Best CFD Platform: A Comprehensive Comparison and Reviews

Best CFD platform: Find the perfect one for you When it comes to trading Contracts for Difference (CFDs), having access to the best platform is …

Read Article

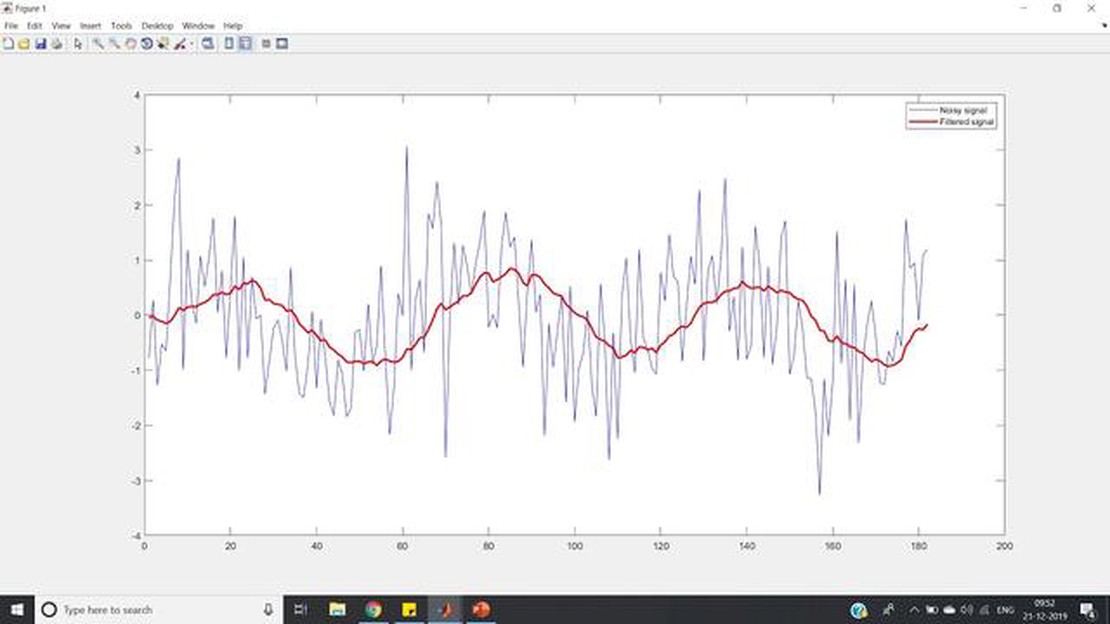

The Exponentially Weighted Moving Average (EWMA) is a commonly used statistical method in Matlab for smoothing data and identifying trends. This article will provide a comprehensive overview of EWMA, its applications, and how to implement it in Matlab.

EWMA is particularly useful for analyzing time series data. It assigns exponentially decreasing weights to previous observations, with the most recent data points having the highest weights. This characteristic makes EWMA highly responsive to recent changes in the data and enables it to capture short-term trends.

One of the main advantages of using EWMA is its simplicity. The calculation of the EWMA only requires the current value and the previous EWMA value, making it computationally efficient. Additionally, the smoothing factor can be easily adjusted to control the responsiveness of the EWMA, allowing for customization based on the specific data and desired level of smoothing.

EWMA has a wide range of applications, including financial analysis, quality control, and forecasting. In finance, EWMA is commonly used to analyze stock returns and volatility, as well as to predict future returns. In quality control, EWMA can be used to identify process variations and detect anomalies. It can also be applied to forecast sales, demand, or any other time-dependent variable.

The Exponentially Weighted Moving Average (EWMA) is a commonly used statistical calculation that allows you to track the average value of a variable over time, giving more weight to recent observations. It is commonly used in finance and quality control applications to monitor processes and detect changes or trends.

The formula for EWMA is as follows:

EWMA = (1 - α) * xt-1 + α * xt

Where:

xt is the current observation or value

xt-1 is the previous EWMA value

α is the smoothing factor, often represented as a decimal between 0 and 1. The higher the value, the more weight is given to recent observations.

