Understanding Divergence Signals: An In-Depth Guide

Understanding Divergence Signals Divergence signals are a key component of technical analysis in trading. They indicate a discrepancy between the …

Read Article

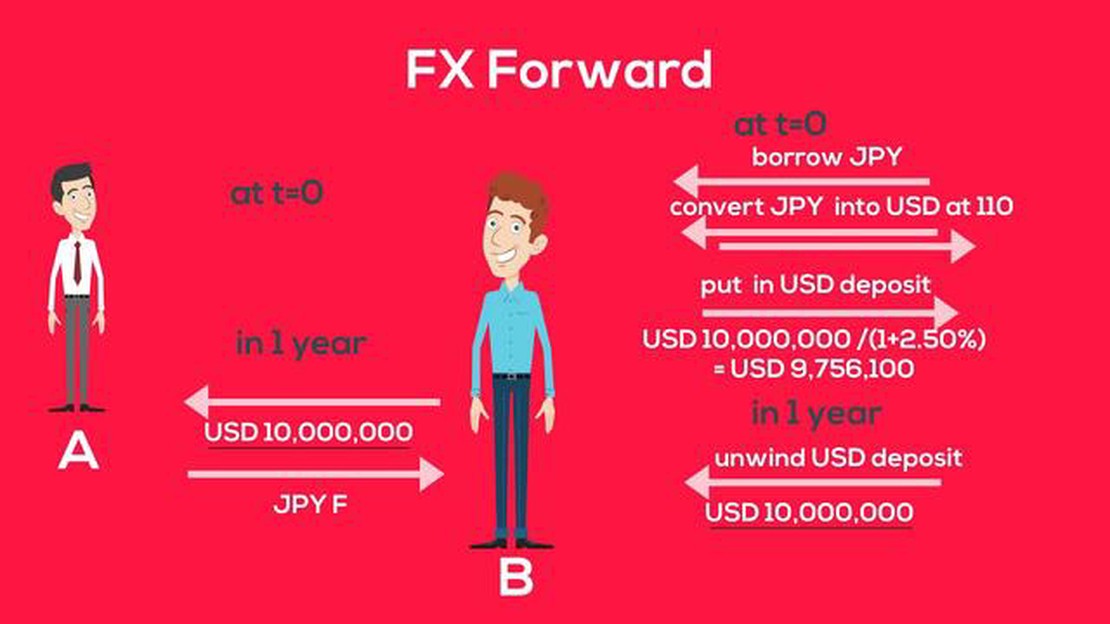

In the world of foreign exchange (FX) trading, one of the key aspects to understand is how FX forwards are settled. The settlement process is crucial as it ensures that both parties involved in the transaction fulfill their obligations and exchange the agreed-upon currencies at the specified future date.

FX forward settlement can be executed in various ways, depending on the market and the agreement between the parties. One of the most common methods is through physical delivery, where the buyer and seller physically exchange the currencies at the agreed-upon rate and date. This method is typically used when the amounts involved are large and the currencies are readily available.

Alternatively, settlement can also be done through a cash payment, known as a cash settlement or a cash netting. In this case, instead of exchanging the physical currencies, the parties settle the transaction by paying or receiving the net amount of the difference between the agreed-upon rate and the prevailing market rate at the time of settlement. This method is often used when the currencies are not easily accessible or when there is no need for physical delivery.

It is important to note that FX forward settlement is typically conducted in a centralized clearing system or through a financial institution acting as the intermediary. This ensures the smooth and efficient execution of the settlement process, as well as mitigates counterparty risk. Additionally, certain regulatory and compliance requirements may be imposed to ensure transparency and accountability in the settlement process.

Overall, understanding the settlement process in FX forward transactions is crucial for traders and market participants to ensure smooth execution and minimize the risks associated with currency exchange. Whether through physical delivery or cash settlement, the settlement method should be agreed upon and clearly defined by the parties involved. With the proper understanding of settlement mechanics, traders can navigate the FX market confidently and make informed decisions.

FX forward contracts are settled through a process known as physical delivery or cash settlement. The settlement method chosen depends on the specific requirements of the parties involved in the transaction.

In a physical delivery settlement, the buyer and the seller of the FX forward contract exchange the agreed-upon currencies on the settlement date. This involves actual delivery of the currencies to the respective parties. The settlement date is typically a predetermined future date, which allows both parties to make necessary arrangements for the exchange.

