Do metal debit cards really work? A comprehensive guide

How do metal debit cards work? Debit cards made of metal have become a popular trend among financial institutions in recent years. These cards, often …

Read Article

Currency exchange rates play a crucial role in the global economy, affecting international trade, tourism, investment, and even everyday transactions. Understanding how exchange rates are determined is key to making informed decisions in the world of foreign exchange.

At its core, an exchange rate is the value of one currency expressed in terms of another. It represents the relationship between two currencies and fluctuates in response to various factors, including supply and demand, interest rates, inflation, government policies, and market sentiment.

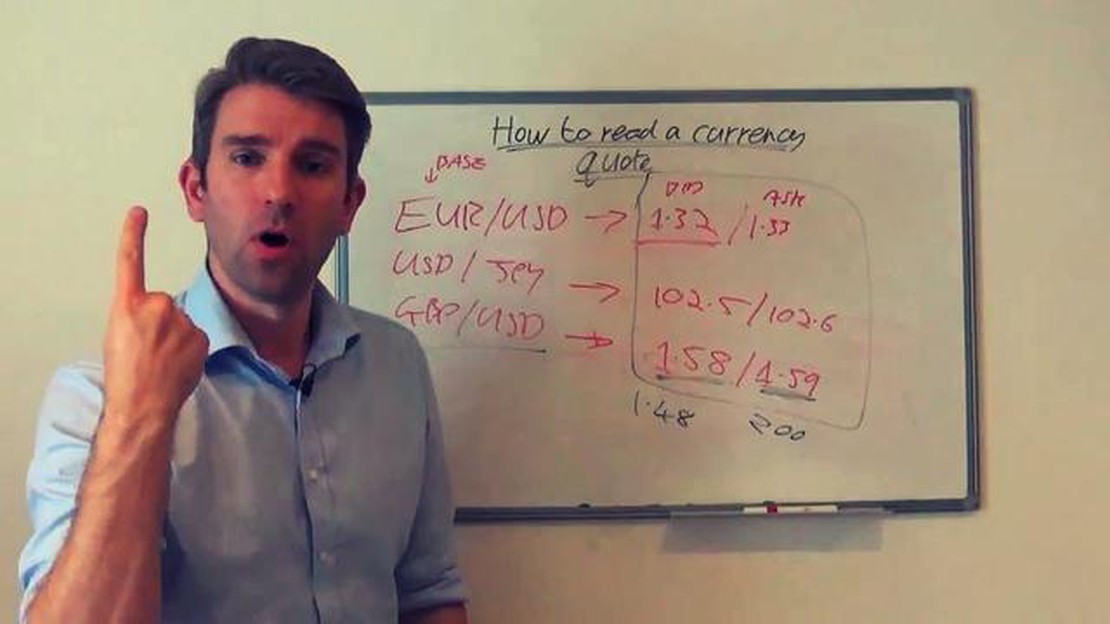

FX quotes, also known as forex quotes or currency quotes, are the prices at which currencies are traded in the foreign exchange market. They consist of a bid price, which is the price at which market participants are willing to buy a particular currency, and an ask price, which is the price at which they are willing to sell it.

The bid-ask spread is the difference between these two prices and reflects the market’s liquidity and the costs associated with currency trading. Typically, banks, financial institutions, and forex brokers provide currency exchange services and quote their rates with a spread built-in to cover their costs and make a profit.

In the forex market, exchange rates are determined by the interplay of multiple factors and can change rapidly. Economic indicators, geopolitical events, central bank policies, and market speculation all contribute to the movement of currency prices. Traders and investors analyze these factors and use various tools and techniques to predict exchange rate movements and take advantage of potential opportunities.

Overall, understanding the factors influencing exchange rates and keeping up with the latest news and trends is essential for anyone involved in international business or traveling abroad. By staying informed and utilizing the right tools, individuals and businesses can navigate the complex world of currency exchange and optimize their financial decisions.

When it comes to foreign exchange, understanding how FX quotes are determined is essential. FX quotes, also known as currency exchange rates, represent the value of one currency in relation to another currency.

FX quotes consist of two prices - the bid price and the ask price. The bid price is the price at which a buyer is willing to purchase a currency, while the ask price is the price at which a seller is willing to sell a currency.

The bid-ask spread is the difference between these two prices and represents the cost of trading. Brokers and financial institutions make their profits by buying currency at the bid price and selling it at the ask price. The wider the spread, the higher the trading costs for individuals and businesses.

Read Also: How Many Pounds is a Typical Household Move? Find Out Here!

FX quotes are typically displayed in pairs, such as EUR/USD or GBP/JPY. The first currency in the pair is known as the base currency, and the second currency is known as the quote currency. The FX quote shows how many units of the quote currency are needed to buy one unit of the base currency.

