Do Stock Options Transfer to Spouse Upon Death? Find Out Here

Stock Options Transfer to Spouse Upon Death: Explained Stock options are a popular form of compensation offered by many companies, allowing employees …

Read Article

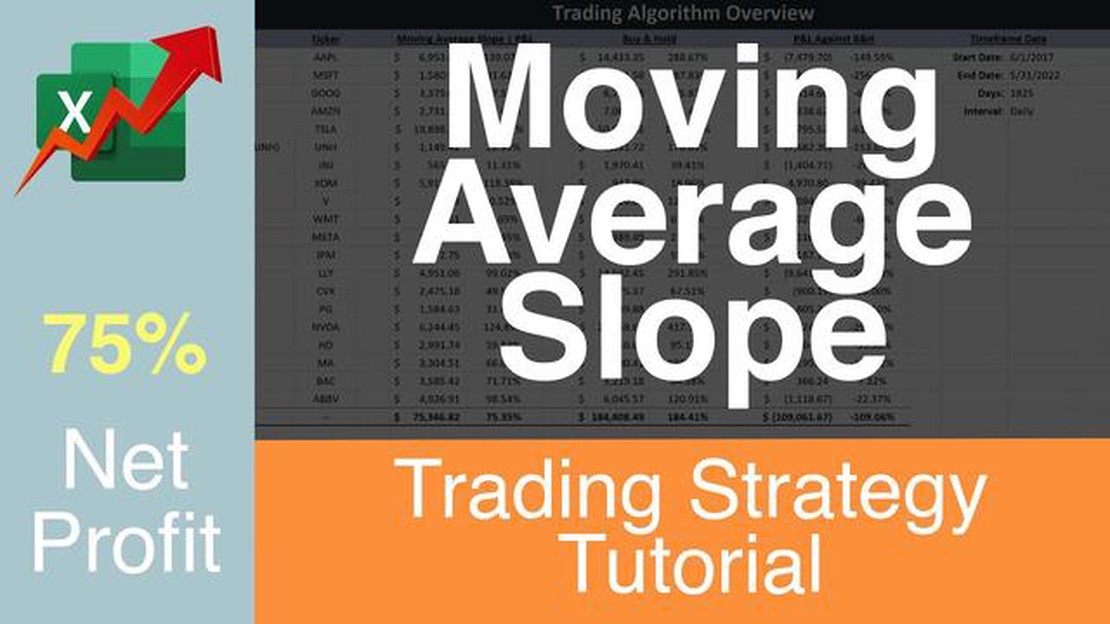

When analyzing financial data, one commonly used tool is the moving average. It helps to smoothen out price fluctuations and identify trends over a certain period of time. However, just knowing the direction of the trend is often not enough. Traders and investors also need to understand the angle or slope of the moving average, as it provides additional insights into the strength and momentum of the trend.

To calculate the angle of a moving average, one must first determine the change in value between two consecutive data points. This can be done by subtracting the previous data point from the current one. Next, measure the time interval between these two points. By dividing the change in value by the time interval, you can obtain the slope or angle of the moving average.

The angle of a moving average can be expressed as a percentage or in degrees. A positive angle indicates an upward slope, suggesting an uptrend, while a negative angle indicates a downward slope, suggesting a downtrend. The steeper the angle, the stronger the trend is likely to be. Conversely, a flatter angle suggests a weaker trend or consolidation.

Example: Suppose you are analyzing the 50-day moving average of a stock’s price. On day 1, the moving average is $50, and on day 2, it increases to $55. The time interval between these two points is 1 day. Therefore, the change in value is $55 - $50 = $5, and the angle of the moving average is 5/1 = 5 or 500%.

By calculating the angle of a moving average, traders and investors can gain a deeper understanding of the trend and potentially make more informed decisions. Remember, however, that the angle is just one aspect of analyzing moving averages, and it should be used in conjunction with other technical indicators and charts to confirm trends and assess potential investment opportunities.

In technical analysis, the angle of a moving average can provide valuable insights into the direction of the market. It is a simple yet effective tool that can help traders determine whether an asset is trending up or down. Calculating the angle involves a few steps, which we will outline in this guide.

Step 1: Choose a Timeframe and Moving Average

The first step is to select a timeframe and moving average that suits your trading strategy. The timeframe refers to the period over which you want to analyze the data, such as daily, weekly, or monthly. The moving average is a mathematical calculation that smoothes out price fluctuations and reveals the underlying trend. Common moving averages include the simple moving average (SMA) and the exponential moving average (EMA).

Step 2: Collect Data

Next, you need to collect the data for the chosen timeframe. This could be the closing prices of a specific asset over a certain period. Make sure you have enough data points to ensure the accuracy of your calculations.

