Step-by-Step Guide to Find the Exponentially Weighted Moving Average

Discover the Exponentially Weighted Moving Average Calculation In the field of statistics and finance, the Exponentially Weighted Moving Average …

Read Article

Trading in the financial markets can be a lucrative venture if done correctly. It requires careful analysis, strategizing, and timely execution of trades. One effective method that traders can utilize to maximize their profits is by using pending orders. Pending orders allow traders to set specific conditions for opening trades, which can be especially helpful in volatile markets.

When using pending orders, traders have more control over their trades as they can specify the price at which they want to enter or exit a position. This enables traders to take advantage of potential market movements even when they are not actively monitoring the markets. However, for pending orders to be effective, traders need to understand how to use them properly and make informed decisions.

In this step-by-step guide, we will walk you through the process of successfully trading with pending orders. We will cover the different types of pending orders, how to set them up, and provide tips on how to use them effectively. Whether you are a beginner or an experienced trader, this guide will equip you with the knowledge and skills to utilize pending orders to your advantage in the financial markets.

Types of Pending Orders

There are several types of pending orders that traders can choose from, depending on their trading strategy and market conditions:

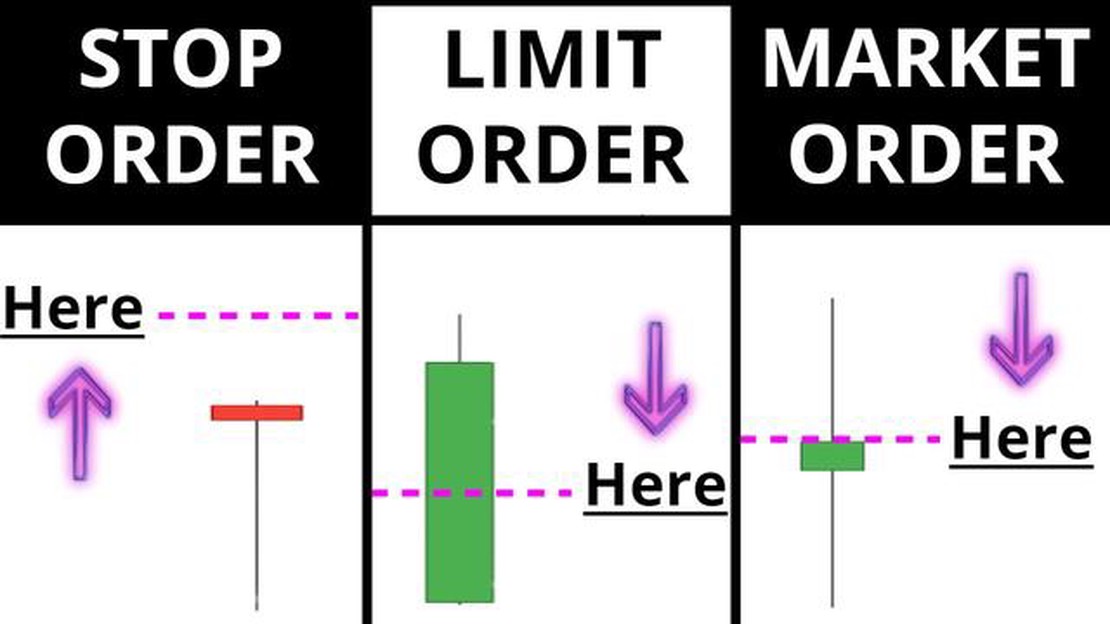

In the world of trading, a pending order is an instruction to buy or sell a financial instrument at a specified price in the future. Unlike market orders, which are executed immediately at the current market price, pending orders allow traders to set their desired entry or exit points in advance.

There are several types of pending orders, including:

| Buy Limit | A pending order to buy an asset at a price lower than the current market price. |

| Sell Limit | A pending order to sell an asset at a price higher than the current market price. |

| Buy Stop | A pending order to buy an asset at a price higher than the current market price. |

| Sell Stop | A pending order to sell an asset at a price lower than the current market price. |

Using pending orders can offer a number of advantages for traders:

Overall, pending orders are a valuable tool for traders to effectively manage their trades and increase their chances of success in the financial markets.

