Can You Hedge with Put Options? How to Protect Your Investments

Using Put Options to Hedge Bets Protecting investments is a key concern for investors who want to minimize risk and maximize returns. One strategy …

Read Article

If you are planning to travel to the United States and need to exchange your Indian Rupees for USD, you may be wondering if you can do so at ICICI Bank. ICICI Bank is one of the largest banks in India and offers a range of services, including foreign exchange.

The good news is that you can exchange your Indian Rupees for USD at ICICI Bank. The bank offers currency exchange services for a variety of currencies, including the US Dollar. This means that you can easily convert your Indian Rupees to USD at one of their branches.

It’s important to note that the exchange rate may vary and there may be fees associated with the currency exchange. It’s always a good idea to check the current exchange rate and any fees before you go to the bank to exchange your Indian Rupees for USD.

ICICI Bank offers currency exchange services at their branches across India. You can visit their website or contact their customer service for more information on the exchange rates and fees.

In conclusion, if you need to exchange your Indian Rupees for USD, you can do so at ICICI Bank. Just make sure to check the current exchange rate and any fees before you go to the bank.

ICICI Bank offers a comprehensive range of currency exchange services to facilitate the seamless conversion of Indian Rupees to various foreign currencies, including USD. Whether you need to exchange currency for travel purposes or for any other reason, ICICI Bank is a trusted and reliable option.

With ICICI Bank’s currency exchange services, you can enjoy the following benefits:

Whether you are planning a trip abroad or need to exchange currency for any other reason, ICICI Bank’s currency exchange services are a convenient and reliable option. Visit your nearest ICICI Bank branch to avail of their currency exchange services today.

Yes, you can exchange Indian Rupees for USD (United States Dollars) at various banks, including ICICI Bank.

ICICI Bank offers currency exchange services for a variety of currencies, including Indian Rupees and USD. You can visit your nearest ICICI Bank branch and inquire about their currency exchange services.

When exchanging Indian Rupees for USD, there are a few things to keep in mind:

Read Also: Understanding the Calculation of DSO: A Step-by-Step Guide

Overall, exchanging Indian Rupees for USD at ICICI Bank or any other bank is a convenient way to convert your currency for international travel or other purposes. Make sure to consider the exchange rates and any fees involved to get the best value for your money.

ICICI Bank offers competitive exchange rates for various currencies, including Indian Rupees to USD. The exchange rates are constantly updated to reflect the current market conditions.

Read Also: Does Calforex charge a fee? Find out here!

If you are interested in exchanging Indian Rupees for USD at ICICI Bank, you can check the current exchange rates on their official website or by contacting their customer service. It is important to note that exchange rates may vary depending on the amount and method of exchange.

ICICI Bank aims to provide transparent and fair exchange rates to their customers. They strive to offer competitive rates and ensure a hassle-free currency exchange experience.

Before exchanging your Indian Rupees for USD at ICICI Bank, it is advisable to compare their rates with other banks or currency exchange providers to ensure you are getting the best possible rate.

ICICI Bank also offers other currency exchange services, such as foreign currency drafts and travel cards, which can be helpful for international travelers or individuals who frequently need to exchange currencies.

When visiting ICICI Bank for currency exchange, remember to carry your identification documents, such as passport or Aadhaar card, as they may be required for the transaction.

Overall, ICICI Bank provides a reliable and convenient option for exchanging Indian Rupees for USD or other currencies, with competitive rates and a commitment to customer satisfaction.

Yes, you can exchange Indian Rupees for USD at ICICI Bank. They offer currency exchange services for various currencies, including the US dollar.

