How to trade on MQL5: A comprehensive guide for beginners

Trading on MQL5: Everything You Need to Know Are you new to trading on MQL5? Want to learn how to navigate the platform and make successful trades? …

Read Article

The stock market is a complex and dynamic environment where investors and traders try to outperform the market by making profitable investment decisions. One popular approach to analyzing stock prices is through the use of candlestick patterns.

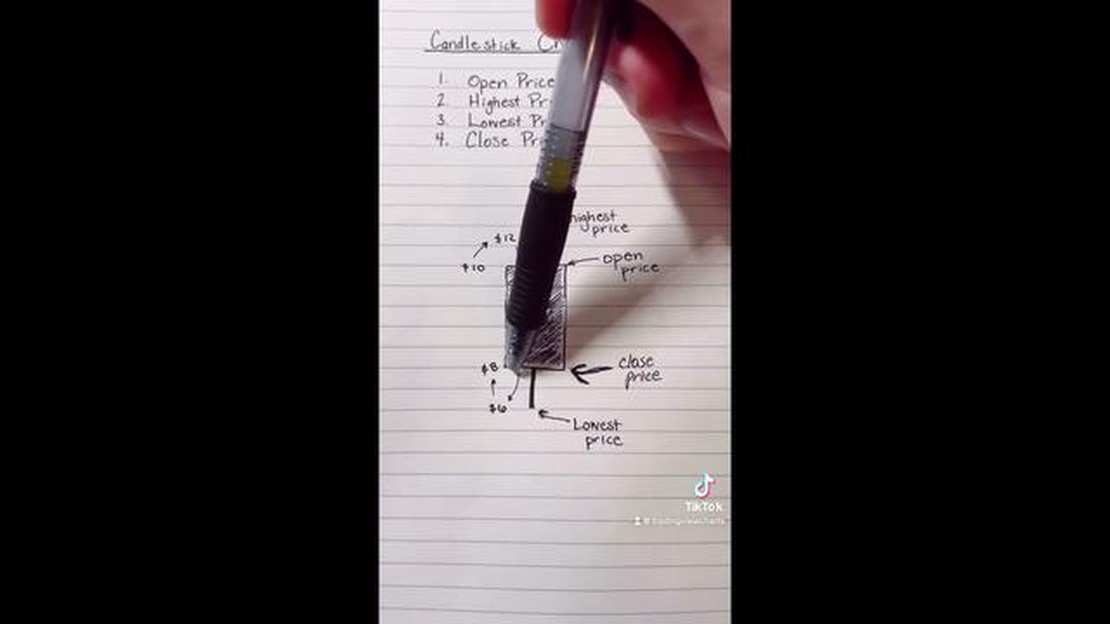

Candlestick patterns are a visual representation of price movements and provide valuable insights into market sentiment. These patterns are formed by the open, high, low, and close prices of a particular stock or market. They can help identify potential reversals or continuation in a stock’s price trend.

There are various types of candlestick patterns, such as doji, hammer, shooting star, and engulfing, among others. Each pattern has its own unique characteristics and interpretation. Traders often use these patterns to make buy or sell decisions based on the probability of certain price movements.

However, the effectiveness of candlestick patterns in predicting stock market movements is a subject of debate among market participants and researchers. While some claim that these patterns have a high degree of accuracy and can enhance trading strategies, others argue that their predictive power is limited and may lead to false signals.

Further research is needed to determine the true effectiveness of candlestick patterns in the stock market. Factors such as market conditions, timeframes, and the overall trading strategy employed should be taken into consideration. Traders and investors should be cautious and combine candlestick analysis with other technical and fundamental indicators to make well-informed trading decisions.

In conclusion, candlestick patterns offer a visual representation of price movements in the stock market and can provide valuable insights into market sentiment. However, their effectiveness in predicting stock market movements remains a topic of ongoing research and debate. It is important for traders and investors to carefully analyze these patterns and consider other indicators before making investment decisions.

When it comes to analyzing stock market trends and making informed investment decisions, candlestick patterns have long been a valuable tool for traders. Candlestick charts display the price movement of an asset over a specific time period and can provide valuable insights into market behavior and investor sentiment.

Candlestick patterns, such as doji, hammer, engulfing, and shooting star, form based on the open, close, high, and low prices of a stock. Traders use these patterns to identify potential reversals, trend continuations, and market indecisiveness.

Research has shown that candlestick patterns can have a significant impact on stock market performance. By studying the historical occurrence of certain patterns and their subsequent price movements, traders can develop strategies to increase their chances of success.

For example, the doji pattern, which indicates market indecision, often precedes significant price movements. Traders who recognize this pattern can anticipate potential trend reversals and make profitable trades.

