Understanding Pivot Levels in Forex Trading

Understanding Pivot Levels in Forex Trading Foreign exchange (Forex) trading is a complex and ever-evolving market. Traders constantly look for tools …

Read Article

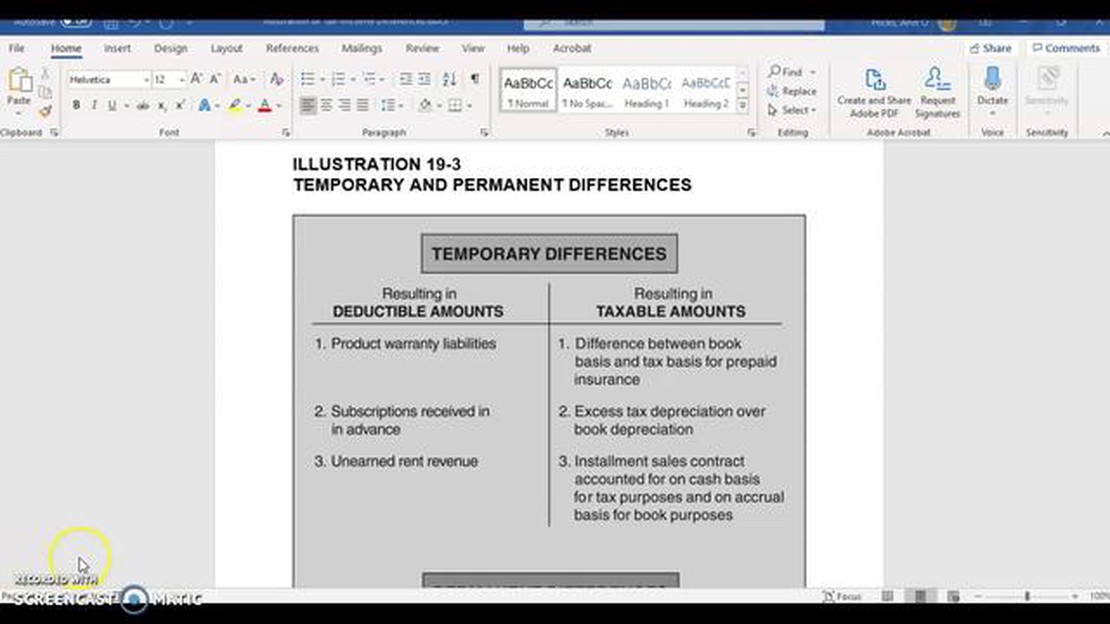

Temporary differences are a key concept in accounting, referring to the variation between the reported amount of an asset or liability for tax purposes and its carrying amount for financial reporting purposes. These differences arise due to discrepancies in the timing of recognition and measurement for tax and financial reporting purposes.

Understanding temporary differences is important for both individuals and businesses, as they can have a significant impact on taxation and financial decision-making. By recognizing and exploring common instances of temporary differences, individuals and businesses can gain insight into the complexities of accounting and make more informed financial decisions.

One common example of a temporary difference is the depreciation of assets. For tax purposes, the depreciation expense may be calculated differently than for financial reporting purposes. For example, tax laws may allow for accelerated depreciation methods, while financial reporting may require the use of straight-line depreciation. This difference in depreciation methods results in a temporary difference between the tax basis and the carrying amount of the asset.

Another example of a temporary difference is the recognition of revenue. In some cases, tax laws may allow for the recognition of revenue when received, while financial reporting requires revenue to be recognized when earned. This difference in recognition timing can result in a temporary difference between taxable income and financial income, which will have an impact on tax liabilities in the current and future periods.

Overall, understanding and exploring examples of temporary differences is essential for individuals and businesses to navigate the complexities of accounting and taxation. By recognizing these instances and their implications, individuals and businesses can make more informed financial decisions and ensure compliance with tax laws and financial reporting standards.

