Why Account Management is Crucial for Successful Forex Trading

Account Management in Forex Trading: The Pros and Cons Forex trading is a high-risk, high-reward venture. It offers the potential for substantial …

Read Article

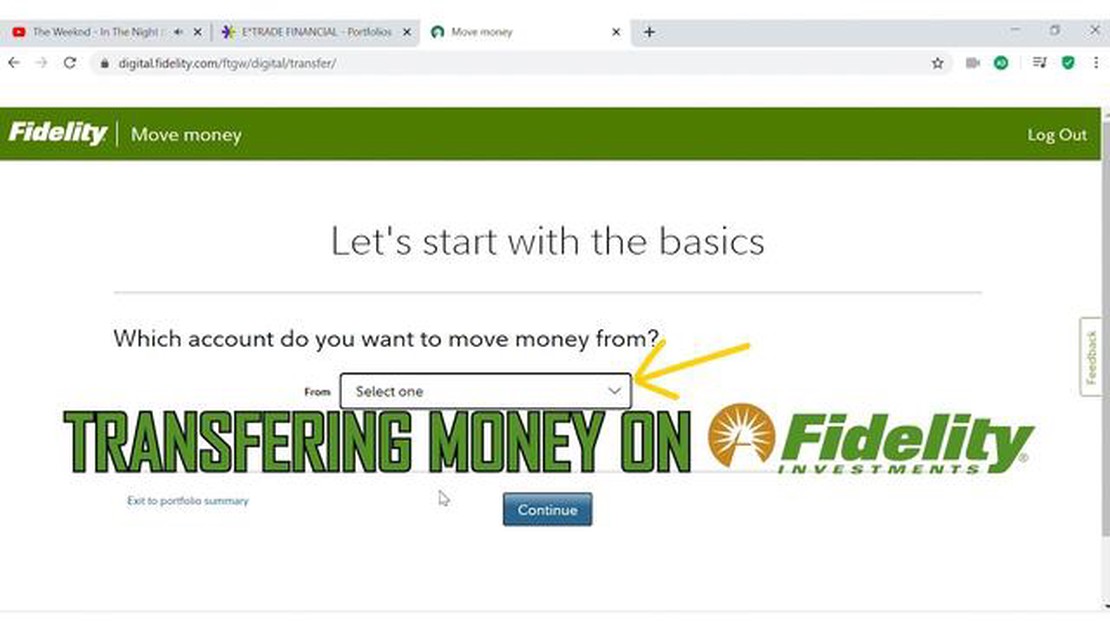

Wiring money to Fidelity is a convenient and secure way to transfer funds to your investment account. Whether you need to deposit money, make a contribution, or simply manage your finances, wiring money to Fidelity is a straightforward process. In this step-by-step guide, we will walk you through the necessary steps to ensure a successful transfer.

Step 1: Gather the required information

Before initiating a wire transfer to Fidelity, make sure you have all the necessary information readily available. You will need the Fidelity account number, the bank name, the routing number, and the SWIFT/BIC code. This information can be found on your Fidelity account statement or by contacting Fidelity directly.

Step 2: Contact your bank

Reach out to your bank and inform them that you would like to wire money to Fidelity. They will provide you with the necessary wire transfer request form or guide you through the process. Be sure to ask about any fees associated with the wire transfer and inquire about the estimated timeline for the funds to be received by Fidelity.

Step 3: Fill out the wire transfer form

Complete the wire transfer form provided by your bank. Ensure that all the information is accurate and double-check the account numbers to prevent any errors or delays. It is essential to provide the correct Fidelity account number to ensure the funds are deposited into the intended account.

Step 4: Verify the details

Before submitting the wire transfer request, review all the details to ensure accuracy. Check that the bank name, routing number, and SWIFT/BIC code are correct. Additionally, confirm that the Fidelity account number matches the account you wish to deposit the funds into.

Step 5: Submit the wire transfer request and wait for confirmation

Once you have completed the wire transfer form and verified all the details, submit it to your bank. They will initiate the transfer and provide you with a confirmation or reference number. Keep this number for future reference and to track the progress of your transfer if needed.

