Bank Exchange Rate for CAD to INR: Everything You Need to Know

What is the bank exchange rate for CAD to INR? The bank exchange rate for Canadian Dollar (CAD) to Indian Rupee (INR) is an important factor to …

Read Article

Spread betting is a popular form of gambling that involves speculating on the movement of financial markets. While some may believe that spread betting is a 50/50 gamble, the truth behind the odds reveals a more complex picture.

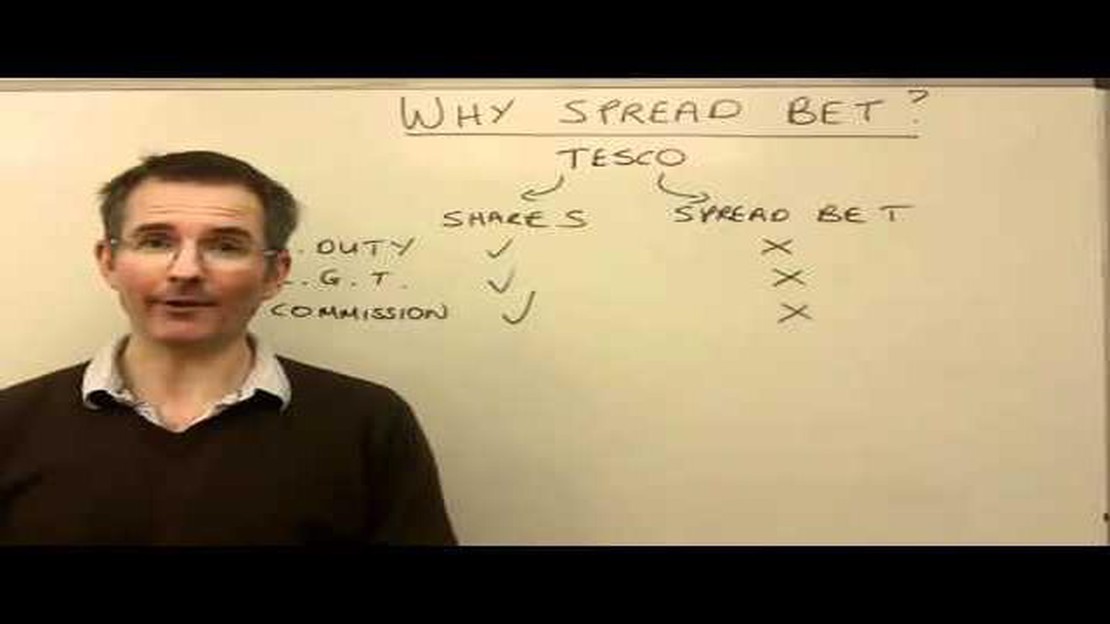

Unlike traditional betting where you wager on the outcome of an event, spread betting allows you to speculate on the price movement of various financial instruments, such as stocks, currencies, or commodities. The key concept in spread betting is the spread, which represents the difference between the buy and sell price of a particular asset.

Spread betting providers offer a range of markets and instruments, each with its own unique spread. The spread is determined by various factors, including market volatility, liquidity, and the provider’s own costs. Therefore, the odds in spread betting are not fixed and can vary significantly.

It’s important to understand that spread betting is a high-risk activity that carries the potential for significant gains or losses. While it is possible to make profits by correctly predicting price movements, the unpredictable nature of financial markets means that spread betting is far from a 50/50 proposition. It requires a combination of skill, knowledge, and careful risk management.

In conclusion, spread betting is not a simple 50/50 gamble. The odds can vary depending on the market and instrument being traded, as well as a range of other factors. As with any form of gambling, it is important to approach spread betting with caution and to educate oneself about the risks involved.

Spread betting is a form of betting that allows you to speculate on the movement of a financial market without actually owning the underlying asset. Instead of buying and selling stocks, currencies, or commodities, you are placing a bet on whether the market will rise or fall.

The key concept in spread betting is the spread, which is the difference between the bid price (the price at which you can sell) and the ask price (the price at which you can buy). The spread is determined by the bookmaker or broker, and it represents their profit margin.

To place a spread bet, you first need to decide on the size of your stake. This is the amount of money you are willing to risk on the bet. The stake can be as small or as large as you want, but keep in mind that the potential profits or losses will be proportional to your stake.

Next, you need to decide whether to go long or short. Going long means betting that the market will rise, while going short means betting that the market will fall. If you think the market will rise, you would place a buy bet, and if you think the market will fall, you would place a sell bet.

Once you have decided on the direction, you need to choose your market and the time frame for the bet. You can spread bet on a wide range of markets, including stocks, indices, currencies, commodities, and more. The time frame can range from minutes to months, depending on your trading strategy.

When the bet is placed, the bookmaker or broker will provide you with a quote that includes the bid and ask prices. If you believe the market will rise, you would buy at the ask price, and if you believe the market will fall, you would sell at the bid price. The difference between the two prices is the spread.

If your prediction is correct and the market moves in your favor, you will make a profit. However, if the market moves against you, you will incur a loss. The amount of profit or loss will depend on the size of your stake and the distance the market moves from your entry point.

Read Also: Is MetaTrader 4 Free to Download? Find Out All About MT4 Here

Spread betting offers potential advantages such as the ability to profit from both rising and falling markets, the flexibility to trade on margin and magnify your potential returns, and the tax advantages in certain jurisdictions. However, it also carries risks, including the potential for significant losses if the market moves against your bet.