Read Also: Understanding the Momentum Meter Indicator: How It Works and How to Use It

To calculate the EWMA, you start with an initial value for xt-1 and iterate through your dataset, calculating a new EWMA value for each observation. The choice of initial value and α will depend on the specific application and desired level of responsiveness to changes.

The EWMA formula allows for a gradual adjustment to changes in the observed values, as it gives more weight to recent observations. This is in contrast to a simple moving average, which assigns equal weight to all observations. The weighting factor α effectively determines the rate at which new observations are incorporated into the average.

By monitoring the EWMA values over time, you can detect changes and trends more quickly than with a simple moving average. Variations in the EWMA values can indicate shifts in the underlying process or outliers in the data.

Overall, understanding the EWMA formula and its application can help you analyze and interpret data more effectively, especially when dealing with time-series data or processes that exhibit trends or changes over time.

In Matlab, the Exponential Weighted Moving Average (EWMA) model can be implemented through a simple formula. Here is how you can create an EWMA function in Matlab:

ewma that takes two input arguments: data and alpha.y with the same size as data to store the EWMA values.y to be the same as the first value of data.data.y(i) = alpha * data(i) + (1 - alpha) * y(i-1).y as the output of the function.Here is an example implementation of the ewma function:

Read Also: Trading Forex with $100: Is it Possible and Profitable?

function y = ewma(data, alpha)y = zeros(size(data));y(1) = data(1);for i = 2:length(data)y(i) = alpha * data(i) + (1 - alpha) * y(i-1);endend

To use the ewma function, simply call it with your data and desired alpha value. For example:

data = [1, 2, 3, 4, 5];alpha = 0.5;result = ewma(data, alpha);

The variable result will then contain the EWMA values calculated from the input data.

By implementing the EWMA model in Matlab, you can easily perform exponential smoothing on your data to obtain a smoothed time series that can help with trend analysis and forecasting.

EWMA stands for Exponentially Weighted Moving Average. It is a statistical method used to calculate the weighted average of a time series data, with more weight given to recent observations.

The purpose of using EWMA is to give more importance to recent data points while calculating the moving average, as it is believed that recent data points have more relevance and impact on future values.

In Matlab, EWMA can be calculated using the ewma function. This function takes the time series data as input along with the desired span, which determines the weight given to each observation. It then calculates the exponentially weighted moving average of the data.

The default span value used in Matlab’s EWMA function is 12. This means that the function will give more weight to the last 12 data points while calculating the moving average.

Yes, you can customize the span value in Matlab’s EWMA function. You can specify the desired span value as an input parameter to the ewma function.

EWMA stands for Exponential Weighted Moving Average, which is a popular method used for smoothing data in Matlab. It assigns exponentially decreasing weights to the previous data points, with the most recent data points having the highest weights. This helps in reducing noise and highlighting the underlying trends in the data.

To use the EWMA function in Matlab, you first need to have the Signal Processing Toolbox installed. Once you have the toolbox installed, you can simply call the function ewma and pass in the input data as the argument. The function will return the exponentially weighted moving average of the input data.

Best CFD platform: Find the perfect one for you When it comes to trading Contracts for Difference (CFDs), having access to the best platform is …

Read ArticleWhat is the Formula for Spread in Forex? Understanding the spread is essential for any forex trader. The spread is the difference between the bid and …

Read ArticleThe Troubles of Forex Trading: Unveiling the Problem Forex trading, also known as foreign exchange trading, is a complex and highly volatile market. …

Read ArticleUnderstanding the EWM Formula in Pandas In the world of data analysis and time series forecasting, moving averages play a crucial role in …

Read ArticleIs IBKR good for options? When it comes to options trading, the choice of broker can make a significant impact on your overall trading experience. One …

Read ArticleUnderstanding Short-Term Capital Gain on ESOP Shares Employee Stock Ownership Plans (ESOPs) provide an excellent opportunity for employees to own a …

Read Article