What is flipping in an IPO? Everything you need to know | WebsiteName

Understanding IPO Flipping: Definition, Strategies, and Risks In the world of finance, an initial public offering (IPO) is a major event for a …

Read Article

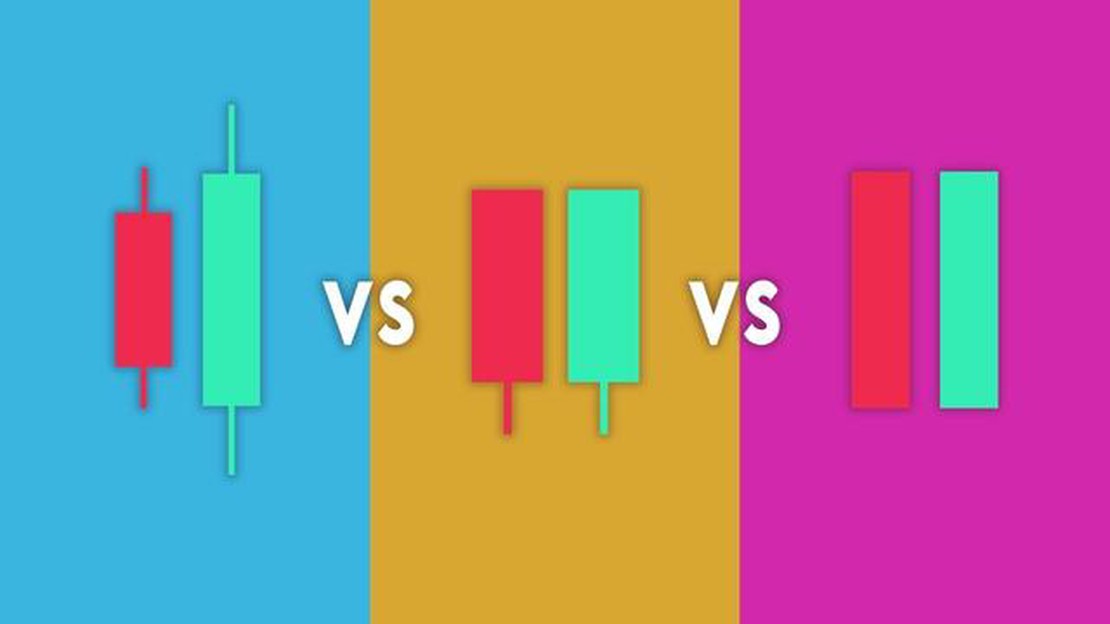

Candlestick charts are widely used in technical analysis to identify potential market trends and patterns. One of the most common and powerful candlestick patterns is known as the hammer pattern. This pattern is characterized by a small body and a long lower shadow, resembling a hammer.

The hammer pattern is considered a bullish reversal pattern, signaling a potential trend reversal from a downtrend to an uptrend. It represents a situation where sellers have been dominating the market for a period of time, but buyers have stepped in and pushed the price back up.

To identify a hammer pattern, you need to look for a candlestick with a small body (or no body at all) and a long lower shadow that is at least twice the length of the body. The color of the candlestick is not as important as the shape and position of the shadows. The longer the lower shadow, the stronger the signal.

Traders interpret the hammer pattern as a sign of a potential change in market sentiment. It suggests that buyers have become more active and are likely to continue pushing the price higher. Traders may use the hammer pattern as a signal to enter a long position or to close their short positions.

It’s important to note that the hammer pattern should not be considered in isolation. It should be used in conjunction with other technical indicators and chart patterns to confirm the potential reversal. Additionally, traders should always manage their risk and set appropriate stop-loss levels to protect themselves from unexpected market moves.

In conclusion, understanding the meaning of hammer candlestick patterns can be a valuable tool for technical traders. By identifying and interpreting this pattern correctly, traders can gain insight into potential trend reversals and take advantage of trading opportunities in the market.

A hammer candlestick pattern is a type of candlestick pattern that often appears at the bottom of a downtrend and indicates a potential reversal in the price direction. It is formed when the open, high, and close prices are very similar, with a long lower shadow that is at least twice the length of the body. The pattern resembles the shape of a hammer, hence its name.

