Learn How to Identify Support and Resistance in Forex Trading

How to Identify Support and Resistance in Forex Trading Support and resistance are essential concepts in forex trading. They refer to specific price …

Read Article

Malaysia, a Southeast Asian country known for its diverse culture and vibrant economy, is a popular destination for tourists and expatriates alike. Whether you plan to visit Malaysia for a vacation or are considering a long-term stay, understanding the average exchange rate is crucial for managing your finances effectively. In this article, we will explore the factors that influence the exchange rate in Malaysia and provide insights into how it may affect your budget.

The exchange rate is the value of one currency in relation to another. In Malaysia, the national currency is the Malaysian Ringgit (MYR). The exchange rate determines how much foreign currency you will receive in exchange for your home currency or vice versa. It fluctuates daily due to various economic factors such as interest rates, inflation, political stability, and market demand.

The average exchange rate is the average value of the Malaysian Ringgit against a basket of other currencies over a specific period. This rate is often used as a reference point for converting one currency to another. It is important to note that the actual exchange rate you receive may differ slightly from the average rate due to fees and commissions charged by banks or currency exchange services.

Tip: It is recommended to check the exchange rates regularly before making any currency exchanges to ensure you get the best value for your money.

When planning your trip to Malaysia or budgeting for daily expenses, understanding the average exchange rate can help you estimate your expenses more accurately. If the average exchange rate is favorable for your home currency, you will receive more Malaysian Ringgit for the same amount of money. On the other hand, if the exchange rate is unfavorable, your home currency will have less purchasing power in Malaysia.

By keeping an eye on the average exchange rate and making informed decisions, you can make the most out of your financial transactions in Malaysia and have a better understanding of how much your money is worth. Whether you are a tourist or a long-term resident, understanding the average exchange rate is an essential aspect of managing your finances effectively in Malaysia.

When planning a trip to Malaysia, it is important to understand the currency exchange rates to ensure that you are getting the best value for your money. The exchange rate refers to the value of one currency compared to another, and it determines how much money you will receive when exchanging one currency for another.

In Malaysia, the official currency is the Malaysian Ringgit (MYR). It is often denoted by the symbol RM. When exchanging your currency to MYR, it is essential to keep in mind that the exchange rate can fluctuate frequently.

There are several factors that can influence currency exchange rates, including economic conditions, interest rates, inflation rates, and geopolitical events. These factors can cause the value of one currency to rise or fall relative to another currency.

When exchanging your currency to MYR, it is advisable to shop around and compare exchange rates offered by different banks or money changers. You can also check online currency converters or use mobile apps to get the latest exchange rates.

Read Also: Trading Futures at Night: Everything You Need to Know

It’s important to note that banks and money changers may charge a fee or commission for the currency exchange service. Thus, it is recommended to compare the fees and rates offered to find the best deal.

