Find Out Wells Fargo's Stock Trade Fees and Charges

Wells Fargo Stock Trade Fees: What is the Cost? If you’re considering trading stocks with Wells Fargo, it’s important to understand the fees and …

Read Article

Quoting currency pairs is an essential skill for anyone involved in foreign exchange (FX) trading. Understanding how to accurately quote FX pairs is crucial for traders to make informed decisions and execute successful trades. Whether you’re a beginner or an experienced trader, this comprehensive guide will walk you through the basics of quoting FX pairs and provide valuable insights into the factors that impact currency exchange rates.

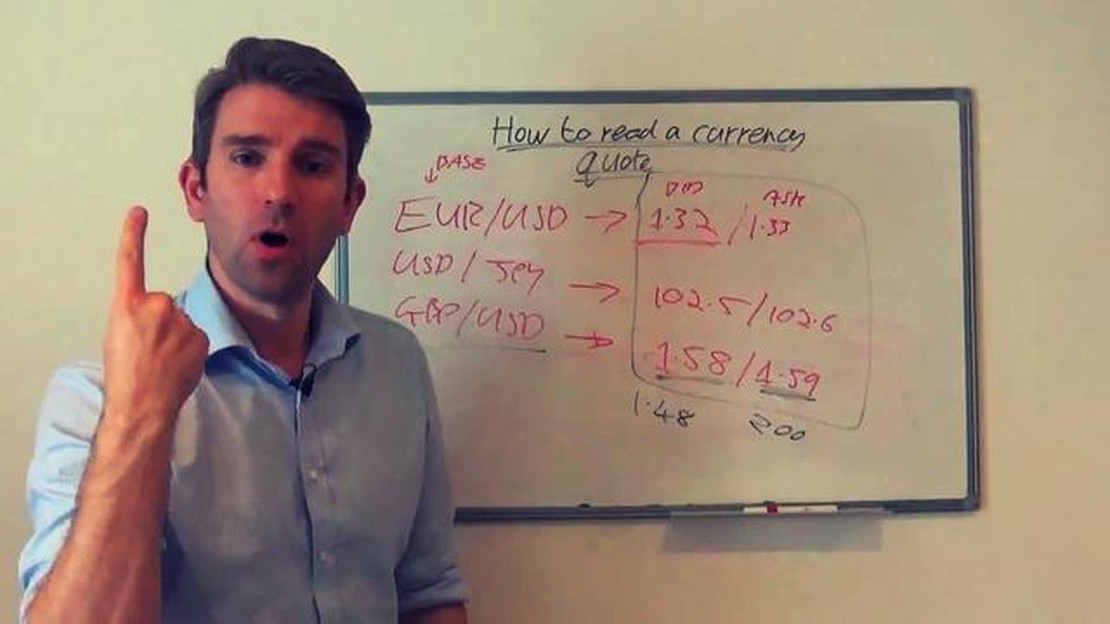

When quoting currency pairs, it’s important to remember that each pair consists of a base currency and a quote currency. The base currency is the currency you are buying or selling, while the quote currency is the currency you are using to make the transaction. For example, in the EUR/USD pair, the euro is the base currency, and the US dollar is the quote currency.

To accurately quote FX pairs, traders use bid and ask prices. The bid price represents the highest price that a buyer is willing to pay for a particular currency pair, while the ask price represents the lowest price that a seller is willing to accept. The difference between the bid and ask price is known as the spread and is usually expressed in pips.

Factors such as economic data, interest rates, geopolitical events, and market sentiment can all influence the exchange rates of currency pairs. Traders need to stay updated on these factors and understand how they impact the quoted prices. By monitoring and analyzing these factors, traders can make more accurate predictions about the direction of currency pairs and take advantage of potential profit opportunities in the FX market.

In the world of foreign exchange trading, currencies are always traded in pairs. This means that when you buy one currency, you are simultaneously selling another currency. The relationship between the two currencies in a pair is crucial for understanding how the forex market works.

The first currency in a pair is called the base currency, while the second currency is called the quote currency. The exchange rate between the two currencies determines the value of the pair. For example, if the exchange rate for the EUR/USD pair is 1.10, it means that 1 euro is worth 1.10 US dollars.

FX pairs are represented by a three-letter code known as the ISO code. The first two letters represent the country or region, and the third letter represents the currency. For example, EUR/USD represents the euro as the base currency and the US dollar as the quote currency.

When quoting FX pairs, there are two types of quotes: direct quotes and indirect quotes. In a direct quote, the base currency is the domestic currency, while in an indirect quote, the domestic currency is the quote currency. For example, a direct quote for a euro-based investor would be EUR/USD, while an indirect quote would be USD/EUR.

Understanding FX pairs is essential for forex traders as it helps them determine the relative strength or weakness of a particular currency. By analyzing different currency pairs, traders can make informed decisions about buying or selling currencies to profit from fluctuations in exchange rates.

