What is the Most Profitable Timeframe to Trade Options?

What is the optimal timeframe for trading options? When it comes to trading options, the choice of timeframe can play a crucial role in determining …

Read Article

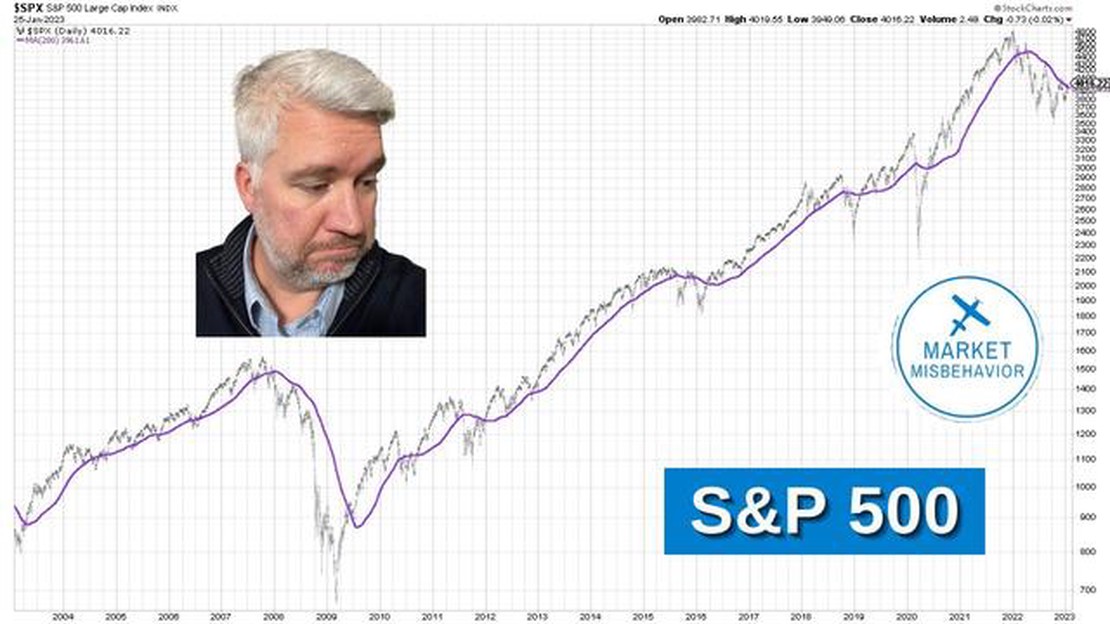

The 200-day moving average (MA) of the S&P is a commonly used technical analysis tool in the stock market. It is obtained by calculating the average closing price of the S&P 500 index over the last 200 trading days. This moving average is considered a key indicator of the long-term trend of the market, providing insights into the overall direction and momentum of the index.

The 200-day MA is often used by traders and investors to gauge the strength and stability of the market. When the S&P 500 index is trading above its 200-day MA, it is generally seen as a bullish signal, indicating that the market is in an uptrend. Conversely, when the index is trading below its 200-day MA, it is considered a bearish signal, suggesting that the market is in a downtrend.

Traders and investors also pay attention to the steepness of the 200-day MA. If the moving average is sloping upwards, it suggests that the market is gaining momentum and is more likely to continue its upward trend. On the other hand, if the moving average is sloping downwards, it indicates that the market is losing momentum and may be headed for a reversal or a downtrend.

In addition to its role as a trend indicator, the 200-day MA is also used as a support and resistance level. During periods of market volatility, traders often look to the 200-day MA as a level where the market may find support or face resistance. If the S&P 500 index bounces off the 200-day MA and starts moving higher, it suggests that the support level is holding. Conversely, if the index breaks below the 200-day MA and continues to decline, it indicates that the resistance level has been breached.

The 200-day moving average is a commonly used technical analysis tool in the financial markets. It is a trend-following indicator that helps investors and traders identify the overall direction of a stock, index, or other financial instrument.

The 200-day moving average is calculated by taking the average closing price of a stock or index over the past 200 trading days. This average is then plotted on a chart to create a line that represents the long-term trend of the asset.

The 200-day moving average is often considered a significant level of support or resistance. When the price of an asset is above its 200-day moving average, it is generally seen as a bullish signal, suggesting that the price is in an uptrend. Conversely, when the price is below its 200-day moving average, it is seen as a bearish signal, indicating that the price is in a downtrend.

Traders and investors use the 200-day moving average in various ways. Some use it as a simple tool to determine the overall trend of an asset, while others use it as a basis for their trading strategies. For example, a trader may only take long positions when a stock is above its 200-day moving average and short positions when it is below.

It is important to note that the 200-day moving average is a lagging indicator, meaning that it reacts to price movements after they have already occurred. Therefore, it may not always provide timely signals. As with any technical analysis tool, it is best used in conjunction with other indicators and analysis methods to confirm signals and make informed trading decisions.