By following these simple steps, you can easily wire money to Fidelity and ensure that your funds are deposited into your account accurately and securely. Remember to always double-check the information provided and reach out to Fidelity or your bank if you have any questions or concerns.

If you don’t already have a Fidelity account, the first step is to open one. Fidelity offers a variety of investment and retirement account options, including Individual Retirement Accounts (IRAs), brokerage accounts, and managed accounts.

Read Also: Software Used by National Stock Exchange for Efficient Trading

To open an account, you’ll need to provide some personal information, such as your name, address, date of birth, social security number, and employment information. You may also be required to provide proof of identity and residency.

Once you’ve provided all the necessary information, you can choose the type of account you want to open and fund it with an initial deposit. Fidelity may require a minimum deposit to open an account, so be sure to check the requirements for the specific account type you’re interested in.

Read Also: Forex Market Opening Time in Malaysia: Everything You Need to Know

Opening a Fidelity account is typically a straightforward process that can be done online or over the phone. If you have any questions or need assistance, Fidelity’s customer service team is available to help you through the process.

Once you have your Fidelity account set up, you will need to link your bank account to facilitate wire transfers. Follow the steps below to successfully link your bank account to Fidelity:

| Step 1: | Log in to your Fidelity account using your username and password. |

| Step 2: | Navigate to the “Transfers” tab in the Fidelity menu. |

| Step 3: | Click on the “Link a Bank Account” option. |

| Step 4: | Choose your bank from the list of available banks or search for your bank using the search bar. |

| Step 5: | Enter your bank account number and routing number in the designated fields. |

| Step 6: | Verify the accuracy of the entered information and click “Submit”. |

| Step 7: | Follow any additional prompts or authentication steps as required by your bank. |

| Step 8: | Once your bank account is successfully linked, you can proceed with wiring money to Fidelity. |

Linking your bank account to Fidelity is a simple and secure process that allows you to transfer funds easily for investments or other financial transactions.

Once you have gathered all the necessary information and completed the corresponding forms, it’s time to initiate a wire transfer request to Fidelity. Follow these steps to ensure a smooth and successful transfer:

It’s important to note that wire transfers may take some time to process, usually ranging from a few hours to a couple of business days. Additionally, your bank may have specific cut-off times for same-day transfers, so be sure to initiate the request within the designated timeframe.

By following these steps, you can successfully initiate a wire transfer to Fidelity and ensure a timely and secure transfer of your funds.

Fidelity is a financial services company that offers investment management, retirement savings, and brokerage services. You may need to wire money to Fidelity if you want to fund your investment account or make a withdrawal.

To wire money to Fidelity, you will need the following information: Fidelity’s bank name and address, your Fidelity account number, the routing number, and the amount you want to wire.

The time it takes for a wire transfer to reach Fidelity varies depending on the sending bank and the method of transfer. Generally, wire transfers can take anywhere from a few hours to a few business days to be credited to your Fidelity account.

Yes, there may be fees associated with wiring money to Fidelity. These fees can vary depending on your bank and the type of wire transfer you are making. It is best to check with your bank or Fidelity for specific fee information.

Yes, you can wire money to Fidelity from an international bank. However, the process may be slightly different and you may need additional information, such as Fidelity’s SWIFT/BIC code, to successfully complete the international wire transfer.

Account Management in Forex Trading: The Pros and Cons Forex trading is a high-risk, high-reward venture. It offers the potential for substantial …

Read ArticleWhat is the employee discount on stock options? Employee discount on stock options is a valuable benefit that many companies offer to their employees. …

Read ArticleUnderstanding Options on Stock Indices and Currency Options on stock indices and currency are powerful financial instruments that allow investors and …

Read ArticleUnderstanding the Kagi Trading Strategy Do you want to enhance your trading skills and unlock the secrets of a powerful trading strategy? Look no …

Read ArticleUnderstanding the Spread in Forex Trading In the world of Forex trading, understanding the spread is essential. The spread refers to the difference …

Read ArticleHow to Predict the Next Candle in Binary Options In the world of binary options trading, accurately predicting the movement of an asset’s price is …

Read Article