For example, if the EUR/USD exchange rate is 1.10, it means that 1 euro can be exchanged for 1.10 US dollars. If you want to buy euros, you would need to pay the ask price, which is higher than the bid price. On the other hand, if you want to sell euros, you would receive the bid price, which is lower than the ask price.

FX quotes are influenced by various factors, including interest rates, inflation, geopolitical events, and economic indicators. Central banks and government policies also play a significant role in determining currency exchange rates.

It’s important to keep in mind that FX quotes are constantly changing due to market fluctuations. Traders and investors closely monitor these quotes to make informed decisions and take advantage of potential profit opportunities.

In conclusion, understanding FX quotes is crucial for anyone involved in foreign exchange trading or international business. By knowing how these quotes are determined and the factors that influence them, individuals can better navigate the global currency markets.

Several factors can influence currency exchange rates. These factors can be broadly categorized into economic, political, and market factors.

| Economic Factors | Political Factors | Market Factors |

|---|---|---|

| 1. Interest rates | 1. Political stability | 1. Supply and demand |

| 2. Inflation rates | 2. Government policies | 2. Market speculation |

| 3. GDP growth | 3. Political events | 3. Exchange rate regimes |

| 4. Trade balances | 4. Trade agreements | 4. Economic indicators |

Economic factors play a significant role in determining exchange rates. Central banks use interest rates to control inflation and stimulate economic growth. Higher interest rates tend to attract foreign investors and increase demand for a currency, leading to a stronger exchange rate. Inflation rates also impact exchange rates, with higher inflation generally leading to a weaker currency. GDP growth and trade balances can also affect exchange rates, as stronger economic performance and positive trade balances indicate a robust economy and can attract foreign investment.

Read Also: Is Weekend Trading Worth It? Find Out Here!

Political stability and government policies are important determinants of currency exchange rates. Countries with stable political environments and sound economic policies generally experience more favorable exchange rates. Political events, such as elections or policy changes, can cause uncertainty and volatility in currency markets, leading to fluctuations in exchange rates. Trade agreements between countries can also have an impact on exchange rates, as they influence economic activity and trade flows.

Market factors, such as supply and demand and market speculation, also influence currency exchange rates. The foreign exchange market is the largest financial market in the world, and currency prices are determined by market participants buying and selling currencies. Changes in supply and demand for a currency can cause fluctuations in exchange rates. Market speculation, driven by factors such as economic data releases or geopolitical events, can also impact exchange rates in the short term.

Overall, currency exchange rates are influenced by a complex interplay of economic, political, and market factors. Understanding these factors can help individuals and businesses make informed decisions when dealing with foreign exchange.

Currency exchange rates are determined by a variety of factors including interest rates, inflation, political stability, and economic performance. These factors are constantly changing and can cause fluctuations in currency values.

Banks and financial institutions use a variety of methods to determine foreign exchange rates. They often rely on market data, supply and demand dynamics, and economic indicators to calculate exchange rates. They may also consider factors such as transaction costs and their own profit margins.

While individuals may not have a direct influence on currency exchange rates, their collective actions can indirectly impact rates. For example, if many individuals buy a particular currency, its value may increase relative to other currencies. However, the overall impact of individual actions on exchange rates is usually minor compared to larger economic forces.

No, exchange rates between two currencies are constantly changing. They can be influenced by a variety of factors, such as economic indicators, interest rate changes, and geopolitical events. Exchange rates are determined by the foreign exchange market, where currencies are bought and sold, and are subject to fluctuations based on market conditions.

The foreign exchange market is a decentralized market where participants buy and sell currencies. It operates 24 hours a day, five days a week, and is the largest financial market in the world. Currency exchange rates are determined by the supply and demand for different currencies. Participants, including banks, financial institutions, corporations, and individuals, trade currencies based on their own needs and expectations.

How do metal debit cards work? Debit cards made of metal have become a popular trend among financial institutions in recent years. These cards, often …

Read ArticleAnalysis of the recent fluctuation in Priceline stock price Once a high-flying stock and a Wall Street darling, Priceline has recently experienced a …

Read ArticleForex Factory News Trading: A Comprehensive Guide Forex trading is a complex and exciting market, with trillions of dollars being traded daily. To …

Read ArticleHow to Receive Forex Signals If you’re new to the world of forex trading, you may be wondering how to get forex signals to help you make better …

Read ArticleHow to Use Moving Average to Enhance Volume Indicator Moving averages are widely used in technical analysis to identify trends and potential reversals …

Read ArticleBest Period for Exponential Moving Average Exponential Moving Averages (EMAs) are an important tool in technical analysis for traders and investors. …

Read Article