Reasons for Trading Suspension: Understanding the Causes

Reasons behind trading suspensions In the world of financial markets, trading suspensions can occur for a variety of reasons. Understanding these …

Read Article

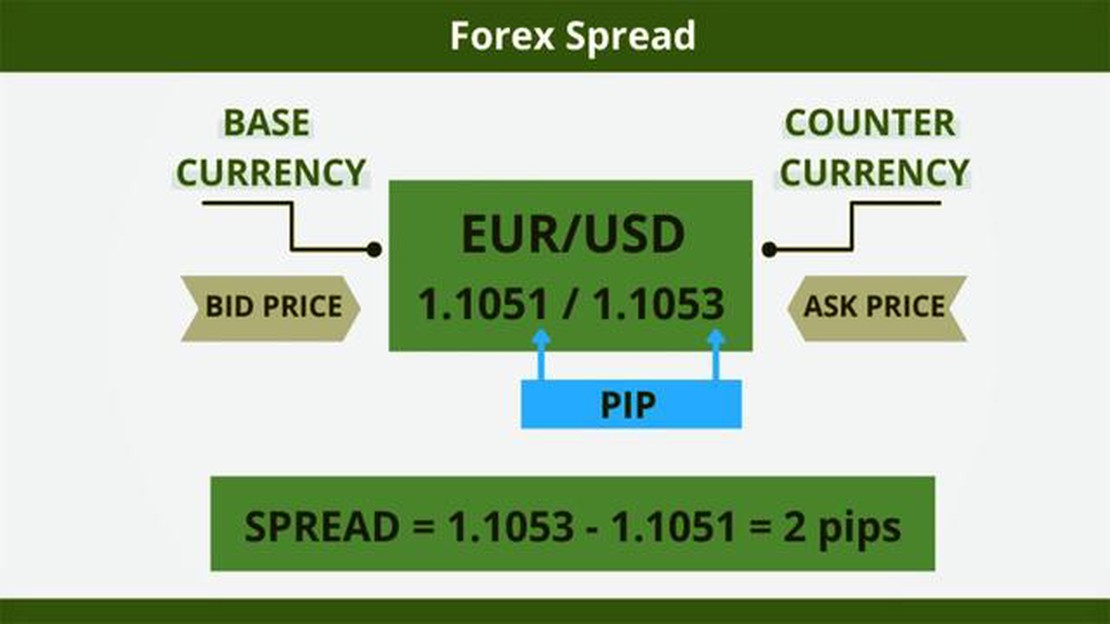

Understanding the spread is essential for any forex trader. The spread is the difference between the bid and ask price of a currency pair, and it represents the cost of trading. By knowing how to calculate the spread, traders can assess the profitability of their trades and make informed decisions.

To calculate the spread, you need to know the bid and ask price of the currency pair you are trading. The bid price is the highest price a buyer is willing to pay, while the ask price is the lowest price a seller is willing to accept. The spread is then calculated by subtracting the bid price from the ask price.

For example, let’s say the bid price for the EUR/USD currency pair is 1.1000 and the ask price is 1.1005. The spread would be calculated as follows:

Spread = Ask Price - Bid Price

Spread = 1.1005 - 1.1000

Spread = 0.0005 or 5 pips

It’s important to note that the spread can vary depending on market conditions and the liquidity of the currency pair. Major currency pairs, such as the EUR/USD, typically have tighter spreads due to high liquidity, while exotic currency pairs may have wider spreads.

By understanding and calculating the spread, forex traders can effectively manage their trading costs and optimize their profitability. It’s a fundamental concept in forex trading that every trader should master.

When engaging in forex trading, it is important to understand the concept of spread. The forex trading spread refers to the difference between the bid price and the ask price of a currency pair.

The bid price is the price at which the market is willing to buy a particular currency, while the ask price is the price at which the market is willing to sell the currency. The spread is the cost that traders incur in order to enter a trade.

For example, let’s say the bid price for the EUR/USD currency pair is 1.2000 and the ask price is 1.2005. The spread for this currency pair is 0.0005 or 5 pips. Traders will need to pay this spread when they buy the currency pair, and it will also be deducted from their profits when they sell the currency pair.

The spread can vary depending on various factors, such as market liquidity and volatility. In general, major currency pairs tend to have lower spreads compared to exotic currency pairs. This is because major currency pairs have higher liquidity and are more actively traded.

Understanding the forex trading spread is important because it directly affects the profitability of trades. A wider spread means that traders will need to overcome a larger cost in order to make a profit. On the other hand, a narrower spread can make it easier for traders to earn profits.

