Quick and Easy Ways to Check the Status of your Balikbayan Box

Checking the Status of My Balikbayan Box Sending balikbayan boxes is a popular way for Filipinos overseas to send gifts and necessities to their loved …

Read Article

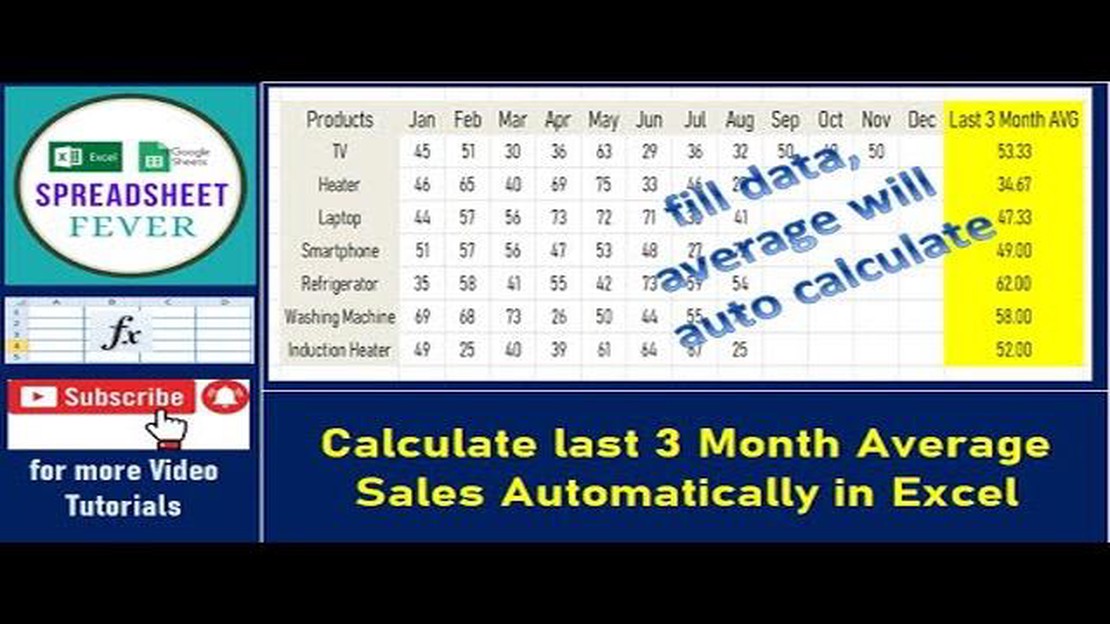

When it comes to analyzing data, one important metric to consider is the average. The average provides valuable insights into the overall trends and patterns within a dataset. However, not all averages are created equal. To gain a deeper understanding of data, it is essential to calculate the dynamic average.

The dynamic average, also known as the moving average, takes into account a specific time frame or window of data. Rather than considering the entire dataset, the dynamic average focuses on a subset of data points within that window. By doing so, it provides a more accurate representation of the data’s behavior over time.

To calculate the dynamic average, follow these step-by-step instructions. First, select the desired time frame or window size for your analysis. This depends on the nature of the dataset and the specific insights you are seeking. A shorter window size will capture short-term fluctuations, while a longer window size will smooth out the data to reveal long-term trends.

Next, determine the number of data points to include within the window. This can be a fixed number or a percentage of the total dataset. For example, if you have a dataset of 100 data points and want to use a window size of 10%, you would include 10 data points within each window. This flexibility allows for customization based on the dataset and analysis goals.

The dynamic average calculation is a method used to calculate the average of a set of numbers that changes over time. This calculation is commonly used in various fields such as finance, statistics, and data analysis.

The dynamic average takes into account the changing nature of the data by continuously updating the average based on new data points that are added or removed. This allows for a more accurate representation of the overall trend or pattern in the data.

One common application of the dynamic average calculation is in financial markets, where it is often used to calculate moving averages of stock prices. By using a dynamic average, traders and analysts can identify trends and patterns in the market, which can help guide their investment decisions.

To calculate the dynamic average, you first need to determine the number of data points you want to include in the calculation. This is often referred to as the “window size” or “period.” A larger window size will result in a smoother average that is less responsive to short-term fluctuations, while a smaller window size will result in a more responsive average that is sensitive to short-term changes.

