How to Locate Lost Stock Shares: A Step-by-Step Guide

How to Locate Lost Stock Shares If you believe that you have lost track of your stock shares or maybe inherited shares from a relative but unable to …

Read Article

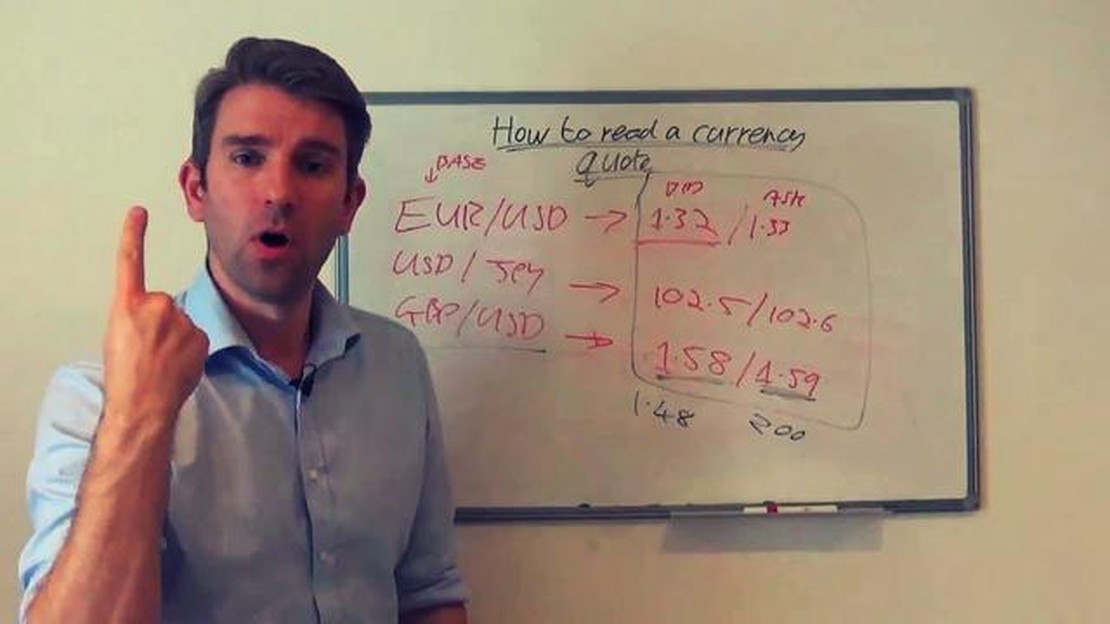

If you are new to forex trading, understanding the different terms and lingo used in the industry can be quite overwhelming. One of the first things you will notice is that there are American and European terms used interchangeably. It is important to familiarize yourself with both sets of terms to navigate the forex market effectively.

The American and European terms in forex trading refer to the way currency pairs are quoted and expressed. In the American terms, the base currency is always expressed in terms of a fixed amount of the counter currency. For example, if you are trading the EUR/USD pair, the American quote would be expressed as 1 euro to a certain number of U.S. dollars.

On the other hand, in European terms, the base currency is always expressed in terms of a fixed amount of the counter currency. Using the same example of the EUR/USD pair, the European quote would be expressed as a certain number of U.S. dollars to 1 euro. It is important to note that these quotes may differ slightly due to bid and ask spreads.

Understanding and being able to interpret both American and European terms in forex trading will enable you to understand currency pair quotes from different perspectives and make more informed trading decisions. It is crucial to stay updated with the current market conventions and understand the implications of each type of quote when placing trades.

Forex trading, also known as foreign exchange trading, involves buying and selling different currencies in the global market. Traders use various terms and conventions to conduct transactions and communicate with each other. Two common sets of terms used in forex trading are the American terms and the European terms.

The main difference between American and European terms lies in the way exchange rates are quoted. In American terms, the domestic currency is the base currency and the foreign currency is the quote currency. For example, if you’re trading USD/EUR, the exchange rate will be expressed as the amount of euro required to buy one US dollar.

On the other hand, European terms use the foreign currency as the base currency and the domestic currency as the quote currency. In this case, if you’re trading EUR/USD, the exchange rate will be expressed as the amount of US dollars required to buy one euro.

| American Terms | European Terms |

|---|---|

| USD/EUR | EUR/USD |

| Base Currency: USD | Base Currency: EUR |

| Quote Currency: EUR | Quote Currency: USD |

| Exchange Rate: Amount of euro required to buy one US dollar | Exchange Rate: Amount of US dollars required to buy one euro |

Another difference between American and European terms is the way profits and losses are calculated. In American terms, profit is made when the exchange rate increases, while in European terms, profit is made when the exchange rate decreases. This distinction is important for traders when analyzing market trends and making trading decisions.

Both American and European terms are widely used in the forex trading industry, and traders need to be familiar with both sets of terms to effectively navigate the market. Understanding the implications of each set of terms is crucial for accurate analysis, risk management, and successful trading strategies.

In conclusion, the choice between American and European terms depends on individual preference and familiarity. While they represent different approaches to quoting exchange rates and calculating profits and losses, both sets of terms can be used to trade currencies effectively.

When it comes to forex trading, understanding the key differences between the American and European terms is essential for traders. These differences can have a significant impact on trading strategies, risk management, and overall profitability.

The first key difference is the quoting convention used. In the United States, the quoting convention is known as the American terms, where the base currency is expressed in terms of the quote currency. For example, if the EUR/USD pair is quoted as 1.1200, it means that 1 euro is equal to 1.1200 US dollars.

