TSX vs TSXV: Understanding the Difference

Understanding the Differences Between TSX and TSXV Exchanges When it comes to investing in the Canadian stock market, two exchanges stand out: the TSX …

Read Article

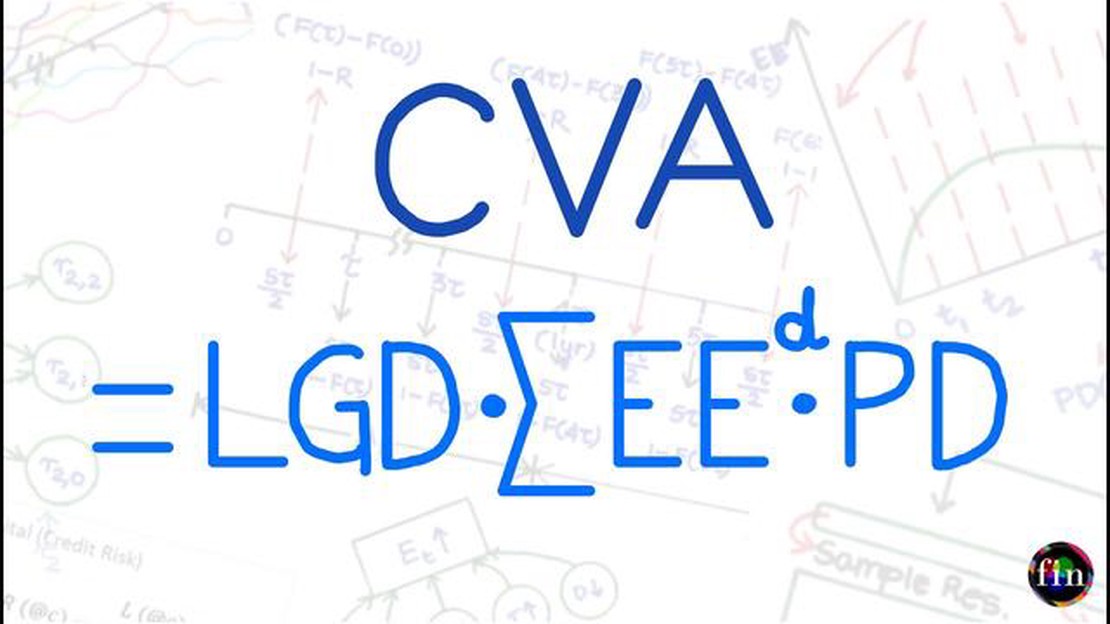

In today’s complex financial landscape, the role of CVA traders plays a crucial role in managing counterparty credit risk. CVA, or Credit Valuation Adjustment, is a measure of the potential loss that can occur due to the default of a counterparty in a financial transaction. CVA traders are responsible for assessing and pricing this risk, ensuring that their firm is adequately protected.

As financial markets have become increasingly interconnected, the need for CVA traders has grown exponentially. These professionals must have a deep understanding of credit risk modeling, derivatives pricing, and the intricacies of financial markets. They must also stay up-to-date with regulatory changes and market trends to make informed decisions.

The work of CVA traders is not easy. They have to deal with complex financial instruments and constantly evaluate the creditworthiness of their counterparties. This requires a strong analytical mindset and the ability to manage large amounts of data. However, the role is also highly rewarding, as CVA traders can have a significant impact on their firm’s bottom line.

Furthermore, CVA traders often collaborate with other departments, such as risk management and trading, to ensure that the firm’s overall risk exposure is managed effectively. Their insights and analysis are invaluable in making informed trading decisions and optimizing the firm’s profitability.

Overall, CVA traders play a vital role in modern finance, helping firms navigate the complex world of counterparty credit risk. Their expertise and analysis contribute to the overall stability of financial markets and the success of their firms. As financial markets continue to evolve, the role of CVA traders will only become more important.

Within the modern financial landscape, CVA (Credit Value Adjustment) traders play a crucial role in managing the counterparty credit risk of financial institutions. Their responsibilities are wide-ranging and require a deep understanding of financial markets and complex derivatives.

One of the primary responsibilities of CVA traders is to assess and price the counterparty credit risk associated with various financial transactions. They analyze market data, creditworthiness of counterparties, and other relevant factors to determine the potential credit exposure. By accurately pricing the risk, CVA traders allow financial institutions to properly measure and manage their overall risk exposure.

