Can Forex Trading Help Pay Your Bills?

Does Forex Trading Generate Enough Income to Cover Your Bills? Forex trading, or foreign exchange trading, has gained popularity as a way to make …

Read Article

Investing in stock options can be an exciting venture, but managing them in a private company comes with its own set of challenges. Unlike publicly traded companies, private companies operate differently, and understanding how to effectively navigate the world of stock options in this context is essential for investors.

One key aspect of managing stock options in a private company is understanding the valuation process. Unlike public companies, where stock prices are readily available and transparent, private companies often have a more complex valuation process. Investors need to familiarize themselves with the methods used to determine the value of the stock options they hold in order to make informed decisions.

Another important factor to consider is the timing of exercising stock options. Private companies often have specific requirements and restrictions when it comes to exercising options, such as vesting periods or blackout periods. Knowing when and how to exercise stock options can significantly impact an investor’s returns, and careful planning is crucial.

Furthermore, it is essential to have a clear understanding of the terms and conditions attached to the stock options. Private companies may have different rules and regulations regarding stock options compared to public companies. Investors should thoroughly review the stock option agreement, seeking legal advice if necessary, to ensure they fully grasp the implications and potential risks.

Overall, managing stock options in a private company requires a deep understanding of the unique dynamics and challenges that come with investing in this context. By familiarizing themselves with the valuation process, timing their exercises appropriately, and ensuring a thorough understanding of the terms and conditions, investors can navigate the world of stock options in private companies with confidence and maximize their potential returns.

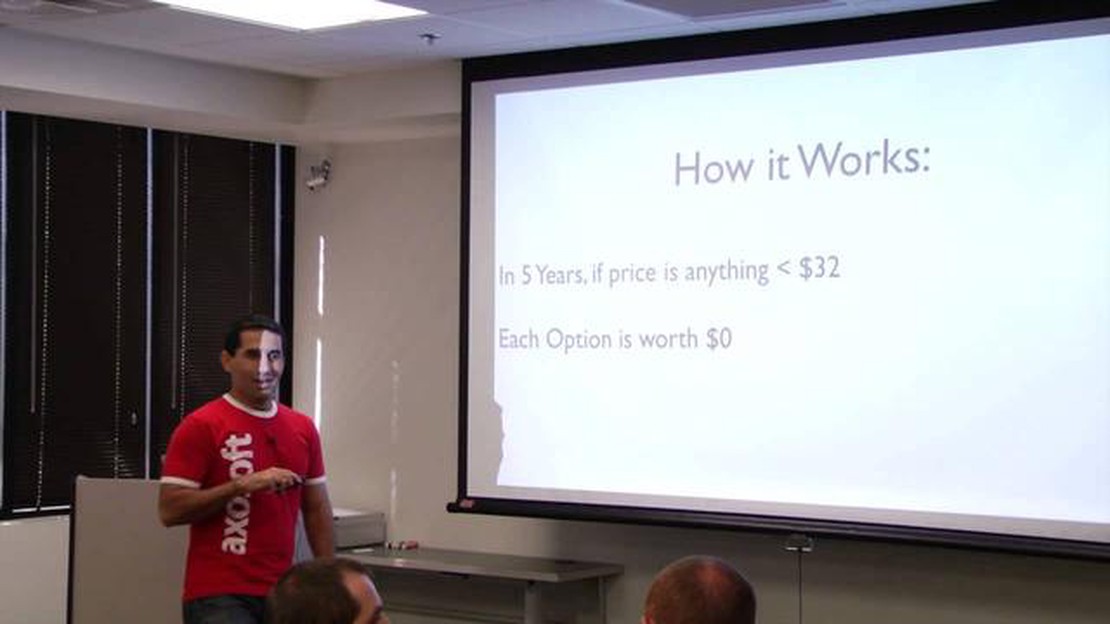

Private company stock options are a form of equity compensation that are offered to employees and investors as an incentive to align their interests with the company’s success. These options give the holder the right to buy a certain number of shares of the company’s stock at a predetermined price, known as the strike price, within a specified period of time.

Unlike stock options in publicly traded companies, which can be easily bought and sold on the stock exchange, private company stock options are generally illiquid and cannot be sold until the company is sold or goes public.

