Understanding DFA (Dynamic Financial Analysis) in Finance

What is DFA in finance? DFA, or Dynamic Financial Analysis, is a powerful tool used in finance to analyze and manage risk. It is a method of modeling …

Read Article

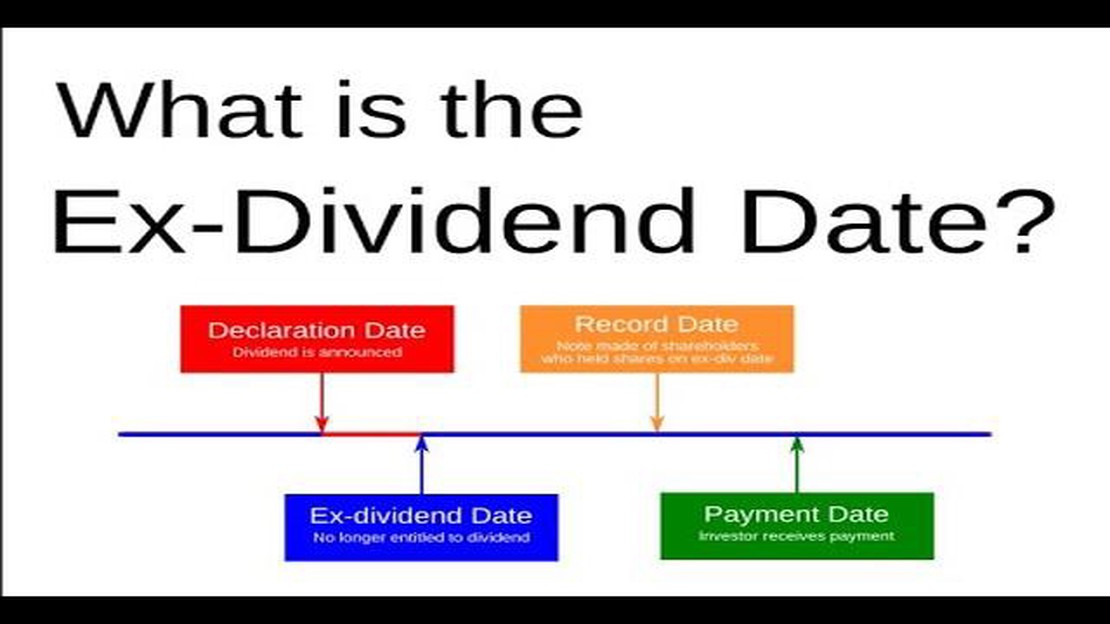

Many investors rely on dividends as a source of income and a way to grow their investments. Dividends are typically paid out by companies on a regular basis, and the ex-dividend date is an important date for investors to be aware of. But what exactly is the ex-dividend date, and does the stock market take a hit on this day?

The ex-dividend date is the date on which a stock no longer carries the right to receive the next dividend payment. In other words, if an investor wants to receive the dividend for a particular stock, they must own the stock before the ex-dividend date. If they purchase the stock on or after the ex-dividend date, they will not be eligible to receive the upcoming dividend payment.

So, does the stock market take a hit on the ex-dividend date? The answer is not so clear-cut. On one hand, the price of a stock typically drops by an amount equal to the dividend payment on the ex-dividend date. This is because investors who are seeking to receive the dividend will buy the stock before the ex-dividend date, driving up demand and therefore the price. Once the ex-dividend date arrives, there is less incentive for investors to buy the stock, leading to a decrease in price.

However, it’s important to note that the impact of the ex-dividend date on the stock market as a whole is relatively small. The overall value of the stock market is influenced by a wide range of factors, including economic data, geopolitical events, and investor sentiment. The ex-dividend date is just one piece of the puzzle and is unlikely to significantly impact the broader stock market.

Furthermore, it’s worth considering the long-term performance of dividend-paying stocks. While the price may drop on the ex-dividend date, many dividend-paying stocks have historically provided investors with steady and reliable returns over time. Dividends can be an attractive feature for investors, especially those who are looking for income or a way to enhance their total return.

In conclusion, while the stock market may experience some short-term fluctuations on the ex-dividend date, the overall impact is usually minimal. Investors should consider the ex-dividend date as just one factor among many when making investment decisions, and focus on the long-term performance and potential of dividend-paying stocks.

The ex-dividend date is an important milestone for investors, as it determines who is entitled to receive the dividends declared by a company. On this date, the stock price of a company typically decreases by the amount of the dividend, representing the value paid out to shareholders. This leads to a common belief that the stock market takes a hit on the ex-dividend date.

However, the impact of the ex-dividend date on the stock market is not as straightforward as it may seem. While the stock price does usually decrease on the ex-dividend date, it is important to consider the overall context and dynamics of the market.

