Calculating Option Premium: A Comprehensive Guide

Calculating Option Premium: Understanding the Basics Options trading can be a complex and risky endeavor, but understanding how to calculate option …

Read Article

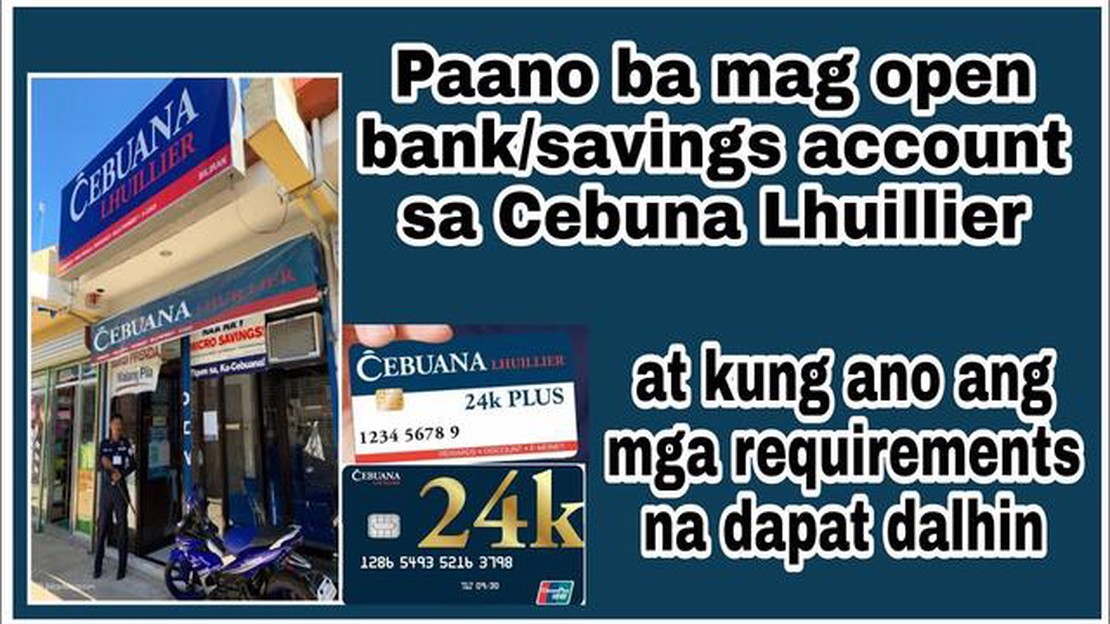

When it comes to managing our finances, it is essential to have a clear understanding of the financial institutions we interact with. One such institution is Cebuana, a popular financial service provider in the Philippines. However, there is a common misconception about whether Cebuana is a bank or not.

The truth is, Cebuana is not a bank. It is a non-bank financial institution that offers a wide range of financial services to its customers. Cebuana is known for its expertise in pawnshop services, money remittance, and other financial transactions.

So, what exactly makes Cebuana different from a traditional bank? Unlike banks, Cebuana does not offer savings accounts, checking accounts, or other typical banking services. Instead, it focuses on providing accessible and convenient financial solutions for individuals who may not have access to traditional banking services.

One of the key services offered by Cebuana is pawnshop services. People can bring their valuable items to Cebuana branches and use them as collateral to secure a loan. This provides an alternative source of funding for those who may not qualify for traditional loans from banks.

Moreover, Cebuana also offers money remittance services, allowing people to send and receive money locally and internationally. This service is especially valuable for Filipinos who have family members working abroad and need a reliable and convenient way to send and receive money.

In conclusion, while Cebuana is a well-known financial service provider in the Philippines, it is important to understand that it is not a bank. Cebuana provides accessible financial solutions, such as pawnshop services and money remittance, to individuals who may not have access to traditional banking services. By offering these services, Cebuana plays a crucial role in the financial well-being of many Filipinos.

Cebuana is a financial service company that provides various services such as money remittance, bills payment, and microloans. While it is not a bank, it has a network of branches and agents across the Philippines, making it easily accessible to many Filipinos.

One of the main services offered by Cebuana is money remittance. With Cebuana, individuals can send and receive money locally and internationally. Customers can visit any Cebuana branch or agent and provide the necessary details to complete a transaction. The recipient can then pick up the money at any Cebuana branch or agent, usually within minutes.