Read Also: Discover the 5 Essential Hand Signals for Safe Driving

Similarly, the engulfing pattern, where a smaller candle is completely engulfed by a larger candle in the opposite direction, can signal trend reversals. Traders who identify this pattern early can take advantage of the price momentum and make profitable trades.

While candlestick patterns can be a valuable tool in stock market analysis, it is important to note that they are not foolproof. Market conditions, news events, and other factors can influence stock prices and lead to unexpected outcomes.

When using candlestick patterns, traders should consider them as part of a more comprehensive analysis, incorporating fundamental and technical indicators to make well-informed trading decisions.

In conclusion, examining the impact of candlestick patterns on stock market performance can be a useful approach for traders seeking to maximize their profitability. By understanding these patterns and their implications, traders can gain a better understanding of market dynamics and make informed investment decisions.

Candlestick patterns are a popular tool used by traders to analyze price action in the stock market. They provide valuable insights into market trends and can be used to predict future price movements.

A candlestick chart is formed using a series of candlestick patterns, which are represented by rectangular shapes with “wicks” or “shadows” on either end. Each candlestick represents a specific time period, such as a day, a week, or an hour, and provides information about the stock’s open, high, low, and close prices during that period.

There are various types of candlestick patterns, each with its own unique characteristics and interpretations. Some patterns signal a potential reversal in the trend, while others indicate a continuation of the current trend. Traders use these patterns to make informed decisions about when to enter or exit a trade.

Some commonly recognized candlestick patterns include the doji, engulfing pattern, hammer, shooting star, and spinning top. The doji pattern, for example, occurs when the open and close prices are very close or equal, resulting in a small or nonexistent body and long wicks. This pattern often indicates indecision in the market and can precede a trend reversal.

Read Also: Steps to becoming a broker in Cyprus: A comprehensive guide

The engulfing pattern, on the other hand, occurs when a small candlestick is followed by a larger candlestick that completely engulfs it. This pattern suggests a strong shift in momentum and often predicts a reversal in the current trend.

It is important for traders to understand and correctly interpret candlestick patterns to make accurate predictions and maximize their profits. Real-time chart analysis and pattern recognition software can assist traders in identifying and analyzing these patterns.

While candlestick patterns can be a useful tool, they should not be the sole basis for making trading decisions. Other technical indicators, fundamental analysis, and market sentiment should also be taken into consideration to obtain a comprehensive view of the market.

In conclusion, understanding candlestick patterns is crucial for traders looking to analyze price action and predict future market movements. By recognizing and correctly interpreting these patterns, traders can gain an edge in the stock market and make informed trading decisions.

Candlestick patterns are graphical representations of price movements in the stock market. They are formed by the open, high, low, and close prices for a given period of time, such as a day or a week. These patterns can provide valuable information about the future direction of stock prices.

Candlestick patterns help in stock market analysis by providing visual indications of potential market trends and reversals. Traders and investors use these patterns to identify buy and sell signals, as well as to determine levels of support and resistance in the market.

Some common candlestick patterns include doji, hammer, engulfing, and shooting star. A doji pattern indicates indecision in the market, while a hammer pattern suggests a potential trend reversal. An engulfing pattern occurs when a large candle engulfs the previous candle, indicating a potential change in market sentiment. A shooting star pattern signals a potential reversal after an uptrend.

Candlestick patterns can be reliable indicators, but they should not be used as the sole basis for making trading decisions. It is important to consider other technical indicators, such as volume and moving averages, as well as fundamental analysis, when evaluating the effectiveness of candlestick patterns.

Yes, candlestick patterns can be used in other financial markets, such as forex and commodities. The principles behind candlestick analysis are based on human psychology and can be applied to any market where price movements are influenced by supply and demand.

Trading on MQL5: Everything You Need to Know Are you new to trading on MQL5? Want to learn how to navigate the platform and make successful trades? …

Read ArticleUnderstanding the Inside Bar Trading Technique Inside bars are powerful candlestick patterns that can provide valuable insights into market trends and …

Read ArticleBest Strategy for EMA When it comes to trading, having a reliable strategy is crucial for success. One popular strategy that many traders swear by is …

Read ArticleHow much money is required to trade options? Options trading is a popular and potentially lucrative investment strategy. It allows investors to …

Read ArticleAre demo accounts free? In the world of finance and investing, demo accounts have become an indispensable tool for both novice and experienced …

Read ArticleUnderstanding Testing in Forex: A Comprehensive Guide Forex trading is a complex and highly volatile market. It involves the buying and selling of …

Read Article