Unlocking the Secret of the 200 Day Moving Average Strategy

Understanding the 200 Day Moving Average Strategy: A Practical Guide Investors and traders are constantly seeking out new strategies to gain an edge …

Read Article

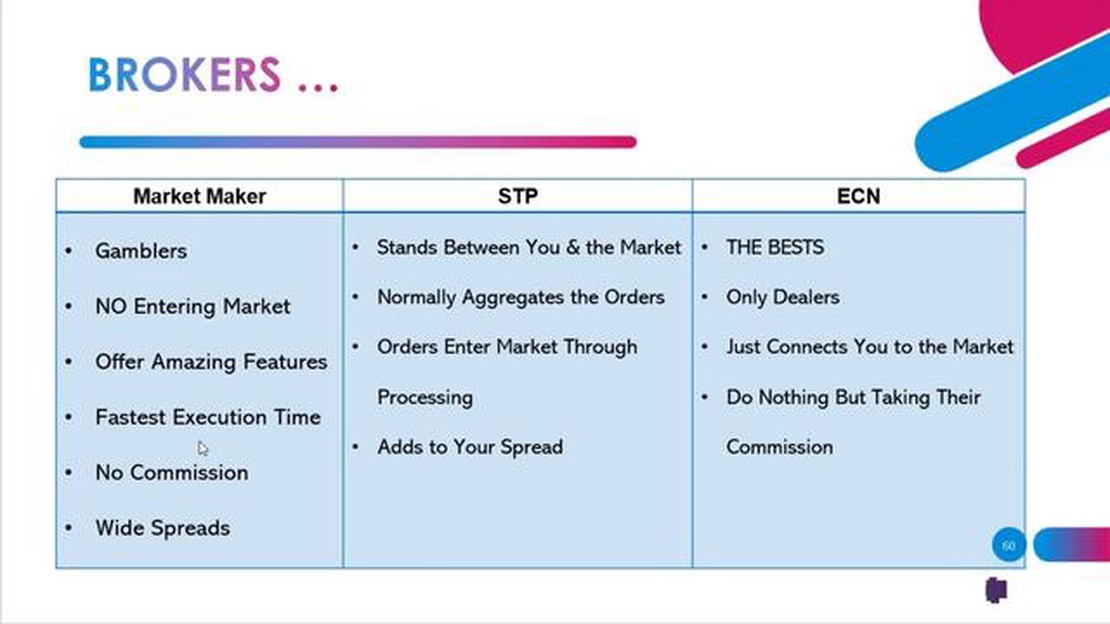

Choosing the right type of broker is an important decision for any trader. Two popular options in the market are Electronic Communication Network (ECN) brokers and market makers. While both serve as intermediaries in the financial markets, there are key differences between them that can greatly impact a trader’s experience and profitability.

An ECN broker operates on a platform that connects market participants, such as banks, financial institutions, and individual traders, allowing them to trade directly with each other. This results in tighter spreads and more transparent pricing, as the prices are determined by the market participants themselves. In contrast, a market maker acts as the counterparty to the trades, creating a market for the trader by taking the opposite side of their positions.

One of the key benefits of choosing an ECN broker is the access to a deep and diverse pool of liquidity. As the trades are executed directly with other market participants, there is no need for a middleman to match the orders. This can lead to faster execution times and potentially better prices.

ECN brokers offer a more level playing field for traders, as the market participants are competing against each other, rather than against the broker. This eliminates any potential conflicts of interest and reduces the chances of unfair practices, such as stop hunting or price manipulation.

In contrast, market makers may have a conflict of interest, as they profit from the trader’s losses. This can lead to potential issues such as requotes, slippage, and order rejections, especially during times of high market volatility.

In conclusion, while both ECN brokers and market makers play important roles in the financial markets, ECN brokers have distinct advantages in terms of transparency, pricing, and execution. With access to a diverse pool of liquidity and a more level playing field, traders may find that ECN brokers offer a more favorable trading environment.

ECN brokers operate by connecting traders directly to the interbank market. This means that trades are matched with other traders in a decentralized manner. ECN brokers typically charge a commission for each trade and provide traders with access to transparent pricing and high liquidity.

