Inside Bar Trading Technique: A Complete Guide to Trading Inside Bars

Understanding the Inside Bar Trading Technique Inside bars are powerful candlestick patterns that can provide valuable insights into market trends and …

Read Article

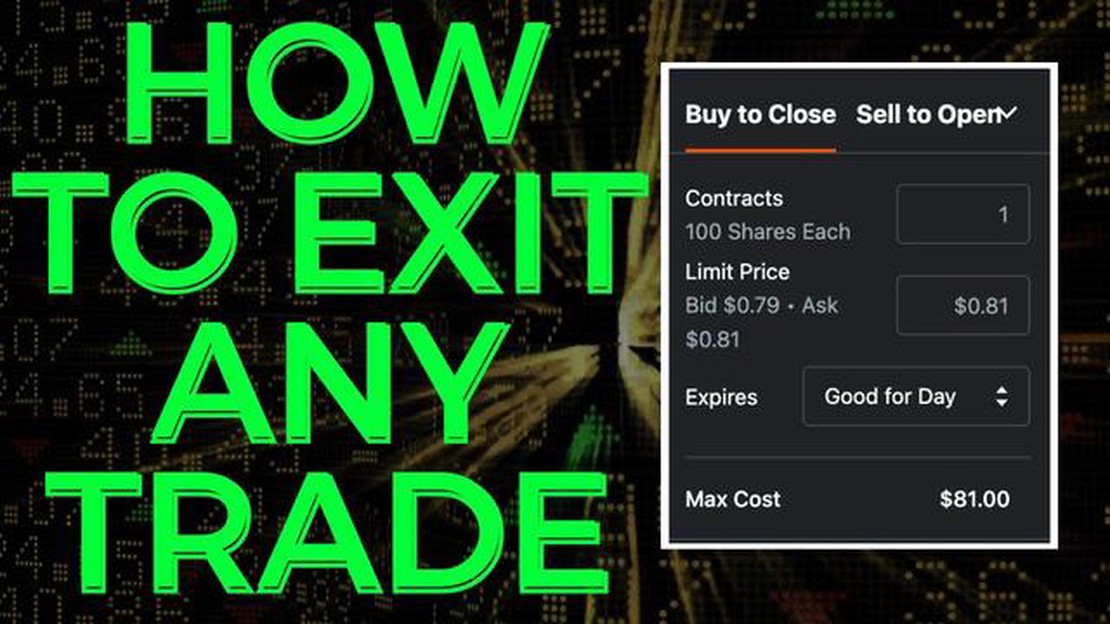

Exiting an option before its expiry date is a common practice among options traders. When you buy or sell an option contract, you have the right, but not the obligation, to exercise the option at any time before the expiration date. This flexibility allows traders to manage their positions and take advantage of market changes.

When you exit an option before expiry, you can either sell the option back to the market or exercise the option by buying or selling the underlying asset at the strike price. The decision to exit an option depends on various factors, including the current market conditions, the option’s intrinsic value, and your trading strategy.

If you decide to sell the option back to the market, you can close your position by selling the option contract to another trader. This transaction can be done at any time during the market hours. The price at which you can sell the option depends on factors such as the option’s time value, the underlying asset’s price, and the current market volatility.

Alternatively, you can exercise the option by buying or selling the underlying asset at the strike price. This is only applicable for American-style options, which can be exercised at any time before expiry. By exercising the option, you are essentially converting the option into the underlying asset.

It is important to note that when you exit an option before expiry, you may incur transaction costs, such as commissions and fees. These costs can vary depending on your broker and the type of option contract you are trading.

Exiting an option before expiry can be a strategic move to lock in profits, cut losses, or adapt to changing market conditions. However, it is crucial to carefully consider the potential risks and rewards before making any decision. It is recommended to consult with a financial advisor or an experienced options trader to ensure you are making informed choices.

Exiting an option before its expiry date can have both positive and negative consequences.

If you decide to exit an option before expiry, you have the ability to close out your position and potentially lock in any gains or losses you may have accumulated. This can be beneficial if you believe that the option’s value has reached a level that satisfies your profit target or if you want to limit your losses.

On the other hand, exiting an option before expiry also means that you are giving up the potential for further profit if the option’s value continues to move in your favor. Additionally, exiting an option prematurely could result in locking in losses if the option’s value has not reached your desired level.

When you exit an option before expiry, you will need to sell or buy back the option contract. The price at which you can close out your position will depend on various factors, including the current market conditions and the time remaining until expiry.