CVA traders are also responsible for hedging and mitigating credit risks. They develop and execute strategies to offset the potential losses that can occur due to counterparty default. This involves using credit default swaps (CDS), derivatives, and other hedging instruments to hedge a portfolio of transactions and reduce the overall credit risk exposure.

Furthermore, CVA traders closely collaborate with other departments within the financial institution, such as risk management, legal, and compliance, to ensure that credit risk is accurately assessed and managed. They provide valuable insights and input on the overall risk management strategy and assist in making informed decisions regarding credit exposure.

Continuous monitoring and ongoing analysis of credit risk is another essential responsibility of CVA traders. They regularly review the creditworthiness of counterparties, analyze market trends and developments, and assess the impact on the existing portfolio of transactions. This proactive approach allows CVA traders to identify and address any potential credit risks in a timely manner.

Read Also: Understanding the Span of Exponential Moving Average (EMA): A comprehensive guide

Lastly, CVA traders are accountable for staying up to date with industry regulations and best practices. They need to understand and comply with the various regulatory requirements imposed on financial institutions to manage credit risk effectively. This includes maintaining knowledge of accounting standards, risk models, and other relevant guidelines.

In summary, CVA traders play a critical role in the contemporary financial landscape by assessing and pricing counterparty credit risk, hedging and mitigating credit risks, collaborating with other departments, continuously monitoring credit risk, and staying abreast of industry regulations. Their expertise and efforts are vital to ensuring the stability and soundness of financial institutions in today’s complex and interconnected markets.

CVA traders play a crucial role in the field of modern finance by actively managing the risk associated with credit valuation adjustment (CVA). CVA is an important metric used to account for the counterparty default risk in derivative transactions.

Derivative trades are often entered into between two parties, and the risk of one party defaulting on their obligations is an ever-present concern. CVA traders use their expertise to calculate and mitigate this risk by incorporating market and credit risk factors into their evaluation.

Read Also: Understanding Ladder Options: A Comprehensive Guide

One of the primary responsibilities of CVA traders is to determine the appropriate level of capital that needs to be set aside to cover potential credit losses. By doing so, they ensure that the institution is adequately protected against counterparty default risk.

Furthermore, CVA traders constantly monitor the creditworthiness of their counterparties and adjust their risk strategies accordingly. They carefully analyze the financial condition, credit ratings, and market perceptions of their counterparties to make informed decisions about their exposure to credit risk.

CVA traders also work closely with other teams within the organization, such as risk management and pricing teams. They collaborate to enhance risk models, develop hedging strategies, and ensure the accurate pricing of derivatives considering the associated counterparty risk.

Overall, the significance of CVA traders in risk mitigation cannot be overstated. They are vital in safeguarding financial institutions against potential losses arising from counterparty default, and their expertise contributes to the overall stability and health of the financial system.

CVA traders play a crucial role in modern finance by managing the credit value adjustment of financial instruments. They assess and mitigate the risk of counterparty default and calculate the fair value of derivatives.

Successful CVA traders need a strong understanding of financial markets, risk management techniques, and quantitative analysis. They should also possess excellent communication and negotiation skills to interact with counterparties.

CVA traders manage the risk of counterparty default by assessing the creditworthiness of counterparties, monitoring exposures, and implementing hedging strategies. They use tools such as credit default swaps and credit derivatives to transfer the risk.

CVA has a significant impact on derivative pricing as it represents the cost of counterparty default risk. CVA is calculated as the difference between the risk-free value of a derivative and its market value, taking into account the likelihood of counterparty default.

Understanding the Differences Between TSX and TSXV Exchanges When it comes to investing in the Canadian stock market, two exchanges stand out: the TSX …

Read ArticleIs demo trading realistic? In the world of trading, demo accounts have become a popular tool for both beginner and experienced traders to practice …

Read ArticleGet Money Exchange Franchise in India: Step-by-Step Guide Starting a money exchange franchise in India can be a lucrative business venture. With the …

Read ArticleIs AI Forex Trading Profitable? Artificial intelligence (AI) has revolutionized various industries, and the forex market is no exception. With its …

Read ArticleReview: Is FX Impact M3 a Good Choice? The FX Impact M3 is a highly regarded air rifle that has gained popularity among shooting enthusiasts and …

Read ArticleUnderstanding the Impact of Dark Cloud Cover on Market Trends The Dark Cloud Cover is a popular candlestick pattern that can provide traders with …

Read Article