Unleash Your Potential: Anyone Can Become a Forex Trader!

Is Forex Trading for Everyone? Debunking Common Myths Are you dreaming of financial independence and the ability to work from anywhere in the world? …

Read Article

Options trading can be a complex and risky endeavor, but understanding how to calculate option premiums can give traders a competitive edge. Option premiums are the prices that buyers pay and sellers receive for options contracts. These premiums are determined by a variety of factors, including the current market price of the underlying asset, the strike price of the option, the time remaining until expiration, and the level of market volatility.

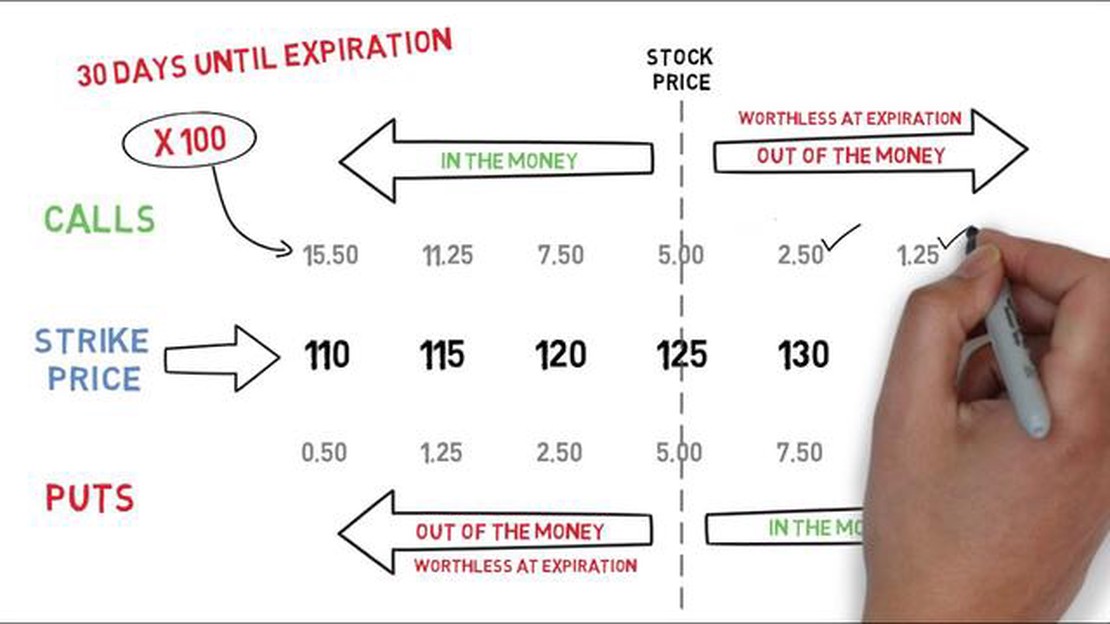

One of the key components in calculating option premiums is the intrinsic value. The intrinsic value is the difference between the current market price of the underlying asset and the strike price of the option. If the option has no intrinsic value, it is said to be “out of the money.” If the intrinsic value is positive, the option is considered “in the money.” Traders must also consider the time value of the option, which is influenced by factors such as interest rates and the expected volatility of the underlying asset.

In addition to intrinsic value and time value, traders must consider the impact of market volatility on option premiums. Options on assets with higher levels of volatility will generally have higher premiums. This is because higher volatility increases the likelihood that the option will move “in the money” before expiration, increasing its value. Traders can use statistical models, such as the Black-Scholes model, to estimate the impact of volatility on option premiums.

Calculating option premiums is a crucial skill for options traders, as it can help inform trading decisions and manage risk. By understanding the factors that influence option premiums and utilizing mathematical models, traders can make more informed choices and potentially increase their profitability in the options market.

Options are financial instruments that give investors the right, but not the obligation, to buy or sell an underlying asset at a specified price, known as the strike price, within a certain period of time, known as the expiration date.

There are two types of options: call options and put options. A call option gives the holder the right to buy the underlying asset, while a put option gives the holder the right to sell the underlying asset.

Options provide investors with flexibility and the potential for leverage. They can be used for various purposes, such as speculation, hedging against potential losses, or generating income through option premium.

When trading options, it’s important to consider the factors that affect their value, such as the price of the underlying asset, the strike price, the time until expiration, and market volatility. These factors determine the option premium, which is the price that investors pay to buy or receive when selling options.

Option contracts are traded on options exchanges, where buyers and sellers can enter into contracts and execute trades. Each contract typically represents 100 shares of the underlying asset.

It’s crucial to understand the risks and potential rewards of options trading before getting involved in this complex financial market. Options can be a valuable tool, but they also carry significant risks and are not suitable for all investors. It’s recommended to seek professional advice and educate oneself about options trading strategies before trading.

Read Also: Interbank Rates: Understanding How Banks Trade Currencies

In summary, options are financial instruments that give investors the right to buy or sell an underlying asset at a specified price within a certain period of time. They provide flexibility and potential leverage, but also carry risks. It’s important to educate oneself and seek professional advice before trading options.

