How to Calculate Free Margin and Margin in Trading: A Beginner's Guide

Calculating Free Margin and Margin: A Step-by-Step Guide Trading in financial markets can be a lucrative venture, but it is also important to …

Read Article

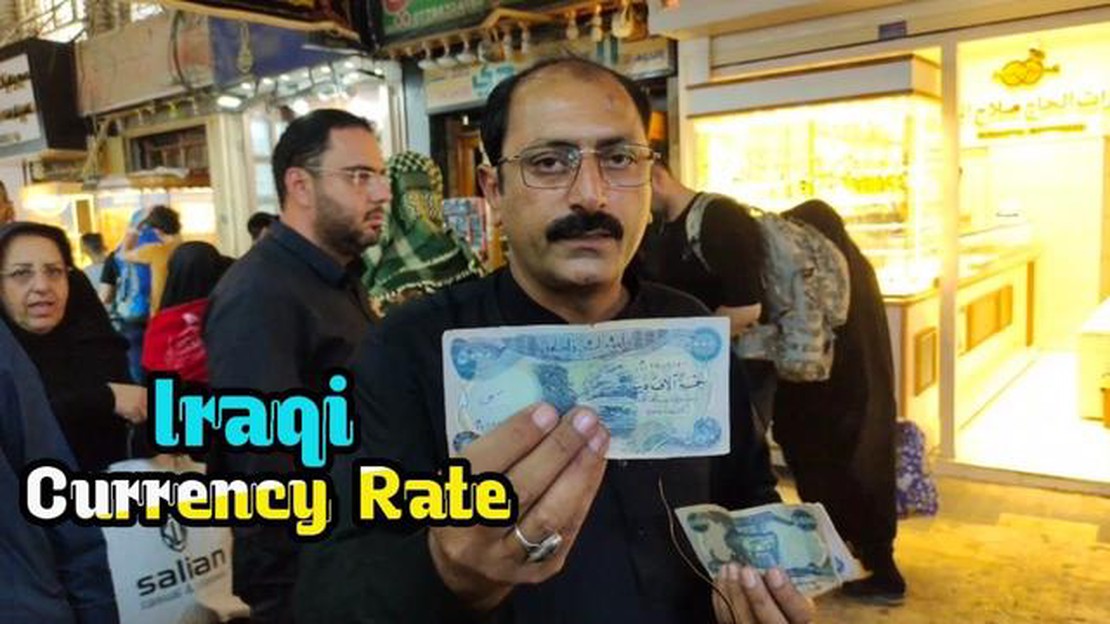

In today’s financial landscape, where global trade and economic interdependence are thriving, exchange rates play a crucial role in determining the value of currencies. One such exchange rate that has caught the attention of many is the Iraq to Bangladesh exchange rate, specifically the rate of 1 dinar to Bangladeshi taka.

With Iraq being an oil-rich nation and Bangladesh having a burgeoning economy, the exchange rate between their respective currencies is closely monitored by economists, investors, and businesses alike. A strong understanding of this exchange rate can help individuals and organizations make informed decisions regarding financial transactions between the two countries.

The stability and fluctuation of the Iraq to Bangladesh exchange rate are influenced by various factors, including geopolitical events, government policies, trade relations, and market forces. Monitoring these factors allows economists to predict potential changes in the exchange rate and assess the economic health of both Iraq and Bangladesh.

Disclaimer: The information provided here is for informational purposes only and does not constitute financial advice. It is recommended to consult with a professional financial advisor or conduct further research before making any financial decisions.

Overall, understanding the current exchange rate between Iraq’s dinar and Bangladesh’s taka is essential for anyone involved in international trade or investments. Whether you are a government official looking to enhance economic relations, a business owner exploring new markets, or an individual planning a personal transaction, staying informed about the exchange rate can help you navigate the global financial landscape with confidence.

The current exchange rate between Iraq and Bangladesh is 1 Dinar to Bangladesh Taka. This means that for every 1 Dinar, you will receive a certain amount of Bangladesh Taka. The exchange rate is constantly changing due to various economic factors, so it’s important to stay updated on the latest rates.

When exchanging your Dinar to Bangladesh Taka, it’s essential to find a reliable and reputable exchange service or bank. They will be able to provide you with the most accurate and up-to-date exchange rate. It’s also advisable to compare rates from different sources to ensure you are getting the best deal.

Before traveling to Bangladesh, it’s a good idea to familiarize yourself with the local currency and its denominations. The currency in Bangladesh is called the Taka, and its symbol is ৳. The Taka is divided into smaller denominations, including the Paisa. It’s important to have a mix of larger and smaller denominations for easy transactions.

