Are Australian Cattle Dogs High Maintenance? Uncover the Truth

Are Australian Cattle Dogs High Maintenance? Australian Cattle Dogs, also known as Blue Heelers or Queensland Heelers, are intelligent and energetic …

Read Article

Employee Stock Ownership Plans (ESOPs) have gained popularity as an effective way to align the interests of employees with the long-term success of a company. ESOPs provide employees with an ownership stake in the company, giving them a sense of ownership and pride in their work. This sense of ownership can lead to increased productivity, loyalty, and overall job satisfaction.

One of the major benefits of ESOPs is that they incentivize employees to perform at their best. When employees have a financial stake in the company, they are more motivated to work hard and contribute to its success. This can lead to improved performance, increased innovation, and ultimately, higher profitability for the business.

In addition to motivating employees, ESOPs can also be a powerful tool for attracting and retaining top talent. In a competitive job market, offering an employee stock ownership plan can set your business apart from the competition and make it an attractive place to work. Employees are more likely to stay with a company that offers them a potential financial reward in the form of stock ownership.

Furthermore, ESOPs can also provide significant tax advantages for both the company and the employees. Contributions made to the ESOP by the company are tax-deductible, providing a valuable tax break. Additionally, employees are not taxed on the value of the stock until they receive it, allowing them to defer their tax liability. This can be an attractive benefit for employees.

In conclusion, Employee Stock Ownership Plans can bring numerous benefits to your business. From motivating employees to attracting top talent and offering tax advantages, ESOPs can be a powerful tool for driving the success and growth of your company. Consider implementing an ESOP and see the positive impact it can have on your employees and your business as a whole.

Employee Stock Ownership Plans, or ESOPs, are a type of retirement plan that allows employees to become partial owners of the company through stock ownership. This means that employees are given shares of company stock as an additional form of compensation.

ESOPs can offer numerous benefits to both the employees and the business itself. For employees, having ownership in the company can provide a sense of pride and motivation, as they are directly tied to the company’s success. As shareholders, employees can also benefit from any increase in the company’s stock value over time.

For businesses, ESOPs can help attract and retain talented employees. The opportunity to become an owner can be a strong incentive for employees to stay with the company long-term and contribute to its success. ESOPs can also help businesses to build a loyal and dedicated workforce, as employees are more likely to be invested in the company’s goals and performance.

In addition, ESOPs can also have tax advantages for both the employees and the business. Contributions made to the ESOP are tax-deductible for the company, and employees can defer paying taxes on their shares until they are sold. This can provide significant tax savings for both parties.

ESOPs can also be used as a succession planning tool for business owners who are looking to retire or transition out of the company. By selling shares of the company to the ESOP, owners can ensure that the business remains in good hands and that employees have a stake in its continued success.

Overall, ESOPs can offer a win-win situation for both employees and businesses. Employees have the opportunity to become owners and benefit from the company’s success, while businesses can attract and retain talented employees and enjoy tax advantages. Consider implementing an ESOP in your business to reap these benefits and create a stronger, more engaged workforce.

Read Also: Can you use Swish for Forex transactions?

Employee morale and engagement play a crucial role in the success of any business. When employees are happy, motivated, and feel a sense of ownership over their work, they are more likely to go the extra mile, be innovative, and work collaboratively as a team. An Employee Stock Ownership Plan (ESOP) can significantly boost employee morale and engagement in several ways.

Firstly, by offering employees the opportunity to become owners of the company through an ESOP, they feel a deeper sense of connection and loyalty to the organization. They have a vested interest in the success of the company as their own financial future is directly tied to it. This ownership mentality encourages employees to take pride in their work and go above and beyond their regular responsibilities.

Read Also: Understanding Trade Options: A Comprehensive Guide

Additionally, the transparency and open communication that come with implementing an ESOP can improve employee morale. When employees are regularly updated on the company’s financial performance and strategic goals, they feel more valued and included in the decision-making process. This increased transparency helps build trust and fosters a positive and collaborative work environment.

Furthermore, the potential financial benefits of an ESOP, such as dividends or stock appreciation, can serve as powerful motivators for employees. Knowing that their hard work and dedication can directly impact their personal wealth creates a strong incentive for employees to perform at their best and contribute to the overall growth and success of the company.

In conclusion, implementing an ESOP can have a significant positive impact on employee morale and engagement. By creating a sense of ownership, improving transparency, and providing financial incentives, businesses can foster a culture of motivation and collaboration, leading to higher levels of employee satisfaction and overall success.