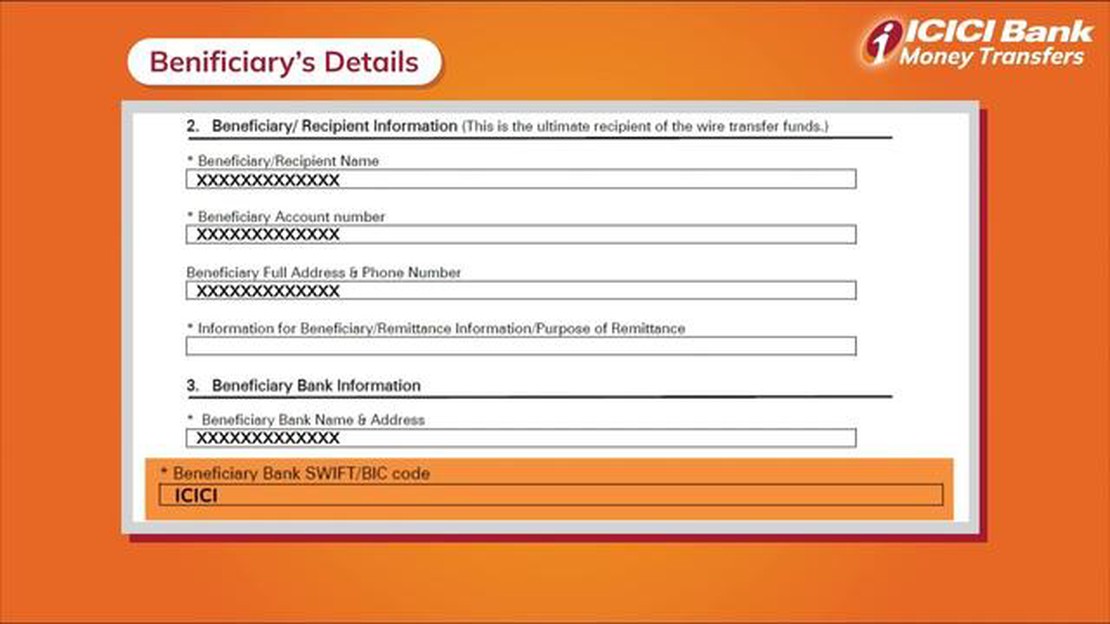

The process for exchanging Indian Rupees for USD at ICICI Bank is simple. You need to visit any ICICI Bank branch that offers foreign exchange services. You will need to fill out a currency exchange form providing your personal details and the amount of Indian Rupees you want to exchange. You will then be provided with the current exchange rate and the equivalent amount in USD. You can choose to receive the USD in cash or have it loaded onto a prepaid forex card. ICICI Bank will require you to provide the necessary identification and address proof documents as per the guidelines set by the Reserve Bank of India.

Yes, there are fees and charges involved when exchanging Indian Rupees for USD at ICICI Bank. The fees and charges vary depending on the amount of money you are exchanging and the method of exchange (cash or prepaid forex card). It is recommended to check with ICICI Bank for the exact fees and charges before proceeding with the currency exchange.

Yes, ICICI Bank offers the facility to exchange Indian Rupees for USD online through their internet banking platform. You can login to your ICICI Bank account, go to the forex section, and place a request for currency exchange. You will need to provide the necessary details and choose the amount of Indian Rupees you want to exchange. The exchange rate and the equivalent amount in USD will be displayed to you. Once you confirm the transaction, the amount will be debited from your account and the USD will be credited to your chosen account. It is important to note that online currency exchange may have different fees and charges compared to exchanging in person at an ICICI Bank branch.

Using Put Options to Hedge Bets Protecting investments is a key concern for investors who want to minimize risk and maximize returns. One strategy …

Read ArticleUnderstanding Risk Disclosures: What You Need to Know Risk disclosure is an important concept that every investor should understand. It refers to the …

Read ArticleUnderstanding the Concept of Trading Strategy Trading strategy is a crucial aspect of the financial markets, guiding traders in making informed …

Read ArticleWhat is the most affordable method of currency exchange in India? When traveling to India, finding the most affordable currency exchange options is …

Read ArticleUnderstanding the Foreign Exchange Market in the US The U.S. Foreign Exchange Market is a critical component of the global financial system, where …

Read ArticleOptions Trading vs Forex Trading: Which is the Better Investment?+ When it comes to trading in financial markets, there are a variety of options …

Read Article