Is the Envelope Method Effective? Pros and Cons Explained

Is the envelope method good? The envelope method is a popular budgeting system that helps individuals control their spending and manage their …

Read Article

When it comes to trading on the Forex market, one of the key factors that can greatly affect your trading experience is the location of the Forex server. The Forex server is where all trading activities take place, and it plays a crucial role in determining the speed and accuracy of your trades.

So, where exactly is the Forex server located? Well, the location of the server depends on the broker you are trading with. Most brokers have their servers located in major financial hubs around the world. These hubs include New York, London, Tokyo, and Singapore, among others. The choice of location is strategic, as it allows for faster execution of trades due to the proximity of the server to the main financial markets.

It is worth noting that the location of the server can have a significant impact on the speed of your trades. If you are located far away from the server, you may experience delays in the execution of your trades. This can result in slippage, where your trade is executed at a different price than expected. To avoid this, it is recommended to choose a broker that has a server located close to your geographical location.

In addition to the physical location of the server, brokers also invest in advanced technology to ensure fast and reliable trading execution. This includes using high-speed internet connections, state-of-the-art servers, and redundant systems to ensure uninterrupted trading. By choosing a broker with a well-located and technologically advanced server, you can minimize latency issues and enjoy a smoother trading experience.

Forex servers are computer systems or networks that provide the infrastructure for trading forex or foreign exchange currencies. They play a crucial role in facilitating the seamless execution of trades and ensuring the efficient flow of information between traders and the market.

Forex servers are designed to handle the high volume of data generated by the forex market, including real-time quotes, price charts, order books, and historical data. They are equipped with robust hardware and software configurations to handle the demanding requirements of forex trading.

These servers are typically located in data centers that are strategically positioned near major financial hubs and exchanges. The proximity to these hubs ensures low latency and fast execution speeds, which are crucial for traders looking to take advantage of market opportunities.

Forex servers are connected to the internet via high-speed and redundant connections to ensure uninterrupted connectivity. They are also secured with advanced encryption and authentication measures to protect sensitive trading data and ensure the integrity of transactions.

In addition to their role in facilitating trading, forex servers also provide other services such as hosting trading platforms, providing access to market data and analytics, and offering other value-added services that enhance the trading experience for traders.

In summary, forex servers are the backbone of the forex market, providing the infrastructure and connectivity necessary for traders to access the market, execute trades, and access real-time data. They are essential for ensuring the smooth operation of the forex market and enabling traders to execute trades in a timely and efficient manner.

The location of a Forex server is a critical factor that can greatly impact the efficiency and effectiveness of trading activities. Here are a few reasons why the location of the server is important:

In summary, the location of a Forex server plays a crucial role in the speed, reliability, security, and compliance of trading activities. Traders should carefully consider the location of their server to optimize their trading experience and maximize their chances of success.

Read Also: The Advantages of Issuing Stock Options: Exploring the Benefits

Discovering the location of forex servers is an essential step for forex traders. The physical location of the servers can impact the speed and reliability of the trading platform, ensuring that traders have the best possible experience. Here are some methods to discover the location of forex servers:

1. Contact the Forex Broker

The first and easiest way to discover the location of forex servers is to contact the forex broker directly. Most brokers will provide this information upon request. They may have multiple server locations, so make sure to inquire about the server that is closest to your desired trading location.

