Understanding Currency Strength: How to Determine the Strength of a Forex Currency

How to Evaluate the Strength of a Forex Currency When it comes to trading on the forex market, one key factor to consider is the strength of a …

Read Article

Investing is a key activity for individuals and businesses looking to secure their financial future. However, it can be challenging to navigate the complex world of investment strategies and determine the best approach for your specific goals and risk tolerance. One strategy that is frequently discussed is diversification. In this article, we will explore the 6 steps of diversification to help you gain a deeper understanding of this investment strategy.

The first step in diversification is determining your investment goals and risk tolerance. This involves considering your financial objectives, such as saving for retirement or purchasing a home, as well as how comfortable you are with taking on risk. Understanding your goals and risk tolerance will help guide your investment decisions and ensure that you are comfortable with the level of risk you are taking on.

Next, you will need to assess your current investment portfolio. This involves reviewing your current holdings and analyzing the level of diversification within your portfolio. The goal is to identify any concentration of assets or overexposure to a particular sector or industry. By identifying these potential risks, you can make adjustments to your portfolio to achieve a more balanced and diversified investment mix.

Once you have assessed your current portfolio, the third step is to research and analyze different investment opportunities. This involves researching various asset classes, such as stocks, bonds, and real estate, as well as different industries and sectors. By conducting thorough research and analysis, you can identify investment opportunities that align with your goals and risk tolerance.

After researching and analyzing different investment opportunities, the fourth step is to create a diversified investment strategy. This involves determining the ideal allocation of your assets across different asset classes and industries. The goal is to create a portfolio that is diversified and balanced, reducing the risk of concentration and increasing the potential for returns.

Once you have determined your diversified investment strategy, the fifth step is to implement your plan. This involves executing your investment decisions and making the necessary adjustments to your portfolio. It is important to regularly review and monitor your portfolio to ensure that it remains aligned with your investment strategy and goals.

The final step in the diversification process is to regularly review and rebalance your portfolio. This involves monitoring the performance of your investments and making adjustments as needed. Over time, certain assets may outperform or underperform, which can impact the balance and diversification of your portfolio. By regularly reviewing and rebalancing, you can maintain a diversified and balanced portfolio that aligns with your goals and risk tolerance.

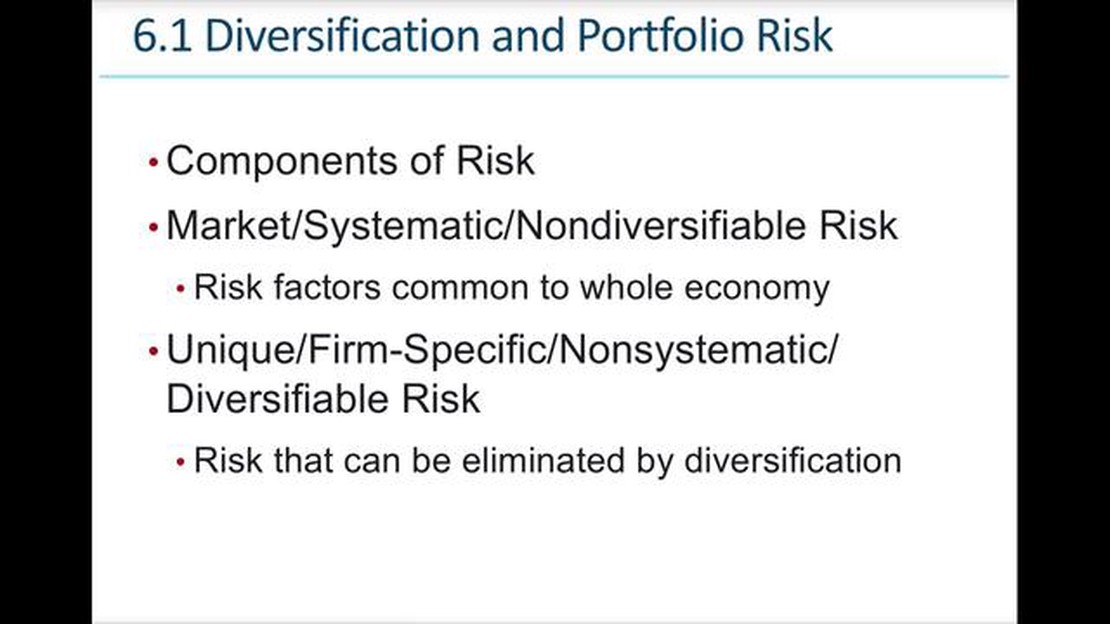

Diversification is a crucial concept in the world of investments. It refers to the practice of spreading your investment portfolio across different assets, industries, and geographic regions. The primary goal of diversification is to reduce the risk associated with investing by ensuring that you are not overly exposed to any single investment.