An Employee Stock Ownership Plan (ESOP) is a type of retirement plan that allows employees of a company to become owners of company stock.

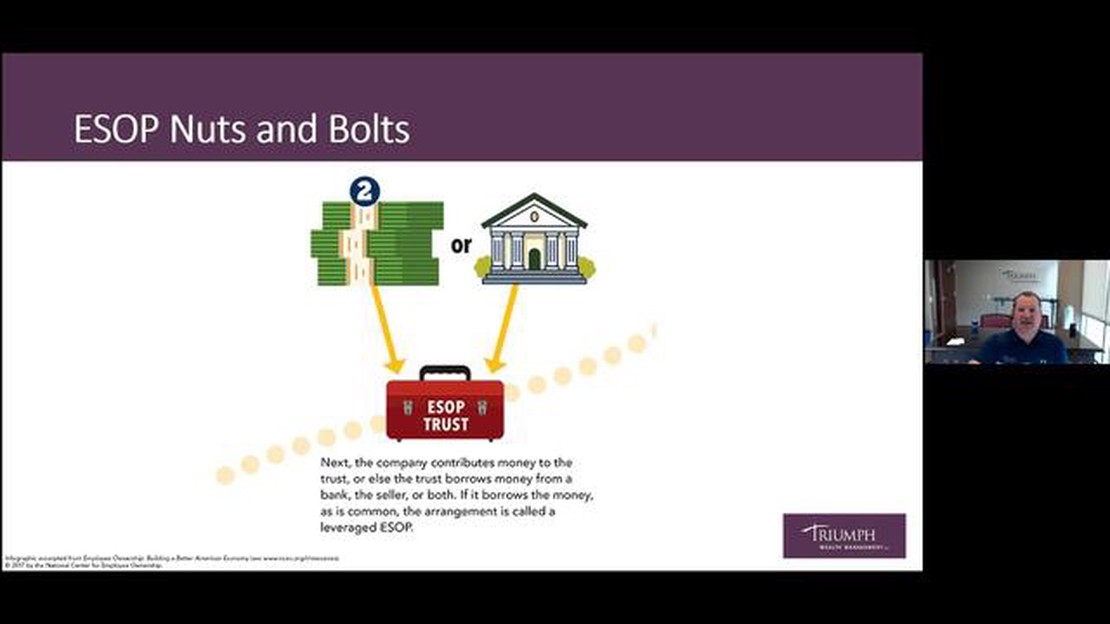

An ESOP works by the company setting up a trust, which then purchases company stock to distribute to employees. The stock is held in individual employee accounts and the value of the stock increases as the company grows.

An ESOP can provide employees with a sense of ownership and pride in the company, as well as the opportunity to build wealth and save for retirement. In addition, contributions to an ESOP are tax deductible for the company, so employees may receive additional benefits from the tax savings.

An ESOP can benefit a business by improving employee morale and loyalty, as well as increasing productivity and innovation. It can also provide a competitive advantage in attracting and retaining top talent, as employees may be more likely to stay with a company that offers ownership opportunities.

While an ESOP can offer many benefits, there are also some potential disadvantages to consider. For example, the cost of setting up and administering an ESOP can be high, and there may be restrictions on the company’s ability to raise capital or make certain business decisions. In addition, if the value of company stock declines, employees may lose a significant portion of their retirement savings.

An Employee Stock Ownership Plan (ESOP) is a retirement benefit plan in which a company contributes its own stock or cash to a trust on behalf of its employees. The trust holds the stock in individual accounts for the employees, and they become part owners of the company. The employees can then benefit from the company’s success by selling the stock at a later date or receiving dividends.

Are Australian Cattle Dogs High Maintenance? Australian Cattle Dogs, also known as Blue Heelers or Queensland Heelers, are intelligent and energetic …

Read ArticleLearn How to Use EMA and ADX in Your Trading Strategy Trading in the financial markets can be a challenging task, even for experienced traders. …

Read ArticleUnderstanding the 2 Point Moving Average Data analysis is an essential part of understanding and interpreting data, and there are various techniques …

Read ArticleIs QQQ Aggressive? When it comes to investing, one of the crucial factors to consider is risk. This is particularly true for aggressive investment …

Read ArticleIs DSS a good buy? When it comes to making smart investments, one of the key questions on many investors’ minds is whether Digital Subscriber System …

Read ArticleWhat is the success rate of Bollinger squeeze? The Bollinger Squeeze is a popular technical indicator used in financial markets to identify periods of …

Read Article