Canadian Dollar: Latest Trends and Predictions

Current Canadian Dollar Exchange Rate: Is it Up or Down? The Canadian dollar, also known as the loonie, has been on a rollercoaster ride in recent …

Read Article

Weighted Moving Average (WMA) is a popular method used in forecasting to predict future values based on weighted averages of past observations. While WMA has several advantages, such as its ability to account for trends and variations in data, it also faces some significant disadvantages that need to be carefully considered.

One major drawback of using WMA for forecasting is its sensitivity to outliers. Since WMA gives more weight to recent data points, any extreme values can have a significant impact on the forecasted values. This means that if there are outliers in the data, the forecasted values may not accurately represent the underlying pattern, leading to misleading results.

Another disadvantage of WMA is its inability to handle non-linear trends. WMA assumes a linear relationship between past observations and future values, which may not always be the case in real-world scenarios. If the data follows a non-linear trend, such as exponential growth or decay, WMA may not be able to capture the true pattern, resulting in inaccurate forecasts.

Furthermore, WMA requires the selection of appropriate weights for each observation. This can be a subjective process, as there is no fixed rule for assigning weights. The choice of weights can significantly impact the forecasted values, and if not chosen carefully, can lead to biased or unreliable predictions.

In conclusion, while Weighted Moving Average forecasting has its advantages, it is essential to be aware of its limitations. The sensitivity to outliers, inability to handle non-linear trends, and subjective selection of weights are significant disadvantages that can affect the accuracy of forecasts. Therefore, it is crucial to carefully evaluate the appropriateness of WMA for a given forecasting task and consider alternative methods when necessary.

1. Limited effectiveness with trended data: Weighted Moving Average forecasting is designed to capture short-term fluctuations in data and may not be suitable for forecasting data that exhibit long-term trends. It is less effective at capturing long-term patterns and may result in inaccurate forecasted values.

2. Sensitivity to outlier values: Weighted Moving Average forecasting gives equal importance to all data points within the given time period. This means that outlier values can have a significant impact on the forecasted values, leading to potential inaccuracies. Outliers can distort the overall trend and produce misleading forecasts.

3. Dependence on historical data: Weighted Moving Average forecasting heavily relies on historical data and assumes that past patterns will continue in the future. This assumption may not always hold true, especially in the presence of changing market conditions or other external factors. It can result in inaccurate forecasts when the underlying data patterns change significantly.

Read Also: The 20 EMA 50 EMA Strategy: Understanding and Implementing

4. Difficulty in choosing appropriate weights: Weighted Moving Average forecasting requires the selection of appropriate weights for each data point. Determining the optimal weights can be challenging and subjective. The choice of weights can greatly impact the forecasted values, and selecting incorrect weights can lead to inaccurate forecasts.

5. Not suitable for volatile or erratic data: Weighted Moving Average forecasting assumes a certain level of stability and regularity in the data patterns. It may not be suitable for forecasting highly volatile or erratic data that exhibit random fluctuations. In such cases, alternative forecasting methods that are better suited for volatile data should be considered.

6. Inability to capture seasonality: Weighted Moving Average forecasting does not explicitly account for seasonality in the data. It treats all data points equally and does not consider any recurring patterns or cycles. This can result in inaccurate forecasts for data that exhibit seasonal variations.

7. Lack of robustness: Weighted Moving Average forecasting is a relatively simple and straightforward method, but it may not be robust enough to handle complex or non-linear data patterns. It may struggle to capture and accurately forecast data with irregular or unpredictable patterns.

While Weighted Moving Average (WMA) forecasting can be a useful tool for predicting future values, it also presents its fair share of challenges. These challenges must be carefully considered and addressed to ensure accurate and reliable forecasts. Some of the main challenges in implementing WMA forecasting include:

| 1. | Choosing appropriate weights: | Assigning the right weights to each data point can be a subjective process. Determining the appropriate weights requires domain expertise and a thorough understanding of the data patterns. Incorrect weights can lead to inaccurate forecasts and unreliable results. |

| 2. | Handling outliers: | Outliers can significantly affect the accuracy of the WMA forecast. These extreme values can distort the weighted average and lead to misleading predictions. Robust methods for detecting and handling outliers should be implemented to minimize their impact on the forecast. |

| 3. | Period selection: | Choosing the appropriate length of the forecast period is crucial in WMA forecasting. A shorter period might not capture long-term trends, while a longer period might not respond quickly to short-term fluctuations. Balancing the trade-off between responsiveness and accuracy requires careful consideration. |

| 4. | Computational complexity: | Implementing WMA forecasting requires computational power and resources. As the number of data points and the complexity of the weights increase, the computational complexity also grows. Efficient algorithms and computing systems should be employed to handle large datasets and complex weighting schemes. |

| 5. | Data availability: | WMA forecasting heavily relies on historical data. In cases where the availability or quality of historical data is limited, the accuracy and reliability of the forecast can be compromised. Adequate data collection and preprocessing techniques should be employed to ensure the availability of accurate and sufficient historical data. |

Read Also: Top Advantages of Forex Trading: Why Traders Choose the Forex Market

Addressing these challenges and implementing appropriate strategies can enhance the effectiveness of Weighted Moving Average forecasting and improve the accuracy of future predictions.

