Understanding the Weighted Moving Average Method for Accurate Forecasting

Understanding the Weighted Moving Average Method for Forecasting The accurate forecasting of future trends is crucial for businesses to make informed …

Read Article

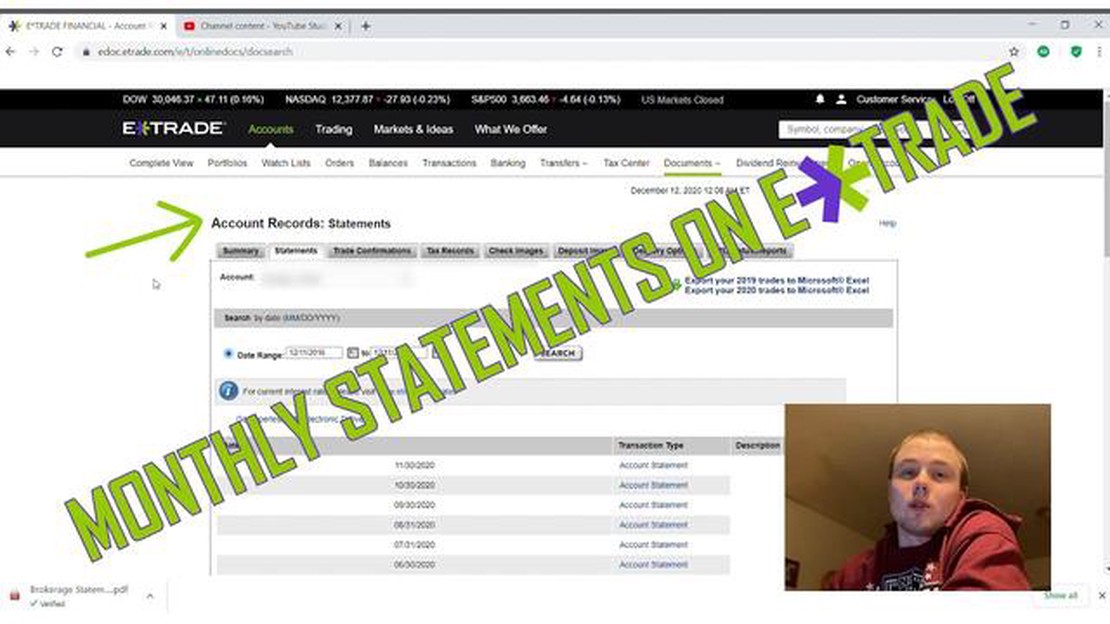

If you’re considering using E-Trade for your online trading needs, you may be wondering whether or not there is a monthly fee associated with the platform. E-Trade is known for providing a wide range of services and features, but it’s important to understand the cost structure before you sign up. In this article, we will explore whether or not E-Trade charges a monthly fee and what fees you may encounter when using their services.

Many online brokers charge their customers a monthly fee for access to their trading platform, but E-Trade is different. While they do have fees for certain services and transactions, E-Trade does not charge a monthly fee simply for using their platform. This means that you can open an E-Trade account and have access to their trading tools and resources without having to pay a recurring fee.

However, it’s important to note that there are other fees that you may encounter when using E-Trade. For example, E-Trade charges commissions for trades, which vary depending on the type of investment and the size of the trade. Additionally, there may be fees for certain account activities, such as wire transfers or account transfers. It’s important to review E-Trade’s fee schedule and terms of service to understand exactly what fees you may encounter as a user.

In conclusion, while E-Trade does not charge a monthly fee for using their platform, there are other fees that you may encounter when using their services. It’s important to carefully review their fee schedule and terms of service to understand the cost structure and determine whether or not E-Trade is the right choice for your online trading needs. By doing your research and understanding the fees associated with E-Trade, you can make an informed decision and ensure that you are getting the best value for your money.

E-Trade is an online brokerage platform that offers a wide range of services to its customers. Whether you are a beginner or an experienced trader, E-Trade has something to offer for everyone.

One of the key services provided by E-Trade is the ability to buy and sell stocks, options, and mutual funds. Through their user-friendly platform, customers can access real-time market data and execute trades with ease. E-Trade also provides educational resources to help customers make informed investment decisions.

In addition to trading services, E-Trade offers banking solutions such as online savings and checking accounts. Customers can easily manage their finances and access their funds through E-Trade’s digital banking platform.

Read Also: Discover the highest returning ETFs: find out which one is the best for you

E-Trade also offers retirement planning tools and services, including IRA accounts and retirement planning guidance. Customers can set goals, track their progress, and receive personalized recommendations to help them reach their retirement goals.

Another standout feature of E-Trade is their robust research and analysis tools. Customers have access to market insights, analyst research reports, and trading ideas to help them stay informed and make well-informed investment decisions.

Overall, E-Trade provides a comprehensive suite of services for investors and traders. From trading and banking to retirement planning and research tools, E-Trade has all the tools and resources you need to manage your investments effectively.

When considering using the services of E-Trade, it is important to understand the cost structure associated with the platform. E-Trade charges various fees for different types of transactions and services. By being aware of these fees, investors can make informed decisions about using E-Trade for their financial needs.

Overall, while E-Trade provides a convenient and user-friendly platform for investing, it is important to consider the cost structure associated with their services. By understanding the fees charged for various transactions and services, investors can make informed decisions and manage their costs effectively.

Yes, E-Trade does charge a monthly fee for its services. The specific fee depends on the type of account you have and the level of service you require. The fees can range from $0 to $25 per month.

Read Also: Effective Strategies for Trading VIX 75

E-Trade offers several types of accounts, including brokerage accounts, retirement accounts (such as IRAs), and managed portfolios. Each type of account has its own fee structure, and the specific fees depend on the account size and trading activity.

E-Trade charges a fee of $0 per trade for stocks, ETFs, and options. However, there may be additional fees for certain types of orders or if you choose to use a broker-assisted service. It’s important to review the fee schedule provided by E-Trade to understand all the potential charges.

No, E-Trade does not require a minimum balance to open an account. However, some account types may have minimum balance requirements in order to qualify for certain benefits or services. It’s best to check with E-Trade directly to determine if there are any minimum balance requirements that apply to your specific account.

E-Trade strives to be transparent with its fee structure, but it’s always a good idea to review the fine print to ensure you understand all the potential charges. While E-Trade does not have any hidden fees, there may be additional fees for certain services, such as wire transfers, paper statements, or overnight delivery of documents.

E-Trade does not charge a monthly fee for its basic brokerage account. However, there may be fees associated with certain services or account types.

Yes, E-Trade does charge a monthly fee for its premium services. The exact fee depends on the level of service and the account balance. The fee can range from $25 to $250 per month.

Understanding the Weighted Moving Average Method for Forecasting The accurate forecasting of future trends is crucial for businesses to make informed …

Read ArticleIs Michael Kors a Luxury Designer Brand? Michael Kors is a prominent name in the fashion industry, known for his elegant designs and timeless style. …

Read ArticleCan you negotiate a stock option? Stock options can be a valuable form of compensation, allowing employees to potentially reap significant financial …

Read ArticleScalping Forex with Spread: Strategies and Techniques Scalping is a popular trading strategy in the Forex market that involves making quick trades to …

Read ArticleIs trading without leverage halal? In Islamic finance, the concept of halal (permissible) and haram (forbidden) plays a crucial role in determining …

Read ArticleWhat Does GMT Stand for in Forex? Greenwich Mean Time (GMT) is a time reference used in the world of forex trading. GMT is a standard time that is …

Read Article