Read Also: Is Forex Trading Legit or a Scam? Find Out Here

Market makers, on the other hand, make money through spreads on the bid-ask prices. They act as counterparties to traders’ orders and often take the opposite side of a trade. Market makers typically provide their own quotes and may offer fixed spreads, which can be beneficial for traders seeking stability in their trading costs.

One of the key benefits of ECN brokers is the potential for lower spreads. Since ECN brokers aggregate prices from multiple liquidity providers, they can offer tighter spreads compared to market makers. Additionally, the absence of a dealing desk means there is no conflict of interest between traders and brokers, ensuring fair and transparent execution.

However, market makers also have their advantages. They often offer a wider range of tradable instruments and may have advanced trading tools and platforms that cater to the needs of different types of traders. Market makers can also provide liquidity during periods of low market activity, which can be beneficial for traders who require immediate execution.

In conclusion, both ECN and market maker brokers have their strengths and weaknesses. Traders need to consider their individual preferences, trading style, and goals when choosing between the two. While ECN brokers may be better suited for traders seeking lower spreads and direct market access, market makers can provide added convenience and diverse trading options. Ultimately, the choice between ECN and market maker boils down to personal preference and individual trading needs.

Read Also: What Happened to Knight Trading? A Look at the Rise and Fall of a Wall Street Giant

Electronic Communication Network (ECN) trading has several advantages over market maker trading. These advantages include:

In conclusion, ECN trading offers numerous advantages over market maker trading, including transparency, lower spreads, no conflict of interest, high liquidity, anonymous trading, the ability to scalp and use automated trading strategies, and better order execution. These advantages make ECN trading an attractive option for traders looking for fair and efficient trading conditions.

ECN (Electronic Communication Network) is a type of trading execution where orders are matched directly with other market participants. Market makers, on the other hand, are intermediaries who create a market for a particular security by both buying and selling it. The key difference is that ECN allows for direct trading with other market participants, while market makers act as counter-parties to trades.

Trading with an ECN offers several benefits. Firstly, ECNs often provide better liquidity as orders are matched directly with other market participants. This can result in tighter spreads and better execution prices. Secondly, ECNs typically have faster order execution speeds compared to market makers. Additionally, ECNs offer transparency as they display the best bid and ask prices available in the market. Overall, trading with an ECN can provide a more efficient and fair trading environment.

While trading with an ECN has many advantages, there are a few drawbacks to consider. One disadvantage is that ECNs often charge commissions for each trade, which can increase trading costs. Additionally, ECNs may have minimum deposit requirements or higher account maintenance fees compared to market makers. Finally, ECNs may have limited order types or trading features compared to some market makers. It’s important to consider these factors when deciding whether to trade with an ECN.

The choice between ECN and market maker depends on individual trading preferences and needs. ECNs are generally more suitable for traders looking for better liquidity, faster execution speeds, and transparency. They are particularly beneficial for scalpers or high-frequency traders. Market makers, on the other hand, may be more suitable for beginners or traders who value the convenience of fixed spreads and simpler order execution. It’s important for retail traders to consider their trading style and priorities when choosing between ECN and market maker.

Understanding the 200 Day Moving Average Strategy: A Practical Guide Investors and traders are constantly seeking out new strategies to gain an edge …

Read ArticleWhat is the value of a pip in a mini account? When trading in the forex market, understanding the value of a pip is crucial. A pip, which stands for …

Read ArticleHow long does it take for forex to clear FNB? If you are a Forex trader and use First National Bank (FNB) as your banking partner, it is important to …

Read ArticleWhy is LHS RHS? In the world of mathematics and computer programming, the abbreviations LHS and RHS are frequently used. These acronyms stand for …

Read ArticleIs Intraday Trading Possible in Nifty Options? When it comes to trading in the stock market, there are various strategies that investors can employ to …

Read ArticleStep-by-Step Guide: How to Use MetaTrader 4 for Beginners and Start Making Money for Free Welcome to the beginner’s guide to using MetaTrader 4 (MT4) …

Read Article