Choosing the Perfect Day of the Month for Effective Trading

What is the best day of the month to trade? When it comes to trading, timing is everything. The day of the month can play a significant role in the …

Read Article

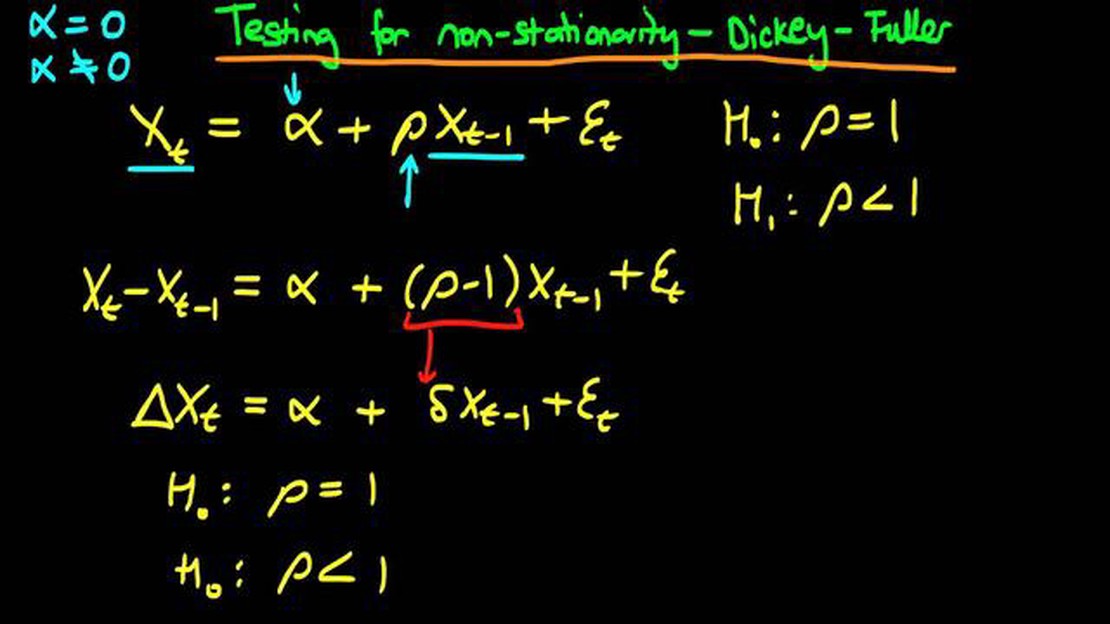

When analyzing time series data, it is essential to determine if the data exhibits a unit root. A unit root indicates that the data is non-stationary and has a stochastic trend. Non-stationary data can lead to unreliable statistical analysis and invalid conclusions. Unit root tests are statistical tools used to assess the presence of a unit root in the data.

In this comprehensive guide, we will explore the four different unit root tests commonly used in econometrics: the Augmented Dickey-Fuller (ADF) test, the Phillips-Perron (PP) test, the Elliott-Rothenberg-Stock (ERS) test, and the Kwiatkowski-Phillips-Schmidt-Shin (KPSS) test.

The ADF test is widely used and is based on the Dickey-Fuller test. It measures the extent to which a unit root is present in the data. The PP test is a modification of the ADF test and addresses the issue of serial correlation. The ERS test is a generalized least squares (GLS) regression-based test that allows for heteroskedasticity in the data. The KPSS test, on the other hand, tests the null hypothesis of stationarity against the alternative hypothesis of a unit root.

Each of these unit root tests has its advantages and limitations. By understanding the differences between these tests and when to use each one, researchers and analysts can make more informed decisions when analyzing time series data. In this guide, we will provide a detailed explanation of each test, step-by-step instructions on how to conduct the tests, and interpretations of the results.

There are four main types of unit root tests that are commonly used in econometrics and finance research. These tests are designed to determine whether a time series variable has a unit root, which implies that the variable is non-stationary and follows a random walk process.

1. Augmented Dickey-Fuller (ADF) Test: This test is one of the most widely used unit root tests. It builds on the original Dickey-Fuller test by including additional lagged differences of the variable in the regression model. The ADF test allows for different types of trends and can be used to test for a unit root under different null and alternative hypotheses.

2. Phillips-Perron (PP) Test: The PP test is similar to the ADF test but uses a slightly different regression model. It is a non-parametric test that does not require specifying the form of the trend in the data. The PP test is robust to certain forms of heteroscedasticity.