On the other hand, cash settlement involves the payment of the difference between the contracted exchange rate and the prevailing spot rate on the settlement date. This means that no physical exchange of currencies takes place. Instead, the parties settle the transaction in cash based on the difference in exchange rates.

Both physical delivery and cash settlement have their advantages and disadvantages. Physical delivery ensures that the parties receive the actual currencies, allowing them to use the funds immediately. However, it also involves logistical challenges, such as the need for safe transportation and custody of the currencies.

Cash settlement, on the other hand, eliminates the need for physical exchange and delivery of currencies, making it more convenient and cost-effective. However, it also introduces a level of currency risk, as the parties are exposed to fluctuations in the exchange rate between the contract date and the settlement date.

The choice between physical delivery and cash settlement depends on various factors, such as the size of the transaction, the availability of the currencies involved, and the preferences of the parties. It is important for market participants to understand the settlement method and its implications before entering into an FX forward contract.

Settlement in FX forward transactions refers to the process by which the parties involved exchange the agreed upon currencies at a specified future date, known as the settlement date. The settlement is a crucial step in completing the FX forward transaction and ensuring that both parties fulfill their obligations.

Read Also: Demystifying Stock Option Agreements: How They Work and What You Need to Know

There are several methods of settlement in FX forward transactions:

1. Cash settlement: In cash settlement, the parties exchange the cash value of the agreed upon currencies on the settlement date. This means that the actual physical delivery of the currencies does not take place. Instead, the difference between the agreed upon exchange rate and the spot rate on the settlement date is settled in cash.

Read Also: 5 Effective Strategies to Improve Your Forex Business

2. Physical delivery: In physical delivery settlement, the parties physically exchange the agreed upon currencies on the settlement date. This requires the physical transfer of the currencies from one party to another. Physical delivery settlement is less common in FX forward transactions compared to cash settlement.

3. Net settlement: In net settlement, the parties offset their obligations by calculating the net difference between the agreed upon exchange rate and the spot rate on the settlement date. This means that only the net amount is settled in cash or physically delivered, depending on the chosen settlement method.

4. Third-party settlement: In some cases, the parties may choose to involve a third party to handle the settlement process. This third party, such as a clearing house or a custodian bank, ensures the smooth and efficient transfer of funds and currencies between the parties. Third-party settlement adds an extra layer of security and trust to the FX forward transaction.

It is important to note that the settlement process in FX forward transactions is typically governed by clear and detailed terms specified in the contract or agreement between the parties. These terms include the settlement method, settlement date, and any other relevant conditions that need to be fulfilled for a successful settlement.

In conclusion, settlement in FX forward transactions plays a vital role in completing the transaction and ensuring the exchange of agreed upon currencies. Cash settlement, physical delivery, net settlement, and third-party settlement are common methods used for settling FX forward transactions.

An FX forward transaction is a type of foreign exchange contract where two parties agree to exchange a specified amount of different currencies at a future date, with a predetermined exchange rate.

Settlement in an FX forward transaction occurs on a future date, while settlement in spot FX happens on the spot or immediately. This means that in FX forward, the exchange of currencies and payment takes place at a later date, typically after a certain number of days.

An FX forward transaction is settled by exchanging the agreed-upon amount of currencies between the two parties involved. The settlement process involves the delivery of the currencies and the simultaneous payment based on the predetermined exchange rate.

There are two main options for settlement in an FX forward transaction: physical delivery and cash settlement. Physical delivery entails the actual delivery of the currencies, while cash settlement involves the netting of the payment obligations and transferring the difference in cash.

In physical delivery settlement, the two parties physically exchange the agreed-upon currencies on the settlement date. This typically involves the transfer of funds from one party’s bank account to the other party’s bank account, along with the delivery of any required documentation to complete the transaction.

Understanding Divergence Signals Divergence signals are a key component of technical analysis in trading. They indicate a discrepancy between the …

Read ArticleThe key factors in Forex trading Forex trading, also known as foreign exchange trading, is the buying and selling of currencies on the foreign …

Read ArticleWhat is the movie about predicting the stock market? Have you ever wondered if it’s possible to predict the stock market? The thrilling new movie, in …

Read ArticleUnderstanding the Seagull Option Structure In the world of investing, there are many different strategies and structures that traders and investors …

Read ArticleUnderstanding the Fundamentals in Forex Trading In the dynamic world of finance, the foreign exchange market, or forex, holds a prominent place. It is …

Read ArticleUnderstanding the Principal-Agent Problem for Stock Market Investors The principal-agent problem is a common issue in stock market investing. It …

Read Article