Latest Buying Rate of Euro Today: Discover the Current Exchange Rate

Today’s Euro Buying Rate The euro is one of the most widely used and traded currencies in the world. It is the official currency of 19 out of the 27 …

Read Article

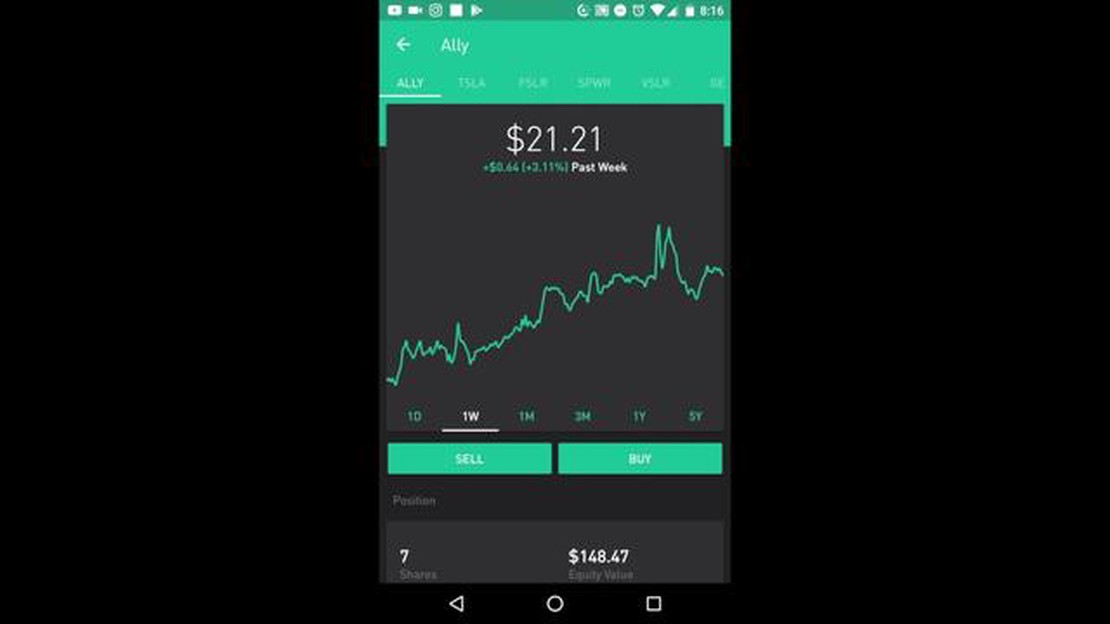

Ally Financial, a leading digital financial services company, made a significant move in the online brokerage industry by acquiring TradeKing in 2016. This strategic acquisition allowed Ally Financial to expand its offerings and strengthen its position in the financial market.

TradeKing, a popular online brokerage platform, was known for its low cost and user-friendly trading tools. By acquiring TradeKing, Ally Financial gained access to a larger customer base and a platform that was already established in the market.

The acquisition of TradeKing by Ally Financial was a strategic decision that aligned with the company’s goal of providing innovative and accessible financial services to its customers. With TradeKing’s expertise in online trading and Ally Financial’s existing banking and lending services, the acquisition created a powerful combination of capabilities in the digital financial space.

Ally Financial’s acquisition of TradeKing not only expanded the company’s offerings but also demonstrated its commitment to staying competitive in the evolving landscape of financial services. By integrating TradeKing’s platform and technology into its own operations, Ally Financial was able to offer its customers a broader range of investment options and an enhanced digital experience.

Ally Financial, a leading digital financial services company, completed its acquisition of TradeKing Group, an online brokerage firm, in 2016. This acquisition marked an important strategic move for Ally Financial as it expanded its product and service offerings to include online trading and investment services.

The acquisition of TradeKing allowed Ally Financial to enter the growing online brokerage market and cater to the increasing needs of its customers for digital investment platforms. As a result of the acquisition, TradeKing was rebranded as Ally Invest, providing customers with a seamless transition and access to a wider range of investment options.

Ally Financial’s acquisition of TradeKing brought together two innovative companies with a shared vision of providing customers with robust and user-friendly financial solutions. Through this acquisition, Ally Financial enhanced its position as a leading provider of digital banking and investment services, offering customers a comprehensive suite of financial products and services.

| Benefits of the Acquisition | Impact on Customers |

|---|---|

| * Expanded product and service offerings |

The acquisition of TradeKing by Ally Financial demonstrated the company’s commitment to innovation and its dedication to meeting the evolving needs of its customers in the digital age. With Ally Invest, customers have the tools and resources they need to make informed investment decisions and grow their financial portfolios.