It is also worth noting that some forex brokers may offer fixed spreads, while others offer variable spreads. Fixed spreads remain constant regardless of market conditions, while variable spreads can change based on market liquidity and volatility.

In conclusion, the forex trading spread is an important factor to consider when engaging in forex trading. Traders should be aware of the spread for the currency pairs they are trading and take it into account when making trading decisions.

Read Also: Find Out if Birmingham Airport has an ATM | FAQs | Birmingham Airport

Disclaimer: Trading forex carries a high level of risk and may not be suitable for all investors. The spread is just one factor to consider, and traders should also consider other factors such as leverage, risk management, and market analysis before making trading decisions. It is advisable to seek professional advice before engaging in forex trading.

Forex trading, also known as foreign exchange trading, is the buying and selling of currencies on the foreign exchange market. The forex market is the largest and most liquid financial market in the world, with trillions of dollars being traded daily.

In forex trading, currencies are always traded in pairs, such as USD/EUR or GBP/JPY. The first currency in the pair is called the base currency, while the second currency is called the quote currency. The exchange rate between the two currencies determines how much of the quote currency is needed to buy one unit of the base currency.

Forex trading can be done by individual traders or institutions, such as banks and hedge funds. It offers opportunities for traders to profit from the fluctuations in currency prices. Traders speculate on whether the value of a currency will increase or decrease relative to another currency and take positions accordingly.

Read Also: How to Wire Money to Fidelity: Step-by-Step Guide

One of the main advantages of forex trading is its 24-hour market. The forex market is open from Sunday evening to Friday evening, allowing traders to trade at any time of the day or night. This flexibility attracts traders from around the world and ensures that there is always liquidity in the market.

| Advantages of Forex Trading | Disadvantages of Forex Trading |

|---|---|

| - High liquidity | - Market volatility |

| - 24-hour market | - Risk of leverage |

| - Lower transaction costs | - Emotional and psychological stress |

| - Ability to profit from both rising and falling markets | - Lack of regulation |

Forex trading involves various factors that can impact currency prices, such as economic indicators, geopolitical events, and central bank decisions. Traders use technical analysis, fundamental analysis, or a combination of both to make trading decisions.

Overall, forex trading offers opportunities for traders to potentially profit from the fluctuations in currency prices. However, it is important for traders to understand the risks involved and to have a solid trading strategy in place.

Spread is a term widely used in forex trading and it refers to the difference between the bid price and the ask price of a currency pair. This difference is essentially the cost of trading and it represents the commission that brokers charge for executing trades.

The spread is important in forex trading for several reasons:

In conclusion, spread is an essential factor in forex trading that impacts various aspects such as liquidity, trading costs, market volatility, price transparency, and trading strategies. Traders should carefully consider the spread offered by their brokers and choose pairs with optimal spreads to maximize their trading potential.

Spread in forex trading refers to the difference between the bid price and the ask price of a currency pair. It represents the cost of trading and is usually expressed in pips.

Spread is calculated by subtracting the bid price from the ask price. For example, if the bid price is 1.2000 and the ask price is 1.2005, then the spread would be 5 pips.

Spread is important because it affects the overall cost of trading. A larger spread means higher transaction costs for traders, while a smaller spread allows for more cost-efficient trading.

Several factors can affect the spread in forex trading, including market volatility, liquidity, and the broker’s pricing model. During times of high volatility or low liquidity, spreads tend to widen.

Yes, the spread can change during a forex trade. Spreads are not fixed and can fluctuate based on market conditions. Traders should be aware of spread fluctuations and factor them into their trading strategies.

Spread in forex trading refers to the difference between the bid price and the ask price of a currency pair. It is essentially the cost of trading and is measured in pips.

Spread is calculated by taking the difference between the bid price and the ask price of a currency pair. For example, if the bid price is 1.2000 and the ask price is 1.2005, the spread would be 5 pips.

Reasons behind trading suspensions In the world of financial markets, trading suspensions can occur for a variety of reasons. Understanding these …

Read ArticleMeaning of “Yard” in Slang The word “yard” is a slang term that originated in African American Vernacular English (AAVE) and has become popularized in …

Read ArticleThe most accurate forex pattern revealed Foreign exchange, commonly known as forex, is the largest and most liquid financial market in the world. …

Read ArticleWho is the Czech Republic’s Biggest Trading Partner? The Czech Republic, nestled in the heart of Europe, has emerged as a major player in the global …

Read ArticleHow much is $1 US in rubles? The exchange rate between the US dollar (USD) and the Russian ruble (RUB) is an important factor for individuals, …

Read ArticleMarty Schwartz’s Trading Strategy: What You Need to Know Marty Schwartz is a highly successful trader and author who has achieved great success in the …

Read Article