A step-by-step guide on trading forex on MetaTrader

Beginner’s Guide to Trading Forex on MetaTrader Forex trading on the popular MetaTrader platform can be a rewarding and profitable experience if …

Read Article

Forex trading, also known as foreign exchange trading, is a popular investment option for individuals looking to trade currencies on the global market. With the potential for high returns, many traders are interested in finding a reliable bank to facilitate their forex transactions. One bank that often comes to mind is Standard Bank.

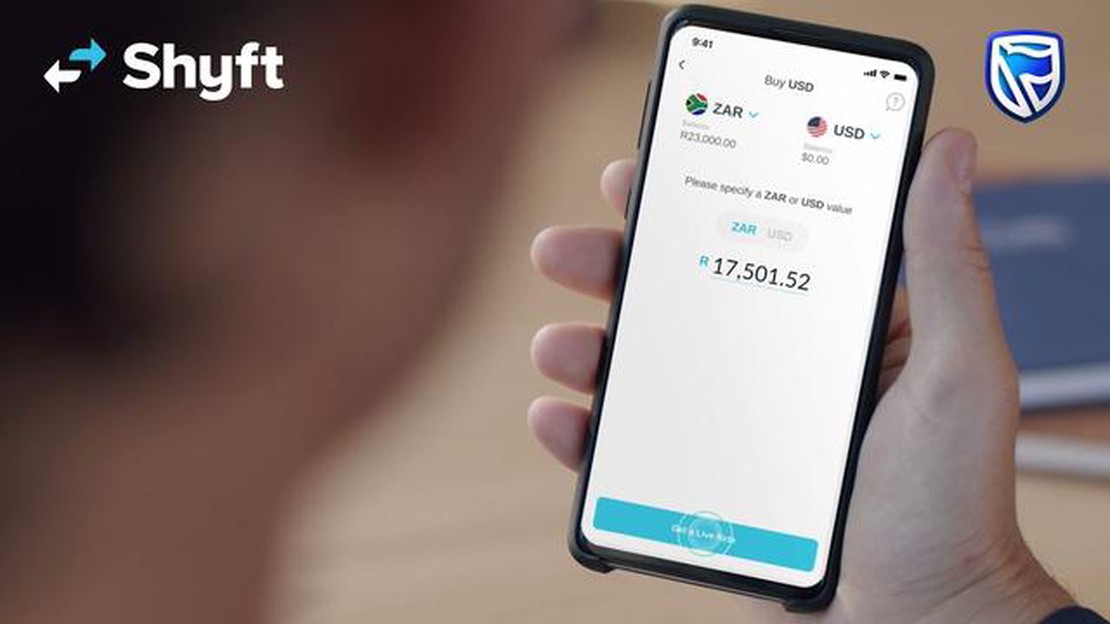

Standard Bank is a well-established financial institution that operates in multiple countries, offering a range of banking services. But is it compatible with forex trading? Let’s take a closer look at what Standard Bank has to offer for forex traders.

One of the key factors to consider when choosing a bank for forex trading is whether they provide access to the currency pairs you wish to trade. Standard Bank offers a comprehensive range of currencies, including major, minor, and exotic pairs.

Aside from the variety of currency pairs, it’s also important to assess the platform and tools provided by the bank. Standard Bank offers an online trading platform that allows traders to access real-time market data, execute trades, and monitor their portfolios. Additionally, they provide analysis tools and research reports to assist traders in making informed decisions.

Another aspect to consider is the availability of customer support. Standard Bank offers customer support services to assist traders with any issues or inquiries they may have. This can be especially valuable for new forex traders who may require guidance in navigating the forex market.

In conclusion, Standard Bank is indeed compatible with forex trading. With its comprehensive range of currency pairs, user-friendly platform, and customer support services, traders can feel confident in using Standard Bank for their forex transactions.

Forex trading, also known as foreign exchange trading, is the buying and selling of currencies on the foreign exchange market. This market is the largest and most liquid in the world, with trillions of dollars being traded every day.

Read Also: What is the most expensive currency? Find out the currencies with the highest exchange rates

The forex market operates 24 hours a day, five days a week, allowing traders from all over the world to participate at any time. Unlike traditional stock markets, forex trading does not have a centralized exchange. Instead, it is conducted over-the-counter through electronic networks.

The main participants in the forex market are commercial banks, central banks, hedge funds, corporations, and individual traders. These participants trade currencies to take advantage of fluctuations in exchange rates, with the goal of making a profit.

Forex trading involves two currencies that make up a currency pair. The first currency is called the base currency, and the second currency is called the quote currency. When trading forex, you are speculating on the relative value of one currency against another.

Forex trading involves buying a currency pair if you believe the base currency will appreciate in value against the quote currency, or selling a currency pair if you believe the base currency will depreciate in value against the quote currency. Traders can profit from these price movements by buying low and selling high.

Traders can access the forex market through a forex broker, who provides trading platforms and tools for executing trades. These brokers may charge commissions or spread fees for their services.

It is important for forex traders to understand the risks involved in trading. The forex market is highly volatile and can be affected by economic, political, and social factors. Traders should also be aware of leverage, which allows them to control larger positions with a smaller amount of capital but also increases the risk of losses.

In conclusion, forex trading is a complex and dynamic market that offers opportunities for profit as well as risks. Understanding the principles behind forex trading and conducting thorough research is crucial for success in this market.

Forex trading with Standard Bank offers a range of benefits for traders. Here are some of the key advantages:

Read Also: Understanding the 2-period RSI Backtest: A Comprehensive Guide for Traders

In conclusion, forex trading with Standard Bank offers traders access to international markets, advanced trading platforms, competitive pricing, expert research and analysis, 24/7 customer support, and education and training opportunities. These benefits can enhance a trader’s forex trading experience and increase their chances of success in the market.

Yes, Standard Bank offers forex trading services to its customers.

There are several advantages of using Standard Bank for forex trading. First, the bank is well established and has a good reputation in the industry. Second, it offers a wide range of forex trading instruments and tools. Third, it provides competitive pricing and low transaction costs. Fourth, it offers excellent customer service and support.

Yes, you can use Standard Bank for forex trading even if you are not a customer of the bank. However, you will need to open a trading account with the bank and go through the required verification process.

Standard Bank offers various types of forex trading accounts to cater to the needs of different traders. These include standard accounts, premium accounts, and VIP accounts. Each type of account has its own features and benefits.

Beginner’s Guide to Trading Forex on MetaTrader Forex trading on the popular MetaTrader platform can be a rewarding and profitable experience if …

Read ArticleTrading system of the Indus Valley civilization The Indus Valley civilization, also known as the Harappan civilization, was one of the oldest urban …

Read ArticleCan US citizens trade in Hong Kong? If you’re a US citizen interested in trading in the bustling and vibrant financial hub of Hong Kong, you might be …

Read ArticleWhat is the best time frame for sniper entries? Time frames play a crucial role in the success of a trader’s sniper entries. Choosing the right time …

Read ArticleIs Swissquote a Trustworthy Broker? In the competitive world of the financial market, it is essential to find a reliable and trustworthy partner to …

Read ArticleWhat is 20 EMA in Share Market? When it comes to analyzing the stock market, there are numerous indicators and tools that traders and investors use to …

Read Article