Day Trading with J.P. Morgan: Your Complete Guide

Can I day trade with J.P. Morgan? Day trading has become an increasingly popular option for investors looking to make quick profits in the stock …

Read Article

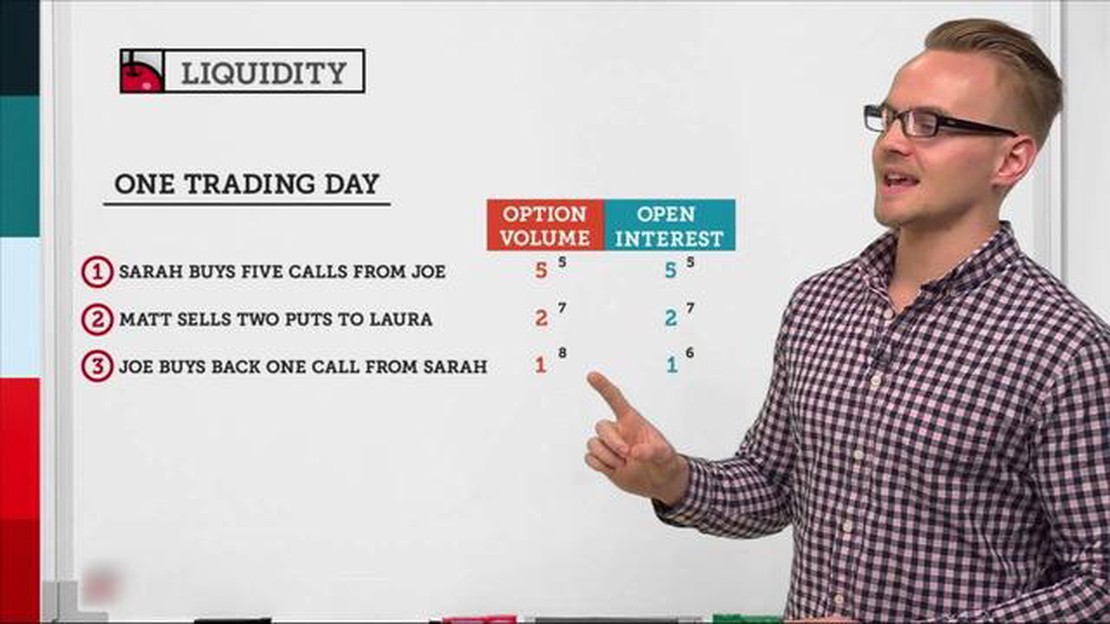

In the world of finance and trading, volume and open interest are two important terms that investors and traders closely monitor. Volume refers to the total number of shares or contracts traded in a particular market during a given time period, while open interest represents the total number of outstanding contracts in a particular market. Both volume and open interest provide valuable insights into the market’s activity and can help traders make informed decisions.

One common question that arises is whether volume can be higher than open interest. In theory, volume cannot be higher than open interest because open interest represents the total number of contracts that are still open and have not yet been offset or settled. However, there are certain scenarios where volume can appear higher than open interest.

One such scenario is when a contract expires or becomes worthless. In this case, the open interest will be reduced to zero, but there can still be trading activity and volume. For example, if a futures contract expires and investors close out their positions, the open interest will decrease to zero, but there may still be trading activity and volume as investors exit their positions. In this situation, the volume can be higher than open interest.

Another scenario is when there are reporting discrepancies or errors. Sometimes, errors or reporting delays can result in volume being reported higher than open interest. This can occur due to technical glitches or mistakes in data reporting. However, such discrepancies are usually temporary and are quickly resolved by the exchange or market regulator.

Overall, while volume cannot technically be higher than open interest, there can be situations where it appears so due to expired contracts or reporting errors. Traders should always keep track of both volume and open interest to gain a comprehensive understanding of market activity and make informed trading decisions.

Volume and open interest are two important measurements in the world of financial markets and derivatives trading. Volume represents the total number of shares or contracts traded during a specified period, while open interest refers to the total number of outstanding contracts at any given time.

Typically, volume levels are expected to be higher than open interest because each trade involves both a buyer and a seller. However, there are instances where volume can be higher than open interest, which may seem unusual.

One possible scenario where volume can exceed open interest is when there is a high level of activity in the market. For example, if many market participants are actively buying and selling a particular asset, the volume can increase significantly. In this case, the volume may be higher than the open interest as traders are constantly entering and exiting positions.

Another scenario where volume can surpass open interest is during the expiration of options contracts. As the expiration date approaches, traders who hold open positions may actively trade their contracts to close or roll them over. This increased trading activity can lead to higher volume levels compared to the open interest.