2. Use Network Tools

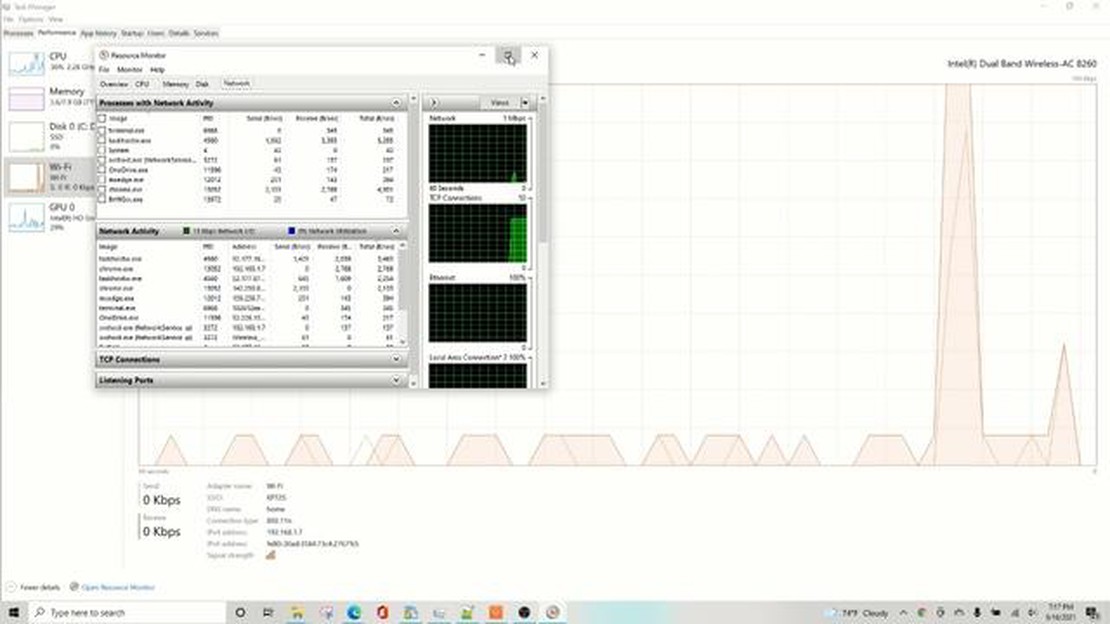

You can use network tools such as ping or traceroute to determine the location of the forex servers. These tools allow you to measure the time it takes for a packet of data to travel from your computer to the server and back. By analyzing the ping or traceroute results, you can get an idea of the server’s location.

3. Check the Trading Platform

Many trading platforms provide information about the server location within the platform itself. Look for a “server status” or “server information” section. This section will usually include details such as the server’s IP address and location. Check the platform’s documentation or contact the platform provider for assistance.

4. Use Geolocation Services

Read Also: Living and Trading Forex in Dubai: Is it Possible?

Geolocation services can help identify the location of forex servers. These services analyze IP address and network data to determine the physical location of an internet connection. There are various online tools and services available that can provide this information. Keep in mind that geolocation services may not always provide accurate results, especially if the broker uses proxy servers or other network routing techniques.

5. Consult Online Communities

Forex trading communities and forums can also be a valuable resource for discovering the location of forex servers. Traders often share their experiences and knowledge about different brokers and their server locations. By engaging with the community, you can gather insights and recommendations regarding server locations.

Discovering the location of forex servers is crucial for ensuring optimal trading conditions. By using these methods, you can obtain the necessary information to make informed decisions about your forex trading setup.

Finding the location of a Forex server can be done by using a few different methods. One way is to check with your broker directly and ask them for the location of their server. Another method is to use a trace route tool or a ping command to determine the location. Additionally, there are websites and online tools available that can provide you with the location of a server based on its IP address.

Knowing the location of the Forex server can be important for a number of reasons. Firstly, it can help you understand the latency or delay in executing trades. If the server is located far away from your location, it may take longer for your trade orders to be processed. Secondly, knowing the location can also help you understand the jurisdiction in which the server operates. Different countries may have different regulations and laws governing forex trading, so knowing the location can help you ensure that your trades are being conducted in compliance with the local laws.

The location of a Forex server is typically determined by the broker or the company providing the trading platform. In most cases, individual traders do not have the ability to change the location of the server. However, if you are experiencing latency issues or other connectivity problems, you can reach out to your broker or the platform provider to see if they have any alternative server locations that you can connect to. They may be able to offer you a solution that can improve your trading experience.

Several factors can affect the performance of a Forex server. One of the main factors is the physical distance between the server and the trader. If the server is geographically far away from the trader, it can result in higher latency and slower execution of trades. Additionally, the server’s hardware and network infrastructure can also impact its performance. A well-maintained and robust server infrastructure is essential for smooth and fast trading execution. Finally, the overall network congestion and internet connectivity of the trader can also play a role in the server’s performance.

Yes, the location of a Forex server can affect the spreads and execution speed. If the server is located closer to the liquidity providers or major financial centers, it can result in lower spreads and faster execution speed. This is because the shorter distance allows for quicker data transmission and reduces the chances of slippage. On the other hand, if the server is located far away, it may result in higher spreads and slower execution speed due to the increased latency. Traders who require fast execution and tight spreads may consider choosing a broker with server locations closer to their geographic location.

A Forex server is a specialized computer that hosts trading platforms and executes currency trades on behalf of traders.

Is the envelope method good? The envelope method is a popular budgeting system that helps individuals control their spending and manage their …

Read ArticleCan you make money just trading spy? Trading the SPY, or the S&P 500 Index fund, has become increasingly popular among individual investors. With its …

Read ArticleUSD to JPY Cross Rate: What You Need to Know When it comes to international currency exchange, one of the most commonly traded currency pairs is the …

Read ArticleIs IG the best forex broker? When it comes to choosing a forex broker, it’s crucial to find one that not only meets your trading needs but also …

Read ArticleHow to Use Day Trade BP Effectively Day trade buying power is a valuable resource for traders looking to take advantage of short-term market …

Read ArticleSimple steps to create an MT5 EA Trading in the financial markets can be a challenging and time-consuming task. However, with the help of technology, …

Read Article