Is Guild Wars 2 Profitable? Evaluating the Financial Success of the Popular MMO

Is Guild Wars 2 Profitable? Benefits and Analysis Guild Wars 2 is one of the most popular massively multiplayer online (MMO) games in the world, …

Read Article

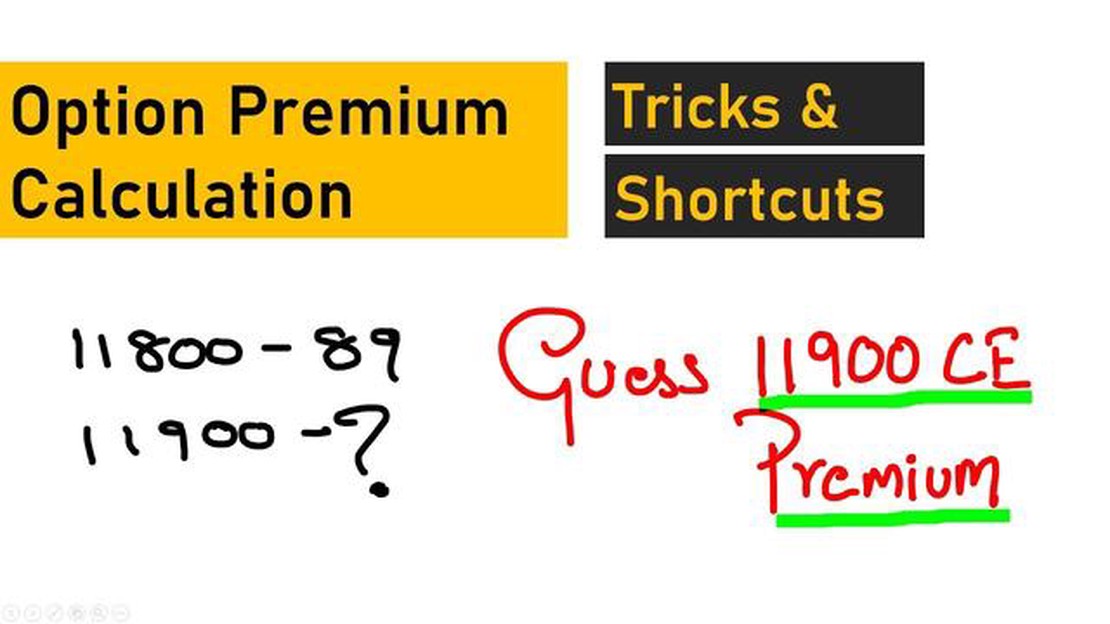

Options trading is a complex financial instrument that allows investors to speculate on the price movement of an underlying asset. One of the key concepts in options trading is the premium, which is the price that investors pay to buy or sell an option.

The premium of an option is determined by various factors, including the current price of the underlying asset, the strike price of the option, the time remaining until the option expires, and the volatility of the underlying asset. These factors are used in mathematical models, such as the Black-Scholes model, to calculate the theoretical value of the option premium.

The current price of the underlying asset is an important factor because it determines the likelihood of the option being in-the-money or out-of-the-money at expiration. If the current price of the underlying asset is close to the strike price, the option is more likely to have value and therefore, the premium will be higher.

Time remaining until the option expires also affects the premium. As the expiration date approaches, the option has less time to move in-the-money, so the premium decreases. Additionally, the volatility of the underlying asset plays a role in the premium calculation. Higher volatility increases the potential for the option to be profitable, leading to a higher premium.

In conclusion, understanding the calculation of premium in options trading is essential for investors to make informed decisions. By considering factors such as the current price of the underlying asset, the strike price, the time remaining until expiration, and the volatility, investors can better assess the value of an option and determine an appropriate premium.

Options trading is a type of investment strategy that involves buying and selling options contracts. An option is a financial derivative that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price within a specified time frame.

There are two types of options: calls and puts. A call option gives the buyer the right to buy the underlying asset, while a put option gives the buyer the right to sell the underlying asset.

Options trading allows investors to speculate on the direction of an underlying asset’s price movement without actually owning the asset. Investors can use options to generate income, hedge against risk, or speculate on price changes.

When trading options, investors can choose to buy or sell options contracts. Buying an options contract is known as taking a long position, while selling an options contract is known as taking a short position.

One of the key characteristics of options trading is the premium, which is the price paid for an options contract. The premium is determined by various factors, such as the current price of the underlying asset, the strike price, the time remaining until expiration, the volatility of the underlying asset, and the prevailing market conditions.

Options trading can be a complex investment strategy, as it involves understanding various concepts and factors. It is important for investors to carefully consider their risk tolerance, investment goals, and knowledge of the options market before engaging in options trading.