It’s important to carefully consider your trading strategy, set a risk management plan, and have a thorough understanding of the market before engaging in spread betting.

Spread betting is a unique form of gambling that allows individuals to speculate on the price movements of financial assets, such as stocks, commodities, and currencies. Unlike traditional betting, spread betting does not involve simply betting on the outcome of an event, but rather betting on the accuracy of a prediction made by a bookmaker or spread betting company.

In spread betting, the bookmaker or spread betting company sets a spread, which is a range or margin that represents the predicted outcome of an event. The individual then bets on whether the final outcome will be higher or lower than the spread. The difference between the actual outcome and the spread is used to determine the individual’s winnings or losses.

The mechanics of spread betting can be understood through an example. Let’s say a bookmaker predicts that the total number of goals scored in a football match will be between 2 and 3. The individual decides to bet £10 per point on the outcome being higher than the spread. If the final outcome is 4 goals, the individual would win £10 for each point above the spread, resulting in a profit of £20. However, if the final outcome is 2 goals, the individual would lose £10 for each point below the spread, resulting in a loss of £20.

It is important to note that spread betting involves a high level of risk, as the potential losses can exceed the initial stake. Additionally, the accuracy of predictions made by bookmakers or spread betting companies can vary, making it essential for individuals to carefully analyze and assess the information before placing a bet.

Spread betting offers a unique and exciting way for individuals to engage in financial speculation. By understanding the concept of spread betting and its mechanics, individuals can make informed decisions and potentially profit from their predictions.

In the world of spread betting, the concept of 50/50 odds can be quite misleading. While it may seem logical to assume that the chances of winning or losing in spread betting are evenly split, the truth is far more complex.

Read Also: Can you invest in WWE stock: A comprehensive guide

Spread betting involves placing a wager on the outcomes of a certain event, such as the number of goals scored in a football match or the total points scored in a basketball game. The bookmaker sets a spread or a range of outcomes, and the bettors can choose to bet on whether the actual outcome will be above or below this spread.

While it might appear that there is an equal chance of the outcome falling above or below the spread, the bookmaker adjusts the odds to ensure their profit margin. The odds are influenced by various factors, including the popularity of the event, the historical data, and the bettors’ behavior. As a result, the odds in spread betting are often skewed in the bookmaker’s favor.

| Odds | Winning Probability | Bookmaker’s Profit |

|---|---|---|

| 1.90 | 52.63% | 5.26% |

| 2.00 | 50.00% | 0.00% |

| 2.10 | 47.62% | -4.76% |

In the table above, you can see that even when the odds are set at 2.00, which may seem like a fair 50/50 chance, the bookmaker still has a built-in profit margin. This profit margin is the “juice” or the “vig” that the bookmaker charges for facilitating the bet.

It’s important to understand that spread betting is not the same as traditional sports betting, where the odds are often presented as decimal or fractional values. In spread betting, the odds are dynamic and can change based on the bets made by other bettors. This allows the bookmaker to adjust the odds to balance the action and mitigate their risk.

So, while the idea of 50/50 odds may be appealing, it’s important to recognize the underlying mechanics of spread betting and the bookmaker’s role in determining the odds. Successful spread bettors understand the concept of value and analyze the odds to identify opportunities where the actual probability of an outcome is higher than the implied probability. It takes skill, knowledge, and a deep understanding of the sport or event to consistently make profitable spread bets.

Spread betting is a type of financial betting where the bettor speculates on the movement of a particular asset’s price. It involves making a bet on whether the price of the asset will rise or fall, and the amount of money won or lost is determined by the accuracy of the bet.

No, spread betting is not 50/50. While it is a speculative form of betting, the odds are not equal. The spread, which represents the difference between the buy and sell price of an asset, is set by the provider and includes a small margin for the house. This means that the odds are slightly in favor of the provider, making it more difficult for bettors to win consistently.

Spread betting has several advantages. Firstly, it offers the potential for high returns on investment, as the amount won or lost is determined by the accuracy of the bet. Additionally, spread betting allows for trading on a wide range of assets, including stocks, commodities, and currencies. It also provides the opportunity for bettors to go long or short, meaning they can profit from both rising and falling markets.

Yes, there are risks involved in spread betting. As a form of financial betting, it carries the potential for significant losses. The amount of money that can be lost is not limited to the initial stake, as losses can exceed the amount wagered. Additionally, spread betting is highly leveraged, which means that a small movement in the price of the asset can result in a large gain or loss. It is important for bettors to manage their risk and set stop-loss orders to limit potential losses.

What is the bank exchange rate for CAD to INR? The bank exchange rate for Canadian Dollar (CAD) to Indian Rupee (INR) is an important factor to …

Read ArticleTypes of Stock Warrants: Exploring the Options Stock warrants are a financial instrument that gives the holder the right, but not the obligation, to …

Read ArticleWhat is the value of 1 lot in trading? Trading in financial markets involves various terms and concepts that a trader needs to understand. One such …

Read ArticleUnderstanding Stock Option Grants Stock option grants are a powerful tool used by companies to attract and retain talented employees. They offer …

Read ArticleEasy Ways to Understand Forex Trading Forex, or foreign exchange, is a decentralized market for trading currencies. It is the largest and most liquid …

Read ArticleIs a Premium Theme Worth Paying For? A premium theme is a paid theme that offers a higher level of customization and additional features compared to …

Read Article