It is important to note that exiting an option before expiry may also incur trading fees and commissions, which can affect your overall profitability.

In summary, exiting an option before expiry provides you with the opportunity to manage your risk and potentially lock in gains or limit losses. However, it also means giving up the potential for further profit and may result in incurring trading fees. It is important to carefully consider your objectives and evaluate the risks before deciding to exit an option before expiry.

Read Also: Understanding Game Theory and its Role in Pricing Options

Options expiry refers to the date on which an options contract becomes null and void. It is the last day on which the owner of the options contract has the right to exercise their options. Understanding options expiry is crucial for traders as it determines the available trading period and the potential outcome of their options.

When an options contract expires, the options holder must make a decision to either exercise the contract or let it expire worthless. If the options contract is in the money, meaning the strike price is favorable compared to the current market price, the options holder may choose to exercise their options and profit from the trade. On the other hand, if the options contract is out of the money, meaning the strike price is less favorable compared to the current market price, the options holder may choose to let the contract expire worthless and avoid incurring any further losses.

Read Also: Is a 1.5 Risk-Reward Ratio Good for Investing or Trading?

The expiration date of an options contract is predetermined and specified in the contract itself. It is typically set as a specific date and time, such as the third Friday of the month at 4 PM ET. Different options have different expiration cycles, including monthly, quarterly, and even weekly expirations. Traders must be aware of the expiration date of their options contracts and plan their trading strategy accordingly.

It is important to note that options contracts can be exited before expiry through a process known as closing the position. Traders may choose to close their options position if they believe they have achieved enough profits or want to limit their losses. Closing the position involves executing a trade to sell the options contracts back into the market.

Options expiry can lead to increased volatility in the market, especially near the expiration date. Traders should be aware of this and take appropriate measures to protect their positions. They can choose to close their options positions early to avoid any adverse price movements or they can adjust their strategies to mitigate the risks associated with options expiry.

In conclusion, understanding options expiry is crucial for options traders. It determines the available trading period and the potential outcome of their options contracts. Traders must be aware of the expiration date of their contracts and make well-informed decisions regarding exercising or letting the contracts expire. Additionally, they should be prepared for increased market volatility near the expiration date and take appropriate measures to protect their positions.

Yes, you can exit an option before it expires. Exiting an option means closing out your position before the expiration date.

There are several reasons why you might want to exit an option before expiry. One reason is to lock in profits if the option has increased in value. Another reason is to cut losses if the option has decreased in value. Additionally, you may choose to exit an option if your original investment thesis has changed.

If you exit an option before expiry, you will either realize a profit or a loss, depending on the current value of the option compared to when you initially purchased it. Exiting an option allows you to close out your position and no longer be obligated to fulfill the terms of the contract.

There may be fees or penalties associated with exiting an option before expiry. These fees can include brokerage fees, transaction fees, or early exit penalties imposed by the exchange. It is important to check with your broker or exchange to understand the specific fees and penalties that may apply.

In most cases, you can exit an option at any time before expiry, as long as there is enough liquidity in the market to facilitate the transaction. However, it is important to note that as the option approaches expiry, its value may change more rapidly, making it more difficult to execute an exit at a desired price.

If you exit an option before expiry, you will either make a profit or a loss, depending on the price at which you exit. If the price has gone up since you purchased the option, you may be able to sell it for a higher price and make a profit. However, if the price has gone down, you may have to sell the option for a lower price and incur a loss.

Yes, you can exit an option before expiry. In fact, many traders choose to do so in order to take profits or limit losses. Exiting an option before expiry allows you to close your position and take your profits or losses without having to wait until the expiration date.

Understanding the Inside Bar Trading Technique Inside bars are powerful candlestick patterns that can provide valuable insights into market trends and …

Read ArticleWhat is the autoregressive moving average? The Autoregressive Moving Average (ARMA) model is a commonly used statistical model in time series …

Read ArticleDoes Commonwealth Bank offer currency exchange services? Welcome to Commonwealth Bank, your trusted partner for all your foreign currency needs. …

Read ArticleUnderstanding Halal and Haram Forex Trading Forex trading, also known as foreign exchange trading, is a popular investment option that allows …

Read ArticleBest Hours to Trade Gold Trading gold can be a lucrative investment opportunity, but timing is crucial. The fluctuations in the price of gold …

Read ArticleAre stock options taxable when exercised? Stock options are a popular form of compensation that many companies offer to their employees. These options …

Read Article