Learn the Most Effective EURUSD Strategy for Successful Trading

EURUSD Strategy: Essential Tips and Techniques Are you interested in trading the EURUSD currency pair? If so, it’s essential to have a solid strategy …

Read Article

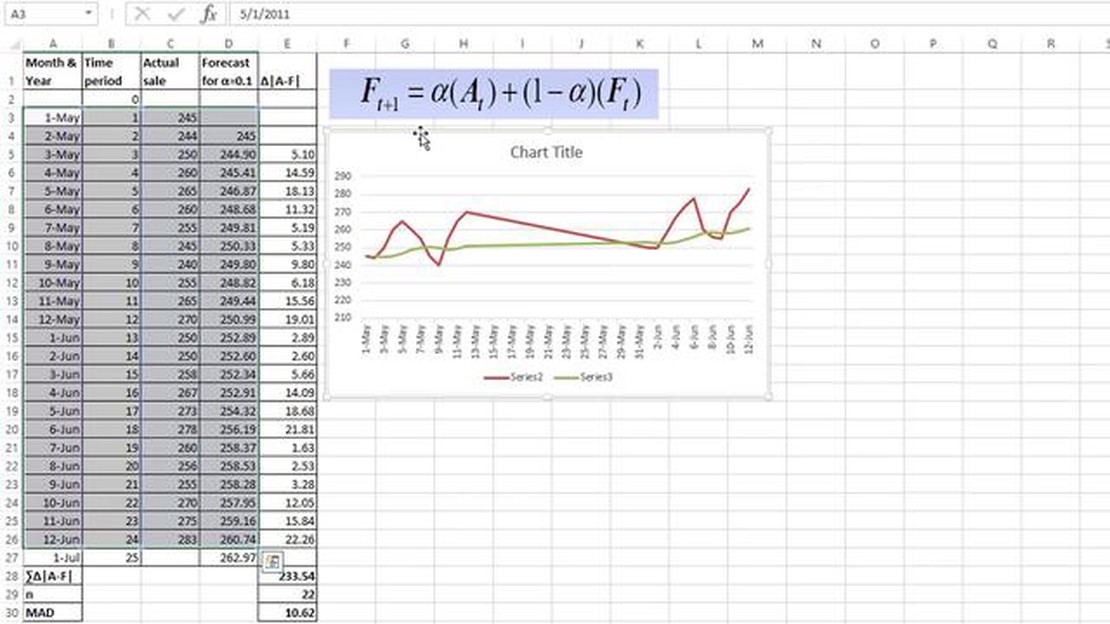

Forecasting is an essential task for businesses and organizations looking to make informed decisions about future demand, sales, or resource allocation. Two widely used methods for time series forecasting are exponential smoothing and moving average. These techniques aim to identify patterns, trends, and seasonality in historical data to predict future values.

Exponential smoothing is a popular method that puts more weight on recent observations and less weight on older ones. It applies a mathematical formula to calculate a weighted average of past data points, with the latest data being given the most significance. This method is known for its simplicity and ability to adapt quickly to changes in trends or seasonality.

Moving average, on the other hand, is a simpler technique that calculates the average of a fixed number of past observations. It assigns equal weight to each data point within the window, regardless of its recency. This approach smooths out short-term fluctuations and highlights long-term trends or patterns.

Both exponential smoothing and moving average have their strengths and weaknesses. Exponential smoothing is particularly useful when there is a need for responsive forecasting, as it focuses on the most recent observations. However, it may not perform well in the presence of outliers or sudden shifts in the data. Moving average, on the other hand, may be more effective in capturing longer-term trends and minimizing the impact of individual outliers.

Ultimately, the choice between exponential smoothing and moving average depends on the specific characteristics of the data and the forecasting objectives. Testing and comparing the performance of both methods on historical data can provide valuable insights to determine which approach is more suitable for a particular forecasting task.

When it comes to forecasting future trends and patterns, there are various methods available for businesses and individuals to choose from. Two popular techniques for time series forecasting are exponential smoothing and moving average.

Exponential smoothing is a technique that assigns exponentially decreasing weights to past observations, with more recent observations given higher weights. This method is particularly useful when there is a need to place more emphasis on recent data, as it provides a quick response to changes in the underlying data. Exponential smoothing is effective in situations where there is a need to forecast short-term trends or when the data is subject to random fluctuations.

Moving average is a simpler forecasting method that calculates the average of a fixed number of past observations to predict future values. This technique is commonly used when there is a need to smooth out fluctuations and identify underlying trends in the data. Moving average is effective in situations where there is a need to forecast long-term trends or when the data is subject to seasonality or cyclic patterns.