An option is a financial instrument that gives an investor the right, but not the obligation, to buy or sell an underlying asset at a predetermined price, known as the strike price, within a specific time period. The underlying asset can be a stock, a commodity, an index, or even a currency.

Options are typically used as a way to manage risk or speculate on the price movement of the underlying asset. There are two main types of options: call options and put options.

A call option gives the buyer the right to buy the underlying asset at the strike price before the expiration date. If the price of the underlying asset rises above the strike price, the buyer can exercise the option and make a profit by buying the asset at a lower price and immediately selling it at a higher price.

On the other hand, a put option gives the buyer the right to sell the underlying asset at the strike price before the expiration date. If the price of the underlying asset falls below the strike price, the buyer can exercise the option and make a profit by selling the asset at a higher price and immediately buying it back at a lower price.

Option prices, also known as premiums, are determined by a combination of factors including the current price of the underlying asset, the strike price, the time to expiration, the volatility of the underlying asset’s price, and the prevailing interest rates. Option premiums can fluctuate based on changes in these factors.

Options can be bought or sold on various exchanges, and they are often used by investors and traders to hedge against potential losses or to speculate on the direction of the market. However, it’s important to note that trading options carries risks, and investors should carefully consider their risk tolerance and financial goals before engaging in option trading.

The option premium plays a significant role in options trading. It represents the price that an option buyer pays to acquire the right, but not the obligation, to buy or sell the underlying asset at a specific price within a specified time frame. The option premium is determined by various factors, including the current price of the underlying asset, the strike price, the time remaining until expiration, and the volatility of the market.

Read Also: The role of Fibonacci numbers in forex trading

One of the main functions of the option premium is to compensate the seller of the option for taking on the risk associated with the transaction. The seller, also known as the option writer, is obligated to fulfill the terms of the contract if the buyer decides to exercise their right. In exchange for this obligation, the writer receives the premium as compensation.

For the buyer of the option, the premium represents the potential loss if the option expires worthless or decreases in value. It’s essentially the maximum amount they can lose on the trade. However, it’s important to note that the premium also offers the potential for unlimited upside if the underlying asset’s price moves favorably. Therefore, the premium acts as a form of insurance for the buyer, providing them with the opportunity to profit from favorable market movements while limiting their potential losses.

In addition to its risk management aspect, the option premium also reflects the market’s collective expectation of the option’s future value. If the market anticipates a higher likelihood of the option ending in-the-money, the premium will be higher. Conversely, if the market perceives a lower chance of the option expiring profitably, the premium will be lower.

Overall, the option premium serves as a crucial component in options trading. It compensates the seller for taking on risk, limits the potential losses for the buyer, and reflects market expectations. Understanding the role of option premium is essential for making informed trading decisions and managing risk effectively.

Option premium is the price that an investor pays to purchase an option contract. It is determined by various factors such as the current price of the underlying asset, the strike price, the time to expiration, the volatility of the underlying asset, and the interest rates.

Option premium is calculated using various pricing models such as the Black-Scholes model. This model takes into account factors such as the current price of the underlying asset, the strike price, the time to expiration, the volatility of the underlying asset, and the interest rates. Other pricing models, such as the binomial model, can also be used to calculate option premium.

The calculation of option premium is influenced by several factors. These factors include the current price of the underlying asset, the strike price, the time to expiration, the volatility of the underlying asset, and the interest rates. Changes in any of these factors can cause the option premium to increase or decrease.

Volatility is an important factor in calculating option premium because it measures the potential price movements of the underlying asset. Higher volatility increases the likelihood of larger price swings, which can result in higher option premiums. Conversely, lower volatility can lead to lower option premiums.

Sure! Let’s say you want to calculate the premium for a call option on a stock. The current price of the stock is $100, the strike price is $110, the time to expiration is 1 month, the volatility of the stock is 20%, and the risk-free interest rate is 2%. Using the Black-Scholes model, the option premium would be calculated as follows: [Calculation steps]. The resulting option premium might be, for example, $5.76.

Is Forex Trading for Everyone? Debunking Common Myths Are you dreaming of financial independence and the ability to work from anywhere in the world? …

Read ArticleWays to Avoid Bank Transfer Fees When it comes to sending money, bank transfer fees can really add up. These fees can eat into the amount you are …

Read ArticleStrategies for Practicing Binary Options Trading Binary options trading can be a highly profitable venture if approached with the right strategies and …

Read ArticleIs It Possible to Earn a Living from Forex Trading? Forex trading has gained significant popularity in recent years, with many people intrigued by the …

Read ArticleHow to buy RMB in India The Chinese renminbi (RMB) is the official currency of China and is widely used in international trade. If you are planning to …

Read ArticleIs Auto Trading Legit? Auto trading, also known as algorithmic trading or robotic trading, has gained a lot of attention in recent years. The idea of …

Read Article