Read Also: Is Stock Manipulation Real? Uncovering the Truth behind Market Manipulation

By diversifying your investments, you are essentially minimizing the potential impact of any one investment’s performance on your overall portfolio. This is because different investments react differently to various market conditions, economic events, and other factors.

One of the most significant benefits of diversification is the potential to improve your portfolio’s risk-adjusted return. By spreading your investments across different asset classes, such as stocks, bonds, and real estate, you can potentially reduce the overall volatility of your portfolio. This can help protect your investments from significant losses during market downturns while still allowing you to participate in potential gains.

Additionally, diversification can help you take advantage of different investment opportunities in various industries and geographic regions. By investing in different sectors and regions, you can potentially benefit from the growth of specific industries or economies, while also mitigating the risk of being overly exposed to any one sector or region.

It is important to note that diversification does not guarantee profits or protect against losses. However, it is widely considered a fundamental principle of risk management in investing. By diversifying your investments, you are spreading your risk and increasing your chances of achieving long-term investment success.

In conclusion, understanding the importance of diversification in investments is key to building a resilient and balanced portfolio. By diversifying across different assets, industries, and geographic regions, you can potentially reduce the risk associated with investing and improve your portfolio’s risk-adjusted return.

Diversification is a key strategy for successful investing, as it allows investors to spread their risk and potentially increase their returns over time. By diversifying their investment portfolio, individuals can reduce the impact of specific investments on their overall financial well-being, as different assets tend to react differently to market conditions.

Read Also: Is it possible to earn money through hedging options?

Here is a step-by-step guide to effective diversification:

By following these steps, you can create an effectively diversified investment portfolio that helps manage risk and potentially enhances your returns over time. Keep in mind that diversification does not guarantee profits or protect against losses, but it can be a helpful risk management tool in achieving your investment objectives.

The six steps of diversification are: 1) Define your investment goals, 2) Set your asset allocation, 3) Choose the right investment vehicles, 4) Monitor and rebalance your portfolio, 5) Evaluate your performance, and 6) Adjust your strategy if necessary.

Diversification is important in investment strategies because it helps to spread risks and reduce the impact of any single investment on the overall portfolio. It can provide a more stable and consistent return over time and help protect against losses in case one investment performs poorly.

Asset allocation refers to the distribution of investments across different asset classes, such as stocks, bonds, and cash. By diversifying investments across different asset classes, investors can reduce the risk associated with any single asset class. This helps to optimize returns and manage risk effectively.

Common types of investment vehicles include stocks, bonds, mutual funds, exchange-traded funds (ETFs), real estate, and commodities. Each type of investment vehicle has its own unique characteristics and risk profile, so it’s important to choose the right mix based on your investment goals and risk tolerance.

The frequency of monitoring and rebalancing your investment portfolio depends on your investment goals, risk tolerance, and market conditions. Generally, it is recommended to review your portfolio regularly, at least once a year, and adjust the asset allocation if it deviates significantly from the desired mix. However, it’s important to keep in mind that frequent trading or excessive rebalancing can increase transaction costs and may not always lead to better performance.

How to Evaluate the Strength of a Forex Currency When it comes to trading on the forex market, one key factor to consider is the strength of a …

Read ArticleIs Forex Trading banned in UK? Forex trading, also known as foreign exchange trading, is a popular investment activity that involves the buying and …

Read ArticleHow to Buy USD in RCBC? Are you planning to buy USD in RCBC? This complete guide will provide you with step-by-step instructions on how to do so. …

Read ArticleHow to Set Up an Incentive Stock Option Plan An incentive stock option (ISO) plan is a popular tool for companies to attract and retain top talent. It …

Read ArticleUnderstanding the Importance of Break-Even Point in Options Trading Options trading can be a highly lucrative investment strategy, but it also carries …

Read ArticleIs EMA 200 good? Technical indicators play a crucial role in trading as they provide valuable insights into market trends and help traders make …

Read Article