7 Stock Exchanges You Need to Know About

7 Stock Exchanges You Need to Know About Stock exchanges are crucial to the global economy as they provide a platform for the buying and selling of …

Read Article

The Golden Cross strategy is a popular technical analysis indicator used in forex trading to identify potential trend reversals and entry points. It involves the crossing of two moving averages – the shorter-term moving average and the longer-term moving average. When the shorter-term moving average crosses above the longer-term moving average, it is considered a bullish signal and indicates that the price may continue to rise. Conversely, when the shorter-term moving average crosses below the longer-term moving average, it is considered a bearish signal and suggests that the price may decline.

Proponents of the Golden Cross strategy argue that it can be an effective tool for traders to capture larger market moves and generate profitable trades. They believe that the crossover of moving averages reflects a change in market sentiment and can provide valuable insights into potential price movements. By following the signals generated by the Golden Cross strategy, traders aim to enter trades at the beginning of a new trend and ride the trend until it reverses.

However, it is important to note that the Golden Cross strategy, like any trading strategy, is not foolproof and does not guarantee profitability. It is just one tool among many that traders can use to make informed trading decisions. The success of the Golden Cross strategy depends on various factors, including market conditions, the timeframes used for the moving averages, and the trader’s ability to accurately interpret and react to signals.

“The Golden Cross strategy can be a useful addition to a trader’s toolbox, but it should not be relied upon as the sole basis for making trading decisions,” says John Smith, a professional forex trader. “Traders should consider incorporating other technical indicators, fundamental analysis, and risk management techniques to enhance their trading strategies.”

In conclusion, while the Golden Cross strategy can be a valuable tool for forex traders, it is not a guaranteed path to success. Traders should always exercise caution, conduct thorough analysis, and consider multiple factors before making trading decisions. With proper risk management and a well-rounded approach to trading, the Golden Cross strategy can be a useful addition to a trader’s arsenal.

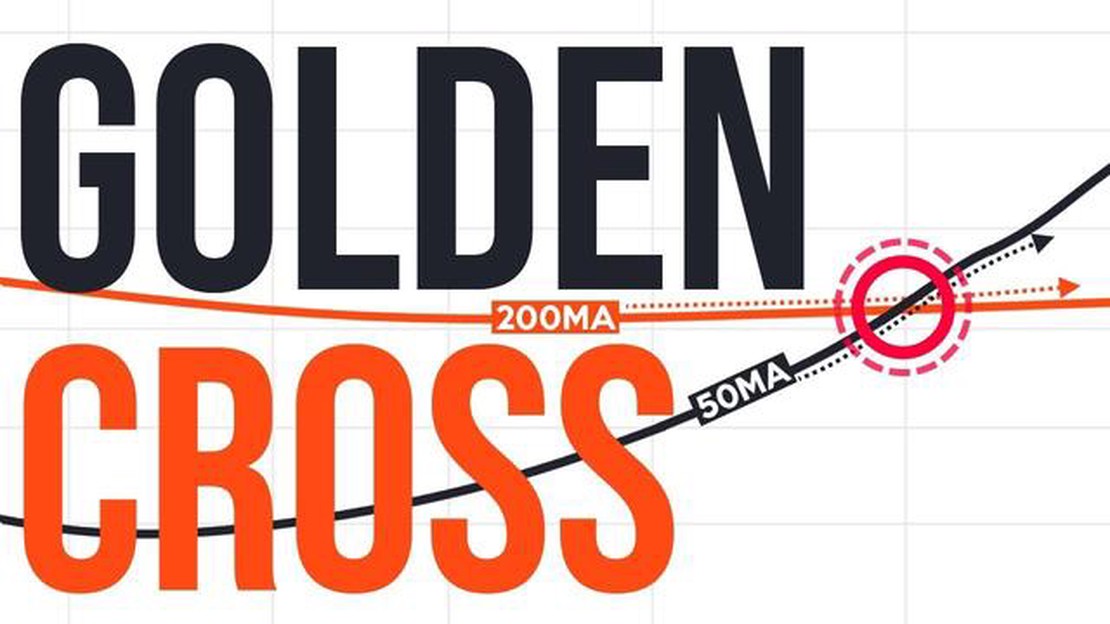

The Golden Cross strategy is a popular technical analysis tool used in forex trading. It involves the intersection of two moving averages on a price chart, namely the 50-day moving average and the 200-day moving average. When the shorter-term moving average (50-day) crosses above the longer-term moving average (200-day), it is considered a bullish signal and is known as a Golden Cross.

The Golden Cross strategy is based on the idea that when the shorter-term moving average crosses above the longer-term moving average, it indicates a shift in market sentiment from bearish to bullish. Traders and investors use this signal as a confirmation of a potential uptrend in the currency pair being traded.

While the Golden Cross strategy can be effective in forex trading, it is important to note that no strategy guarantees success in the market. Traders need to consider other technical indicators, fundamental analysis, and market conditions to make well-informed trading decisions.