Step 1: Determine the market direction

Before placing a pending order, it is important to analyze the market and determine the direction in which you expect the price to move. This can be done by analyzing price patterns, indicators, and market news.

Step 2: Choose the appropriate pending order type

Depending on your market analysis, you can choose from different types of pending orders, such as buy stop, sell stop, buy limit, or sell limit. Each order type has its own purpose and is used in different market conditions.

Step 3: Define the entry and exit levels

Once you have chosen the appropriate pending order type, you need to define the entry and exit levels for your trade. The entry level is the price at which your pending order will be triggered, while the exit level is the price at which you plan to take profit or cut losses.

Step 4: Set the pending order

Read Also: What is cardstock paper used for? Discover its various applications

Using your trading platform, set the pending order by entering the appropriate order type, entry level, and exit level. Make sure to double-check all the parameters before placing the order.

Step 5: Monitor the market

Read Also: What is a Promotion Voucher Code? All You Need to Know

After placing the pending order, it is important to monitor the market and the price movement. Keep an eye on any significant news or events that may affect your trade, and adjust your exit levels accordingly if necessary.

Step 6: Manage your trade

Once your pending order is triggered and your trade is active, it is important to manage your trade effectively. This includes regularly monitoring the price movement, adjusting your stop loss and take profit levels, and making necessary changes to your trade strategy as the market conditions evolve.

Step 7: Close the trade

When the price reaches your exit level, either take profit or cut losses and close the trade. It is important to stick to your trade plan and not let emotions dictate your decisions.

Step 8: Analyze your results

After closing the trade, take the time to analyze your trading results. Review your trade plan, the market conditions, and your execution. This will help you identify any areas of improvement and refine your trading strategy for future trades.

Trading with pending orders can be a powerful tool in your trading arsenal. By following this step-by-step guide, you can improve your chances of executing successful trades and achieving consistent profitability in the forex market.

Pending orders are orders placed in advance to buy or sell a currency pair at a specific price in the future. This allows traders to set up trades that will automatically execute once the specified price is reached.

There are four main types of pending orders in trading: buy limit, sell limit, buy stop, and sell stop. Each type is used in different market situations to enter or exit trades at specific price levels.

To set up a pending order, you need to open the trading platform and select the desired currency pair. Then, choose the type of pending order you want to use and specify the price at which you want the order to be activated. Finally, set the expiration date and time for the order and click the “Place Order” button.

Trading with pending orders allows traders to avoid emotional decision-making by setting up trades in advance. It also allows traders to take advantage of specific market conditions by entering or exiting trades at predefined price levels.

No, pending orders cannot guarantee a successful trade. Market conditions can change rapidly, and there is always the risk of slippage or a gap in price when the order is executed. It is important for traders to carefully analyze the market and set realistic price levels for their pending orders.

Pending orders in trading are orders that are placed in advance to automatically execute a trade when certain conditions are met. They are used by traders to take advantage of potential trading opportunities without the need to monitor the market constantly.

There are several types of pending orders in trading, including buy limit orders, sell limit orders, buy stop orders, and sell stop orders. Each type of order is used to initiate a trade at a specific price level under different market conditions.

Discover the Exponentially Weighted Moving Average Calculation In the field of statistics and finance, the Exponentially Weighted Moving Average …

Read ArticleUnderstanding the G10 Currency Pairs When it comes to foreign exchange trading, the G10 currency pairs are a crucial aspect to understand. These …

Read ArticleIs DTE stock a good buy? When it comes to investing in stocks, making informed decisions is crucial to ensure optimal returns. One stock that has been …

Read ArticleWhat is the average bonus for Morgan Stanley? As one of the leading financial institutions, Morgan Stanley is known for its competitive compensation …

Read ArticleHow Many Trading Strategies Are There in the Stock Market? In the fast-paced world of the stock market, traders employ a wide array of strategies to …

Read ArticleUnderstanding the Consequences of Reaching a Margin Level of Zero In the world of finance, margin trading is a common practice where traders borrow …

Read Article