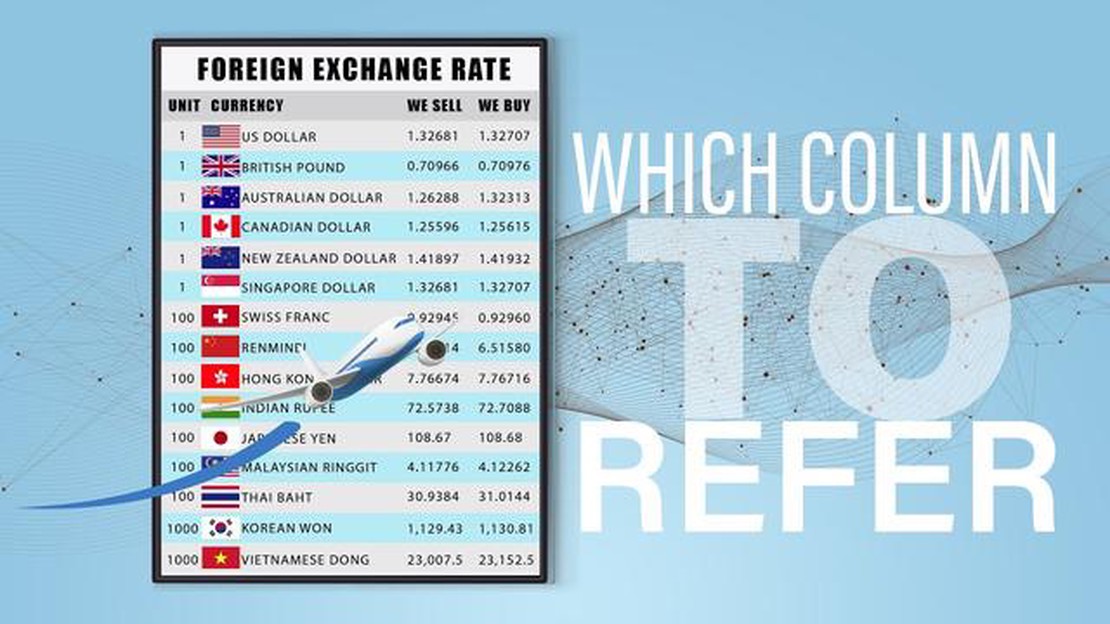

When exchanging currency, it is also important to be aware of the difference between the buying and selling rates. The buying rate is the rate at which the bank or money changer buys your currency, while the selling rate is the rate at which they sell the foreign currency to you. The selling rate is usually higher than the buying rate, and the difference represents the profit for the bank or money changer.

In conclusion, understanding currency exchange rates is essential when planning a trip to Malaysia. By being aware of the current exchange rates and comparing different options, you can ensure that you are getting the best value for your money.

When traveling to a foreign country, it is important for travelers to have a good understanding of the exchange rates between their home currency and the local currency. Exchange rates can have a significant impact on the overall cost of a trip and can affect budgeting decisions.

Read Also: Understanding the Basics of the 10 20 30 40 Vesting Schedule

Here are a few reasons why understanding exchange rates is crucial for travelers:

| 1. Budgeting | Exchange rates determine the value of your home currency in the foreign country. By understanding the exchange rate, you can estimate how much local currency you will receive for a certain amount of your home currency. This knowledge will help you create a travel budget and plan your expenses accordingly. |

| 2. Cost of goods and services | Exchange rates directly impact the cost of goods and services in a foreign country. A favorable exchange rate can make products and services cheaper, allowing travelers to get more for their money. On the other hand, an unfavorable exchange rate can make things more expensive. By understanding the exchange rate, you can make informed decisions about where to spend your money. |

| 3. Currency conversion fees | When exchanging money, banks and currency exchange services often charge fees or commission. Understanding the exchange rates can help you compare the fees charged by different providers and choose the one that offers the best value for your money. |

| 4. Avoiding scams | Being aware of the current exchange rates can help protect travelers from scams when exchanging money. Some dishonest individuals may take advantage of unaware tourists by offering unfair exchange rates. By understanding the prevailing rates, you can identify when you are being offered a rate that is unfavorable or unrealistic. |

Overall, understanding exchange rates is essential for travelers to make informed financial decisions during their trip. It allows them to budget effectively, make cost-effective purchases, minimize currency conversion fees, and protect themselves from potential scams.

The current average exchange rate in Malaysia is 1 USD = 4.20 MYR.

It is generally recommended to exchange currency in Malaysia, as rates in your home country may be less favorable. However, it’s always a good idea to compare rates and fees to make an informed decision.

There are no specific restrictions on exchanging currency in Malaysia for tourists. However, you may need to provide identification and fill out certain forms for larger transactions.

You can find the best exchange rates in Malaysia at licensed money changers, banks, and some hotels. It’s always a good idea to compare rates and fees at different locations before making an exchange.

If you have leftover Malaysian Ringgit after your trip, you can either keep it for future trips or convert it back to your home currency. Some currency exchange services also offer buyback options for a fee.

The current average exchange rate in Malaysia is approximately 4.2 Malaysian Ringgit (MYR) to 1 US Dollar (USD).

How to Identify Support and Resistance in Forex Trading Support and resistance are essential concepts in forex trading. They refer to specific price …

Read ArticleWhat is a Moderately Bearish Option Strategy? When it comes to investing in the stock market, there are a variety of strategies that traders can …

Read ArticleUnderstanding Section 721 of the Dodd-Frank Act Section 721 of the Dodd-Frank Wall Street Reform and Consumer Protection Act, also known as the …

Read ArticleWhere to Buy Forex: Tips and Recommendations When it comes to buying forex, finding the best rates is essential for getting the most out of your …

Read ArticleIce futures trading: What commodities are traded? Welcome to our guide on Ice Futures, where we will explore the most popular futures traded on the …

Read ArticleWhich country has the highest reserves? The world is full of rich natural resources that fuel the global economy. From oil and gas to precious metals …

Read Article