Cebuana also offers bills payment services, allowing customers to pay their utility bills, insurance premiums, and other financial obligations conveniently. Customers can simply bring their bills to any Cebuana branch or agent, provide the necessary information, and make the payment.

Additionally, Cebuana provides microloans to individuals who may need financial assistance. These loans are typically smaller amounts and have shorter repayment terms compared to traditional bank loans. Customers can apply for a microloan at any Cebuana branch or agent by providing the necessary documents and completing the application process.

Overall, Cebuana operates as a financial service company that aims to provide accessible and convenient services to the Filipino population. Through its extensive network of branches and agents, individuals can easily avail of its various services, including money remittance, bills payment, and microloans.

Read Also: Discover the Benefits of the 3 Ducks Trading System | Learn How to Trade with Confidence

Cebuana is a Philippine financial service company that offers various services to its customers. Here are some of the main services provided by Cebuana:

1. Remittance Services: Cebuana offers a convenient and reliable way to send and receive money within the Philippines and even internationally. Whether it’s sending money to family or friends or receiving funds from abroad, Cebuana provides secure and fast remittance services.

2. Money Transfer: Cebuana allows customers to transfer money quickly and safely from one location to another. With a wide network of branches across the country, customers can easily send and receive money without any hassle.

3. Bills Payment: Cebuana provides a convenient platform for customers to pay their bills, including utilities, telecoms, and other necessary expenses. Customers can easily settle their bills at any Cebuana branch, saving them time and effort.

4. Microinsurance: Cebuana offers microinsurance services to protect customers against unforeseen events and emergencies. This service helps customers secure their finances and ensure their well-being during challenging times.

5. Savings Accounts: Cebuana allows customers to open savings accounts, making it easier for them to save money and achieve their financial goals. These accounts provide competitive interest rates and convenient access to funds.

6. Foreign Exchange: Cebuana offers currency exchange services, allowing customers to convert currencies safely and conveniently. This service is particularly useful for travelers or individuals who need to deal with foreign currencies.

These are just some of the services provided by Cebuana. With its commitment to accessibility, convenience, and security, Cebuana continues to be a trusted financial service company in the Philippines.

Read Also: How to Get Free Forex Signals on Telegram: A Step-by-Step Guide

No, Cebuana is not considered a bank. Cebuana Lhuillier is a well-known and trusted financial service company in the Philippines, but it is not a bank. It is a non-bank financial institution that primarily offers pawnbroking services and operates as a remittance agent.

While Cebuana provides various financial services such as remittance, bills payment, insurance, and microloans, it does not have a banking license nor does it offer traditional banking services such as savings accounts, checking accounts, or loans.

However, Cebuana Lhuillier is regulated by the Bangko Sentral ng Pilipinas (BSP), the central bank of the Philippines, and is required to adhere to certain regulations and standards to ensure the safety and security of its customers’ transactions.

So, although Cebuana is not a bank, it is still a reputable and reliable financial service provider in the Philippines, serving millions of Filipinos with their various financial needs.

Cebuana is a financial services company in the Philippines that offers various services including money transfers, bills payment, pawning, and microloans.

No, Cebuana is not a bank. It is a financial services company that provides different services, but it does not have a banking license.

Cebuana offers a wide range of services including money transfers, bills payment, pawning, and microloans. They have over 2,500 branches nationwide where customers can access these services.

No, Cebuana does not offer savings accounts. They primarily focus on providing financial services like money transfers and pawning.

Yes, Cebuana is a well-established and trusted company in the Philippines. They have been in operation for over 30 years and have a wide network of branches nationwide. However, it’s always a good idea to do your own research and exercise caution when dealing with financial transactions.

Calculating Option Premium: Understanding the Basics Options trading can be a complex and risky endeavor, but understanding how to calculate option …

Read ArticleUnderstanding Margin Calls in Forex Trading Forex trading is a popular market where traders buy and sell different currencies in order to make a …

Read ArticleIs Option Trader a Good Job? Option trading is a popular investment strategy that offers the opportunity for significant profits. It involves buying …

Read ArticleHow to trade with 100 dollars Trading can be a lucrative way to make money, but many people believe that it requires a large initial investment. …

Read ArticleHow to Start Trading Binary Options Binary options trading is a popular and accessible form of financial trading that offers potential high returns on …

Read ArticleIs Crypto Trading Legal in Luxembourg? Cryptocurrency trading has gained significant popularity worldwide, with many investors attracted to the …

Read Article