The hammer pattern shows that sellers were initially in control, pushing the price lower, but buyers then stepped in and pushed the price back up, causing a strong rejection of the lower levels. This indicates that the trend may be reversing and that buyers are starting to outnumber the sellers.

There are two main types of hammer candlestick patterns: the bullish hammer and the inverted hammer. The bullish hammer has a small body at the top of the candlestick, while the inverted hammer has a small body at the bottom. Both patterns suggest a potential reversal, but the bullish hammer is considered stronger.

Traders often use hammer candlestick patterns as a signal to enter a long position, as it indicates a potential buying opportunity. However, it is important to wait for confirmation from other technical indicators or patterns before making any trading decisions.

Read Also: The Future of the GBP: Predicting the Path of the British Pound

It is important to note that hammer candlestick patterns should not be used alone as the sole basis for making trading decisions. They should be combined with other forms of technical analysis and used in conjunction with other indicators to increase the likelihood of success.

Hammer candlestick patterns are a popular tool used in technical analysis to predict potential trend reversals in the financial markets. This type of pattern is characterized by a long lower shadow and a small real body, typically forming at the bottom of a downtrend.

Read Also: Understanding the ESOP 30% Rule: What You Need to Know

The name “hammer” is given to this pattern because it resembles a hammer, with a long handle (lower shadow) and a small head (real body). The long lower shadow indicates that sellers have pushed the price down significantly during the trading session, but buyers have managed to regain control and push the price back up. This indicates a potential shift from bearish to bullish sentiment.

Hammer candlestick patterns can be a bullish or bearish reversal signal depending on their location within the overall market trend. In an uptrend, a hammer pattern may indicate a temporary pause or retracement in the upward movement, while in a downtrend, it may signal a potential reversal and the start of an uptrend.

Traders often look for additional confirmation before making trading decisions based on hammer patterns. This could include looking for other technical indicators, such as trendlines, support and resistance levels, or volume analysis. Combining these signals can help increase the reliability of the hammer pattern.

It is important to note that hammer candlestick patterns should not be viewed in isolation, but rather as part of a larger analysis. As with any technical analysis tool, it is essential to consider other factors, such as market conditions, news events, and risk management strategies.

In conclusion, understanding the basics of hammer candlestick patterns can be a valuable tool for traders looking to anticipate potential trend reversals. By recognizing the characteristics of this pattern and using it in conjunction with other technical indicators, traders can make more informed trading decisions.

A hammer candlestick pattern is a bullish reversal pattern that forms at the end of a downtrend. It is characterized by a small body and a long lower shadow, which is at least twice the size of the body. It indicates that the selling pressure has been exhausted and the buying pressure is starting to strengthen.

To identify a hammer candlestick pattern, look for a candlestick with a small body and a long lower shadow. The lower shadow should be at least twice the size of the body. The color of the candlestick doesn’t matter, but a white or green hammer is considered more bullish.

A hammer candlestick pattern indicates a potential bullish reversal. It suggests that the selling pressure has been exhausted and the buyers are starting to take control. It can be a signal to buy or exit short positions, depending on the context.

Hammer candlestick patterns can be used as a signal to enter or exit trades. If a hammer forms after a downtrend, it can be a signal to buy. If a hammer forms after an uptrend, it can be a signal to sell or take profits. It’s important to consider other technical indicators and the overall market trend for confirmation.

Understanding IPO Flipping: Definition, Strategies, and Risks In the world of finance, an initial public offering (IPO) is a major event for a …

Read ArticleWhat is the Best Indicator for Short Term Forex Trading? When it comes to short term forex trading, having the right indicator can make all the …

Read ArticleIs the GTS still working on SoulSilver? When it comes to Pokemon SoulSilver, fans of the game may be wondering if the Global Trade Station (GTS) is …

Read ArticleWhy is it called moving average process? The term “moving average process” is widely used in statistical analysis, particularly in time series …

Read ArticleLocation of GTS Trading Headquarters GTS Trading is a global company with its headquarters located in a prime business district. Situated in the heart …

Read ArticleHow to Gain Profit from Nifty? If you’re looking to maximize your profit from Nifty, the popular stock market index in India, you’ve come to the right …

Read Article