On the other hand, the European terms are used in Europe and many other parts of the world. In the European terms, the quote currency is expressed in terms of the base currency. Using the same example, a quote of 1.1200 for the EUR/USD pair means that 1 US dollar is equal to 0.8929 euros.

Read Also: Step-by-step guide: How to create a binary account and start trading

The second key difference is the trading hours. The forex market in the United States operates on the New York Stock Exchange (NYSE) schedule, which is from 9:30 AM to 4:00 PM Eastern Standard Time (EST). In contrast, the forex market in Europe operates on the London Stock Exchange schedule, which is from 8:00 AM to 4:30 PM Greenwich Mean Time (GMT).

These different trading hours can impact the level of liquidity and volatility in the markets. For example, when the European session overlaps with the American session, there is usually higher trading activity and increased price movements. Traders need to consider these differences in trading hours when developing their trading strategies.

The third key difference is regulatory oversight and compliance requirements. In the United States, forex brokers are regulated by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). These regulatory bodies enforce strict rules and regulations to protect traders and maintain market integrity.

In Europe, forex brokers are regulated by various regulatory authorities, such as the Financial Conduct Authority (FCA) in the United Kingdom. While regulatory oversight exists in both regions, the specific requirements and enforcement may vary. Traders need to be aware of the regulatory framework in their region and choose a reputable broker that complies with the necessary regulations.

Read Also: Why is Audjpy so volatile? Discover the key factors influencing Audjpy volatility

In conclusion, understanding the key differences between American and European terms is crucial for forex traders. These differences in quoting convention, trading hours, and regulatory oversight can have a significant impact on trading strategies, risk management, and overall profitability. Traders should consider these factors and adapt their approach accordingly to navigate the forex market effectively.

When it comes to forex trading, understanding the different terminologies used in the American market is essential. American terms refer to the way currency pairs are quoted and the unique features they bring to the trading table.

One of the primary differences between American terms and European terms is the order in which the currency pair is quoted. In American terms, the currency pair is quoted with the USD as the base currency, while in European terms, the currency pair is quoted with the EUR as the base currency.

For example, in American terms, the quote for the EUR/USD currency pair would be 1.23, meaning that 1 Euro is worth 1.23 US dollars. This is in contrast to European terms, where the same currency pair would be quoted as 0.81, meaning that 1 Euro is worth 0.81 Euros.

One of the advantages of American terms is that they are more widely used in the global forex market. Since the USD is the world’s reserve currency and is widely accepted, trading in American terms allows for greater liquidity and ease of transactions.

Additionally, American terms offer greater flexibility in terms of profit and loss calculations. Trading in American terms allows for easy calculation of pip value as the changes in the exchange rate are reflected in the quoted currency. This makes it easier for traders to calculate their potential gains or losses.

Furthermore, American terms provide a clearer picture of the market sentiment. Since the USD is widely accepted as a measure of strength and stability, fluctuations in the currency pair can provide valuable insights into the overall market trends and investor sentiment.

| Advantages of American Terms: |

|---|

| 1. Greater liquidity and ease of transactions due to USD’s global acceptance. |

| 2. Ease of profit and loss calculations as changes in exchange rate are reflected in the quoted currency. |

| 3. Clearer market sentiment insights due to the USD’s measure of strength and stability. |

In conclusion, understanding American terms in forex trading is crucial for traders looking to navigate the global market. By familiarizing oneself with the unique features and advantages of American terms, traders can make more informed decisions and maximize their trading potential.

The difference between American and European terms in forex trading lies in the way the exchange rate is quoted. In American terms, the exchange rate is expressed as the amount of a foreign currency that can be bought with one unit of the domestic currency. In European terms, on the other hand, the exchange rate is expressed as the amount of the domestic currency needed to buy one unit of a foreign currency.

Both American and European terms are commonly used in forex trading, but the usage may vary depending on the region. In the United States, American terms are typically used, while in Europe, European terms are more common. However, in the global forex market, both terms can be encountered, and traders should be familiar with both.

There are no inherent advantages or disadvantages of using American or European terms in forex trading. The choice of which term to use is largely a matter of convention and personal preference. Some traders may find one term more intuitive or easier to work with, but ultimately, both terms provide the same information about the exchange rate and can be used effectively in trading.

To convert between American and European terms in forex trading, you can use the reciprocal of the exchange rate. For example, if the exchange rate is expressed in American terms as 1.20, you can convert it to European terms by taking the reciprocal, which would be 0.8333. Similarly, if the exchange rate is expressed in European terms as 0.75, you can convert it to American terms by taking the reciprocal, which would be 1.3333.

How to Locate Lost Stock Shares If you believe that you have lost track of your stock shares or maybe inherited shares from a relative but unable to …

Read ArticleUnderstanding the Basics of Stock Options Stock options are a popular investment instrument that allows individuals to participate in the ownership …

Read ArticleBest Operating System for Forex Trading When it comes to forex trading, having the right operating system can make all the difference. Whether you are …

Read ArticleHow to Calculate Average Inventory Cost per Unit Inventory management is a critical aspect of running a successful business. One important metric that …

Read ArticleDoes the SEC regulate options? The Securities and Exchange Commission (SEC) is a regulatory body in the United States that is responsible for …

Read ArticleUnderstanding Historical Volatility Tradingview Volatility is a key concept in trading that can greatly influence investment decisions. To make …

Read Article