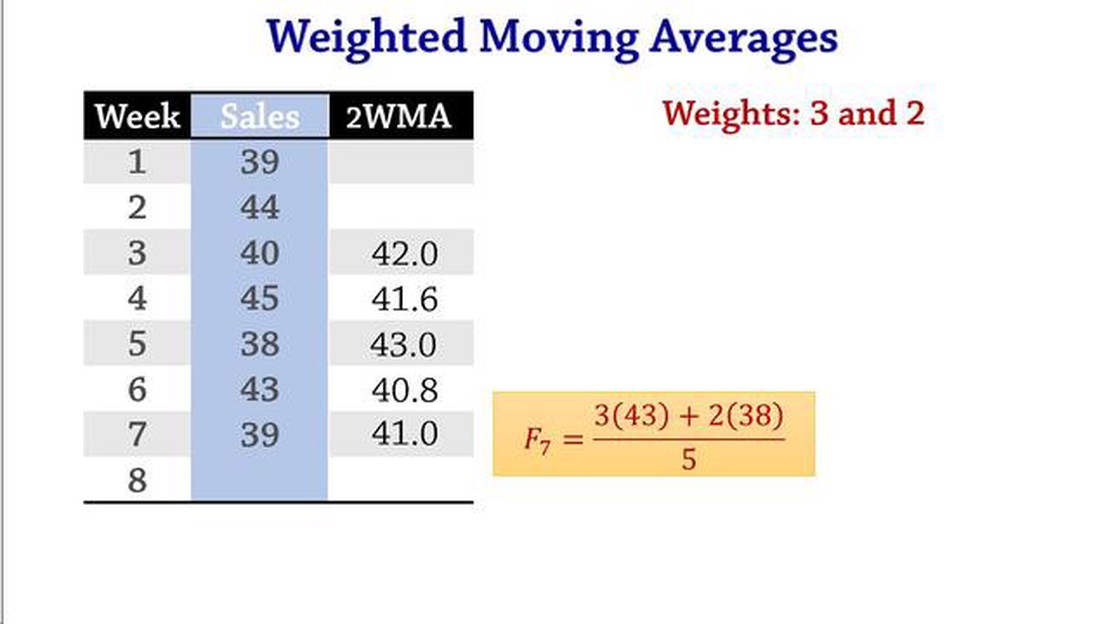

Weighted moving average forecasting is a statistical technique that assigns different weights to different periods in a time series. It is used to predict future values based on past observations.

There are several advantages of weighted moving average forecasting. Firstly, it considers the recent data more heavily, which makes it more responsive to changes in the data. Secondly, it can handle trends and seasonality better than other forecasting methods. Lastly, it is easy to understand and implement.

Despite its advantages, weighted moving average forecasting has some drawbacks. One disadvantage is that it is more sensitive to outliers and data fluctuations, which can lead to less accurate forecasts. Another disadvantage is that it requires the determination of appropriate weights, which can be subjective and time-consuming. Additionally, it does not capture sudden changes or abrupt shifts in the data very well.

Weighted moving average forecasting can be used for a wide range of data, including financial data, sales data, and inventory data. However, it may not be suitable for data with a high degree of volatility or for data that exhibits non-linear patterns.

Yes, there are several alternative forecasting methods to weighted moving average. Some popular ones include exponential smoothing, autoregressive integrated moving average (ARIMA), and machine learning algorithms such as neural networks and random forests. These methods have their own advantages and disadvantages and may be more suitable for certain types of data or forecasting scenarios.

Weighted Moving Average forecasting is a statistical technique used to make predictions about future values based on a weighted average of past values. It assigns different weights to different periods, giving more importance to recent data points.

Current Canadian Dollar Exchange Rate: Is it Up or Down? The Canadian dollar, also known as the loonie, has been on a rollercoaster ride in recent …

Read ArticleIs Node.js Good for Algo Trading? Algorithmic trading has gained significant popularity in recent years, as it offers a more efficient and precise way …

Read ArticleUnderstanding the Current Status of Indian Forex Reserves Forex reserves are a crucial indicator of a country’s economic strength and stability. In …

Read ArticleThe Moving Average Model Explained When it comes to analyzing time series data, one commonly used statistical method is the moving average model. This …

Read ArticleHow Hedge Funds Trade Options Options trading has become an integral part of hedge fund strategies, allowing fund managers to diversify their …

Read ArticleEuro to GBP forecast for 2023 The exchange rate between the euro (EUR) and the British pound (GBP) is a highly watched metric, given the economic …

Read Article