Read Also: The Advantages of Investing in Forex Trading

Temporary differences are differences between the reported financial results and the tax results that occur in a given period. Understanding these differences is crucial for financial reporting and tax purposes. Here are some key points to help you understand temporary differences:

Overall, understanding temporary differences is essential for accurate financial reporting and tax compliance. By properly identifying and recognizing these differences, companies can ensure transparency and consistency in their financial statements and make informed decisions based on the tax impacts.

Temporary differences are differences between the carrying amount of an asset or liability in the financial statements and its tax base. These differences arise because certain items are recognized differently for accounting and tax purposes.

Temporary differences can be either taxable or deductible. Taxable temporary differences result in future taxable amounts, while deductible temporary differences result in future deductible amounts. It is important for companies to understand and classify these differences correctly, as they have a significant impact on the calculation of deferred tax assets and liabilities.

Deferred tax assets represent future tax benefits that a company can utilize to reduce its future tax liabilities. On the other hand, deferred tax liabilities represent future tax payments that a company will have to make due to temporary differences. These assets and liabilities are reported on the balance sheet and can significantly affect a company’s financial position and profitability.

Understanding temporary differences and their impact on deferred tax assets and liabilities is crucial for financial reporting and decision-making. By correctly identifying and measuring these differences, companies can ensure accurate reporting of their financial statements and comply with accounting standards.

In addition, an understanding of temporary differences can help companies plan their tax strategies more effectively. By analyzing the timing and magnitude of temporary differences, companies can make informed decisions on timing of asset sales and purchases, structuring of transactions, and utilization of tax advantages, ultimately optimizing their overall tax position.

In conclusion, temporary differences play a significant role in financial reporting, taxation, and strategic tax planning for companies. They are essential to accurately present a company’s financial position, predict its tax obligations, and optimize tax benefits. Therefore, it is important for companies and financial professionals to have a thorough understanding of temporary differences and their impact on financial statements and tax liabilities.

Read Also: What Happens to Options at the Money? Understanding At-The-Money Options

Some examples of temporary differences in accounting include differences in depreciation expense for tax purposes and financial reporting purposes, timing differences in recognizing revenue, and differences in the valuation of inventory.

Sure! Let’s say a company purchases a piece of machinery for $10,000 and expects to use it for 5 years. For tax purposes, the company is allowed to depreciate the machinery over 3 years, while for financial reporting purposes, the depreciation is spread out over the 5-year life of the asset. This creates a temporary difference in the amount of depreciation expense recognized for tax purposes and financial reporting purposes.

An example of a timing difference in recognizing revenue is when a company receives payment for goods or services in one accounting period but does not recognize the revenue until the following accounting period. This can happen when there is a time lag between providing the goods or services and receiving payment.

The valuation of inventory can create a temporary difference when the company uses the first-in, first-out (FIFO) method for tax purposes and the average cost method for financial reporting purposes. This can result in different values being assigned to the same inventory items for tax purposes and financial reporting purposes, leading to a temporary difference in the amount of inventory recognized in the financial statements and the amount used for tax calculations.

Understanding Pivot Levels in Forex Trading Foreign exchange (Forex) trading is a complex and ever-evolving market. Traders constantly look for tools …

Read ArticleDiscovering Liquid Options in Stocks If you are an options trader, one of the key factors to consider is the liquidity of the options you are trading. …

Read ArticleUnderstanding the 26 Moving Average: A Comprehensive Guide In the world of technical analysis, moving averages are a popular tool used by traders to …

Read ArticleWhat is the Size of a 1 Lot Contract in Forex? When it comes to trading in the foreign exchange market, understanding the size of a 1 lot contract is …

Read ArticleUnderstanding the Legality of Forex Trading in Nepal Forex trading, also known as foreign exchange trading, has gained popularity worldwide as traders …

Read ArticleUnderstanding the Distinction Between Gamma and Vanna Options trading provides investors with a unique opportunity to capitalize on market volatility …

Read Article