When exchanging your Dinar to Taka, it’s important to consider any additional fees or commissions that may be charged by the exchange service or bank. These fees can vary, so it’s advisable to inquire about them beforehand to avoid any surprises.

Overall, understanding the current exchange rate between Iraq and Bangladesh is crucial for anyone planning to travel or conduct business between the two countries. By staying informed about the latest rates and finding a reliable exchange service, you can ensure a smooth and hassle-free currency exchange process.

The current exchange rate between Iraq and Bangladesh is 1 dinar to Bangladesh taka.

The exchange rate between two currencies, in this case the Iraq dinar and the Bangladesh taka, is influenced by a variety of factors. These factors can have both short-term and long-term effects on the exchange rate. Understanding these factors is important for individuals and businesses involved in international trade and finance.

Read Also: Long Stock and Short Call Strategy: Maximizing Returns with Risk Management2. Political Stability: Political stability or instability can greatly affect the exchange rate. Countries with stable political systems tend to attract more foreign investments, which can lead to an appreciation of their currency. On the other hand, countries with political turmoil or uncertainty may experience capital flight, leading to a depreciation of their currency.

3. Balance of Payments: The balance of payments is the record of a country’s transactions with the rest of the world. A positive balance of payments, meaning a country receives more income from exports, foreign investments, and tourism than it pays for imports and foreign debts, can strengthen its currency. Conversely, a negative balance of payments can weaken a currency. Factors such as trade deficits, foreign debt, and capital flows can all impact the balance of payments and, consequently, the exchange rate.

Read Also: Understanding the Purpose and Benefits of Binary Options Trading4. Market Speculation: Exchange rates are also influenced by market speculation. Traders and investors make bets on the future direction of a currency’s value based on economic indicators, political developments, and other factors. If market participants have a positive outlook on a country’s economy, they may buy its currency, leading to an appreciation. Conversely, if there is negative sentiment, investors may sell off the currency, causing a depreciation. 5. Central Bank Policies: The monetary policies of a country’s central bank can have a significant impact on the exchange rate. Central banks use tools such as interest rate adjustments, open market operations, and currency interventions to manage the value of their currency. For example, a central bank may raise interest rates to attract foreign capital and strengthen the currency, or lower interest rates to stimulate economic growth and weaken the currency.

Understanding these factors can provide insights into the dynamics of currency exchange rates and help individuals and businesses make informed decisions when dealing with foreign currencies.

The exchange rate plays a crucial role in international trade. It determines the value of one currency in relation to another, influencing the prices of imported and exported goods and services. Here are some key reasons why the exchange rate is important for trade:

In conclusion, the exchange rate is a crucial factor in international trade. It can impact a country’s competitiveness, import costs, inflation rate, investor confidence, and trade balance. Governments and central banks closely monitor and manage exchange rates to ensure their stability and support a thriving trade environment.

The current exchange rate between Iraq’s dinar and Bangladesh’s taka is 1 dinar to taka.

You can convert Iraq’s dinar to Bangladesh’s taka by visiting a currency exchange office or using an online currency converter.

The current exchange rate is favorable for exchanging Iraq’s dinar to Bangladesh’s taka. However, it is always advised to monitor the exchange rates and consider any fees or charges involved before making a decision.

Yes, many airports have currency exchange counters where you can exchange Iraq’s dinar to Bangladesh’s taka. However, these counters may charge higher fees and offer less favorable rates compared to other options.

It is advisable to check with the local regulations and policies of both Iraq and Bangladesh regarding currency exchange. Some countries may have restrictions or limitations on the amount of currency that can be exchanged.

The current exchange rate between Iraq and Bangladesh is 1 dinar to Bangladesh taka.

1 dinar is equal to Bangladesh taka.

Calculating Free Margin and Margin: A Step-by-Step Guide Trading in financial markets can be a lucrative venture, but it is also important to …

Read ArticleUsing your TSP for Buying Stocks: Know the Possibilities and Limitations Are you a member of the Thrift Savings Plan (TSP)? If so, you have the …

Read ArticleBest Places for Currency Exchange in Bangalore If you’re planning a trip to Bangalore, India, one of the first things you’ll need to do is exchange …

Read ArticleDoes HSBC Work with Brokers? If you’re in the market for a mortgage or other financial product, you may be wondering if HSBC works with brokers. The …

Read ArticleIs it possible to lose everything with options trading? Options trading can be an exciting and potentially lucrative way to invest in the financial …

Read ArticleMastering Supply and Demand: Key Strategies for Success Managing supply and demand is crucial for any business to succeed in today’s competitive …

Read Article