What's the Difference Between Chicken Stock and Chicken Broth? | Explained

The Difference Between Chicken Stock and Chicken Broth Chicken stock and chicken broth are two essential ingredients commonly used in cooking, but …

Read Article

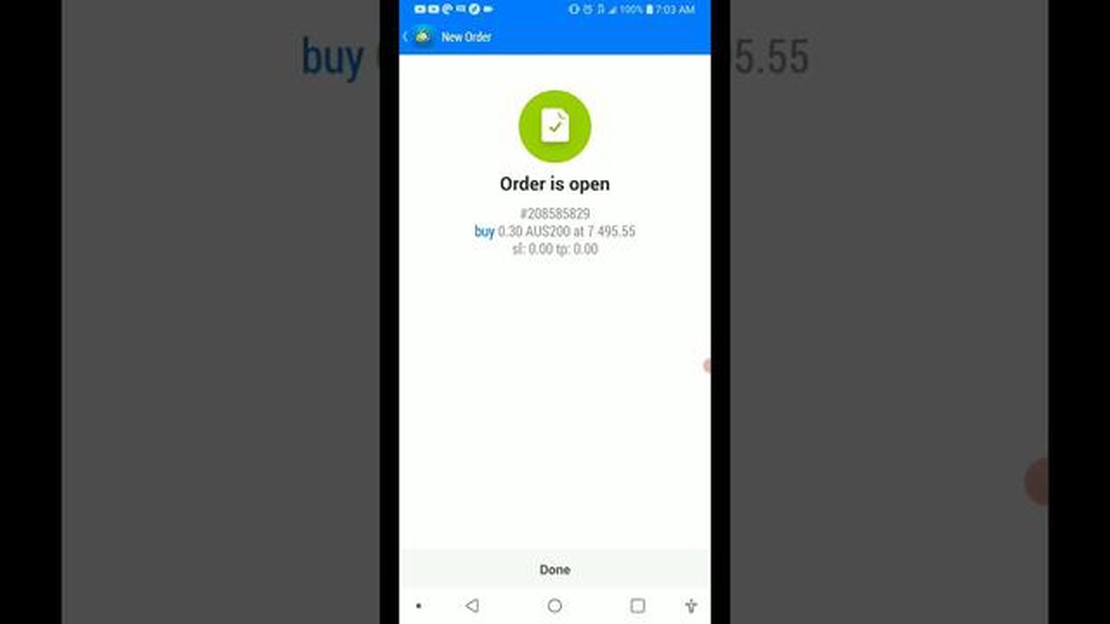

When it comes to investing in the AUS200, also known as the Australia 200 index, it is important to analyze the current market trends and make an informed decision. As this index represents the performance of the top 200 ASX-listed companies, it attracts attention from both experienced and novice investors.

Expert analysis suggests that the AUS200 has been showing a positive trend in recent months, with steady growth and strong performance. The index has been benefiting from the recovery of the Australian economy and the positive outlook for several key sectors, including mining, financial services, and technology.

However, it is important to note that investing in the AUS200 carries risks, as with any investment. Market volatility, economic uncertainty, and geopolitical factors can all impact the performance of the index. Therefore, it is recommended to closely monitor the market conditions and consult with financial experts before making any investment decisions.

In conclusion, whether the AUS200 is a buy or sell largely depends on individual investment goals, risk appetite, and market analysis. While expert recommendations can provide valuable insights, it is important for investors to conduct their own research and make informed decisions based on their individual circumstances.

When it comes to investing and trading, one of the most important questions is whether to buy or sell a particular asset. In the case of AUS200, which represents the Australian stock market index, the decision to buy or sell depends on various factors.

The AUS200 is composed of the top 200 companies listed on the Australian Securities Exchange (ASX), and it is considered a benchmark for the overall performance of the Australian stock market.

Before making any decisions, it is crucial to conduct a thorough analysis of the AUS200 to understand its current state and future prospects. Fundamental analysis involves examining economic indicators, company financials, and market trends to assess the potential growth or decline of the index.

Technical analysis, on the other hand, focuses on historical price patterns and market data to predict future price movements. This analysis involves studying charts, using various indicators and tools to identify trends and patterns that can help determine whether the AUS200 is likely to go up or down.

