Convert 100 MYR to Thai Baht: Currency Exchange Rate

Conversion rate: 100 MYR to Thai Baht Are you planning a trip to Thailand and wondering how much Thai Baht you’ll get for your Malaysian Ringgit? Look …

Read Article

Forex trading has become increasingly popular in recent years as more and more individuals seek to take control of their financial future. However, navigating the complex world of forex can be a daunting task, especially for beginners. That’s where a forex broker comes in. A forex broker is a financial institution that allows traders to buy and sell currencies on the foreign exchange market. In this guide, we will explore how to find the right forex broker and how to use their services for successful trading.

One of the most important factors to consider when choosing a forex broker is regulation. Forex brokers are regulated by various financial authorities around the world to ensure fair and transparent trading practices. It is crucial to choose a broker that is regulated by a reputable authority, such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US. Regulation provides a level of protection for traders and helps to maintain the integrity of the forex market.

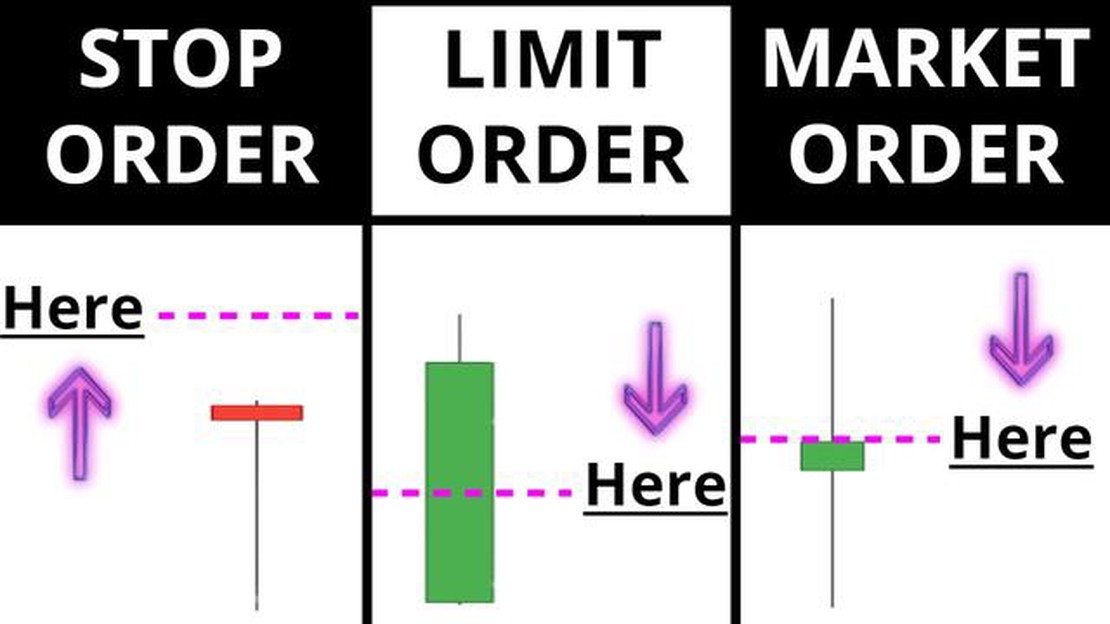

Another key aspect to consider when selecting a forex broker is the trading platform they offer. The trading platform is the software that traders use to execute trades and manage their accounts. A user-friendly and intuitive trading platform can make a significant difference in the trading experience. It should provide access to real-time market data, advanced charting tools, and a variety of order types to suit different trading strategies. Additionally, it is essential to ensure that the trading platform is compatible with your device, whether you prefer to trade on a desktop computer, laptop, or mobile device.

In addition to regulation and the trading platform, other factors to consider when choosing a forex broker include the variety of currency pairs available for trading, the cost of trading (including spreads and commissions), customer support, and the quality of educational resources and research. By carefully considering these factors and conducting thorough research, traders can find a forex broker that meets their individual needs and increases their chances of successful trading.

In conclusion, a forex broker is an essential partner for traders in the foreign exchange market. By choosing a regulated broker with a user-friendly trading platform and considering other important factors, traders can enhance their trading experience and increase their chances of success. However, it is important to remember that trading forex carries risks, and it is crucial to have a solid understanding of the market and develop a sound trading strategy. With the right broker and the necessary knowledge, forex trading can be a rewarding endeavor.