Some traders find the Golden Cross strategy useful because it helps them identify and confirm trends in the forex market. However, it is important to remember that the effectiveness of the strategy may vary depending on the timeframe and the specific currency pair being traded.

Read Also: Best Places to Exchange USD to INR in India

Like any other trading strategy, the Golden Cross strategy has its limitations. It can generate false signals, which may result in losses if not used in conjunction with other indicators or confirmation techniques. Traders should always consider risk management techniques and set stop-loss orders to protect their positions.

In conclusion, the Golden Cross strategy is a popular technical analysis tool used by forex traders to identify potential uptrends in the market. While it can be effective, it should not be the sole basis for making trading decisions. Traders should use it in conjunction with other analysis techniques and risk management strategies to increase their chances of success in forex trading.

The Golden Cross strategy is a widely used technical analysis tool in forex trading that traders rely on to predict market trends and generate buy or sell signals. It is a simple yet effective strategy that makes use of moving averages to identify potential entry and exit points.

At its core, the Golden Cross strategy involves two moving averages: the 50-day moving average and the 200-day moving average. When the 50-day moving average crosses above the 200-day moving average, it is referred to as a Golden Cross signal. This crossover is seen as a bullish signal and indicates a potential upward trend in the market. Conversely, when the 50-day moving average crosses below the 200-day moving average, it is known as a Death Cross signal, which is a bearish signal indicating a potential downward trend.

The Golden Cross strategy works on the assumption that the 50-day moving average represents short-term price momentum, while the 200-day moving average represents long-term price momentum. When the short-term momentum surpasses the long-term momentum, it suggests that the market sentiment is becoming more bullish, making it an opportune time to enter a long position. Conversely, when the short-term momentum falls below the long-term momentum, it indicates a shift in market sentiment towards bearishness, presenting an opportunity to enter a short position.

Traders using the Golden Cross strategy typically wait for confirmation of the crossover before making any trading decisions. This confirmation could be in the form of higher volume or a subsequent price increase following the signal. By waiting for confirmation, traders reduce the risk of false signals and increase the probability of making profitable trades.

Read Also: How to Track Your ESPP in Quicken: Step-by-Step Guide

It is important to note that while the Golden Cross strategy can be a reliable tool in predicting market trends, it should not be used in isolation. Traders are advised to consider other technical indicators and factors such as market volatility, support and resistance levels, and fundamental analysis before making trading decisions.

In conclusion, the Golden Cross strategy is a powerful tool that traders can use to predict market trends and generate buy or sell signals. By analyzing the crossovers between the 50-day and 200-day moving averages, traders can identify potential entry and exit points in the market. However, it is crucial to use this strategy in conjunction with other technical indicators and factors to make well-informed trading decisions.

The Golden Cross strategy in forex trading is a technical analysis tool that involves the intersection of two moving averages. It occurs when a shorter-term moving average, such as the 50-day moving average, crosses above a longer-term moving average, such as the 200-day moving average.

The Golden Cross strategy works by identifying bullish trends in the market. When the shorter-term moving average crosses above the longer-term moving average, it is seen as a bullish signal, indicating that the price is likely to continue rising. Traders often use this crossover as a buy signal to enter long positions.

No, the Golden Cross strategy does not guarantee profitable trades. While it is a widely used technical analysis tool, it is not foolproof and can produce false signals. It is important for traders to use additional indicators and analysis to confirm the signal before entering a trade.

Like any trading strategy, there are risks associated with using the Golden Cross strategy. One risk is that the crossover may indicate a false signal, leading to losses if the price reverses. Additionally, relying solely on this strategy without considering other factors and indicators could result in missed opportunities or entering trades at unfavorable prices.

Yes, there are several alternative strategies that traders can use in forex trading. Some popular ones include the Moving Average Crossover strategy, Bollinger Bands strategy, and the Fibonacci retracement levels strategy. Each strategy has its own advantages and disadvantages, and traders should choose the one that best suits their trading style and market conditions.

7 Stock Exchanges You Need to Know About Stock exchanges are crucial to the global economy as they provide a platform for the buying and selling of …

Read ArticleUnderstanding the Spike Phenomenon in Forex Trading In the world of forex trading, spikes are a frequent occurrence that can have a significant impact …

Read ArticleWhat is the best EMA cross value? When it comes to trading strategies, finding the perfect indicator or parameter is a never-ending quest for traders. …

Read ArticleUnderstanding the Significance of the 200-Day Moving Average for the S&P 500 The 200-day moving average (MA) of the S&P is a commonly used technical …

Read ArticleIs it forbidden to play Forex? Forex trading is a popular form of investment that involves buying and selling currencies. It has gained significant …

Read ArticleTrading Currency on NSE: Everything You Need to Know Trading currency on the National Stock Exchange (NSE) is an exciting and potentially lucrative …

Read Article