In conclusion, the 200-day moving average is a widely used tool for trend analysis in the financial markets. By understanding how it is calculated and interpreting its signals, traders and investors can gain valuable insights into the long-term direction of an asset and make more informed trading decisions.

The 200-day moving average is a technical analysis tool used by traders and investors to identify the overall trend of a stock or market. It is calculated by taking the average closing price of a security over the past 200 trading days. This moving average is considered a long-term indicator and is often used to determine the strength and direction of a market or stock.

By smoothing out price fluctuations over a longer period of time, the 200-day moving average helps to filter out short-term noise and provide a clearer picture of the underlying trend. Traders and investors use this metric to help identify buying or selling opportunities, as well as to confirm the strength of any signals provided by other technical indicators.

Read Also: Top Trusted Forex Brokers in India for Hassle-Free Trading

When the price of a security is trading above its 200-day moving average, it is generally considered to be in an uptrend. This can be seen as a bullish signal and may indicate that the stock or market is experiencing strong buying pressure. On the other hand, when the price is trading below its 200-day moving average, it may be seen as a bearish signal, suggesting that the stock or market is facing selling pressure.

It is important to note that the 200-day moving average is just one tool among many used in technical analysis. It should not be used in isolation but rather in conjunction with other indicators and analysis techniques to make well-informed trading and investment decisions.

The 200-day Moving Average is an important tool used by investors and traders to analyze the long-term trend of a stock or market index. It provides a smoothed average of the stock’s price over the past 200 trading days, which helps to filter out short-term price fluctuations and noise.

One of the key reasons why the 200-day Moving Average is important is that it can help identify the overall direction of the market or a stock. When the price is above the 200-day Moving Average, it indicates a bullish trend, suggesting that the stock or index is generally rising. On the other hand, when the price is below the 200-day Moving Average, it indicates a bearish trend, suggesting that the stock or index is generally falling. This information can be valuable for investors looking to make informed decisions about buying or selling stocks.

Read Also: Understanding Volatility in Binary Options Trading

Another reason why the 200-day Moving Average is important is that it can act as a support or resistance level for a stock or index. When the price approaches the 200-day Moving Average from below, it may act as a support level, preventing further downside and potentially signaling a buying opportunity. Conversely, when the price approaches the 200-day Moving Average from above, it may act as a resistance level, preventing further upside and potentially signaling a selling opportunity. Traders often look for these support and resistance levels to make decisions about entering or exiting positions.

Furthermore, the 200-day Moving Average is widely followed by market participants, which can make it a self-fulfilling prophecy. When a large number of investors and traders are watching and reacting to the 200-day Moving Average, it can influence their buying and selling decisions, leading to increased volatility and momentum in the market. This can make the 200-day Moving Average an important indicator for trend reversals and market sentiment.

In conclusion, the 200-day Moving Average is important because it helps investors and traders analyze the long-term trend, identify support and resistance levels, and gauge market sentiment. By understanding the significance of the 200-day Moving Average, market participants can make more informed decisions and potentially improve their performance.

The 200-day moving average is a widely used technical indicator that shows the average price of a security over a 200-day period. In relation to the S&P, it is often used as a measure of the long-term trend and as a signal for potential changes in market direction.

The 200-day moving average for the S&P is calculated by adding up the closing prices of the index for the past 200 days and then dividing the total by 200. This gives a smoothed average of the price over a long-term period.

If the S&P’s price is above the 200-day moving average, it is generally considered bullish or positive. This indicates that the index’s price is higher than its long-term average and suggests that the market is in an upward trend.

If the S&P’s price crosses below the 200-day moving average, it is often seen as a bearish or negative signal. This indicates that the index’s price is lower than its long-term average and may suggest that the market is entering a downward trend.

The 200-day moving average is just one of many indicators used by traders and investors to analyze the S&P. While it can provide useful insights into the long-term trend, it should not be relied on as the sole indicator for predicting future market movements. Other factors and indicators should be considered as well.

The 200-day moving average of the S&P is a technical analysis indicator that calculates the average price of the index over the past 200 trading days. This moving average is used to identify the trend and potential reversals in the market.

To calculate the 200-day moving average of the S&P, you need to add up the closing prices of the index for the past 200 trading days and then divide the sum by 200. This will give you the average price of the index over the past 200 days.

What is the optimal timeframe for trading options? When it comes to trading options, the choice of timeframe can play a crucial role in determining …

Read ArticleShort Selling Forex: Is it Possible and How Does it Work? Short selling is a common strategy in financial markets, allowing investors to make a profit …

Read ArticleCan you have a foreign currency account in the US? Opening a foreign currency account can be a beneficial option for individuals and businesses alike, …

Read ArticleSPDR Gold Trading Hours: Everything You Need to Know When it comes to trading gold, one of the most popular ways for investors to gain exposure to the …

Read ArticleTrading Forex Trends: Tips and Strategies Trading forex trends can be a profitable strategy for experienced traders and newcomers alike. Understanding …

Read ArticleHow to Load Money to ICICI Forex Card If you are planning to travel abroad, having a forex card can be a convenient and secure way to carry money. …

Read Article