How much money do you need to start trading futures options?

How much money do you need to trade futures options? Trading futures options can be an exciting and potentially profitable venture, but it’s important …

Read Article

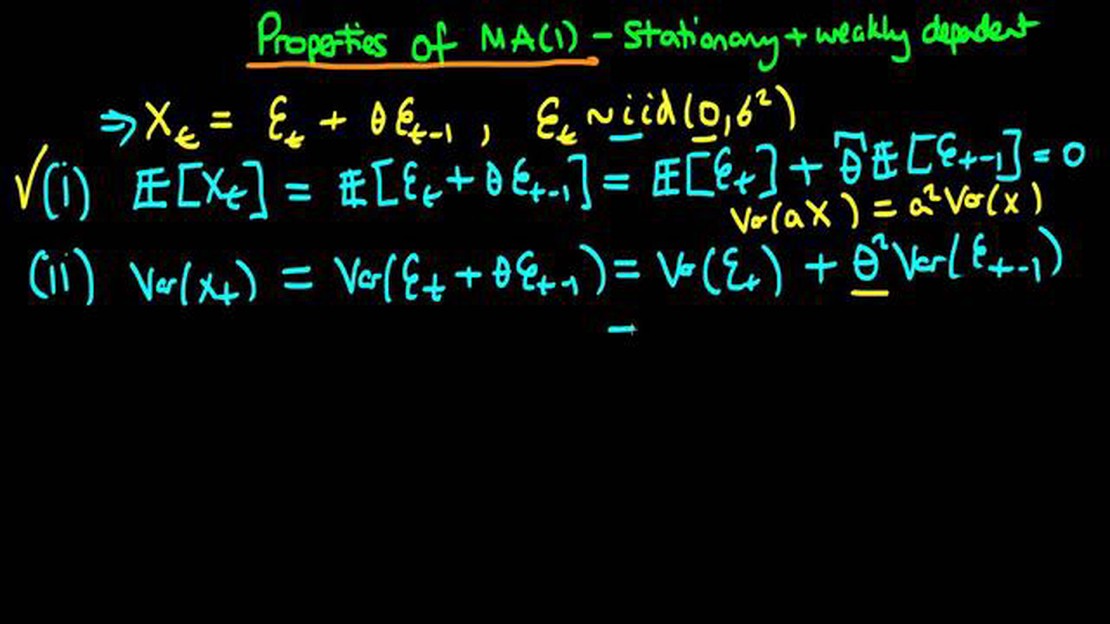

A moving average process is a common time series model that is used to analyze and predict trends in data. It is defined as the average of a specified number of past observations, with each observation given a different weight. While a moving average process can be a useful tool for analyzing data, it is not always stationary.

Stationarity is a key concept in time series analysis. A stationary process is one in which the statistical properties of the data do not change over time. This means that the mean, variance, and autocovariance of the process remain constant. In other words, the process has a constant mean and variance, and the correlation between two observations only depends on the time lag between them.

While a moving average process can be stationary under certain conditions, it is not always the case. The stationarity of a moving average process depends on the weights assigned to the past observations. If the weights are chosen in such a way that the process has a constant mean and variance, and the correlation between two observations only depends on the time lag between them, then the process is stationary. However, if the weights are not chosen appropriately, the process may exhibit trends or other non-stationary behavior.

For example, if the weights assigned to the past observations decrease too slowly, the process may exhibit a trend. On the other hand, if the weights decrease too rapidly, the process may exhibit a high degree of variability. In these cases, the moving average process is not stationary and may not be suitable for analyzing or predicting trends in the data.

It is important to note that determining the stationarity of a moving average process can be a complex task. Various statistical tests and techniques exist to assess the stationarity of a process. These include the Augmented Dickey-Fuller test, the Kwiatkowski-Phillips-Schmidt-Shin test, and others. These tests can help determine whether a moving average process is stationary or not, and provide insights into the behavior of the data.

In conclusion, a moving average process is not always stationary. While it can be a useful tool for analyzing and predicting trends in data, the stationarity of the process depends on the weights assigned to the past observations. To determine the stationarity of a moving average process, it is necessary to use statistical tests and techniques specifically designed for this purpose.

A moving average process is a type of time series model where each value in the series is a weighted average of the previous values and a random error term. It is often used to smooth out fluctuations in data and identify underlying trends or patterns.