Currency quotes play a crucial role in the world of forex trading. They provide traders with valuable information about the exchange rates between different currency pairs. Understanding and interpreting these quotes is essential for making informed trading decisions and capturing potential profits.

Read Also: What is the most affordable way to send euros to Canada?

One of the primary uses of currency quotes is to determine the value of one currency in relation to another. Forex traders analyze these quotes to identify opportunities for buying or selling currency pairs based on their expectations of how the value will change. By comparing different currency quotes, traders can assess the relative strength or weakness of a currency and make strategic decisions accordingly.

Currency quotes are also vital for calculating profits and losses in forex trading. Traders use these quotes to calculate the pip value, which is the measurement of the smallest price movement in a currency pair. By understanding the pip value, traders can quantify their potential gains or losses and manage their risk effectively.

Additionally, currency quotes provide traders with real-time market information. The constantly changing quotes reflect the ongoing supply and demand dynamics of the forex market. Traders can observe the bid and ask prices in the quotes to gauge market sentiment and identify potential market trends. These quotes help traders stay updated and make timely decisions based on the most current information available.

| Key Points to Remember: |

|---|

| - Currency quotes inform traders about exchange rates between currency pairs. |

| - Traders use currency quotes to assess the relative strength or weakness of a currency. |

| - Currency quotes help in calculating pip value and managing risk. |

| - Real-time currency quotes provide valuable market information for making informed trading decisions. |

In the foreign exchange market, FX pairs are quoted using different methods. The most common methods of quoting FX pairs are:

| Method | Description |

|---|---|

| Direct Quotation | A direct quotation is when the domestic currency is the base currency and the foreign currency is the quote currency. For example, if 1 USD is equivalent to 0.8 EUR, the pair would be quoted as USD/EUR 0.8000. |

| Indirect Quotation | An indirect quotation is when the domestic currency is the quote currency and the foreign currency is the base currency. For example, if 1 EUR is equivalent to 1.25 USD, the pair would be quoted as EUR/USD 1.2500. |

| European Terms | European terms are used when the quote currency is the domestic currency. For example, if 1 USD is equivalent to 120 JPY, the pair would be quoted as USD/JPY 120.00. |

| American Terms | American terms are used when the base currency is the domestic currency. For example, if 1 JPY is equivalent to 0.0083 USD, the pair would be quoted as JPY/USD 0.0083. |

Read Also: Discover the New Strategy of BMW: Innovations, Sustainability, and Electric Vehicles

It’s important to note that the method of quoting can vary depending on the country or region and the specific foreign exchange market being referred to. Traders and investors should always be aware of the quoting convention being used in order to accurately interpret and calculate currency exchange rates.

When it comes to trading in the foreign exchange (FX) market, choosing the right quote method is essential for implementing a successful trading strategy. Depending on your specific needs and goals, different quote methods can provide you with the necessary information and insights to make informed trading decisions.

Here are a few factors to consider when selecting the right quote method:

Ultimately, the right quote method for your trading strategy will depend on your individual preferences, risk tolerance, and the type of trading you engage in. It may be helpful to experiment with different methods and evaluate their suitability based on the factors mentioned above.

Remember, no single quote method is perfect for every trading strategy. It’s important to understand the strengths and limitations of each method and choose the one that aligns best with your specific needs and goals.

The purpose of quoting FX pairs is to provide the exchange rate between two currencies.

FX pairs are quoted in terms of one base currency and one quote currency, where the base currency is the currency being bought or sold, and the quote currency is the currency in which the base currency is quoted.

The different methods of quoting FX pairs include direct quotation, indirect quotation, and cross quotation. Direct quotation is when the domestic currency is the base currency and the foreign currency is the quote currency. Indirect quotation is the opposite, where the foreign currency is the base currency and the domestic currency is the quote currency. Cross quotation is when neither currency is the domestic currency, and a third currency is used as the base currency.

Several factors can affect the exchange rate of an FX pair, including interest rates, inflation rates, economic indicators, geopolitical events, and market sentiment. These factors can cause the exchange rate to fluctuate and influence the buying and selling decisions of traders.

Wells Fargo Stock Trade Fees: What is the Cost? If you’re considering trading stocks with Wells Fargo, it’s important to understand the fees and …

Read ArticleUnderstanding India’s Foreign Remittances India, with its enormous population and widespread diaspora, is one of the largest recipients of foreign …

Read ArticleExploring the Role of a Technical Analyst in Finance A technical analyst in finance plays a crucial role in assessing and interpreting market trends …

Read ArticleAre Put Spreads Risky? Options trading can be a lucrative investment strategy, offering the potential for significant returns. However, it is …

Read ArticleUnderstanding the Bollinger Band Trap Bollinger Bands is a popular technical analysis tool that helps traders analyze the volatility and potential …

Read ArticleIs trading necessary in Path of Exile? Path of Exile is an action role-playing game known for its deep and complex gameplay mechanics. One of the key …

Read Article