Read Also: Understanding Moving Average Investopedia: Definition, Calculation, and Application

It’s important to note that volume and open interest are independent measurements that provide different insights into market activity. While volume indicates the overall trading activity, open interest reflects the number of outstanding positions that have not been closed. Therefore, it is possible for volume to be higher than open interest in certain situations, but this does not necessarily indicate any irregularities in the market.

Volume and open interest are two essential concepts in the world of trading. While they are similar in some aspects, they represent different aspects of market activity.

Volume refers to the total number of shares or contracts traded during a specified time period. It provides an indication of the level of activity in a particular market or security. Higher volume usually suggests increased interest and liquidity, making it easier for traders to enter and exit positions.

Open interest, on the other hand, refers to the total number of outstanding contracts that are held by market participants at the end of a trading day. It represents the number of contracts that have not been closed out, exercised, or expired. Open interest is a measure of market participation and can provide insight into the potential future activity in a particular market.

In general, volume and open interest are positively correlated, meaning that as the volume increases, the open interest tends to increase as well. This is because as more contracts are traded, more positions are being created or closed, resulting in a larger number of outstanding contracts.

However, there may be situations where the volume is higher than the open interest. This can occur when there are a significant number of opening transactions, such as the creation of new positions or the initiation of new contracts. In these cases, the volume may exceed the open interest temporarily, but over time, the open interest should catch up.

Read Also: Using HDFC Forex Card for Secure Online Payments

It’s important for traders to understand the relationship between volume and open interest as it can provide valuable insights into market dynamics and potential price movements. By analyzing these two indicators together, traders can gain a better understanding of market sentiment and make more informed trading decisions.

There are several factors that can affect the volume and open interest in a given market:

3. Market Volatility: Volatility can play a significant role in determining volume and open interest. When there is high volatility in the market, traders may be more inclined to trade, leading to higher volume and open interest. Conversely, when volatility is low, traders may be less active, resulting in lower volume and open interest.

4. Liquidity: The level of liquidity in a market can also impact volume and open interest. A market with high liquidity typically has a large number of participants and a high level of trading activity, leading to higher volume and open interest. On the other hand, a market with low liquidity may have fewer participants and less trading activity, resulting in lower volume and open interest.

5. Market Structure: The structure of the market itself can also affect volume and open interest. For example, in a market with a large number of participants and a wide range of trading instruments, there may be more trading opportunities, leading to higher volume and open interest. Conversely, in a market with limited participants and a narrow range of trading instruments, there may be fewer trading opportunities, resulting in lower volume and open interest.

3. Market Volatility: Volatility can play a significant role in determining volume and open interest. When there is high volatility in the market, traders may be more inclined to trade, leading to higher volume and open interest. Conversely, when volatility is low, traders may be less active, resulting in lower volume and open interest.

4. Liquidity: The level of liquidity in a market can also impact volume and open interest. A market with high liquidity typically has a large number of participants and a high level of trading activity, leading to higher volume and open interest. On the other hand, a market with low liquidity may have fewer participants and less trading activity, resulting in lower volume and open interest.

5. Market Structure: The structure of the market itself can also affect volume and open interest. For example, in a market with a large number of participants and a wide range of trading instruments, there may be more trading opportunities, leading to higher volume and open interest. Conversely, in a market with limited participants and a narrow range of trading instruments, there may be fewer trading opportunities, resulting in lower volume and open interest.

Overall, volume and open interest are influenced by a combination of market sentiment, economic news and events, market volatility, liquidity, and market structure. Traders and investors should consider these factors when analyzing volume and open interest data to make informed trading decisions.

Can I day trade with J.P. Morgan? Day trading has become an increasingly popular option for investors looking to make quick profits in the stock …

Read ArticleUnderstanding the Meaning of Expanding Bollinger Bands The Bollinger Bands indicator is a popular technical analysis tool used by traders to analyze …

Read ArticleIs forex trading Legal in Poland? Forex trading, also known as foreign exchange trading, is a popular investment option that involves the buying and …

Read ArticleThe Forecast for J.P. Morgan in 2030 In the ever-evolving world of finance, J.P. Morgan stands as one of the most prominent and influential banking …

Read ArticleBest Grid Bot Trading Pair Grid bot trading is a popular automated strategy used by cryptocurrency traders to capitalize on market volatility. The …

Read ArticleTypes of Pickling: Exploring the 4 Different Methods When it comes to preserving food, pickling is a traditional method that has been used for …

Read Article