3. Kwiatkowski-Phillips-Schmidt-Shin (KPSS) Test: Unlike the ADF and PP tests, the KPSS test is used to test for stationarity rather than a unit root. It examines whether the time series variable has a unit root or is trend-stationary. The test is based on a null hypothesis that the variable is stationary around a deterministic trend.

Read Also: Is Forex trading a scam? Uncovering the truth behind Forex trading fraud

4. Elliott-Rothenberg-Stock (ERS) Test: The ERS test is a modified version of the ADF test that accounts for potential structural breaks in the time series data. It allows for the presence of unknown structural breaks, which can occur due to changes in the underlying economic or financial factors.

Overall, the choice of unit root test depends on the specific characteristics of the time series data and the research question at hand. Researchers should carefully consider the assumptions and limitations of each test before applying them to their data.

When performing time series analysis, it is crucial to choose the right unit root test for your data. Different unit root tests have different assumptions and are suited for different types of data. Here, we will discuss the four most common unit root tests and provide guidance on how to choose the appropriate test.

| Unit Root Test | Assumptions | Appropriate Use |

|---|---|---|

| Augmented Dickey-Fuller (ADF) Test | The error term is serially uncorrelated and follows a specific distribution (either normal or with a constant variance) | Most commonly used unit root test, suitable for testing for a unit root in a wide range of time series data |

| Phillips-Perron (PP) Test | The error term is serially uncorrelated, but its distribution does not need to be specified | Similar to the ADF test, suitable for testing for a unit root, commonly used when dealing with heteroscedastic data |

| Kwiatkowski-Phillips-Schmidt-Shin (KPSS) Test | The error term is stationary with no unit root | Used to test for stationarity, opposite to the ADF and PP tests, often applied when dealing with trend-stationary data |

| Phillips-Ouliaris (PO) Test | The error term is serially correlated and may exhibit heteroscedasticity | Suitable for testing for a unit root in the presence of serial correlation and heteroscedasticity |

When choosing the right unit root test, it is important to consider the specific characteristics of your data, such as the presence of trends, heteroscedasticity, and serial correlation. Understanding the assumptions and limitations of each test is key in making an informed decision. Additionally, it is recommended to compare the results of multiple unit root tests to increase the robustness of your analysis.

By selecting the appropriate unit root test, you can ensure the validity and reliability of your time series analysis, leading to more accurate and meaningful results.

Read Also: Learn How to Program a Forex Bot - Step-by-Step Guide | Forex Trading

A unit root test is a statistical test used to determine if a time series has a unit root, which indicates that the series is non-stationary and has a time-dependent trend.

Testing for unit roots is important because if a time series has a unit root, it means that the series is non-stationary and cannot be modeled using traditional statistical techniques. This can lead to incorrect results and interpretations in any subsequent analysis or modeling.

The four different unit root tests discussed in the article are the Augmented Dickey-Fuller (ADF) test, the Phillips-Perron (PP) test, the Kwiatkowski-Phillips-Schmidt-Shin (KPSS) test, and the Elliot-Rothenberg-Stock (ERS) test.

The ADF test and the PP test are similar in that they both test for the presence of a unit root in a time series. However, the ADF test allows for the inclusion of lagged differences in the regression equation, whereas the PP test uses a non-parametric correction for serial correlation.

The KPSS test has the advantage of being able to test for both stationarity and non-stationarity in a time series. However, it can be less powerful than the ADF and PP tests when the series is near the unit root, and it can be affected by the presence of structural breaks.

A unit root in time series analysis refers to a situation where a variable has a root equal to 1. This means that the variable does not converge to a fixed level and exhibits a stochastic trend over time.

Having a unit root in a time series can cause problems in statistical analysis. It implies that the variable is non-stationary and violates the assumption of stationarity, which is often required for accurate modeling and forecasting. It can lead to spurious regression, making the results unreliable.

What is the best day of the month to trade? When it comes to trading, timing is everything. The day of the month can play a significant role in the …

Read ArticleHow much is 1 yen in sgd? If you’re planning to travel to Singapore or have any financial transactions involving Japanese yen and Singapore dollars, …

Read ArticleSecond Quarter Earnings of BNSF 2023 In the world of finance and investments, staying up-to-date with the latest quarterly earnings reports of major …

Read ArticleUnderstanding How Loan Sales Work Loan sales have become an integral part of the financial industry, allowing financial institutions to manage their …

Read ArticleIs Mutual Fund the Best Option? When it comes to investing, there are numerous options available, each with their own set of advantages and …

Read ArticleCalculating Forex Lot Sizes Calculating the appropriate lot size is crucial when trading in the Forex market. It determines the amount of currency you …

Read Article