Read Also: Employee Stock Options: Understanding Dividends and Their Role

In 2016, Ally Financial, a leading digital financial services company, announced the acquisition of TradeKing, an online brokerage firm that offers low-cost trading services. Ally Financial acquired TradeKing for approximately $275 million in order to further expand its presence in the digital financial services market.

The acquisition of TradeKing allowed Ally Financial to enhance its product offerings and provide its customers with a broader range of investment options. TradeKing’s technology platform and customer base also complemented Ally Financial’s existing digital banking and auto finance capabilities.

| Key Points: |

| • In 2016, Ally Financial acquired TradeKing for $275 million. |

| • The acquisition aimed to expand Ally Financial’s digital financial services presence. |

| • TradeKing’s technology platform and customer base complemented Ally Financial’s existing capabilities. |

The acquisition of TradeKing by Ally Financial has had a significant impact on both companies and the financial industry as a whole. The merger between these two entities has created a powerful alliance that has reshaped the landscape of online brokerage services.

First and foremost, the acquisition has allowed Ally Financial to diversify its offerings and enter the online trading market. Prior to the merger, Ally had primarily focused on providing auto financing and banking services. With the addition of TradeKing, Ally can now offer its customers a comprehensive range of financial products, including brokerage services.

On the other hand, TradeKing has greatly benefited from the acquisition as well. By joining forces with Ally Financial, TradeKing has gained access to a broader customer base and extensive financial resources. This has enabled them to expand their services and enhance their technological capabilities, ultimately providing a better trading experience for their clients.

Furthermore, the acquisition has had a ripple effect on the financial industry. It has intensified competition among online brokers, prompting them to innovate and improve their offerings. Customers now have access to a wider range of brokerage options, leading to increased competition and better pricing for traders.

The acquisition has also resulted in synergies between Ally Financial and TradeKing. The companies have been able to combine their expertise in banking, finance, and technology to develop innovative solutions for their customers. This collaboration has not only benefited the firms themselves but has also enhanced the overall efficiency and functionality of the online brokerage industry.

Read Also: Understanding the T Chart Strategy: A Step-by-Step Guide

In conclusion, the acquisition of TradeKing by Ally Financial has had a profound impact on both companies and the financial industry as a whole. It has allowed Ally to expand its product offering and enter the online trading market while providing TradeKing with a broader customer base and increased resources. Additionally, the acquisition has spurred competition and innovation within the online brokerage industry, resulting in better options and pricing for traders.

Yes, Ally Financial did acquire TradeKing. The acquisition was announced in April 2016 and was completed in June 2016. TradeKing was rebranded as Ally Invest after the acquisition.

Ally Financial acquired TradeKing in June 2016. The acquisition was announced in April 2016.

After Ally Financial acquired TradeKing, the company was rebranded as Ally Invest. Ally Invest offers a range of investment options, including self-directed trading and managed portfolios.

Ally Financial acquired TradeKing to expand its offerings in the digital financial services sector. By acquiring TradeKing, Ally Financial was able to enhance its position in the brokerage and investment industry.

The acquisition of TradeKing by Ally Financial means that customers now have access to a wider range of investment options through Ally Invest. Customers can take advantage of self-directed trading or opt for managed portfolios.

Yes, Ally Financial did acquire TradeKing. The acquisition was completed in 2016.

The reason behind Ally Financial’s acquisition of TradeKing was to expand their presence in the online brokerage industry and strengthen their position in the financial services market.

Today’s Euro Buying Rate The euro is one of the most widely used and traded currencies in the world. It is the official currency of 19 out of the 27 …

Read ArticleIs it Possible to Live on $3000 a Month in Thailand? Thailand has long been a popular destination for expatriates looking to live a comfortable and …

Read ArticleInvesting in Gold Futures: Should You Do It? Gold has always fascinated investors and traders alike. Its unique properties and undeniable value have …

Read ArticleWhat is the Bank Rate for NZD to USD? The NZD to USD bank rate is the exchange rate between the New Zealand dollar (NZD) and the United States dollar …

Read ArticleWhich indicator is most accurate for intraday trading? Intraday trading is a fast-paced and dynamic form of trading that involves buying and selling …

Read ArticleWhat is the forecast for natural gas stocks? Investing in natural gas stocks can be a lucrative opportunity for both short-term traders and long-term …

Read Article