Once you have determined the window size, you can start calculating the dynamic average by adding up the values of the data points within the window and dividing the sum by the window size. As new data points are added or removed, the average is updated by subtracting the value of the oldest data point that is no longer within the window and adding the value of the newest data point that is now included in the window.

| Data Point | Dynamic Average |

|---|---|

| Data Point 1 | Value |

| Data Point 2 | Value |

| Data Point 3 | Value |

| Data Point 4 | Value |

| Data Point 5 | Value |

In the above table, each row represents a data point and its corresponding dynamic average. As new data points are added, the average is updated according to the formula mentioned earlier.

By using the dynamic average calculation, you can obtain a more accurate representation of the data by accounting for its changing nature. This can help you make informed decisions based on the overall trend or pattern in the data, rather than being influenced by short-term fluctuations.

Read Also: Discover the 4 Types of Trading Styles You Need to Know

The first step in calculating a dynamic average is to gather the necessary data. This data will be used to calculate the average and track changes over time.

There are several ways to gather the data, depending on the specific situation. Some common methods include:

| Method | Description |

|---|---|

| Manual entry | Manually inputting data into a spreadsheet or database. This method is often used when working with small amounts of data. |

| Data collection software | Using specialized software or tools to automatically collect and organize data. This method is useful when dealing with large amounts of data or data that changes frequently. |

| API integration | Integrating with an API to automatically retrieve and process data. This method is commonly used when working with external data sources or services. |

Regardless of the method used, it’s important to ensure that the data is accurate and reliable. Data quality is crucial for calculating an accurate dynamic average.

Read Also: Is SMA and MA the same thing? Unveiling the Differences

Once the data has been gathered, it can be stored and used for further calculations. The next steps will involve manipulating and analyzing the data to calculate the dynamic average.

After calculating the deviation values for each data point, the next step in calculating the dynamic average is to determine the weighting factors. The weighting factors are used to assign a level of importance to each data point based on its proximity to the present time.

There are different methods for determining the weighting factors, and the choice depends on the specific application and requirements. Here are a few commonly used methods:

The choice of weighting factor method should be made based on the specific requirements of the analysis and the characteristics of the data being analyzed. Once the weighting factors are determined, they can be used in the next step of calculating the dynamic average.

The dynamic average is a calculation method that takes into account changing data and calculates an average that reflects the most recent values.

To calculate the dynamic average, you need to sum up all the data points you want to include in the average and divide the sum by the number of data points. This way, the average will adjust as new data points are added and old ones are removed.

Dynamic average is useful because it provides a more accurate representation of current data trends compared to a regular average. It allows you to see how the average changes over time and gives more weight to recent data points.

Sure! Let’s say you have a data set of stock prices for the past 10 days. To calculate the dynamic average, you would sum up the prices and divide by 10. As new prices come in, you would remove the oldest price and add the newest one, then recalculate the average based on the updated set of data points.

Dynamic average is commonly used in technical analysis of financial markets. It helps in identifying trends and making predictions based on recent price movements. It can also be used in data analysis to track changes in a variable over time.

Dynamic average is a statistical measure that calculates the average value of a set of data points, considering only the most recent values. It is useful for analyzing time-series data or any data that changes over time.

To calculate dynamic average, you need to set a defined window size, which is the number of most recent data points to consider. Then, you sum up those data points and divide the result by the window size. This gives you the dynamic average. As new data points come in, the dynamic average values will be updated accordingly.

Checking the Status of My Balikbayan Box Sending balikbayan boxes is a popular way for Filipinos overseas to send gifts and necessities to their loved …

Read ArticleWhat Are Stock Option Alerts? Are you a savvy investor looking to maximize your returns in the stock market? If so, you need to know about stock …

Read ArticleHow to Trade with ADX The Average Directional Movement Index (ADX) is a popular technical analysis indicator that is used to determine the strength of …

Read ArticleIs Thai baht rising? For those following the currency markets, the Thai baht has been making headlines in recent months. With its steady appreciation …

Read ArticleHow to check stock options Checking your stock options is an essential part of managing your financial portfolio. Whether you’re a seasoned investor …

Read ArticleImpact of Layoffs on Stock Prices: Analyzing the Aftermath When a company announces layoffs, it can have a significant impact on its stock price. …

Read Article