Expert recommendations can also play a significant role in making the buy or sell decision. Financial analysts and market professionals who specialize in studying the Australian market can provide valuable insights and recommendations based on their expertise and research.

Furthermore, considering the macroeconomic factors and geopolitical events that can influence the market is crucial. News related to interest rates, political stability, international trade, and economic policies can have a significant impact on the AUS200.

In conclusion, whether to buy or sell AUS200 depends on a comprehensive analysis of fundamental and technical factors, expert recommendations, and macroeconomic considerations. It is essential to stay informed and continuously monitor the market to make well-informed investment decisions.

Read Also: Understanding Cost Per Unit: Examples and Explanation

When considering whether to buy or sell AUS200, there are several factors that expert analysts take into account. These factors can provide valuable insights and help inform your decision-making process. Here are some key factors to consider:

| 1. Market Trends | Analysts closely analyze market trends to gauge the overall direction of the AUS200 index. If the market is experiencing a bullish trend, it could signal a buying opportunity. Conversely, a bearish trend may suggest a potential sell-off. |

| 2. Macroeconomic Factors | Economic indicators such as GDP growth, inflation rates, and interest rates can greatly influence the performance of the AUS200 index. Positive economic data may favor a buy recommendation, while negative data may indicate a sell recommendation. |

| 3. Industry Analysis | Examining the performance of specific industries within the index can provide insights into the overall health and prospects of AUS200. Analysts may consider factors such as market share, competition, and industry-specific events when making their recommendations. |

| 4. Company Fundamentals | Individual company performance and financial health can have a significant impact on the performance of the AUS200 index. Analysts may analyze factors such as revenue growth, profit margins, and debt levels to assess the potential for future growth or decline. |

| 5. Sentiment and Investor Behavior | Sentiment among investors and market participants can play a crucial role in the performance of the AUS200 index. Analysts may consider indicators such as investor sentiment surveys, market volatility, and trading volumes to get a sense of the prevailing sentiment. |

| 6. Geopolitical Events | Geopolitical events such as trade tensions, political instability, or major policy changes can have ripple effects on global markets, including AUS200. Analysts keep a close eye on such events and evaluate their potential impact on the index. |

Read Also: Discover the Best Algorithm for Forex to Maximize Your Trading Success

It’s important to note that these factors are subject to change, and expert analysis should not be viewed as a guarantee of future performance. It is advisable to consult multiple sources and conduct thorough research before making any investment decisions.

Diversification is an essential element of a well-rounded investment strategy. Investors should consider diversifying their portfolio across various asset classes, regions, and industries to reduce risk and maximize returns.

Here are some recommendations to effectively diversify your portfolio:

Remember, diversification does not guarantee profits or protect against losses, but it can help reduce risk and increase the potential for returns. By diversifying your portfolio, you can build a more resilient and balanced investment strategy.

According to the expert analysis, the recommendation for AUS200 is not specified. You should consider additional factors and conduct your own research before making any decisions.

Factors influencing the buy or sell decision for AUS200 can include market trends, economic indicators, company performance, geopolitical events, and investor sentiment.

Potential risks associated with buying AUS200 can include market volatility, economic downturns, regulatory changes, company-specific risks, and unforeseen events such as natural disasters or political instability.

Some alternative investments to consider instead of AUS200 can include other stock market indices, individual stocks, bonds, commodities, real estate, or diversifying your portfolio with a combination of different asset classes.

You can find additional expert analysis and recommendations for AUS200 from financial news websites, investment research firms, brokerage firms, and professional financial advisors.

The Difference Between Chicken Stock and Chicken Broth Chicken stock and chicken broth are two essential ingredients commonly used in cooking, but …

Read ArticleCalculating RR in trading: A comprehensive guide Risk to reward ratio (RR) is a crucial concept in trading. It is a metric that allows traders to …

Read ArticleIs High Volume on Options Good? When trading options, volume is an important metric that can provide insight into the market sentiment. Volume …

Read ArticleUnderstanding FX Options: Examples and Explanations Foreign exchange (FX) options are a type of financial derivative that give traders the right, but …

Read ArticleFormula for Moving Average in MATLAB Moving average is a widely used statistical concept that is commonly used in financial analysis, time series …

Read ArticleUnderstanding the Time Limit for AMT Credit When it comes to claiming the Alternate Minimum Tax (AMT) Credit, understanding the time limits is …

Read Article