Stationarity refers to the statistical properties of a time series remaining constant over time. A stationary process has a constant mean, variance, and autocovariance function. In other words, the mean and variability of the process do not change over time, and there is no pattern or trend in the data.

While it is true that a moving average process can be stationary, it is not always the case. Whether or not a moving average process is stationary depends on the weights assigned to the previous values and the properties of the random error term.

If the weights assigned to the previous values in the moving average process are such that the sum of the weights is equal to 1 and the weights are non-zero and finite, then the process is guaranteed to be stationary.

However, if the weights do not meet these conditions, the process may not be stationary. For example, if the sum of the weights is not equal to 1, the process may exhibit a trend or pattern over time. If the weights are not finite, the process may have outliers or extreme values that disrupt the stationarity of the series.

Read Also: Discover the Top Youtube Channel for Forex Trading

Stationarity is an important assumption in many time series models and data analysis techniques. If a moving average process is not stationary, it may require additional preprocessing or transformation to make it suitable for further analysis.

In conclusion, a moving average process is not always stationary. Whether or not a moving average process is stationary depends on the weights assigned to the previous values and the properties of the random error term. It is important to assess the stationarity of a time series before applying any statistical techniques or models.

A moving average process (MA process) is a common model used in time series analysis. It is a type of stochastic process where the current value of the series is a linear combination of the past error terms and the current and past values of a random variable. The past error terms are weighted according to their order.

The MA process can be represented mathematically as:

Yt = μ + εt + θ1εt-1 + θ2εt-2 + … + θqεt-q

where Yt is the current value of the time series, μ is the mean of the series, εt is a randomly generated error term at time t, and θ1, θ2, …, θq are the coefficients of the MA process. The εt terms represent the random shocks or innovations that are not explained by the past values of the time series.

Read Also: Where to Buy Foreign Currency in Hyderabad: A Comprehensive Guide

The MA process is useful in modeling and predicting phenomena that exhibit serial correlation, or a systematic relationship between past and current values. It can be applied to various fields, such as finance, economics, and engineering, to analyze and forecast time series data.

Note that the MA process is not always stationary. The stationarity of the process depends on the coefficients θ1, θ2, …, θq. If the absolute values of these coefficients are less than 1, the process is stationary. Otherwise, it is non-stationary.

Overall, the moving average process is a valuable tool in time series analysis that allows researchers and analysts to identify patterns, investigate correlations, and make predictions based on historical data.

A moving average (MA) process is a type of time series model in which the observed values depend linearly on the current and past error terms. Unlike an autoregressive (AR) process, which depends on its own past values, an MA process only depends on the errors from the current period and previous periods.

There are several important properties of a moving average process:

Overall, understanding the properties of a moving average process is crucial for analyzing and modeling time series data. By considering the stationarity, mean, variance, autocorrelation, cross-correlation, and forecasting of the process, one can gain insights into the underlying trends and patterns in the data.

A moving average process is a time series model where each observation is a weighted sum of the current and past white noise error terms. It is denoted as MA(q), where q represents the order of the moving average process.

A stationary process is one whose statistical properties, such as mean, variance, and autocovariance, do not change over time. In other words, the distribution of values remains constant regardless of the time period under consideration.

No, a moving average process is not always stationary. It depends on the order of the moving average process and the properties of the white noise error terms. If the error terms have a non-zero mean or exhibit correlation over time, then the moving average process may not be stationary.

To determine if a moving average process is stationary, we can check the properties of the white noise error terms. If the error terms have a zero mean and are uncorrelated, then the moving average process can be considered stationary. Additionally, we can also analyze the autocorrelation function (ACF) and partial autocorrelation function (PACF) of the process to look for patterns or trends that indicate non-stationarity.

How much money do you need to trade futures options? Trading futures options can be an exciting and potentially profitable venture, but it’s important …

Read ArticleHow many signals are there in forex trading? Forex trading is a complex and volatile market that requires a deep understanding of various signals and …

Read ArticleUnderstanding the Moving Average in Share Price Share price analysis is an essential tool for investors and traders, enabling them to make informed …

Read ArticleWhat is the best sentiment indicator? Accurate market analysis is crucial for investors and traders to make informed decisions. One important factor …

Read ArticleReasons Behind the Recent Drop in DKS Stock The drop in DKS stock has been a matter of concern for investors and analysts alike. The company, which …

Read ArticleWhat is a FX hedge fund? Foreign exchange (FX) hedge funds have gained popularity in recent years as a way for investors to diversify their portfolios …

Read Article