When it comes to forex trading, choosing the right forex broker can make all the difference in your trading success. With so many brokers to choose from, it can be a daunting task to find the one that is best suited for your needs. Here are some important factors to consider when selecting a forex broker:

Read Also: What is the average income of scalpers?

| Regulation | Make sure the broker you choose is regulated by a reputable regulatory authority. This will help protect your funds and ensure fair trading practices. |

| Trading Platform | The trading platform is where you will be conducting your trades, so it’s important that it is user-friendly and offers the features you need. Look for a platform that is compatible with your device and has a good reputation. |

| Account Types | Consider the different account types offered by the broker. Some brokers offer different account options depending on your trading experience and budget. Choose a broker that offers an account type that suits your needs. |

| Trading Tools and Resources | Take a look at the trading tools and resources provided by the broker. This may include educational materials, market analysis, and trading signals. These tools can be invaluable for improving your trading skills and making informed trading decisions. |

| Customer Service | Good customer service is essential when choosing a forex broker. You want to be able to easily reach out to the broker if you have any questions or issues. Look for a broker that offers multiple channels of communication and has a reputation for prompt and helpful customer support. |

| Transaction Costs | Consider the transaction costs associated with trading with the broker. This may include spreads, commissions, and any other fees. Lower transaction costs can lead to higher profits, so it’s important to compare the costs of different brokers. |

By considering these factors and doing thorough research, you can find the right forex broker that will meet your trading needs and help you achieve success in the forex market.

Choosing the right forex broker is essential for successful trading in the forex market. With so many options available, it can be overwhelming to make a decision. Here are some important factors to consider when selecting a forex broker:

| Regulation and Licensing | Look for a broker that is regulated by a reputable regulatory authority. This ensures that the broker operates within the guidelines set by the regulatory body, providing a level of security and protection for your funds. |

| Trading Platform | A reliable trading platform is crucial for executing trades effectively. Look for a broker that offers a user-friendly interface, fast execution speeds, and advanced charting tools. Additionally, check if the platform is compatible with your preferred devices. |

| Account Types | Consider the different account types offered by the broker. Some brokers offer various account options to cater to different trading styles and capital requirements. Choose an account type that suits your needs and preferences. |

| Leverage and Margin | Understand the leverage and margin requirements offered by the broker. Leverage allows you to trade larger positions with a smaller amount of capital, but it also increases the risk. Ensure that the leverage and margin requirements align with your risk tolerance and trading strategy. |

| Transaction Costs | Consider the transaction costs associated with trading with a particular broker. These costs can include spreads, commissions, and overnight financing charges. Compare the costs among different brokers to find the most competitive rates. |

| Customer Support | Good customer support is crucial when trading forex, especially if you are a beginner. Look for a broker that offers responsive and helpful customer support. This will ensure that you can get assistance whenever you encounter any issues or have questions. |

| Education and Research Resources | Consider the educational and research resources provided by the broker. A broker that offers educational materials, webinars, and market analysis can be valuable for enhancing your trading skills and staying informed about market trends. |

| Deposit and Withdrawal Options | Check the deposit and withdrawal options offered by the broker. Ensure that they support your preferred payment methods and offer convenient and secure transactions. |

| Reputation and Reviews | Do some research and read reviews about the broker you are considering. Look for feedback from other traders to get an idea of their experiences with the broker. A broker with a good reputation and positive reviews is more likely to provide a reliable trading environment. |

Read Also: How much cash should you bring to London? Learn the perfect amount for a smooth trip!

By carefully considering these factors, you can select a forex broker that meets your trading needs and helps you achieve success in the forex market.

A forex broker is a platform that allows traders to access the foreign exchange market and trade various currency pairs.

When choosing a forex broker, you should consider factors such as regulation, trading platforms, customer support, fees, and available trading instruments.

Leverage allows traders to control larger positions in the market with a smaller amount of capital. It amplifies both potential profits and losses.

There are two main types of forex brokers: market makers and ECN brokers. Market makers act as counterparties to traders’ trades, while ECN brokers connect traders directly to the interbank market.

Conversion rate: 100 MYR to Thai Baht Are you planning a trip to Thailand and wondering how much Thai Baht you’ll get for your Malaysian Ringgit? Look …

Read ArticleWhat is the Value of 1 Pip? When it comes to forex trading, one term you will often come across is “pip.” But what exactly is a pip, and why is it …

Read ArticleUnderstanding Currency Options in IG Trading Platform Forex options are a powerful tool that can enhance your trading strategies. Whether you are new …

Read ArticleIs Forex Trading Halal in Pakistan? For Muslims in Pakistan, the question of whether forex trading is halal or haram is a contentious one. With …

Read ArticleUnderstanding the Method of Sysmex XN 1000 In the field of hematology, reliable and efficient analysis of blood samples is crucial in providing …

Read ArticleUnderstanding the Inverted Swap Curve and its Implications An inverted swap curve occurs when long-term swap rates are lower than short-term swap …

Read Article