Step 3: Calculate the Moving Average

Using the collected data, calculate the moving average for each data point in the selected timeframe. For example, if you have chosen a 10-day timeframe, you will calculate the moving average for each day based on the previous 10 days’ closing prices.

Step 4: Determine the Slope

The slope of the moving average line represents the angle of the trend. To calculate the slope, you need to determine the change in the moving average value over the given timeframe. You can do this by subtracting the moving average value at the beginning of the timeframe from the moving average value at the end of the timeframe. Divide this difference by the number of data points in the timeframe to get the average change per point.

Step 5: Convert Slope to Degrees

Read Also: Best Broker for Scalping Options: Find Your Ideal Partner Today

Finally, convert the slope to degrees to get the angle of the moving average. You can use the formula tan(angle) = slope, where angle is the desired angle in degrees. Solve for angle by taking the inverse tangent of the slope. This will give you the angle in radians. To convert it to degrees, multiply the result by 180/pi.

Step 6: Interpret the Angle

Read Also: How long can you hold a stock option? | Insights and strategies

Once you have calculated the angle of the moving average, you can interpret it to determine the direction of the trend. A positive angle indicates an upward trend, while a negative angle indicates a downward trend. The steeper the angle, the stronger the trend.

By following these step-by-step instructions, you can easily calculate the angle of a moving average and use it to gain insights into market trends. Remember to adjust your timeframe and moving average to suit your trading strategy and always analyze multiple indicators for confirmation.

The moving average is a commonly used technical analysis tool that helps investors and traders identify trends and potential reversals in the price of a security or financial instrument. It is calculated by taking the average price of a security over a specific period of time, which is then updated as new data becomes available.

The moving average is often used to smooth out short-term price fluctuations and provide a more accurate representation of the underlying trend. By calculating the average price over a defined time period, the moving average helps to filter out noise and highlight the direction of the market.

There are different types of moving averages, with the most common being the simple moving average (SMA) and the exponential moving average (EMA). The SMA gives equal weight to each data point in the calculation, while the EMA places more importance on recent data points. Traders and investors may choose to use one or the other depending on their specific trading strategies and time horizons.

The moving average can be calculated for any time frame, whether it be minutes, hours, days, or weeks. Shorter-term moving averages tend to be more responsive to recent price action, while longer-term moving averages provide a broader perspective on the overall trend.

One of the key benefits of using moving averages is their ability to generate buy and sell signals. When the price of a security crosses above the moving average, it can be seen as a bullish signal, indicating that it may be a good time to buy. Conversely, when the price crosses below the moving average, it can be interpreted as a bearish signal, suggesting that it may be a good time to sell.

Overall, the moving average is a versatile tool that can be used in various ways to analyze and interpret price data. It is important for traders and investors to understand the different types of moving averages and how they can be applied to their specific trading strategies to make informed decisions in the market.

A moving average is a statistical calculation used to analyze data points over a certain period of time to identify trends or patterns.

Calculating the angle of a moving average can provide valuable insights into the strength and direction of a trend, helping traders and investors make informed decisions.

The formula to calculate the angle of a moving average is angle = arctan(change in moving average / number of data points). This formula gives the angle in radians, which can be converted to degrees by multiplying it by 180/π.

Yes, the angle of a moving average can be negative if the trend is downward. A positive angle indicates an upward trend, while a negative angle indicates a downward trend.

The angle of a moving average can be used as a signal to buy or sell securities. For example, a positive angle may indicate a bullish trend and a signal to buy, while a negative angle may suggest a bearish trend and a signal to sell.

A moving average is a calculation used to analyze data points by creating a series of averages of different subsets of the full data set. It is used to smoothen out fluctuations and identify trends.

Stock Options Transfer to Spouse Upon Death: Explained Stock options are a popular form of compensation offered by many companies, allowing employees …

Read Article1 GBP to 1 SEK exchange rate: current rate and conversion The exchange rate between the British pound (GBP) and the Swedish krona (SEK) is a crucial …

Read ArticleUnderstanding Fixed Income Etrading: Everything You Need to Know Welcome to the comprehensive guide on understanding the basics of fixed income …

Read ArticleBeginner’s Guide to Starting Forex Trading Forex trading is a popular way for individuals to enter the financial markets and potentially make a …

Read ArticleWhich plugin is used to cycle? Are you looking to add an interactive cycling feature to your website? If so, you may be wondering which plugin is the …

Read ArticleBest Settings for Exponential Moving Average When it comes to technical analysis, the exponential moving average (EMA) is a popular indicator used to …

Read Article