How to Install a Premium WordPress Theme for Free

Install a Premium WordPress Theme for Free: Step-by-Step Guide If you’re looking to create a professional website on a budget, using a premium …

Read Article

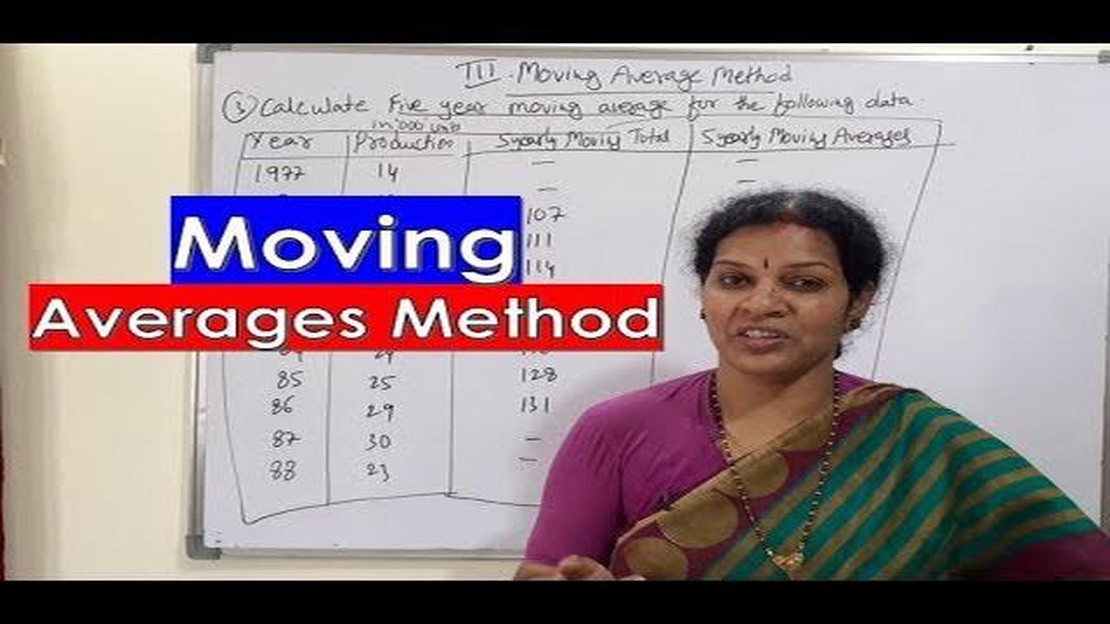

Calculating a moving average is an essential statistical technique used in finance, economics, and other fields to analyze trends and smooth out data over a specific period of time. In this article, we will explore how to calculate a moving average for a five-year period.

A moving average is a calculation that helps to identify the underlying trend by averaging out fluctuations. It is particularly useful when dealing with data that exhibits significant variability over time, such as stock prices or economic indicators.

To calculate a moving average for five years, you need to follow a few simple steps. First, gather the data you want to analyze, such as stock prices for a specific company or economic data for a particular region.

Next, determine the time period over which you want to calculate the moving average. In this case, it is five years. Take the sum of the data values for each year within that five-year period and divide it by five to get the average. Repeat this process for each subsequent five-year period until you have calculated the moving averages for the entire dataset.

By calculating a moving average for five years, you can identify long-term trends and patterns that may not be visible when looking at individual data points. This can be valuable for making informed decisions and predictions based on historical data.

Overall, understanding how to calculate a moving average for five years is a valuable skill for anyone working with time series data. It allows for the identification of long-term trends and can provide valuable insights for making informed decisions. By following the steps outlined in this article, you can easily calculate a moving average and apply it to your data analysis.

A moving average is a statistical calculation used to analyze time series data such as stock prices, sales, or other financial or economic indicators. It calculates the average value of a set of data points over a specific period of time, with the calculated average “moving” as new data becomes available.

One of the main purposes of a moving average is to smooth out the fluctuations and noise in the data to identify and understand the underlying trends. By calculating the average over a specified time period, a moving average can help to filter out short-term fluctuations and highlight long-term patterns or trends. This makes it a useful tool for forecasting or predicting future values based on historical data.

A moving average can be calculated using different types of averaging methods, such as the simple moving average (SMA), exponential moving average (EMA), or weighted moving average (WMA). The choice of the method depends on the specific requirements and characteristics of the data being analyzed.