One reason why the stock market may not necessarily take a significant hit on the ex-dividend date is the concept of the efficient market hypothesis. According to this theory, stock prices already reflect all available information, including expected dividends. Therefore, the decrease in stock price on the ex-dividend date can be seen as a mere adjustment to account for the value paid out to shareholders.

Another factor to consider is that many investors may purchase shares specifically to capture the dividend, taking advantage of the lower stock price on the ex-dividend date. This increased demand for shares can offset the downward pressure on stock prices, resulting in a more muted impact on the overall stock market.

Furthermore, the impact of the ex-dividend date may be overshadowed by other market-related factors, such as economic news, company earnings reports, or geopolitical events. The stock market is influenced by a wide range of factors, and the ex-dividend date is just one piece of the puzzle.

Read Also: What is the minimum deposit for Plus500? - Everything you need to know

In conclusion, while the stock price typically decreases on the ex-dividend date, the impact on the overall stock market is often not significant. The efficient market hypothesis, increased demand for shares, and other market-related factors all play a role in determining the final impact. Investors should consider these factors and the broader market context when analyzing the effect of the ex-dividend date on stock prices.

The ex-dividend date is an important concept for investors to understand when it comes to buying and selling stocks. It refers to the date on which a stock begins trading without the right to receive the next dividend payment. This means that if you buy a stock on or after the ex-dividend date, you will not receive the upcoming dividend payment.

Read Also: EMA vs DEMA: Which Indicator is Better?

On the ex-dividend date, the value of the stock usually drops by an amount equal to the dividend that is being paid. This drop in stock price is often referred to as the “dividend drop” or “dividend haircut.” This is because the dividend payment is considered part of the value of the stock, so when it is paid out, the value of the stock decreases accordingly.

However, it is important to note that the drop in stock price on the ex-dividend date does not necessarily indicate that investors are losing money. While the value of the stock may decrease, investors who hold the stock before the ex-dividend date have already benefited from the dividend payment. The decrease in stock price is simply a reflection of the fact that the company’s assets have decreased as a result of paying out the dividend.

Additionally, it is worth mentioning that the drop in stock price on the ex-dividend date is generally temporary. Once the stock begins trading without the right to receive the dividend payment, the market forces of supply and demand typically come into play and the stock price may fluctuate. Therefore, it is not accurate to say that the stock market takes a hit on the ex-dividend date in the long term.

In conclusion, the ex-dividend date is a significant date for investors to be aware of when trading stocks. It marks the date on which a stock begins trading without the right to receive the next dividend payment, resulting in a temporary decrease in the stock price. However, this drop in stock price does not necessarily mean that investors are losing money, as they have already benefited from the dividend payment if they held the stock prior to the ex-dividend date.

An ex-dividend date is the date on which a stock starts trading without the value of its next dividend payment. If an investor purchases a stock on or after the ex-dividend date, they will not receive the upcoming dividend payment.

Yes, the stock market typically takes a hit on the ex-dividend date. This is because the stock price usually drops by the amount of the dividend payment. Investors who purchase the stock on or after the ex-dividend date are not entitled to the dividend, so they have less incentive to buy the stock at its previous price.

The ex-dividend date typically leads to a decrease in stock prices. This is because the dividend payment is no longer included in the stock’s price, so investors are less willing to pay as much for the stock. The drop in stock price compensates for the dividend payment that the new shareholders will not receive.

It can be a good idea to buy stock right before the ex-dividend date if you want to receive the upcoming dividend payment. However, it’s important to note that the stock price may drop by the amount of the dividend payment on the ex-dividend date. So, while you may receive the dividend, the overall value of your investment may not increase.

If you missed the ex-dividend date, you will not be eligible to receive the upcoming dividend payment. However, you can still purchase the stock and be eligible for future dividend payments. It’s important to consider the stock’s current price and potential for future growth when deciding whether to purchase it after the ex-dividend date.

The ex-dividend date is the date on which all shares bought and sold no longer come attached with the right to be paid the most recently declared dividend.

What is DFA in finance? DFA, or Dynamic Financial Analysis, is a powerful tool used in finance to analyze and manage risk. It is a method of modeling …

Read ArticleWho did the SF Giants get at the trade deadline? The San Francisco Giants have been making moves ahead of the trade deadline, bolstering their roster …

Read ArticleUnderstanding Hybrid Trade: A Comprehensive Guide Hybrid trade is a concept that combines elements of traditional commerce with modern digital …

Read ArticleWhat are R1, R2, R3, and Pivot Points? In the world of financial markets, trading is a complex and ever-evolving practice. Traders continuously look …

Read ArticleCalculate Expectancy in Excel: A Step-by-Step Guide Calculating expectancy in Excel is an essential skill for anyone looking to make informed …

Read ArticleCapital Gains Tax Rate in Spain 2023 Capital gains tax is an important aspect of any country’s tax system. It is a tax imposed on the profits earned …

Read Article