While both exponential smoothing and moving average have their advantages and disadvantages, the choice of forecasting method depends on the specific needs and characteristics of the data being analyzed.

Exponential smoothing offers the advantage of being able to quickly adapt to changes in the underlying data, making it a suitable choice for short-term forecasting. It is also relatively simple to implement and interpret, requiring only a few parameters to be specified. However, exponential smoothing may not perform well in situations where the data has a lot of noise or when there are abrupt changes in the underlying patterns.

Read Also: Is Index Option Trading the Same as Stock Option Trading?

Moving average provides a more stable forecast by smoothing out fluctuations in the data. It is particularly useful when there is a need to identify long-term trends or when the data has a seasonal or cyclic pattern. Moving average is relatively straightforward to implement and does not require complex calculations. However, it may not be as responsive to recent changes in the data compared to exponential smoothing.

In conclusion, both exponential smoothing and moving average are effective forecasting methods, but their suitability depends on the specific characteristics of the data being analyzed. Businesses and individuals should carefully consider the nature of their data and the desired forecasting horizon before selecting the most appropriate method for their needs.

When comparing exponential smoothing and moving average as forecasting methods, it is essential to consider their accuracy and predictive power. Accuracy refers to how close the forecasted values are to the actual values, while predictive power refers to the ability of the method to anticipate future trends.

Exponential smoothing takes into account both recent observations and past forecasts, assigning different weights to each. This method updates the forecast as new data becomes available, resulting in a more responsive and adaptive approach. In contrast, moving average considers a fixed number of past observations and does not update the forecast as new data is collected.

Read Also: Is Forex Trading Available at Morgan Stanley?

The advantage of exponential smoothing lies in its ability to capture and react to sudden changes or shifts in the data. As it gives more weight to recent observations, it can adapt quickly to such changes and provide accurate forecasts. On the other hand, moving average may lag behind changes in the data due to its reliance on past observations and the inability to react to new information.

However, the predictive power of exponential smoothing can be compromised when the data exhibits a high level of volatility or randomness. In these cases, the method may assign too much weight to recent outliers, resulting in less accurate forecasts. Moving average, with its focus on smoothing out fluctuations with a fixed number of observations, may provide more stable and reliable predictions in such situations.

Ultimately, the choice between exponential smoothing and moving average as forecasting methods depends on the specific characteristics of the data and the underlying trends. Exponential smoothing may be more suitable for data with sudden shifts or changes, as it can adapt quickly and provide accurate forecasts in these scenarios. On the other hand, moving average may be better suited for data with high volatility or randomness, delivering stable and reliable predictions.

Exponential smoothing is a time series forecasting method that gives more weight to recent data points and provides a smoother representation of the data compared to moving average. It is a popular technique for short-term forecasting.

Moving average is a time series forecasting method that calculates the average of a certain number of past data points. It treats all data points equally, giving them equal weight. In contrast, exponential smoothing assigns more weight to recent data, making it more responsive to changes in the data and providing a more accurate forecast for short-term predictions.

Exponential smoothing is generally considered more effective for short-term predictions because it gives more weight to recent data points. This makes it more responsive to any abrupt changes or trends in the data, resulting in a more accurate forecast for the near future.

While exponential smoothing is often considered more effective for short-term predictions, moving average has its advantages as well. Moving average provides a smoother representation of the data, which can be useful for identifying long-term trends and removing any short-term fluctuations or noise in the data.

Yes, there are specific scenarios where one method may be more effective than the other. If the data contains a lot of noise or random fluctuations, moving average may be more appropriate as it can smooth out these fluctuations and provide a clearer trend. On the other hand, if there are recent changes or trends in the data that need to be captured accurately, exponential smoothing is the better choice.

Exponential smoothing is a time series forecasting method that assigns exponentially decreasing weights to past observations. It is used to forecast future values based on the weighted average of past observations, with more recent observations receiving higher weights.

EURUSD Strategy: Essential Tips and Techniques Are you interested in trading the EURUSD currency pair? If so, it’s essential to have a solid strategy …

Read ArticleDiscover the Hidden Power of the 2-Period RSI Strategy The Relative Strength Index (RSI) is a popular technical indicator used by traders to identify …

Read ArticleDoes Arduino Have a Standard Library? Arduino is a popular open-source electronics platform that is widely used by hobbyists, students, and …

Read ArticleHow are publicly traded common stocks valued in a decedent’s gross estate and how are they valued if the decedent dies over the weekend? When a person …

Read ArticleWhen and why should I exercise my incentive stock options? When it comes to incentive stock options, many employees find themselves faced with a …

Read ArticleWhat is LP broker? An LP broker, also known as a liquidity provider broker, is a financial institution or individual that acts as an intermediary …

Read Article