Forex the same as binary options? Forex and binary options are both popular ways to trade financial markets, but they have key differences that set …

Read ArticleSetting Targets in Forex: A Comprehensive Guide Setting targets is a crucial step in achieving success in the forex market. Without clear goals, …

Read Article