Current Black Market Exchange Rate for $1 Today

Current black market exchange rate for $1 The black market exchange rate for the US dollar is an important indicator of a country’s economic situation …

Read Article

In the field of forecasting, accuracy and reliability are critical for making informed decisions. One technique that has proven to be effective is moving average smoothing. This method involves calculating the average of a series of data points over a specific time period and using it to predict future values. By smoothing out fluctuations and noise in the data, moving average smoothing provides a clearer picture of the underlying trend, improving the accuracy of forecasts.

One of the major benefits of using moving average smoothing is its ability to filter out random variations in the data. This is especially useful when dealing with data sets that have a lot of noise or irregular patterns. By removing these fluctuations, moving average smoothing helps identify the long-term trend, making it easier to understand the underlying patterns and make better predictions.

Another advantage of moving average smoothing is its ability to respond quickly to changes in the data. Because it takes into account a specific time period, moving average smoothing can adapt to sudden shifts or trends in the data. This flexibility makes it an ideal technique for forecasting in dynamic environments where conditions can change rapidly.

Furthermore, moving average smoothing is relatively easy to implement and interpret. With readily available tools and software, analysts can easily calculate moving averages and incorporate them into their forecasting models. Additionally, because moving averages provide a simple representation of the data, they can be easily understood and communicated to non-experts, making it a valuable tool for decision-making across various industries and sectors.

In conclusion, moving average smoothing offers several benefits for forecasting tasks. By filtering out noise and capturing the underlying trend, it improves the accuracy and reliability of predictions. Its ability to respond quickly to changes in the data and its ease of implementation make it a valuable tool for decision-making in a variety of fields. Overall, moving average smoothing is a technique worth considering for any forecasting endeavor.

Moving average smoothing is a technique used in forecasting to reduce the impact of random fluctuations or noise in a time series data set. It involves calculating the average value of a subset of consecutive data points over a specific time window or period, and using that average as a smoothed value for forecasting future values.

The moving average smoothing technique is based on the assumption that the future values of a time series can be represented as a combination of its trend, seasonality, and random components. By averaging out the random fluctuations, moving average smoothing helps in identifying the underlying trend and seasonality patterns more effectively.

The process of moving average smoothing consists of the following steps:

The choice of the size of the time window or period depends on the nature of the time series data and the desired level of smoothing. Smaller windows result in more responsive smoothing but may fail to capture long-term trends, while larger windows provide smoother forecasts but may lose the ability to react quickly to changes in the data.

Moving average smoothing is commonly used in various fields, such as finance, economics, and weather forecasting, to forecast future values based on historical data. It is a simple and intuitive technique that provides a baseline for more advanced forecasting models and techniques.

Read Also: Discover the Most Accurate Indicator in TradingView for Successful Trading

In forecasting, moving average smoothing techniques are widely used to analyze and predict future trends in data. Moving average smoothing involves calculating the average of a predefined number of consecutive data points from a time series. This technique helps to reduce random fluctuations in the data and provides a clearer picture of the underlying trend.

The moving average is a simple yet effective method that can be applied to various types of data, such as sales figures, stock prices, and temperature readings. By smoothing out short-term fluctuations, moving averages can reveal long-term patterns and help forecasters make more accurate predictions.