Private company stock options can be a valuable and attractive form of compensation, as they provide the opportunity for individuals to share in the success of the company and potentially profit from its growth. They can also help attract and retain top talent, as employees and investors have the potential to earn a significant return on their investment if the company performs well.

Read Also: History of Options on Futures: When Did They Start and How They Evolved

When considering private company stock options, it is important to carefully evaluate the company’s financial health, growth prospects, and overall business strategy. It is also crucial to understand the terms and conditions of the stock options, including the vesting schedule, exercise price, and expiration date.

Vesting Schedule: The vesting schedule determines when employees or investors can exercise their stock options. It typically includes a period of time, known as the vesting period, during which the options gradually become exercisable. Vesting schedules can vary, but a common approach is for options to vest over a period of four years, with a one-year cliff, meaning no options can be exercised until one year of continuous service has been completed.

Exercise Price: The exercise price, also known as the strike price, is the price at which the stock options can be exercised. It is typically set at the fair market value of the company’s stock on the date the options are granted. This ensures that the options have value and incentivizes employees and investors to work towards increasing the company’s value.

Expiration Date: The expiration date is the date on which the stock options no longer have value and can no longer be exercised. Typically, stock options expire within ten years of their grant date, although this can vary depending on the company’s policies.

It is important for individuals who hold private company stock options to be aware of the tax implications associated with exercising and selling these options. The tax treatment can vary depending on various factors, such as the type of options, the length of time the options are held, and the individual’s tax bracket. Consulting with a tax advisor can help individuals navigate the complex tax rules and make informed decisions.

In conclusion, private company stock options can be a valuable component of an individual’s compensation package, providing the potential for financial rewards and aligning interests with the company’s success. Understanding the terms and conditions of these options is key to maximizing their value and making informed decisions.

Investing in private company stock options can offer a range of benefits for investors. Here are a few key advantages:

While investing in private company stock options can offer significant benefits, it’s important to note that it also carries certain risks. Before making any investment decisions, it is crucial to conduct thorough research and seek professional advice to assess the potential risks and rewards.

Read Also: Why Forex Trading During the London Open is Essential

Overall, private company stock options can be an attractive investment opportunity for investors seeking high returns, potential tax advantages, ownership, and diversification in their portfolio.

Stock options are a type of financial instrument that gives individuals the right to buy or sell a certain number of shares at a specific price within a set timeframe.

In a private company, stock options are typically granted to employees as a form of compensation or incentive. These options allow employees to purchase company stock at a predetermined price, usually referred to as the strike price. The employees can exercise their options after a certain vesting period, and potentially profit from any increase in the company’s stock price.

Investors should consider several factors, including the company’s financial stability, growth potential, and the valuation of its stock. They should also assess the vesting schedule and expiration date of the options, as well as any restrictions or regulations imposed by the company. Additionally, it is important for investors to regularly monitor the market conditions and stay informed about the company’s performance and industry trends.

Managing stock options in a private company comes with certain risks. If the company fails or experiences financial difficulties, the options may become worthless. Additionally, the value of the options can be affected by factors such as market volatility, changes in the industry, or regulatory issues. It is important for investors to carefully assess these risks and diversify their investment portfolio to mitigate potential losses.

Yes, there are tax implications when managing stock options in a private company. The tax treatment of stock options varies depending on the jurisdiction and the specific circumstances. In some cases, there may be tax obligations when the options are exercised or sold. It is recommended for investors to consult with a tax advisor or accountant to understand the tax implications and plan accordingly.

Does Forex Trading Generate Enough Income to Cover Your Bills? Forex trading, or foreign exchange trading, has gained popularity as a way to make …

Read ArticleIs exponential moving average better? An exponential moving average (EMA) is a type of moving average that is commonly used in technical analysis to …

Read ArticleHow to Check My ESOP As an employee, it is important to stay informed about your Employee Stock Ownership Plan (ESOP), a beneficial retirement plan …

Read ArticleWhat is the best book for price action? Are you interested in mastering the art of price action trading? Look no further! We have the perfect resource …

Read ArticleWhy is the moving average important in stocks? Stock trading is a dynamic and complex activity that requires thorough research and analysis. One of …

Read ArticleCost of Trading Options on Etrade: Everything You Need to Know When it comes to option trading, it is essential to consider the fees charged by the …

Read Article