Overall, options trading can provide opportunities for investors to diversify their portfolios and potentially profit from price movements in the financial markets.

Options trading is a type of investment strategy that involves the buying and selling of options contracts. An option contract is an agreement between two parties that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified period of time.

Options can be thought of as financial instruments that provide flexibility and versatility in investment strategies. They can be used for various purposes, such as hedging against potential losses, generating income through premium collection, or speculating on the price movements of the underlying asset.

Read Also: Understanding the LBR 3 10 Oscillator: A Comprehensive Guide

There are two types of options: call options and put options. A call option gives the buyer the right to buy the underlying asset at a specified price, while a put option gives the buyer the right to sell the underlying asset at a specified price. Both types of options have an expiration date, which is the date by which the buyer must exercise their right or let the option expire.

When trading options, investors must consider the premium, which is the price at which the option contract is bought or sold. The premium is determined by various factors, including the current price of the underlying asset, the strike price of the option, the time remaining until expiration, and the volatility of the underlying asset.

Options trading can be complex and risky, as the value of options contracts can fluctuate greatly. It requires a deep understanding of market dynamics, risk management, and various trading strategies. However, when used effectively, options trading can offer significant opportunities for profit and portfolio diversification.

Calculating the premium is an essential step in options trading. The premium is the price that an options buyer pays to the options seller for the right to buy or sell the underlying asset at a specific price, known as the strike price, on or before a certain date, known as the expiration date.

Read Also: Step-by-Step Guide: How to Install Drivers in Windows 10

Accurately calculating the premium is crucial because it directly affects the profitability and risk associated with an options contract. Traders need to understand the factors that influence the premium calculation in order to make informed decisions.

One of the main factors that determine the premium is the current market price of the underlying asset. If the asset’s market price is significantly higher than the strike price for a call option or lower for a put option, the premium will be higher. Conversely, if the market price is close to or below the strike price for a call option, or above for a put option, the premium will be lower.

Another factor that affects the premium calculation is the time until expiration. As the expiration date approaches, the time value of the option decreases, resulting in a lower premium. Traders need to consider the time decay when calculating the premium, as it can have a significant impact on the option’s value.

Volatility is also a crucial factor in premium calculation. Higher volatility increases the probability of the underlying asset moving in the direction favorable to the options holder, leading to a higher premium. Conversely, lower volatility reduces the likelihood of favorable movements and results in a lower premium.

Other factors, such as interest rates and dividends, can also impact the premium calculation, although their influence is usually minimal compared to the factors mentioned above.

By accurately calculating the premium, traders can evaluate the potential profitability and risk associated with an options contract. They can assess whether the premium is overpriced or underpriced and make informed decisions based on their trading strategies and beliefs about the future movement of the underlying asset.

In conclusion, premium calculation is essential in options trading as it directly impacts the profitability and risk involved in trading options. Traders need to consider various factors, such as the current market price, time until expiration, and volatility, when calculating the premium. By understanding and accurately calculating the premium, traders can make informed decisions and optimize their options trading strategies.

Options trading is a type of investment strategy where an investor buys or sells options contracts on an underlying asset, such as stocks or commodities.

The premium in options trading is calculated based on several factors, including the current price of the underlying asset, the strike price of the options contract, the time until the contract expires, and the overall volatility of the market.

Sure! The strike price is the predetermined price at which the underlying asset can be bought or sold when exercising the options contract. It plays a crucial role in determining the value of the premium.

Implied volatility is a measure of how much the market expects the price of the underlying asset to fluctuate in the future. Higher implied volatility generally leads to higher premiums, as there is a greater likelihood of the options contract becoming profitable.

Yes, the time until expiration is an important factor in determining the premium. Generally, the longer the time until expiration, the higher the premium, as there is more time for the underlying asset’s price to move in a favorable direction.

An option premium is the price that an options trader pays for the right to buy or sell an underlying asset at a specified price within a specified time period.

Is Guild Wars 2 Profitable? Benefits and Analysis Guild Wars 2 is one of the most popular massively multiplayer online (MMO) games in the world, …

Read Article4 Types of API: A Comprehensive Guide Application Programming Interfaces (APIs) play a crucial role in modern software development. They allow …

Read Article1 PHP to 1 yen: The Current Exchange Rate and Conversion Are you planning a trip to Japan and wondering about the current exchange rate between the …

Read ArticleChoosing the Right Indicator to Use with MFI The Money Flow Index (MFI) is a popular technical indicator used by traders to measure the strength and …

Read ArticleComplete List of Banks in India That Support Western Union Western Union is a global money transfer service that allows individuals to send and …

Read ArticleDoes BPI sell foreign currency? BPI, also known as Bank of the Philippine Islands, is one of the largest banks in the Philippines with a wide range of …

Read Article