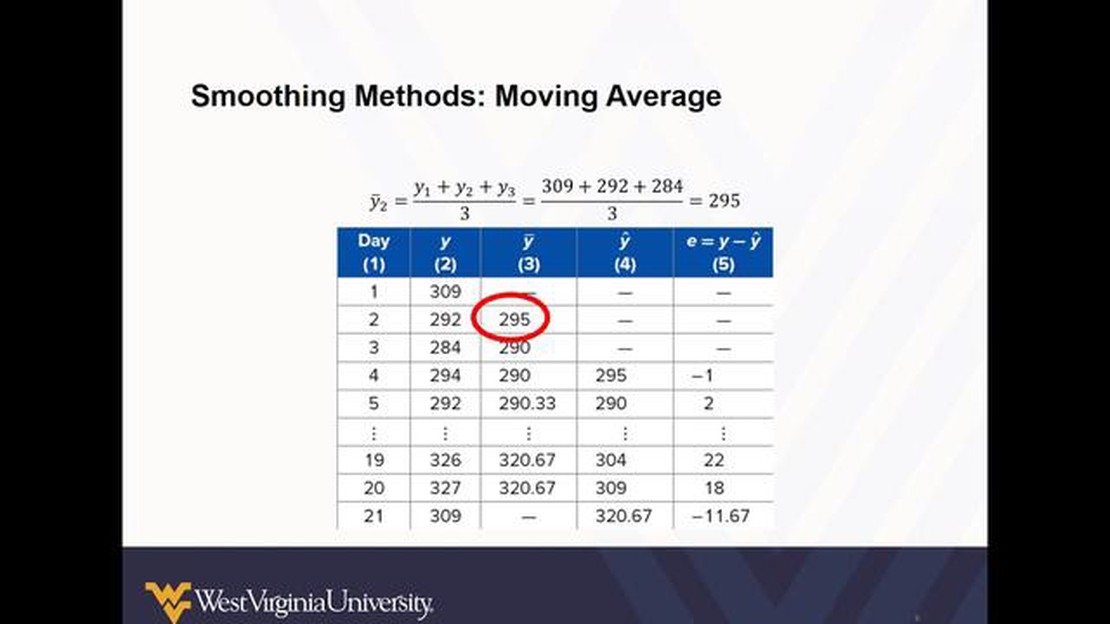

To calculate a moving average, a window of a specific length is defined, which represents the number of data points that will be included in the average calculation. The window starts at the beginning of the time series and moves forward by one data point at a time. At each step, the average of the data points within the window is calculated.

For example, a 3-period moving average would involve taking the average of the first 3 data points, then the average of the second, third, and fourth points, and so on. The larger the window, the smoother the resulting moving average will be, but it may also lag behind the actual trend.

Read Also: Is derivatives allowed in Islam? Understanding the Shariah principles on derivatives trading

Moving averages can be categorized into different types, including simple moving averages (SMA) and weighted moving averages (WMA). SMA gives equal weight to each data point within the window, while WMA assigns different weights to the data points, typically favoring more recent values. The choice of moving average type depends on the specific data characteristics and forecasting goals.

In summary, moving average smoothing techniques in forecasting involve taking the average of a set number of consecutive data points, helping to reduce noise and reveal underlying trends. It is a valuable tool for analyzing time series data and making predictions.

Moving average smoothing technique is a mathematical method used in forecasting to reduce the impact of random variations or noise in the data. It involves calculating the average of a specific number of consecutive data points and using this average as a smoothed value.

Moving average smoothing technique helps in forecasting by filtering out random variations or noise in the data, making it easier to identify underlying trends or patterns. It provides a more stable representation of the data, which can improve the accuracy of forecasts.

There are several benefits of using moving average smoothing technique in forecasting. Firstly, it helps in reducing the impact of random variations or noise in the data, leading to more accurate forecasts. Secondly, it provides a more stable representation of the data, making it easier to identify underlying trends or patterns. Lastly, it is a simple and easy-to-use technique that does not require complex mathematical calculations.

Yes, there are some limitations or disadvantages of using moving average smoothing technique. One limitation is that it is a lagging indicator, meaning it may not capture sudden or abrupt changes in the data. Another limitation is that it can obscure or smooth out important short-term fluctuations in the data, which may be relevant for certain forecasting purposes. Additionally, the choice of the moving average window size can have an impact on the accuracy of the forecasts.

Moving average smoothing technique can be used for various types of data, such as time series data, financial data, and sensor data. However, its effectiveness may vary depending on the characteristics of the data. It is generally more suitable for data that exhibits a certain degree of smoothness or trend, rather than highly volatile or erratic data.

Moving average smoothing is a technique used in forecasting to remove random fluctuations or noise from a time series data. It involves calculating the average of a certain number of consecutive data points and replacing each data point with this moving average value.

Current black market exchange rate for $1 The black market exchange rate for the US dollar is an important indicator of a country’s economic situation …

Read ArticleWhich RAM is best for trading? RAM, or random access memory, is an essential component of any trading computer setup. It plays a crucial role in …

Read ArticleUnderstanding the Concept of 200-Day Moving Average The 200-day moving average is a popular technical indicator used by traders and investors to …

Read ArticleWhat is SMS and BMS? In today’s digital age, communication plays a vital role in our everyday lives. One of the most widely used forms of …

Read ArticleUnderstanding Option Call and Put In the world of finance, options are financial derivatives that give traders the right, but not the obligation, to …

Read ArticleWhat is the formula for ATR? The Average True Range (ATR) is a technical analysis indicator that measures the volatility of a financial instrument. It …

Read Article