The calculation of a moving average involves taking the sum of a set of data points over a specified period and dividing it by the number of data points in the set. For example, a 5-day moving average would calculate the average of the last 5 days’ worth of data. As new data becomes available, the moving average “moves” by dropping the oldest data point and including the newest data point in the calculation.

A moving average can be plotted on a chart to visually represent the trend of the data. It is often used in technical analysis to help identify support and resistance levels, determine entry and exit points for trades, or confirm the direction of a trend.

Overall, a moving average is a useful tool for smoothing out data, identifying trends, and making predictions based on historical patterns. It is widely used in various industries and disciplines, including finance, economics, sales, and market research.

A moving average is a commonly used statistical calculation that helps smooth out fluctuations in data by creating a series of averages over a specific period of time. It is often used to identify trends or patterns in data and can be helpful in forecasting future values.

Read Also: Is Trading 212 suitable for beginners? A comprehensive review

To calculate a moving average for 5 years, you would take the average of a specific variable, such as sales or stock prices, over a period of 5 years. This can be done by adding up the values of the variable for each year and dividing by 5.

For example, if you wanted to calculate the 5-year moving average for stock prices, you would add up the closing prices for the most recent 5 years and divide by 5. This would give you the average price over that 5-year period.

Read Also: Understanding the Formula for Bollinger Bands: A Comprehensive Guide

The moving average is useful because it helps remove short-term fluctuations in data, making it easier to observe long-term trends or patterns. By smoothing out the data, it can provide a clearer picture of the underlying trend and make it easier to identify changes or anomalies.

The moving average is a simple yet powerful tool that is widely used in various fields, including finance, economics, and data analysis. It can be applied to different time frames, such as months, quarters, or years, depending on the specific needs of the analysis.

| Year | Variable |

|---|---|

| 2014 | 100 |

| 2015 | 150 |

| 2016 | 200 |

| 2017 | 250 |

| 2018 | 300 |

In the table above, the variable represents the data you want to calculate the moving average for. To find the 5-year moving average for this dataset, you would add up the values for each year (100 + 150 + 200 + 250 + 300) and divide by 5. The resulting average would be 200.

Calculating moving averages can provide valuable insights into trends and patterns in data. It is a useful tool for analyzing historical data and making informed decisions based on the underlying trends.

A moving average is a statistical calculation used to analyze data points by creating a series of averages of different subsets of the full data set.

Calculating a moving average for 5 years can help smooth out fluctuations in data and provide a clearer picture of long-term trends. It is commonly used in finance and economics to analyze stock prices, economic indicators, and other time series data.

To calculate a moving average for 5 years, you need to sum up the values of the data points over the past 5 years and divide by 5. Then, you can move the window by one year and repeat the calculation until you have calculated the moving average for all relevant periods.

Using a 5-year moving average can help smooth out short-term fluctuations in data and provide a clearer indication of long-term trends. It reduces the impact of outliers and noise in the data, allowing you to focus on the overall trend over a longer period of time.

Yes, you can calculate a moving average for any desired period. The choice of the period depends on the specific data and the level of detail you want to analyze. Shorter periods, like 3 years, provide a more detailed view of short-term trends, while longer periods, like 10 years, give a broader perspective on long-term trends.

To calculate a moving average for 5 years, you need to add up the values of a particular variable over a span of 5 years and then divide it by 5 to get the average. This process should be repeated for each consecutive 5-year period.

Install a Premium WordPress Theme for Free: Step-by-Step Guide If you’re looking to create a professional website on a budget, using a premium …

Read ArticleUnderstanding Non-Transferable Stocks: Key Facts and Considerations When it comes to investing in stocks, one term that you may come across is …

Read ArticleDiscover the Best EMA Crossover Strategy for Optimal Results When it comes to trading in the financial markets, having a solid strategy is key to …

Read ArticleHow to recover lost funds from binary options? Binary options trading can be a highly risky endeavor, and many people have found themselves in a …

Read ArticleGuide to Intraday Options Trading Options trading is a complex and exciting field that can offer lucrative opportunities for investors. Among the …

Read ArticleUnderstanding the 2 Hour Trading Timeframe When it comes to trading in the financial markets, timing is everything. Traders are constantly looking for …

Read Article